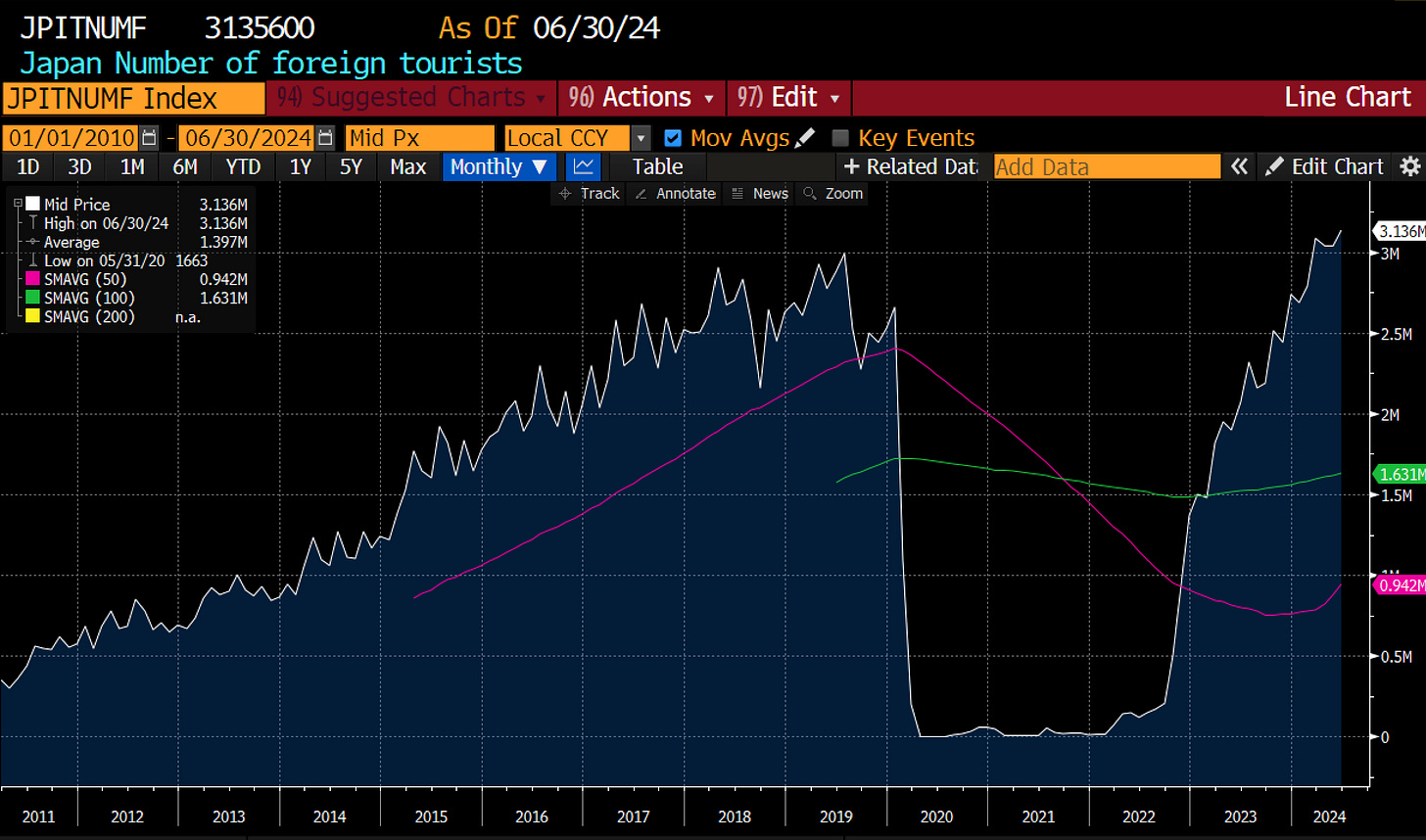

For years Japan had a tourism imbalance. Japanese went and travelled the world, but the numbers of tourists visiting Japan was limited. Under Prime Minister Abe a number of policies were implemented to promote tourism. Since 2011, the number of tourist has surged six fold and has recently eclipsed pre-Covid levels.

In Japanese current account data, Japan now receives more from tourism that it spends. As late as 2014, this balance was negative, but is now extremely positive.

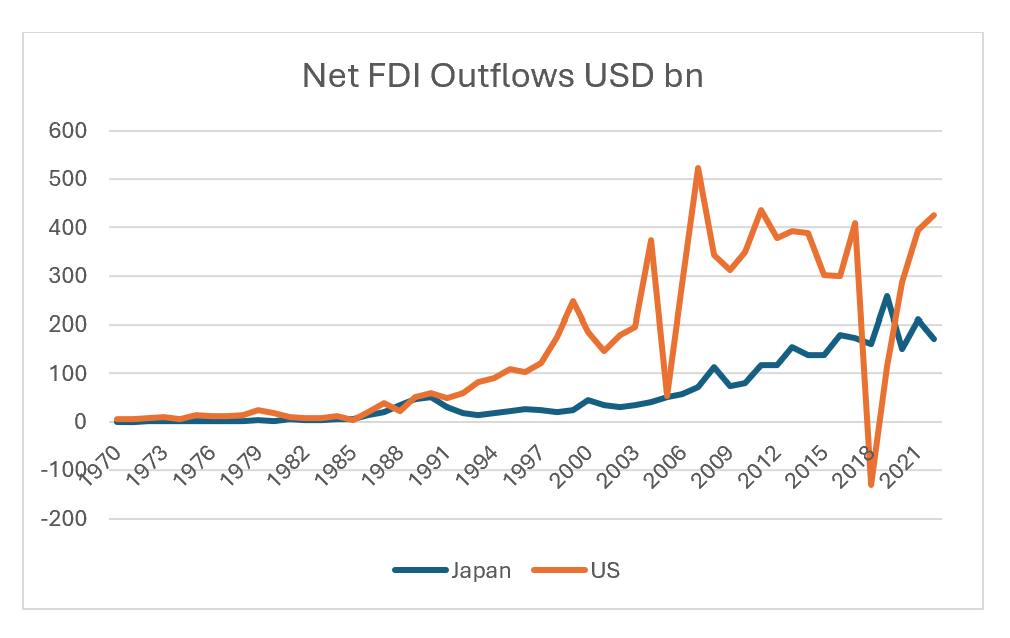

There is another imbalance in the Japanese economy that I think may soon be rectified. Japan, almost uniquely among major economies, has never really had any major foreign direct investment flows. What does that mean in plain English? Foreign companies never built any factories in Japan. While the US has had large FDI flows since 1980, Japan has only recently started to see FDI inflows increase, but still lagging the US.

When we look at net outflows, we can see that Japan has very large outflows. Not as large as the US, but much larger than relative inflows. (I don’t know why the US shows a negative print here for 2019 for the US - data is from World Bank)

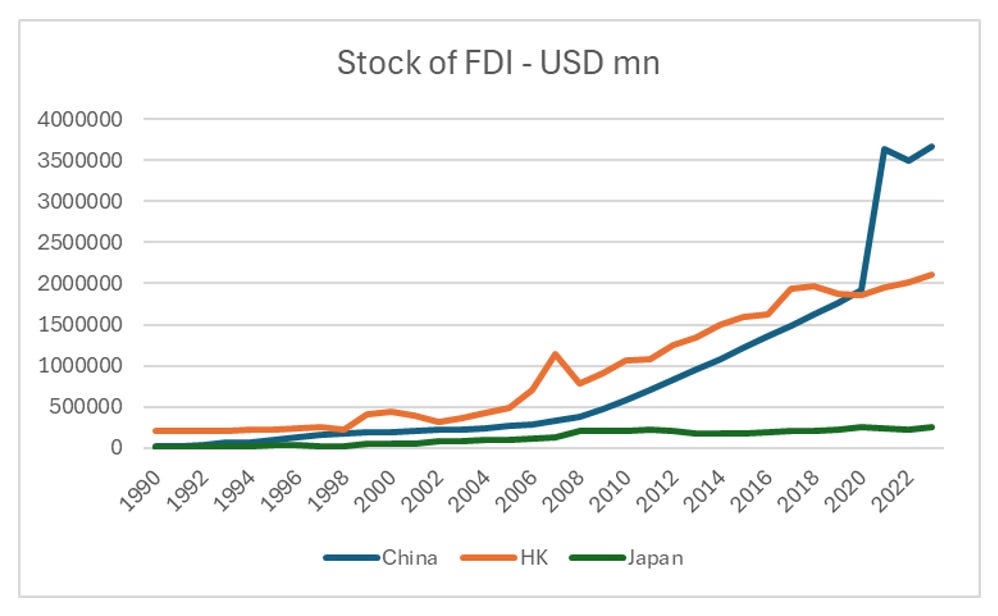

How does this compare to China? China is almost the exact reverse of Japan. It attracted huge inflows first, which are now reversing. China now has substantial outflows, as Chinese corporates invest overseas.

Using China data, which is more up to date, it has China moving to a negative FDI position. Direct investment into China has moved negative (implying that existing investments in China are being sold). That is production is being moved out of China.

Data from the United Nations Conference on Trade and Data (UNCTAD), we can get a “stock” value of FDI (basically a sum of all inflows). This seems to imply there is USD4 trillion invested in China, with another USD 2 trillion invested in HK, while Japan has only USD250bn of investment.

There is a stock of near USD 3.5 trillion of FDI in China that is no longer growing, and at risk of rising tariffs, at least in the Western World. I do not know how much of the stock of FDI in China is from Japanese corporates - but a reasonable chunk in my view. The current view is that a large part of the investment in China will be diverted to other markets - India, Vietnam, Bangladesh are the most likely names. The problem with these three is that they are not US military alliance members, and never likely to be. South Korea and Taiwan are members of US military alliance, but both are threatened by near neighbours. It seems to me that investing back into Japan makes the most sense from a geo-political point of view. This seems especially true when gross wages in Japan are inline with other developed Asia.

Japan used to have much more expensive land costs than the rest of Asia. Not only has this premium declined, Japanese property prices seem to be moving inline with the rest of Asia now. Japanese property prices are at level first seen in the 1980s.

Japan is still a centre for an innovation, with 3rd most patent applications globally.

The big question here is whether the Japanese government can enact policies to promote domestic production - just as it enacted policies to promote domestic tourism? Historically Japanese government did just that, but under pressure from Washington, and globalisation, moved more and more production off shore. Japanese industrial production is at 1984 levels.

Currently Japanese politics is in a state of flux, with leadership race for the LDP surprisingly open. The room for a “Japan first” style politician seems to be opening up. Will they grasp the nettle?