On most measures market and macro indicators are at extremes. S&P 500 vs MSCI World captures the major extreme. US assets have massively outperformed, even more so than during the dot com bubble, which would mean a “reverting to normal” trade implies shorting US equities.

When combined with my own preferred measure of extreme capital flows, net international investment position (NIIP), the US private sector has been at dot com extremes since 2016, and pushed beyond that level. (I separate out foreign reserve holding of US assets, as the private sector position has historically offered a better read on leverage and asset flows). This again implies shorting US assets.

However, this analysis misses the major change in financial markets over the last ten years. US corporates have become the price setters for equity through their use of share buy backs. This is stark contrast to the dot com era, when corporates issued equity.

Outside of the US, only the Nikkei has followed the S&P 500 in reducing share count considerably. This probably explains why the Nikkei is the only other index that is above its 2007 high.

The US Federal Reserve since the GFC has constantly acted to reduce the cost of corporate debt. This has caused the relationship between HYG (Blackrock High Yield Bond ETF) and the S&P 500 to be quite strong.

Where we are today, you can make a bullish and bearish argument. The bearish argument is that over the last year, loose monetary policy has coincided with rising inflation. With US CPI running at 7%, high yield corporate bonds only yield slightly more than 4%, the risk is that corporate bond yields normalise to some level above inflation, and take equities with them.

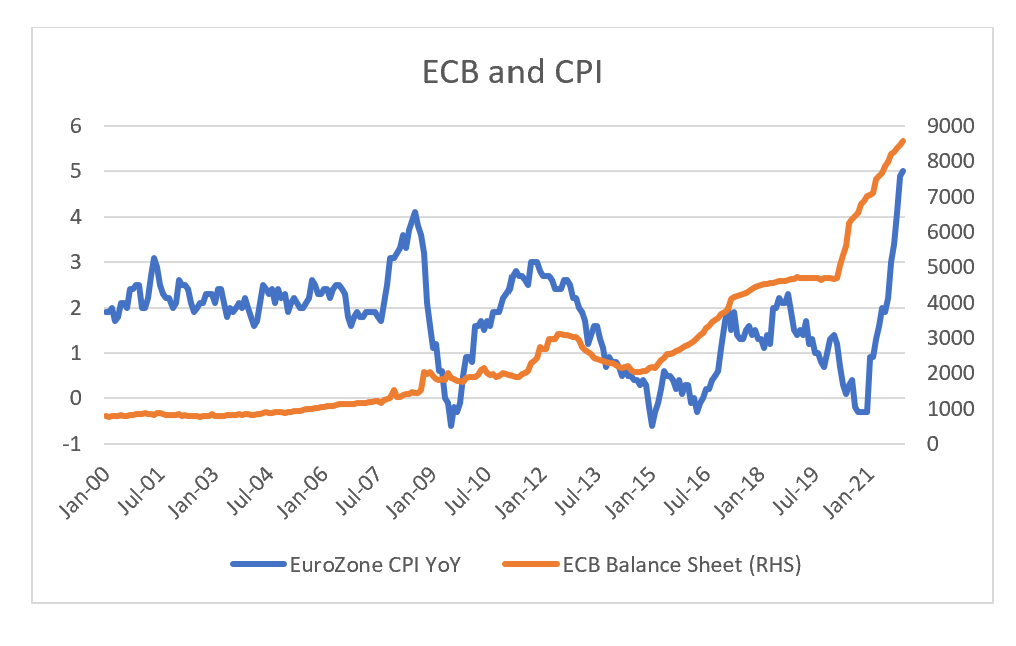

On the bullish side, if we look at the ECB where inflation recently topped 5%, the highest level since the creation of the Euro, the ECB balance sheet continues to grow, and talk of raising interest rates remain non-existent. That is central banks really don’t care about inflation, and hence share buy backs will remain supported.

If you take the view that central banks do not care about inflation then this sell off is purely driven by the “fear” of of the central banks raising interest rates. This fear becomes self reinforcing through the VIX index and volatility targeting strategies, that must sell when volatility rises. At current levels of 30, have been buying opportunities previously.

In a free market, I would suggest the risk reward of shorting US equities as excellent. But with central banks buying bonds with yields below inflation, and corporates selling bonds to buy back equities, any analysis of markets needs to incorporate central banks response. With the ECB and the BOJ both declining to even move interest rates positive, short selling will remain tricky.