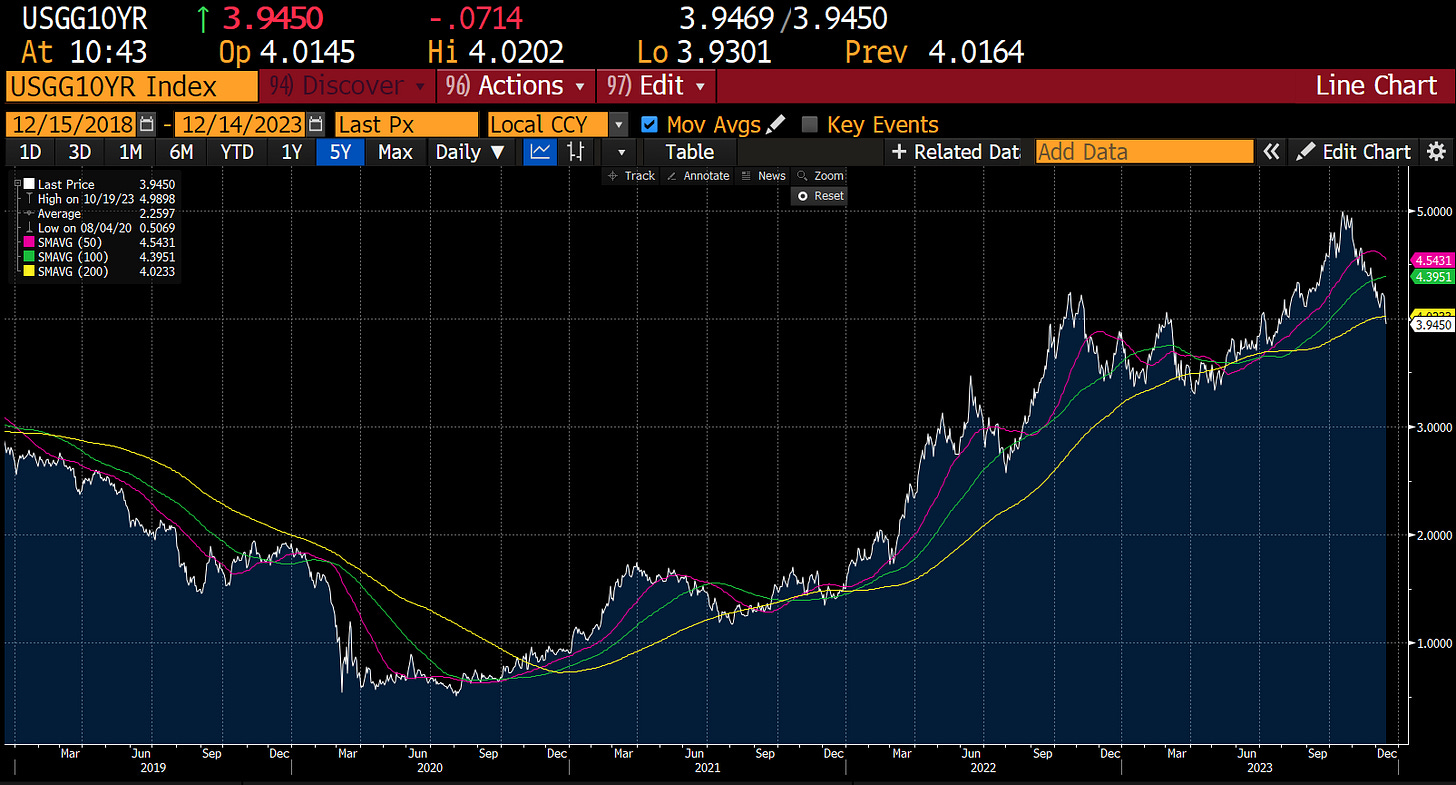

The dovish turn in Federal Reserve probably made a lot of people very happy. The US 10 Year yield has now dropped below 4%, after briefly touching 5% earlier this year.

The approximate cause of this fall in yields is that the Federal Reserve probably feels like it is “mission accomplished” in its fight against inflation. The most recent print is coming at at 3.1%

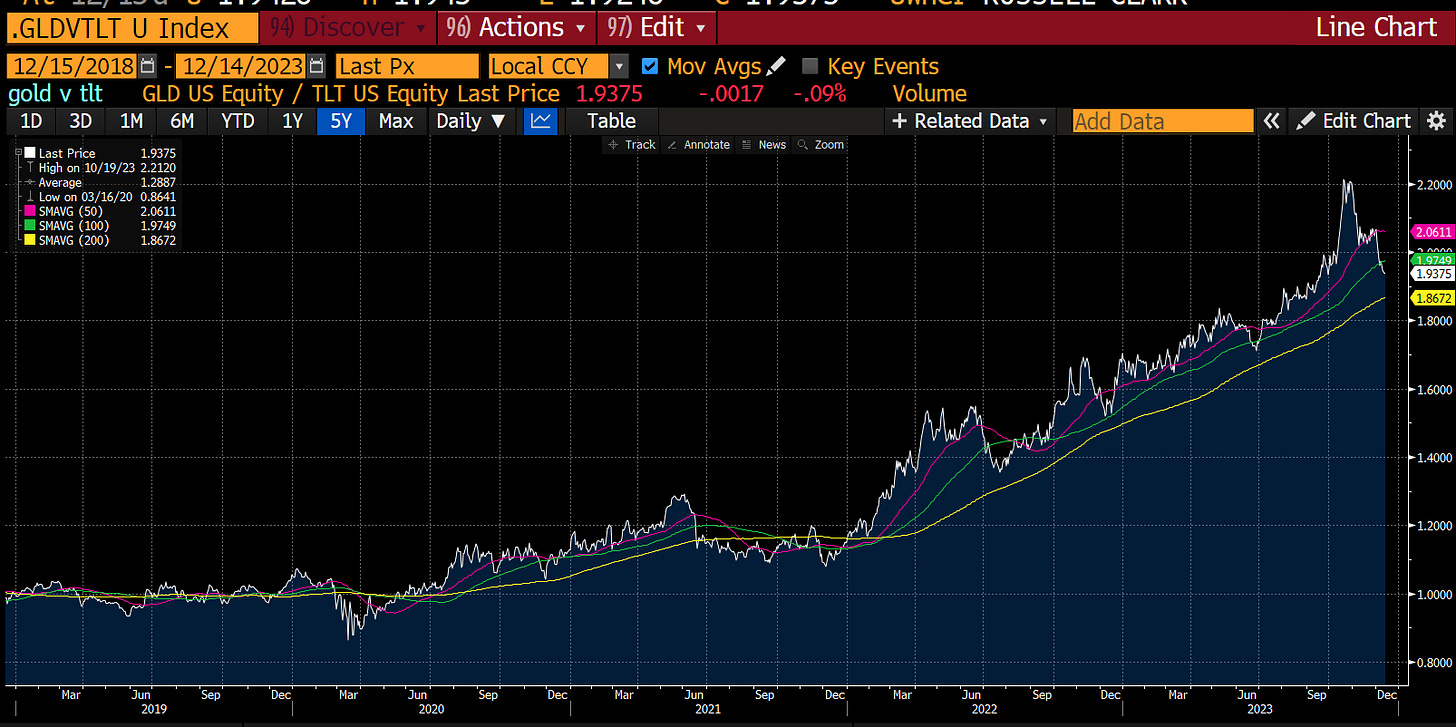

Sadly for me, my GLD/TLT trades has reversed on me, falling more than 10% since end of October.

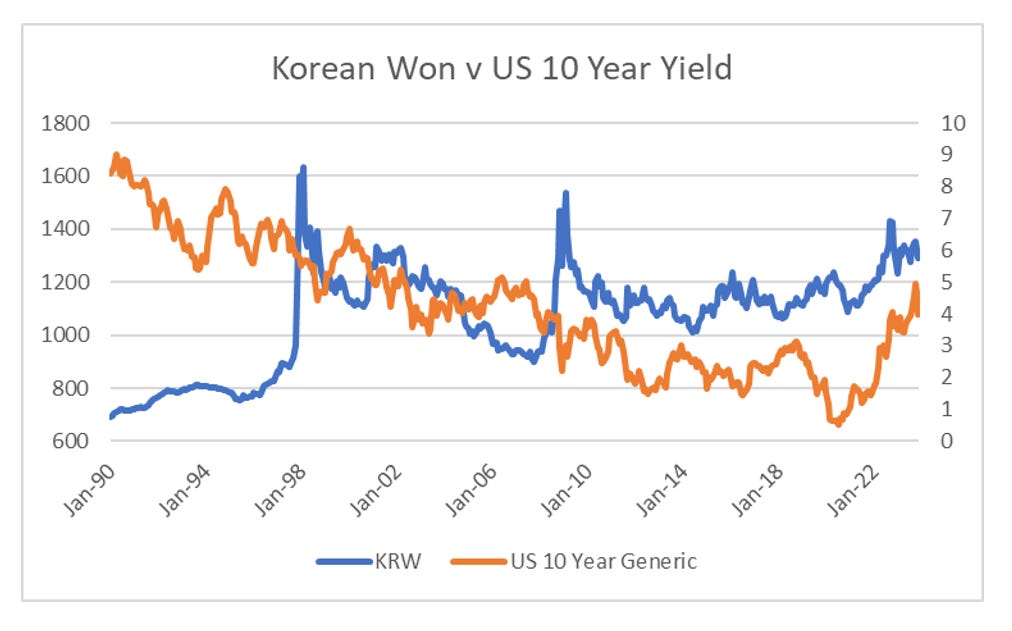

What I find amusing about the Federal Reserve and this “pivot” is that the global macro for US inflation has been ultra deflationary. Because of the hawkish Federal Reserve policy, the US dollar has been very strong. This has also seen a reversal of more typical currency trends. When the Korean Won has weakened, this has usually meant a weakening cycle and US 10 year bonds yields tend to fall. Not this cycle. Korean Won has been weak, even as US 10 year yields have risen significantly. A strong dollar tends to be a deflationary trade.

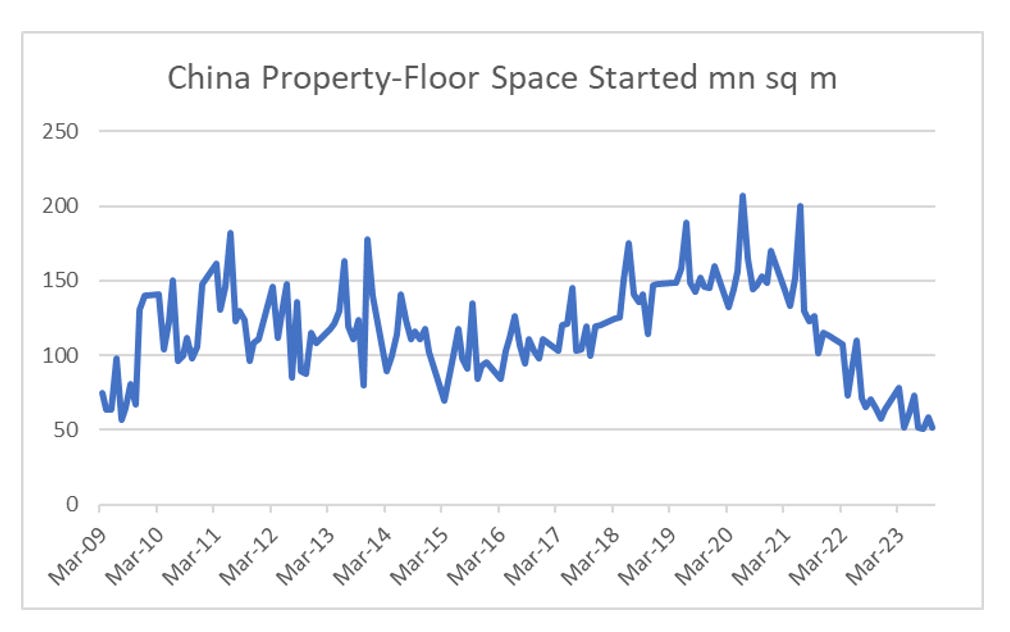

Perhaps even more deflationary has been China’s decision to end the property speculation bubble. China has crushed the number of new houses it is building. For the decade from 2011, the Chinese residential property market was often cited as the single largest risk to markets, but the last two years, activity has been cut without any large CNY devaluation, or deflation in the rest of the world. China has taken advantage of the rest of world adopting expansionary policies to deal with domestic risk.

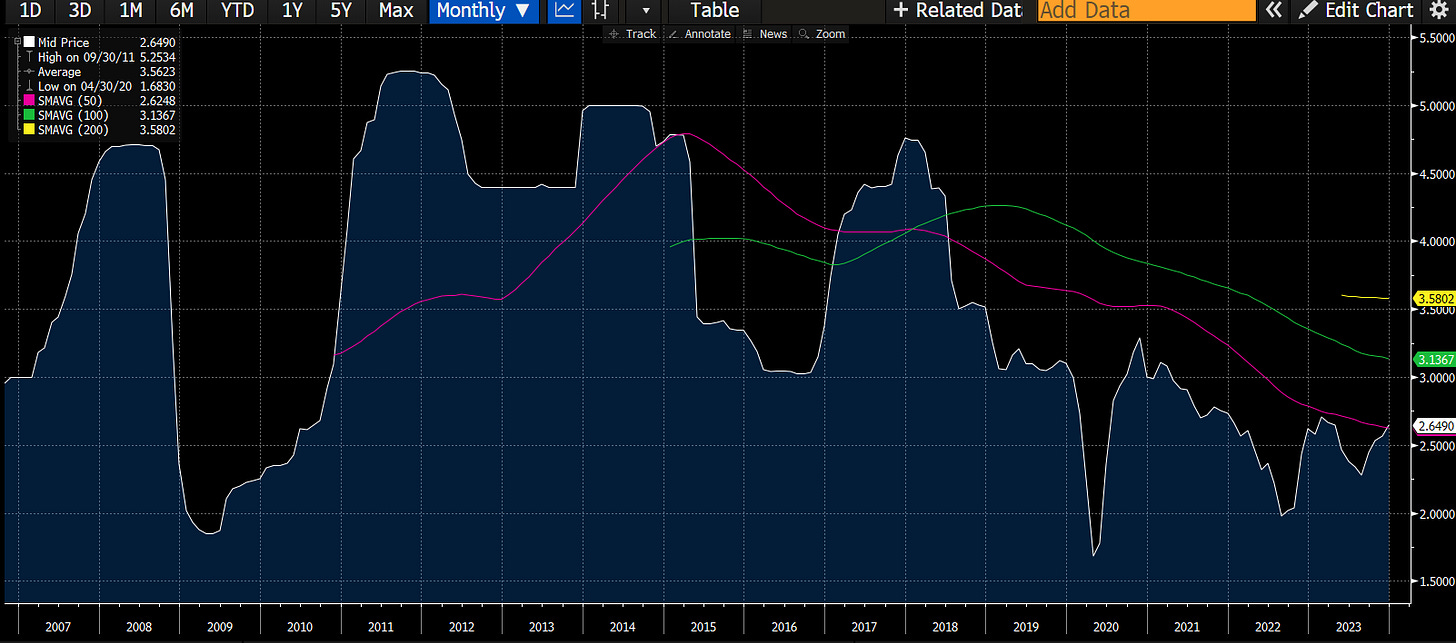

Why do I mention this? Well I learnt a long time ago, that the Shanghai Interbank Overnight Rate market was an extremely good lead indicator on Chinese activity. When it was rising, it was inflationary, and falling deflationary. Broadly speaking for the past 7 years it has been on a deflationary setting. But just as short rates are falling in the west, they are beginning to move higher in China. Has the government decided that enough deleveraging has occurred?

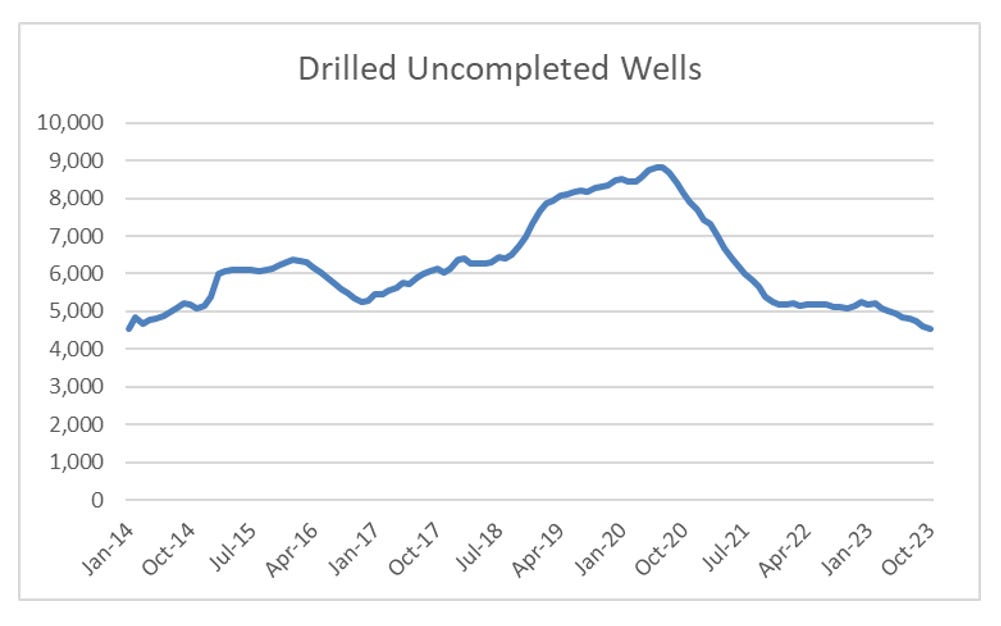

Finally, even though energy prices have been weak this year, the shale revolution in the US no longer looks like its structurally deflationary. The inventory of drilled uncompleted wells in the US has drawn down to the lowest level in nearly 10 years.

The US has also taken advantage of recent energy price spikes to get rid of the obsolete strategic petroleum reserve. Unlike other people, I agree with this. It’s a smart play, but it does reduce a significant overhang from the market.

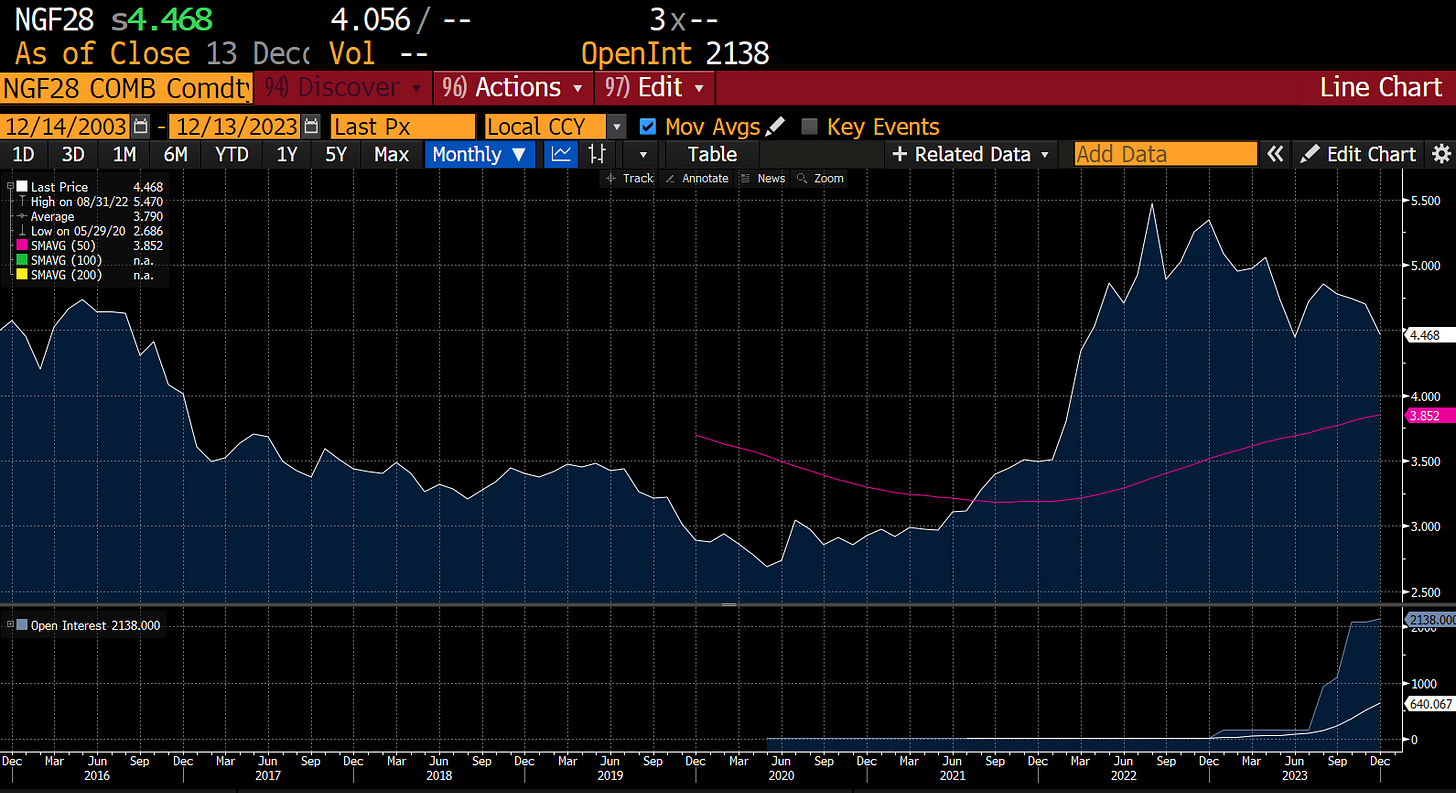

Probably most negative for shale is that long dated natural gas markets in the US continue to indicate a much tighter outlook for natural gas than in 2020 or 2021. Here is pricing for January 2028 natural gas.

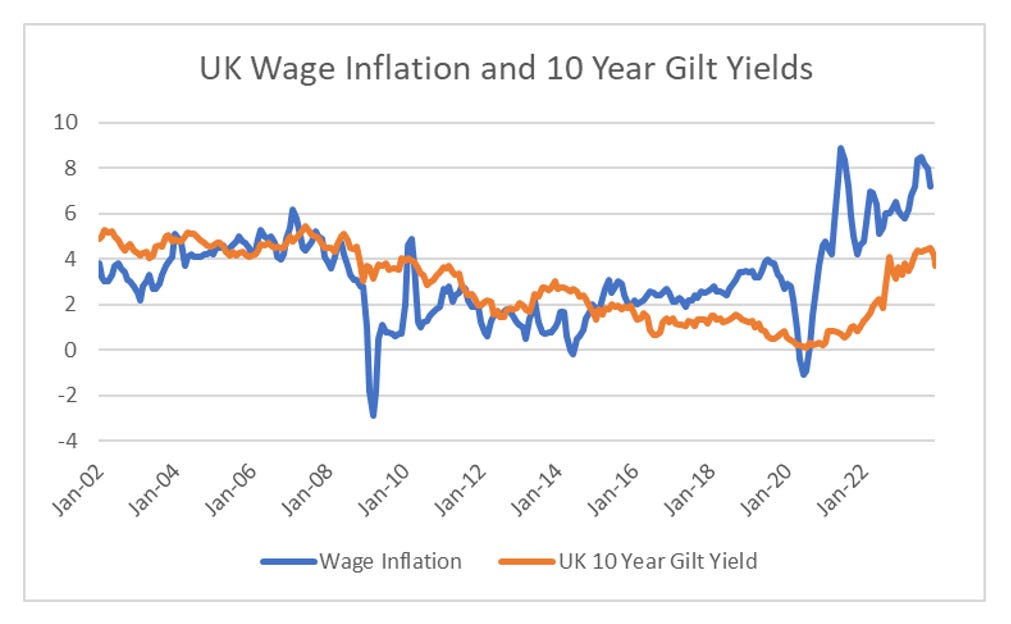

The expectations of rate cuts are really crazy in my view. In the UK, the chances that we have a Labour government next year are extremely high. The chances that the NHS will see significant funding increases and wage increases are also high in my view (NHS is the largest employer in the UK). Anyone else think that 3.7% yield is a bit low to lend to the UK government for 10 years? Anyone else think wages inflation falling back to 0 seems unlikely for the foreseeable future?

The move back in GLD/TLT has hurt my portfolio this month, and reminds me of the various times markets have gone against me. If I am right, then this should be an excellent entry point, and China, commodities and politics all are turning inflationary as investors get positioned deflationary. If I am wrong, then I can forget about this idea of launching a new fund and try and find something better to do! Both are appealing to me, so I am happy to let the markets decide. My gut feeling is that this is a good entry point. Lets see.