When I got my first fund back in 2006, I had nothing to lose. I had no money, and only one investor. I was bullish on emerging markets, but almost as soon as I got fully invested in April 2006 (100% long) and made a quick 10%. Then the markets dumped, and I drew down over 20%. I remember going home to my new wife and telling her how I had already fucked my one shot. John Horseman was my only investor, he called me over, asked me about my positions (I only had about 10 or 12). I explained them to him, and he said great. He doubled the money I was managing, and kicked off the process to open to outside investors. His timing was great - the fund made 100% from then to end of 2007. I won Eurohedge Best New Equity Hedge Fund.

By 2010, I felt that the China story was coming apart. The government orchestrated housing boom of 2009 looked to me to be a disaster, and the most likely outcome was a China crisis of some sort. This made me bullish bonds, and bearish anything to do with emerging markets. This was good call, but too early. Emerging markets continued to rally until suddenly the markets tanked in 2011, and the short emerging market trade took off.

2010/11 was very tough, as I combined a bearish view on emerging markets with a bullish view on European bonds. I particularly liked Irish bonds, which I saw as having zero chance of defaulting. I bought them when they yielded 8%, unfortunately they went to 12% before rallying.

The combination of bearish emerging markets, and bullish bonds before the trends got going led to horrendous underperformance and redemptions. I was sure I was right, but it was awful.

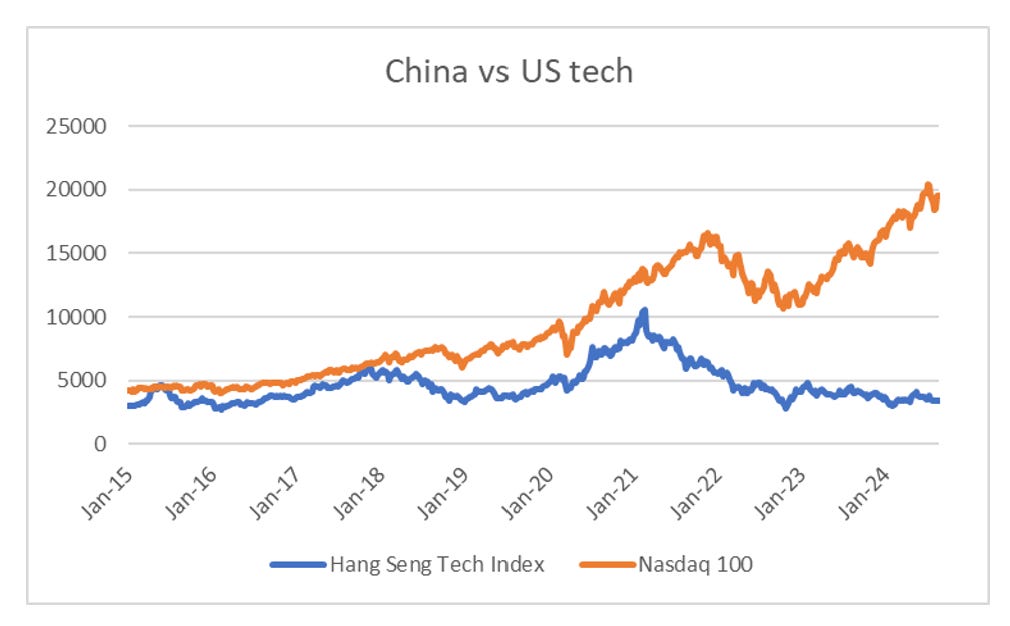

In 2021, I got very bearish on Chinese tech as I read what the regulators and government wanted to do, and was very correct. But I also thought this would be very negative for US tech, and this was very wrong. Why was I bearish? Generally I view tech as being deflationary (by definition) - and this has been the case in China. But in the US, tech deflation does not really exist. Has anyone seen the cost of using Apple cloud fall? Does Netflix membership fees fall with scale? Is AWS deflationary for users anymore? Despite only incremental improvements in the iPhone, do they get cheaper? The answer of course is no. But I thought it tech deflation would revert for a long time - and suffered because of it. Sometimes you got to know when to hold them, and know when to fold them.

I mention all this, as I am in another moment of existential angst.