So the trade I have been recommending for a while now is long GLD/Short TLT. It has been trading great, and I suspect it will continue to trade great.

Now typically in fund management, managers and allocators rely heavily on back testing as a way of working out the riskiness of a trade. This back testing would currently be suggesting that either the dollar is too strong, or bonds are oversold (which is exactly what the macro community is suggesting) The dollar appreciation from 2001 to 2015 coincided with GLD/TLT underperforming.

Separating out the performance of GLD and TLT, would lead you to think that gold looks overvalued. In this case, back testing would highlight that gold has held up well despite bonds being weak. In particular, when TLT was weak in 2014, gold got destroyed.

The combination of strong gold price and a strong dollar leads to the most arresting chart (for me in anyway), gold in yen terms. What I find extraordinary is that in 2001, gold in yen terms was the same price it was in 1978. No wonder Japan felt so wealthy in the 1990s and 2000s, but feels poor today. In 2016, I would have assumed a collapsing Chinese Yuan would drag down gold prices, but Chinese policy has been very pro-labour which is about supporting wages, not asset markets.

How do I fit all these contradictory signals together? Politics provides a much better way to understand this. In 2016 with the election of Trump, and 2020 with the election of Biden, we have had two “pro-labour” presidents. 2024 will most likely see the third straight “pro-labour” presidency (either Trump or Biden again). Pro labour policy in the US is a combination of tariffs, Buy American provisions, and low unemployment. I also see pro labour policy as being “strong dollar”. Why? Workers know when their wages buy less, so keeping real wages strong implies a strong currency. Also until 2016, free markets would push up undervalued currencies (and labour), and push down overvalued currencies (and labour). In a free market world, Japan with its deflation and constant trade surpluses would see a Yen rally. In a world where the US has tariffs and domestic production subsidies, the Yen is weak.

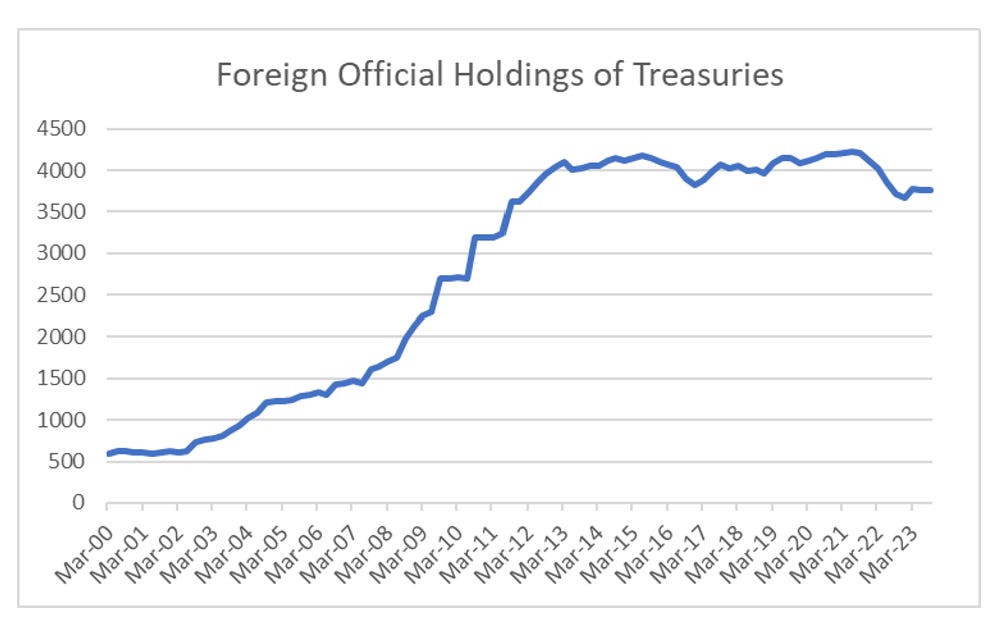

In a protectionist world pro-labour world, a trade surplus is a sign of economic weakness, not competitive strength. All of these are good for the US, except for one area. Treasuries. In the new world, where trade surpluses are weaknesses, why would anyone buy treasuries as a foreign reserve? Both economically and politically it makes no sense. Official holdings are beginning to reflect that reality.

So treasuries are a short - but why hold gold? Going back to Japan, in 2013 Abenomics was launched and is an extremely pro-capital policy. With the US moving to pro-labour, this has led to the break out of gold in yen terms. For me, if the Federal Reserve moves to pro-capital policies then I would expect a similar move in USD terms. Gold is held in place by tight monetary policy, and should the Fed go back to old habits, we should see gold move higher. GLD/TLT is what I call a “correlation break” trade, and is one of my tools for running net short. You can read more about it here. In essence a correlation break is when a macro relationship reverses, and catches the macro community out. What that means you can be long and short trades that should be positive correlated, and then make windfall gains when the correlation changes. GLD/TLT offers a template for this trade. As mentioned previously, I think private equity is probably the industry that dies in this correlation break.