In a recent post, I wondered if the Trump administration was going to force the Federal Reserve out of the “QE Business” - or in other words ban them from buying assets, and get them to focus solely on interest rate markets. This could be a huge issue for markets. Whenever asset markets have threatened to unwind, central banks have stepped in as buyers. The UK gilt market is good example, where the Truss budget was a shock, that caused initial margins on gilt trading to rise which caused the market to have no bidders and yields to surge. It required the BOE to restart QE to bail out basis traders.

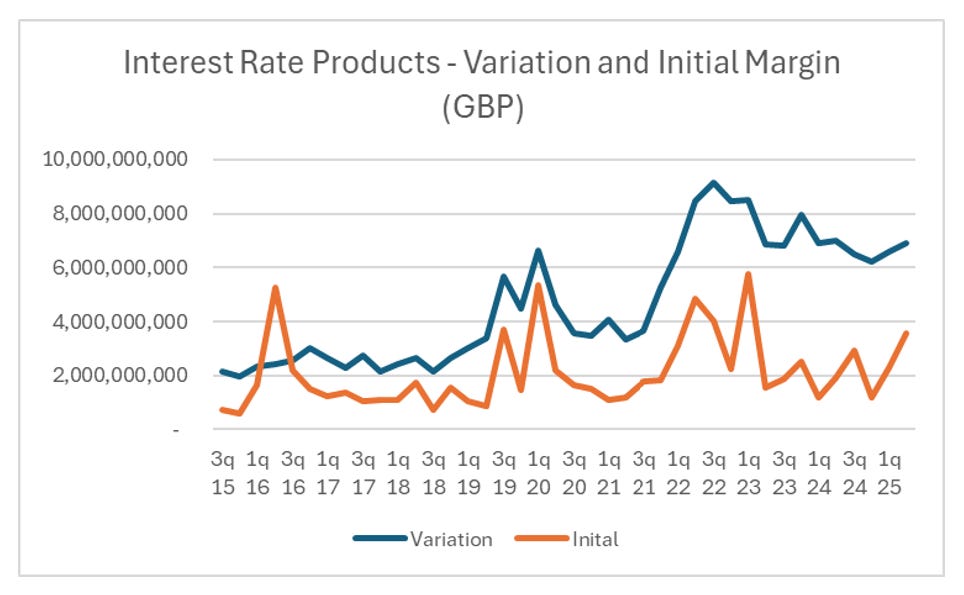

When looking at basis trades (typically buying physical treasuries and then selling interest rate futures or derivatives) there are two different market to look at. LCH owned by the LSE Group and has dominant market share in interest rates derivatives and European bonds. CME dominates Treasury trading, and JSCC dominates JGB trading. We are mainly concerned with treasuries here, so we will look at date from LCH and CME. Looking at variation and initial margin data, there is a cyclicality to this. Spikes in variation and initial margins SHOULD be correlated. As of the most recent data point, q2 2025, margins look low at LCH.

CME data is more interesting. Q2 data shows much more of a spike in both variation and initial margins, more inline with the air pocket we saw in Treasuries during the “Liberation Day” tariff sell off.

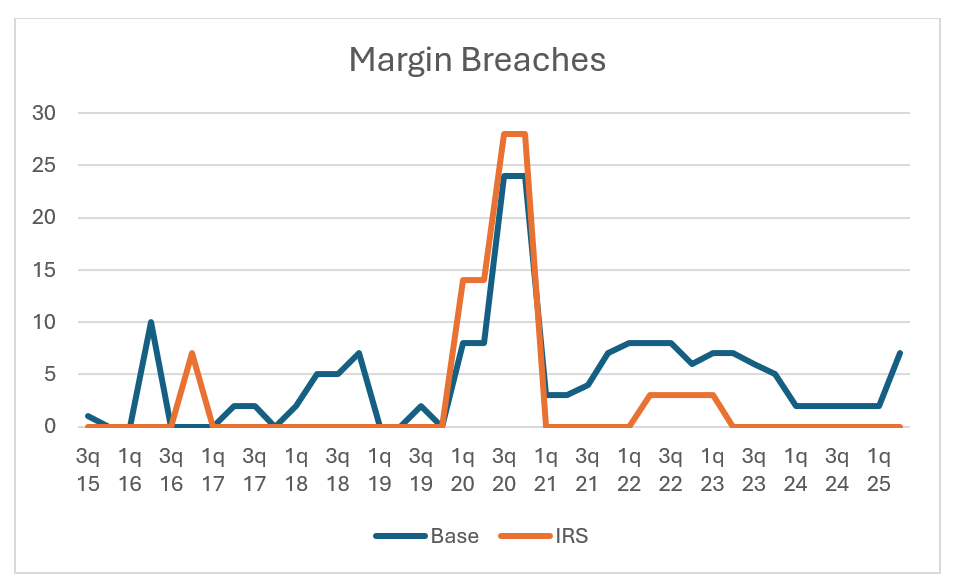

More surprising was the lack of margin breaches at LCH

Something we also saw at CME.

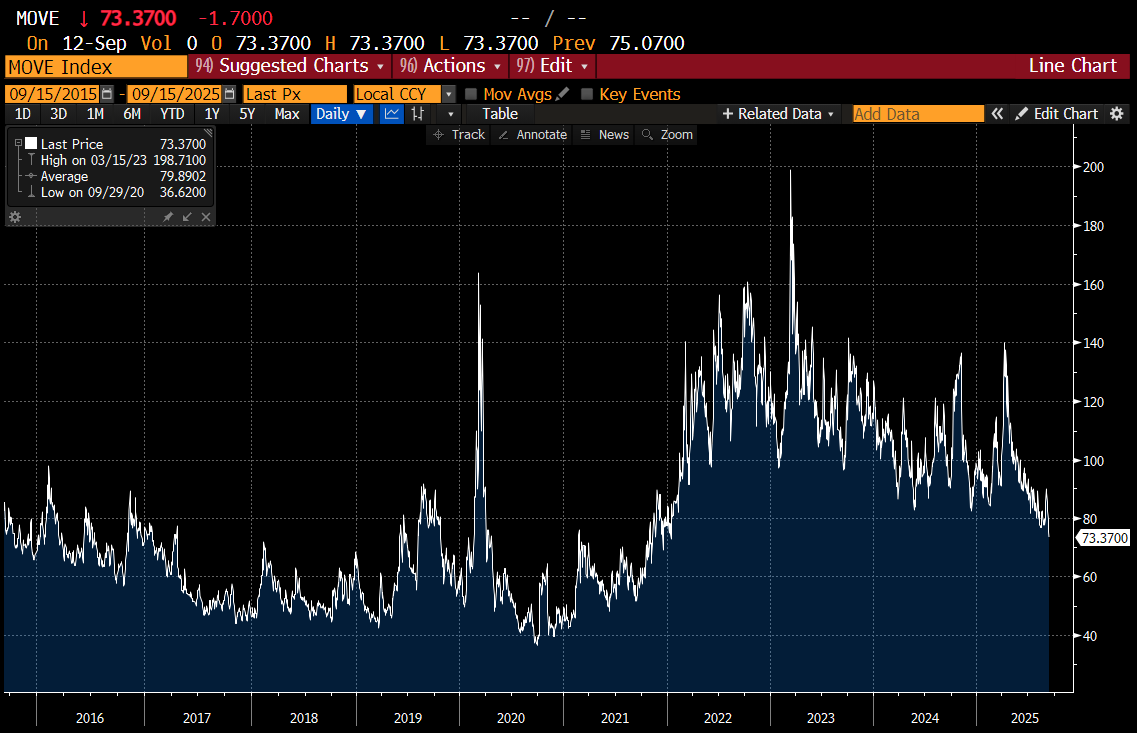

Having studied clearinghouses for a while, this would match up with market moves. The MOVE Index (a measure of bond volatility) tends to match initial margins, and spikes from low levels to high levels tend to march up with margin breaches. So 2020, and 2022 saw margin breaches, but since 2023, the MOVE index has tended to be moving lower.

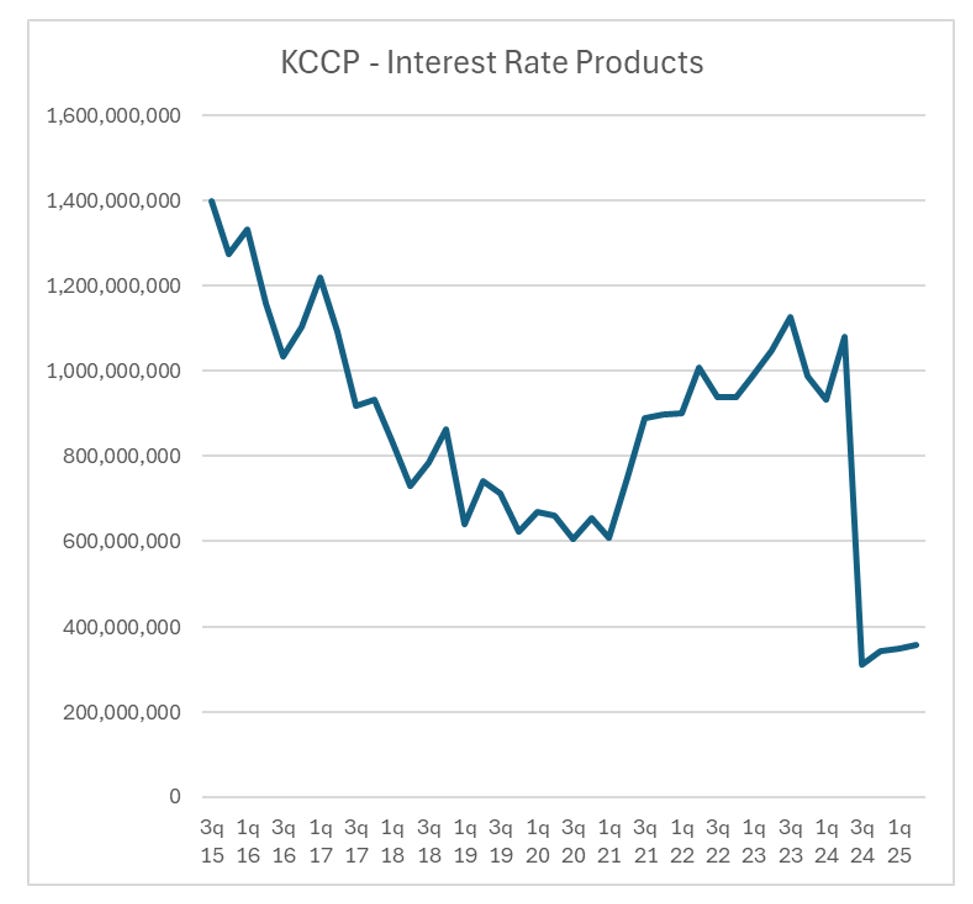

Generally speaking, clearinghouses tend to cause trend following to work well. So when things are going well, for example the MOVE Index is going lower, then initial margins will fall, and asset markets will behave. It is only a problem when volatility inflects higher. So generally speaking, IF the Fed gets out of the bond buying business, AND the Trump administration delivers inflationary fiscal policy or we get an oil shock, then we will have a problem. But the data above suggests that will be more likely a 2026 or 2027 problem. The only data point that I found particularly bearish was a huge drop in KCCP - which determines the capital charge for trading with LCH.

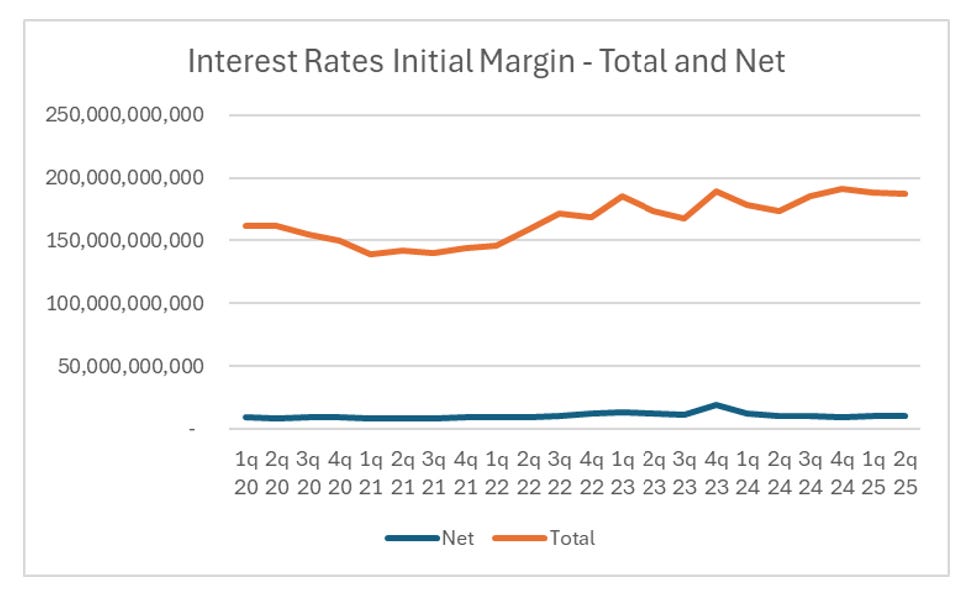

This fall in capital charge is very good for basis traders and other users of the clearinghouse, as it allows less capital to be put aside. The fall was driven by a regulatory change, which in essence allows the clearinghouse to net trades. But netting is the key issue with clearinghouses. Netting is the fundamental driver of basis trade, and leverage. LCH reports initial margin numbers on a total and net basis. As I understand it, the net number is purely hypothetical. Is the amount of initial margin LCH calculates would be necessary if all trades could be netted.

Theoretically this should be fine. But analysis suggests that we are ending up with a bifurcated market, with hedge funds all one side, and banks all the other side. As an old report form the BIS noted, all US banks have become a net lender to the repo market.

Putting it all together, conditions are nearly perfect for a clearinghouse blow up - but not yet. A sustained period of the MOVE index trading in the 50 to 60 range should allow sufficient leverage to build for a blowout move. I still think long dated government bond yields go higher. But an air pocket move like we saw in gilts in 2022, or treasuries earlier this year looks unlikely until 2026.