I don't really read other macro thinkers. Generally speaking we are looking at the same data - or should be - so I am better off limiting other people's influence of my analysis. However in my 25 years of working there is one guy I will always read, Christopher Woods over at Jefferies. If he wrote a substack I would be a paying subscriber. Sadly he works at a brokerage so you need to be doing business with Jefferies to get access to his work now - which is a very different decision to signing up to a substack. Why is he worth reading? Well he called the top in the Japanese market.

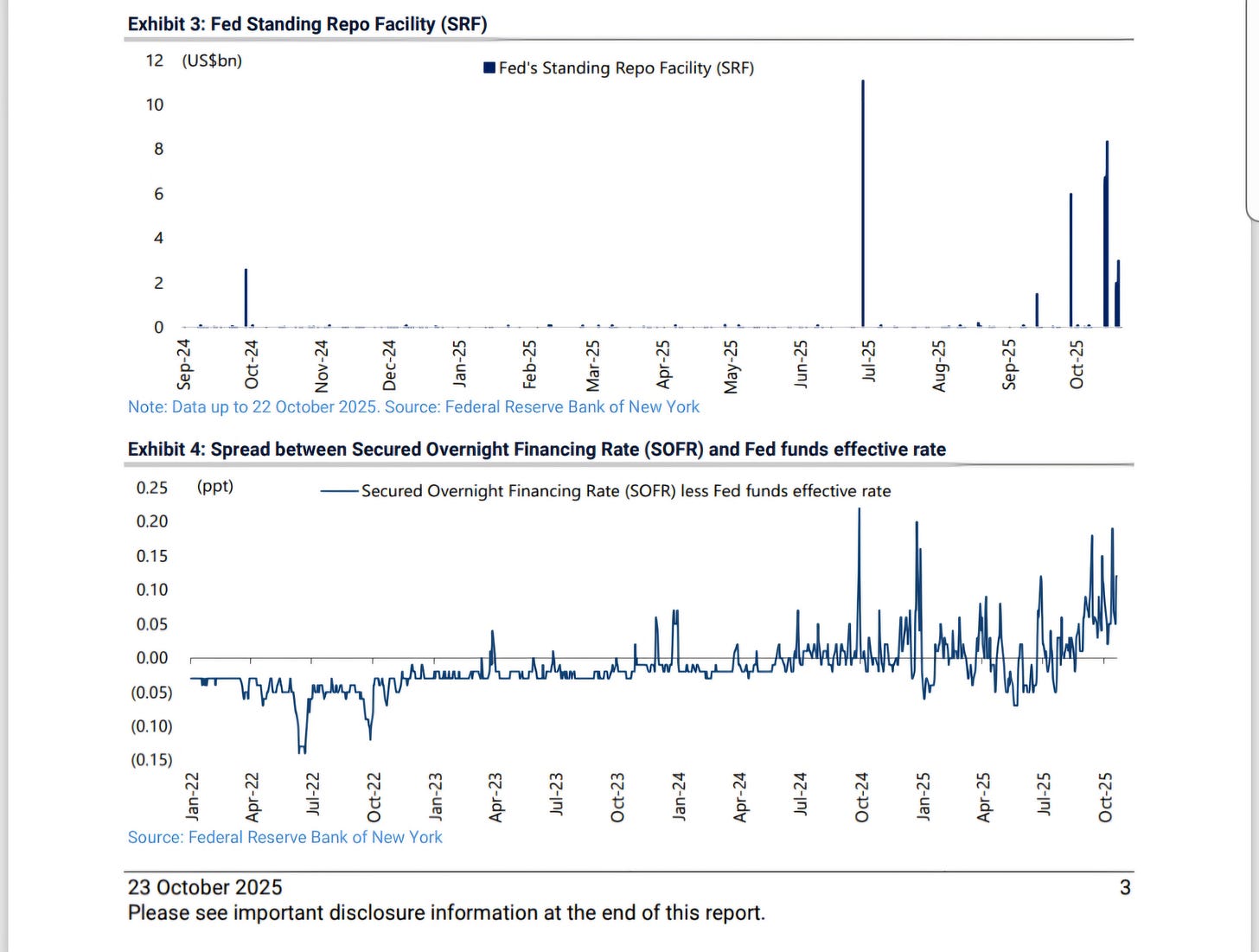

Readers of his newsletter, Greed and Fear, will know he was short Fannie Mae and Freddie Mac into the GFC. And he also was bearish into China devaluation fears.in 2015. Like myself he has come to look at global markets via Asia. In general I like to be similarly positioned to Chris - the only caveat to this is he does take liquidity and drawdown risk on his long portfolios which professional money managers cannot do. I mention Chris as I am going to use some of his charts - which I could make myself - but am too lazy to do. Chris has also picked up on financial stress entering the system. Banks are tapping the Standing Repo Facility and SOFR is rising above Fed Fund Rate.

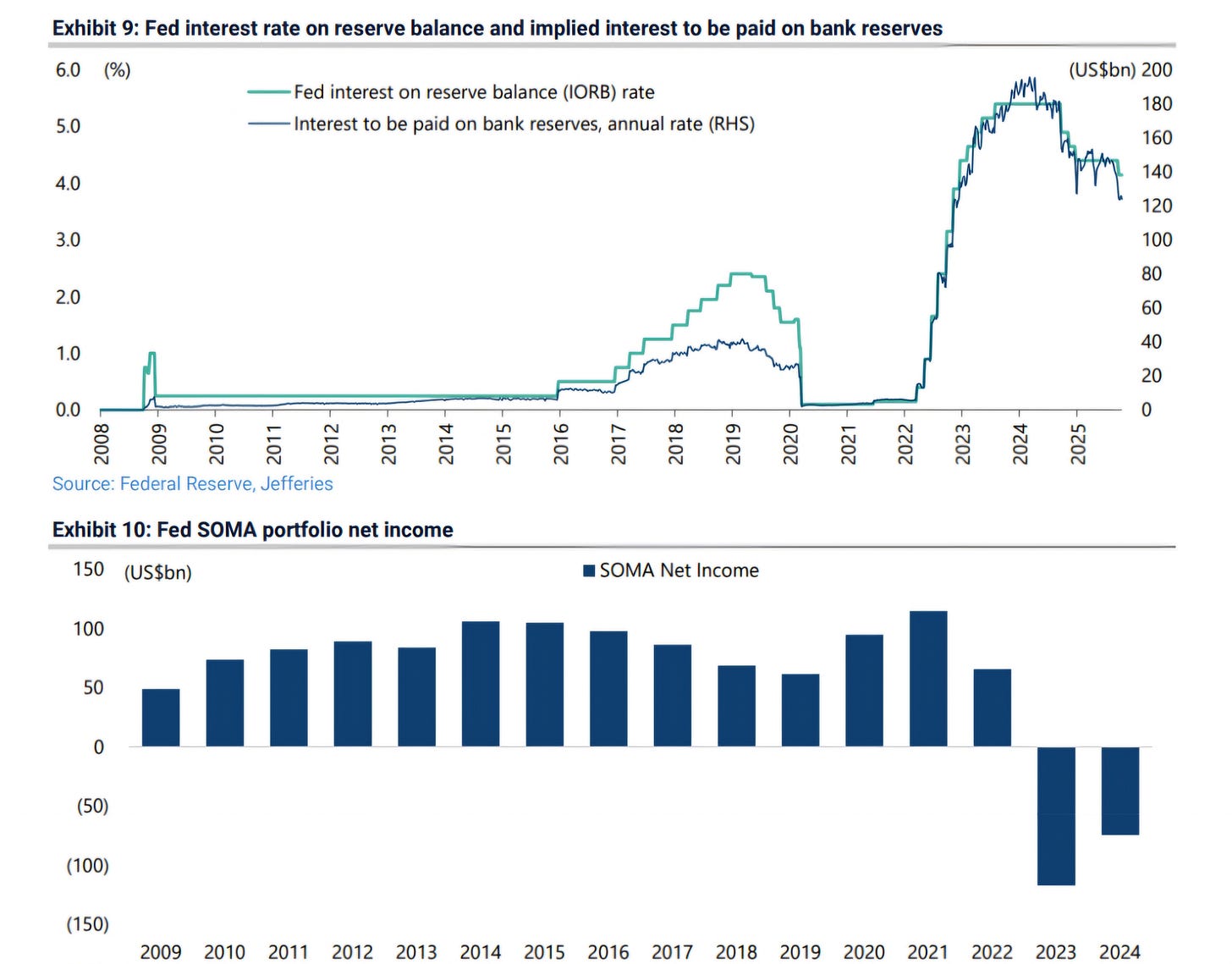

The obvious problem here is the treasury basis trade - something Chris also sees. And as I have mentioned the Fed has come under political pressure. One thing I had not picked up.was the scale of losses that the Fed now has due to paying interest on bank reserves. I mentioned in a previous post the move to a negative primary income balance was driven by higher interest rates. This is sort of saying the same thing.

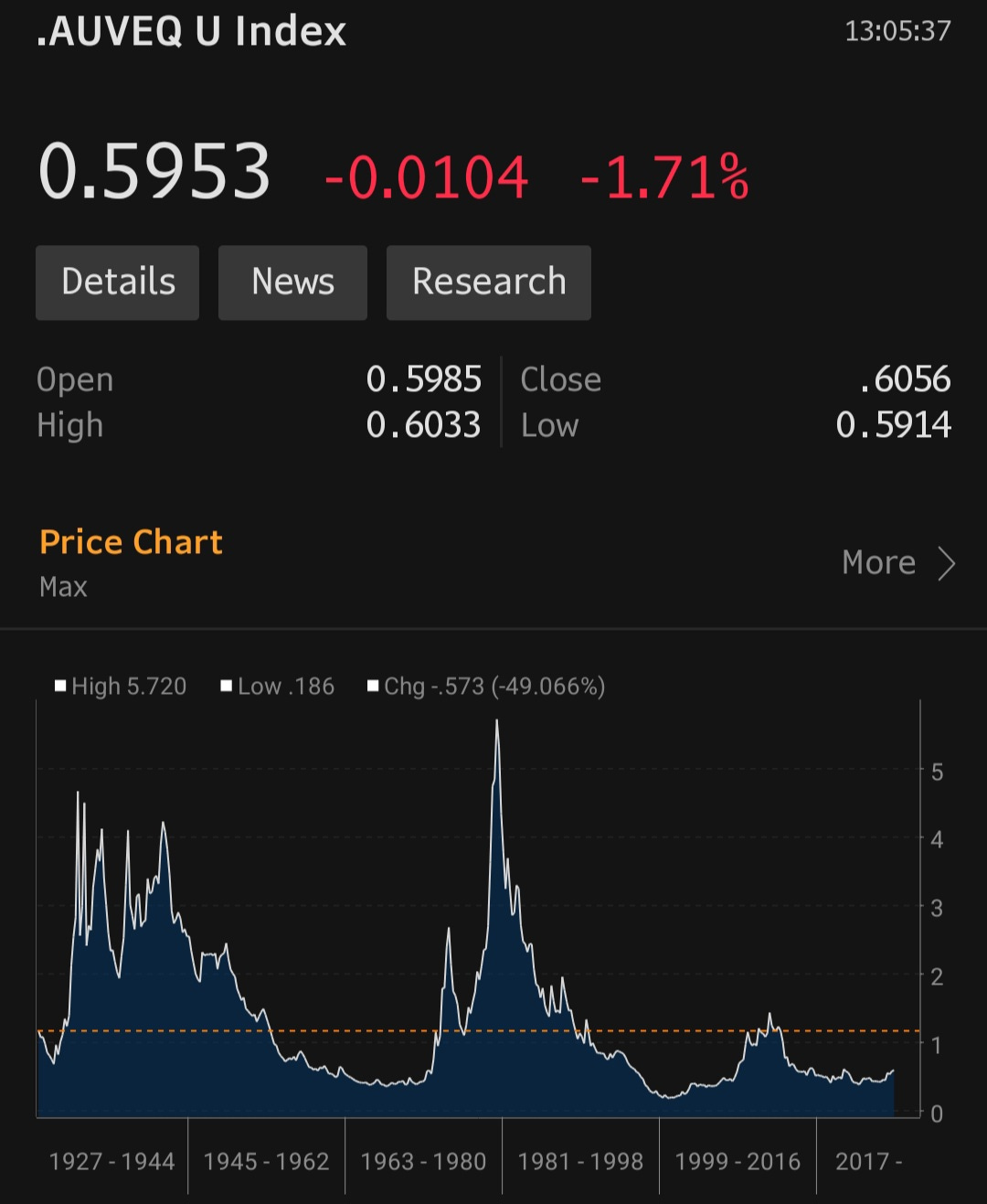

For Chris the above means the end of quantitive tightening and the beginning of balance sheet expansion and hence a bullish view - at least on gold. I think he is probably also implying a bullish view on equities. I look at gold v SPX and wonder if that's correct?

If Chris is right about loosening and I am right about semiconductors as the new oil then tech should fly higher. As I write this, Korean semiconductor company SK Hynix is approaching an all time high. Long time Asia watchers should be as surprised as I am.

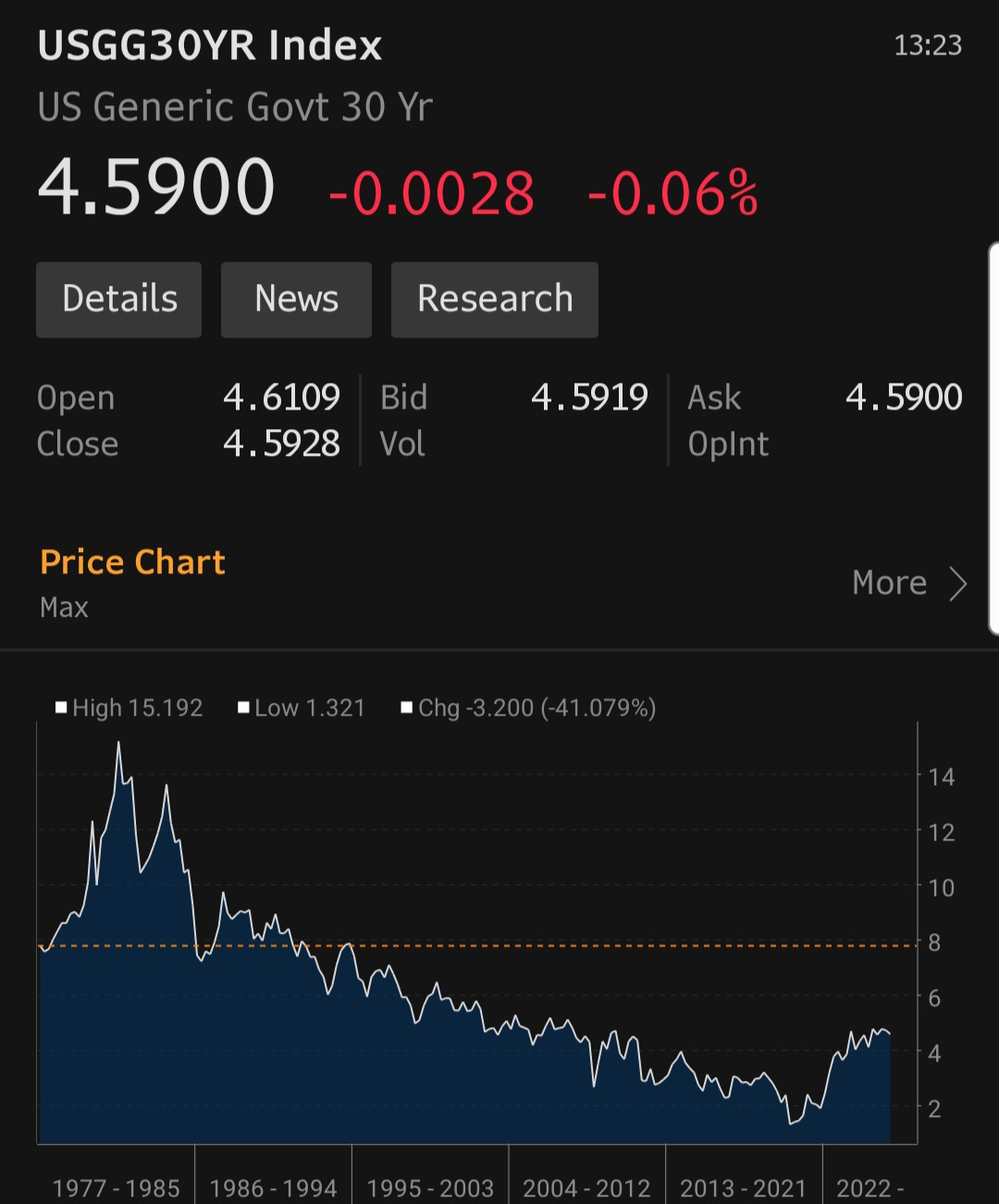

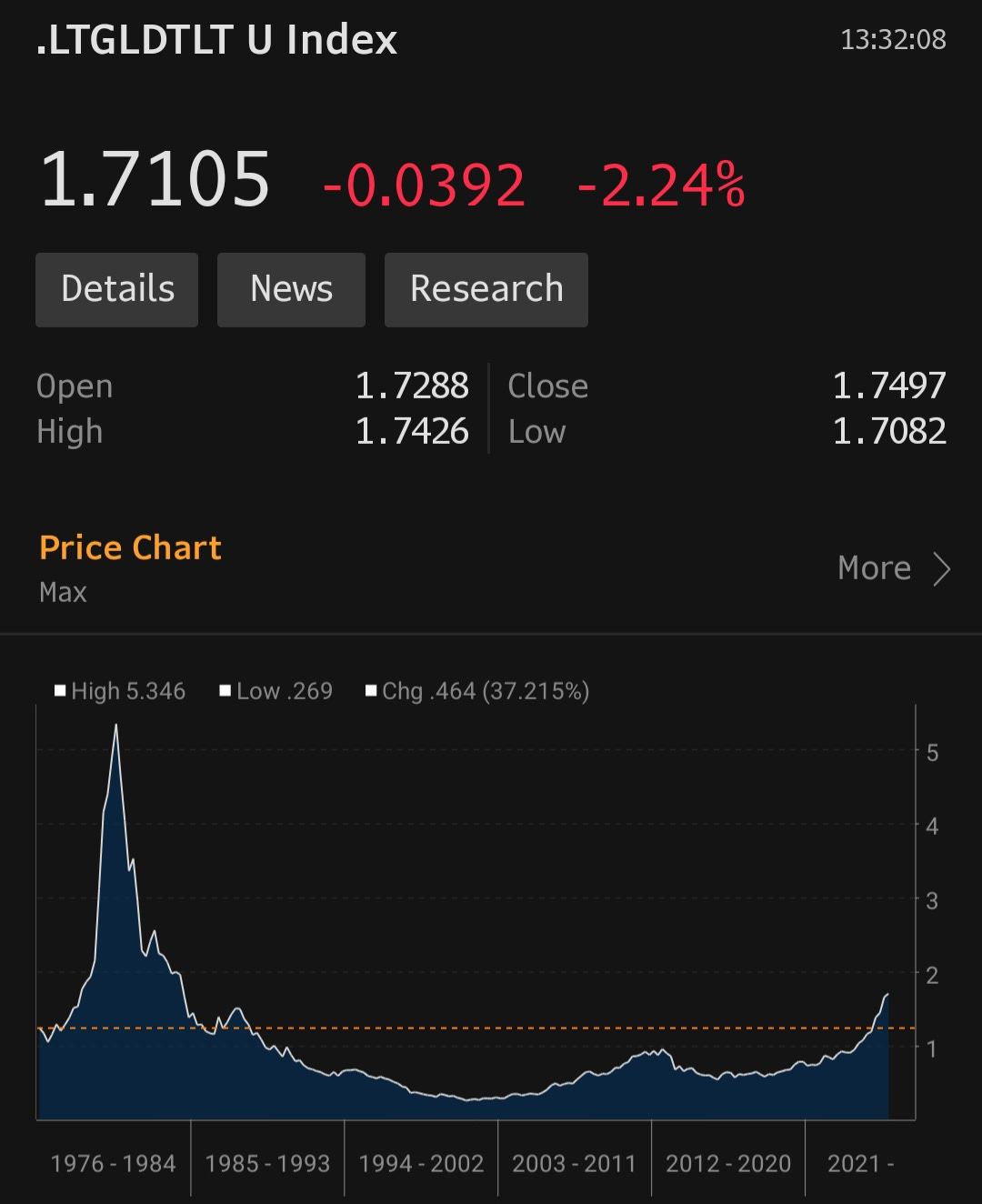

What I read from Chris would be probably bullish gold AND tech. As I have pointed out bullish tech seems to be an inflation trade so that makes sense. What I also read is that inflation is going to start surprising to the upside again very soon. That is maybe Gold/Spx is not turning now - but another sell off in treasuries is over due. 30 year US treasuries at 4.6% looks wrong. My target remains 10%.

What I like about the Treasury short here is that it should work in a bear market driven by the unwinding of the basis trade AND in a Chris Wood predicted dovish turn in the Fed. Maybe this is what is needed to get back to 1980 levels on gold/treasuries.

To me the connection between semis and tech and inflation is becoming more and more obvious. Chris is probably right that the Fed will come to realise it too late and despite surging semiconductor pricing will cut interest rates. Certainly, a bullish view on stocks and gold has been the right view this year.