GLD/TLT has carved out a new high in recent days, which is pleasing.

The original idea behind GLD/TLT is that in a world where governments are becoming more “populist” (i.e. more concerned with raising wages rather than asset prices) - then inflation will be entrenched, and central banks will need run much tighter monetary policy to keep inflation under control. This year has really been the year of gold, as western central banks have really wanted to cut interest rates.

Why the Federal Reserve wants to cut interest rates when house prices are pushing higher from already high levels is a mystery. The decision making and the thought process of Federal Reserve governors is extremely poor for people with that much power. It is pretty much guaranteed that once the Fed governors leave office, no one will have any interest in their ideas. Their power comes from their institutional political power, not their inherent intelligence. They are not Friedman, Hayek or Keynes.

For various reasons, the market had convinced themselves that long term US rates had found a bottom. TLT has been in a range for a year now.

What remains most striking was the sheer amount of investment that has gone into TLT, while gold flows have remained fairly stagnant. As I have mentioned, ETF flows usually follow performance - but for some reason people have convinced themselves that low interest rates are here forever.

A much more typical example is China, where recent surge in shares has also seen a surge in shares outstanding for FXI US (China large cap ETF).

From a market perspective, the strength of the Chinese Yuan is probably the most inflationary signal out there.

My guess is that deflation trades, such as TLT are now in the firing line of the market. Even with the recent rate cut, short TLT generates a positive carry.

The JGB market has also stayed in a quiet bear market, even with the Federal Reserve rate cut, and the recent strength of the Yen.

So here is the trillion dollar question. Was the Federal Reserve rate increases only deflationary for Chinese assets? Was the pressure that it put on the Chinese Yuan leading to weakness in the Chinese property market? The original idea of needing asset price weakness to keep inflation in check was correct - but only in terms of Chinese asset prices? Given the size of the Chinese economy and property market, this could well be true.

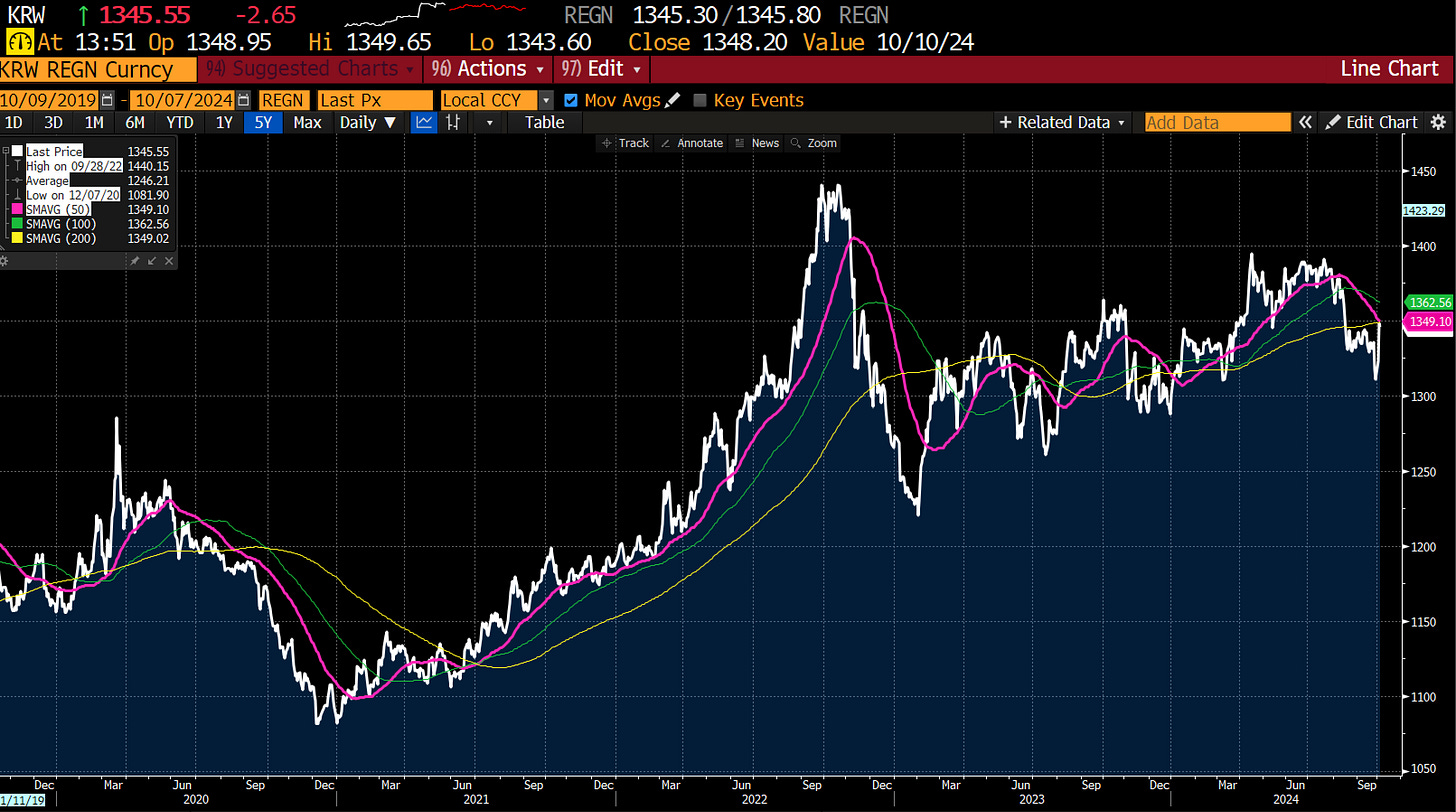

If that was so, then rising Chinese equities would indicate rising inflation, and a possible tightening of interest rates in the US, meaning inflation in China leads to tighter monetary policy elsewhere. We are already seeing signs of this, with currencies like Korean Won weakening on Friday - pricing in potential Federal Reserve rate hikes?

It is an interesting idea. And a long way of saying that I think TLT is likely to weaken from here, and GLD could well take a rest.