When I talk about a political shift from pro-labour to pro-capital policies, I have tended to talk about the Thatcher/Reagan revolution beginning in the 1980s. This was more out of convenience than anything else, as no one is going to argue with dating a pro-capital shift to the rise of Thatcher. However, the reality of political revolutions is that they start out small and then seem to happen all at once. For me, I think of the real beginning of the shift from pro-labour policies to pro-capital was the decision to leave the gold standard. From the moment FDR instituted a minimum wage in 1939, until the moment the gold standard was abandoned, an increase in the minimum wage was a “real” increase. American workers could afford more gold at the very least. From when FDR began using a Federal Minimum wage until 1980, it rose over 1000% in 40 years.

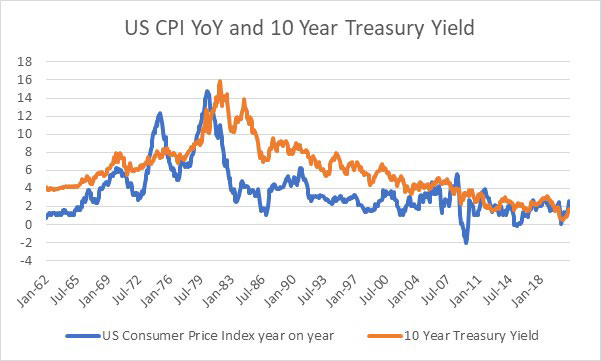

But as gold left the US, and flowed back to Europe, it required higher and higher interest rates to maintain the link between the US dollar and gold prices. At a certain point, Nixon decided the economic pain of higher interest rates was not worth it, and decided to devalue. Still powerful unions and labour interests saw it for what it was, a wage cut and to push for equivalent increase in wages, and the era of stagflation and misery index was born. But eventually by the end of the 1970s, workers (or production worker’s) hourly wages had fallen back by 90% in gold terms. The 1980s then saw an era of much slower wage increase, but tight monetary and fiscal policy. Wages in gold terms rose again, but with a substantial fall in the gold price. But with advent of Ben Bernanke and his policies of continual stimulus and QE, we have seen worker wages plummet back to 1980s lows, and remain there for 10 years. As an explanation for why central bankers garner such visceral hate, you could not find a better chart. House price to incomes tell a similar story.

Broadly speaking, maintaining positive real interest rates will keep your currency strong, and allow real wages to increase. Volcker in 1980s did exactly that. Ben Bernanke did the exact opposite.

Since the GFC, and driven by Ben Bernanke idea, devaluation has become the default policy of central bankers in the rest of the world, with the notable exception of China, which I have written about extensively. One of the mysteries of this policy position, is that I have yet to find a nation that has devalued itself to prosperity. If currency devaluation was really the panacea it was made out to be, then surely Italy would be the richest nation in the EU and not Germany? Or Mexico should be more successful than the US? The Asian financial crisis saw many nations devalue, and perhaps with the exception of Korea, it is hard to see how this benefited these nations in any way. In fact in 1990s, central bankers knew that devaluation was a failed policy, and actively raised interest rates to stop the currency from devaluing. Somewhere along the line, it was decided that sacrificing real wages for higher profits was a good strategy. Back when I was running money, I would try to avoid being long countries that I thought would devalue, which outside of the 2000 to 2008 period was almost every emerging market, which is why this period was so good for emerging market investing. It is also the main reason I remain lukewarm on investing in India.

And here is the rub, China is not devaluing, and has a number of policies that is slowing the property market, and anti-cartel policies that are good for the stock market. But as mentioned in previous posts, luxury stocks do not seem to be indicating any great slowdown in Chinese consumption. The Western World has been emphasising profits and pro-capital policies, and weak real wages until recently at least. China has been focusing on raising real wages, and a strong currency. And as mentioned, I have yet to see a country devalue its way to propserity - and this it probably one reason I keep wondering if China is winning….