When I first started thinking about a pro-labour world, I tried to imagine how exactly that would look. My thoughts were that wages would rise, and unemployment would stay low. Interest rates would be higher than expected, and long dated bonds would do poorly. I expected financial assets to underperform real assets and commodities. I also expected to see real assets surge if central banks, and particularly the Federal Reserve started to go dovish, and this to cause the yield curve to steepen. We saw this happen in late 2023, and this is when I started to have confidence that my world view was coming into play. But from that point, we have seen a chunky reversal, but still in an uptrend.

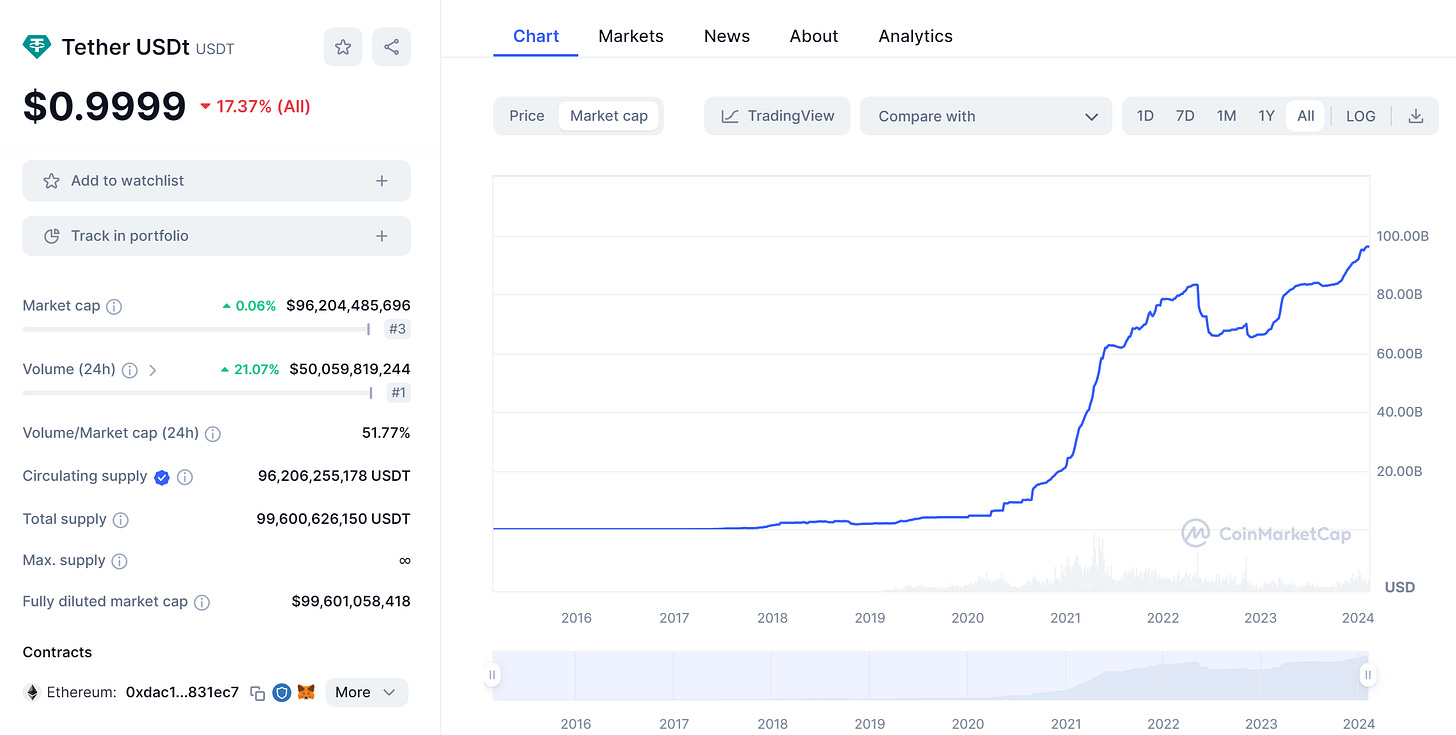

However there are a number of things that have not matched up with that world view. I thought higher short term rates would suck money from speculative assets, causing real financial difficulties. While there has been some examples of this, there have been plenty of counter examples. In the crypto space, money has flowed into Tether, supporting the entire crypto arena.

Likewise the Nasdaq has fully recovered from its 2022 sell off.

While China has followed a “pro-labour” cycle in my view, Japan has surged ahead. Many people have remarked on the huge divergence in these two markets.

I have been toying with the idea that semiconductors are a the new oil - and hence have become a strategic asset. This explains the surge in the Nasdaq and the Nikkei to a degree, but does not really explain tether or Bitcoin very well. This would not also explain the continued superb performance of luxury. LVMH continues to trade well.

One thing I agree with Dennis Gartman about is that systems should be kept simple. Simplicity breeds elegance. So is there a simple explanation for why financial/speculative assets are trading so well? There is but I suspect you won’t like it. The Fed had high interest rates all through the 1990s, and dot-com bubble developed anyway. But during that time, the Bank of Japan (BOJ) only finally raised interest rates in 1999 and then the bubble burst. The sub-prime and European debt crisis all developed despite the Fed and the ECB raising interest rates earlier that the BOJ. But when Japan began to tighten in late 2006, everything started to unwind. I could also argue brief attempts raise rates in 1996 also caused the Asian Financial Crisis. If you follow this analysis, with the BOJ still running negative interest rates, speculative assets can continue to do well.

Moving away from policy rates to balance sheets, the BOJ invented QE in early 2000s. By 2006, it removed its QE liquidity from the market, and the subprime crisis began soon after. The BOJ balance sheet briefly contracted in 2022, before expanding again. Markets have seemingly moved more with the BOJ balance sheet than the Fed or the ECB.

The BOJ has maintained super loose policy, despite food inflation taking off in Japan, after decades of doing nothing. This is a surprise for me, but matches how I have been surprised by the performance of speculative assets. For really old investors, loose Japanese monetary policy also explained the bubble economy of the 1980s. BOJ Balance Sheet and S&P 500 have decent correlation in my book.

This also offers a nifty reason for why higher bond yields have not been so bad for asset markets. As JGB 10 yeilds have risen, the BOJ has committed to unlimited purchases to keep it below 1%.

What has been surprising is that wages in USD terms has continued to weaken to levels not seen since 1990. In recent years falling USD wages have been driven by BOJ policy.

The BOJ has continued its QE policy despite food inflation has also taken off in Japan, which is very different to the 1990s and 2000s.

What is great about this analysis is that it says two things. BOJ is the only central bank that matters (as Japan is the biggest international lender that makes sense) and that we need to get bearish the US when the BOJ raises interest rates. Given the moves in bond markets and food inflation, this is a matter of time. Given my plans for a new fund, a bear market would be extremely useful for me. I will be taking a closer look at the BOJ in the near future.