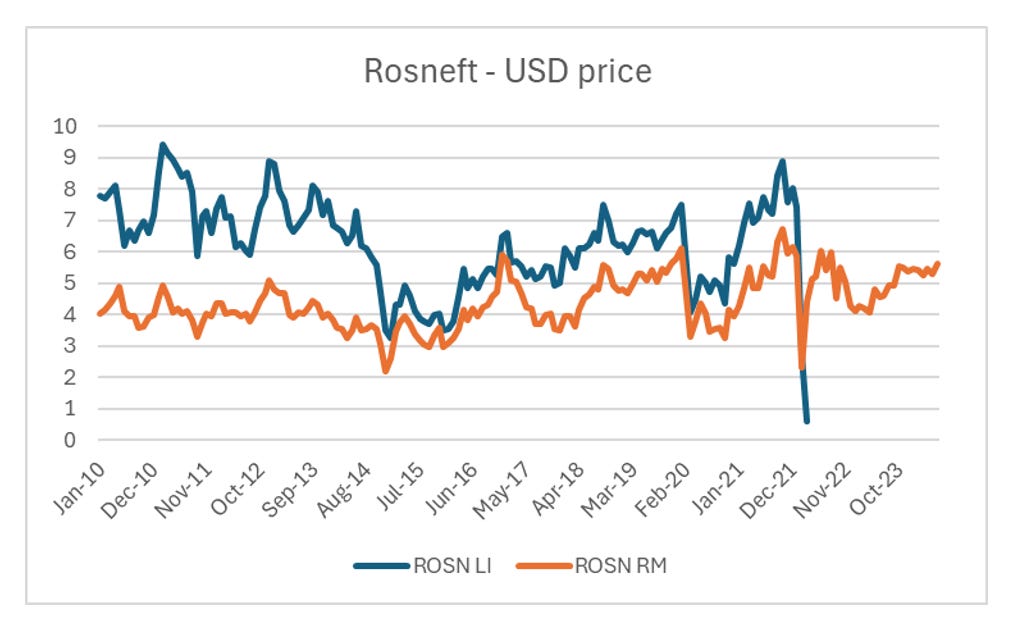

To be bullish on China, you have to be comfortable with sanction risk. What I mean by that is you won’t become a forced seller due to sanctions. When Russia invaded Ukraine, sanctions made Rosneft uninvestable. In practical terms, foreign investors (via ROSN LI) who owned Rosneft saw the value of the stock collapse, while domestic Russian investors saw its value maintained. Of course, there is the small problem of getting capital out of Russia. This is what I mean by investable. Getting capital out of China is already a problem, and various semiconductor related names like SMIC are already subject to sanctions, so this is not a hypothetical issue.

The second question is do you have to be involved in China? If you do and are not fully invested, then you are already lagging the market, and are now running career risk.

From that perspective, buy Alibaba and Tencent and you already have 25% of the index, and you are covering the risk of Chinese tech emulating the magnificent seven effect we have seen in the US.

If you believe in the Chinese tech story, you can see that Alibaba has derated from 11 times EV/Sales to about 1.5 today. For long only managers, not owning enough Alibaba would be a problem today.

For what it is worth, in my view Chinese tech will likely remain risky while Xi remains in power. But I do think Chinese authorities are willing to change their view on is the property market. Rather than benefiting tech billionaires, a change in the fortune of the property activity is probably something the authorities could get behind. Floor space built has fallen 75% since 2021.

One high quality company I like plays into this theme.