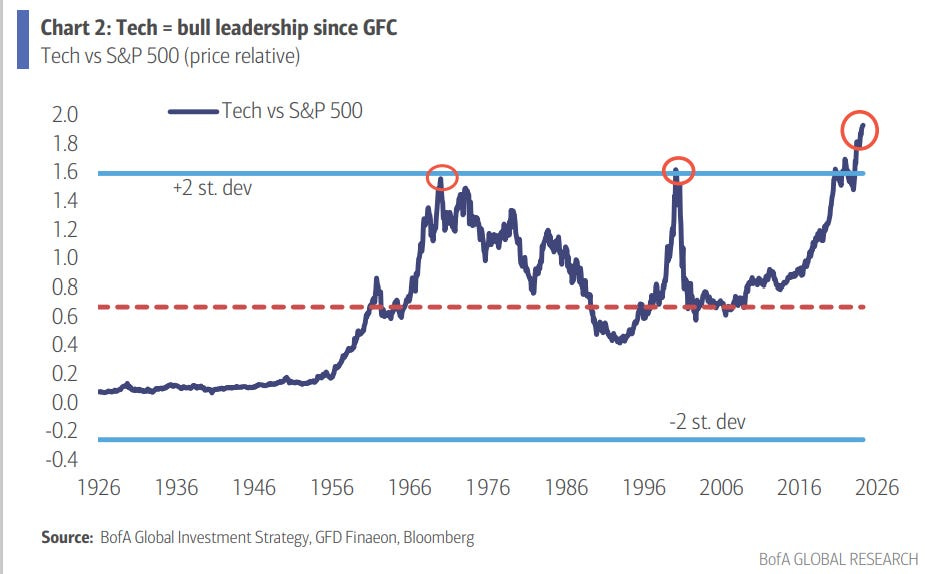

Why are large cap US stocks doing so well? I have been thinking about this a lot, as THE question for fund managers is whether this will continue to forever, or change in coming. I had thought that a trend change in bond yields would lead to a change in market leadership, but this view has been wrong. Leading stocks, and particularly tech, continue to dominate.

The more I think about how the US works, the more I realise that you need to square the political circle of being popular with voters, AND being able to raise the funds from corporates to fund a punishingly expensive political system. You end up with an economic system that focuses on keeping prices to consumer cheap, while allowing businesses that face other businesses to build huge cartels. It is best explained by Lina Khan's Amazon’s Antitrust Paradox. Generally speaking, if you are corporate, you are pretty much left to yourself. The government will not protrct you against other dominant corporates.

In practice, if you wanted to advertise on Facebook, or Google, you were likely to pay cartel prices, that is not a competitive price but the price the market could bear. Healthcare in the US is typically paid for by corporates, and so a system developed where list prices are extraordinarily high, making sure that corporates deal with a consolidated PBM sector. Cloud computing is going the same way, with three or so providers, but with limited ability to shift between providers, allowing pricing power. The leading companies in the US combine a free or low cost consumer facing business, with a heavily consolidated and powerful business facing business. Meta, Google, Apple, Visa, Mastercard, Walmart all have these two sided businesses.

The question here is when does dominant corporate power towards other corporates becomes a political problem? When do small businesses start to complain that social media cartel makes advertising too expensive? When do small businesses find that providing healthcare is too expensive? When do small businesses find the unavoidable expenses of payment systems unbearable? When do small businesses find the cost of cloud computing unappealing (which is what a surging Nvidia share price suggests)?

What is interesting has been collapsing small business optimism, at the same time as the stock market is surging. Old school macro fund managers would see this as a turn in credit cycle. This explains the continues enthusiasm for deflationary trades like long yen, and long treasuries. But I suspect that small business optimism is falling because corporate price increase by American cartels are extreme. In this case collapsing business optimism is not deflationary, but inflationary.

Just as there was a roadmap to power for Trump in 2016 by focusing on disgruntled union workers, I see a roadmap to power by focusing on small business owners, and reducing the power of American cartels. The problem of course is that taking on the US cartels would be taking on some extremely powerful business interests, and would likely tank the market, just as China taking on Tencent and Alibaba has tanked its market.

Perhaps the better trade will be to be long US small caps relative to its large caps? Certainly the Russell 2000 has lagged the S&P 500 in recent years.

The obvious conclusion of this would be that the current obsession with Chinese corporates is a dead end for US politicians. Banning TikTok only entrenches Meta and Google. Chinese corporates were the only potential competition for high end semiconductors, another area of increasing cartel pricing. China payment systems are small business friendly, but poison to Visa and Mastercard. Allowing Medicare to negotiate drug prices rather than privately owned PBMs would be disastrous for drug and insurance companies. For US small business, the enemy is within, not without.