When I was 17 and learning Japanese, I read the entire series of Dragonball in Japanese. As a manga aimed at young boys, all the difficult Chinese characters would have the pronunciation written out in small characters next to it, so you would now how to read it (furigana). The recurring theme of Dragonball was that the hero, Goku, would face an enemy, lose, and then find a way to evolve into a stronger fighter. I suspect the story of Super Saiyanjin has moved on from when I read it when I was 17, but whenever I see anyone continual evolve to be unbeatable, I think of them as a Super Saiyanjin. Usually I do this with sportspeople (think king of clay, Rafa Nadal winning at Wimbledon), or sometimes politicians (Boris Johnson was a ebullient pro-capitalism Mayor of London, before effortless evolving into a Brexit loving Champion of left behind areas of the North). As I gaze at the S&P 500 effortless knocking out new all time highs, despite interest rates at 5%, I am amazed at its ability to evolve - it is a true Super Saiyanjin. When I first started thinking about pro-labour shifts, and changes in interest rates, I really expected the S&P 500 to struggle. Even with the highest interest rats in nearly 20 years, the dividend yield on the S&P 500 is back at close to all time lows.

Higher interest rates did destroy “speculative” investing, like the ARKK Innovation fund.

Even away from the speculative side of American capitalism, I expected higher rates to have a more negative effect on the S&P 500. Looking at one of the most American companies you can think of - Coca Cola - has been doing share buybacks since at least the 1990s.

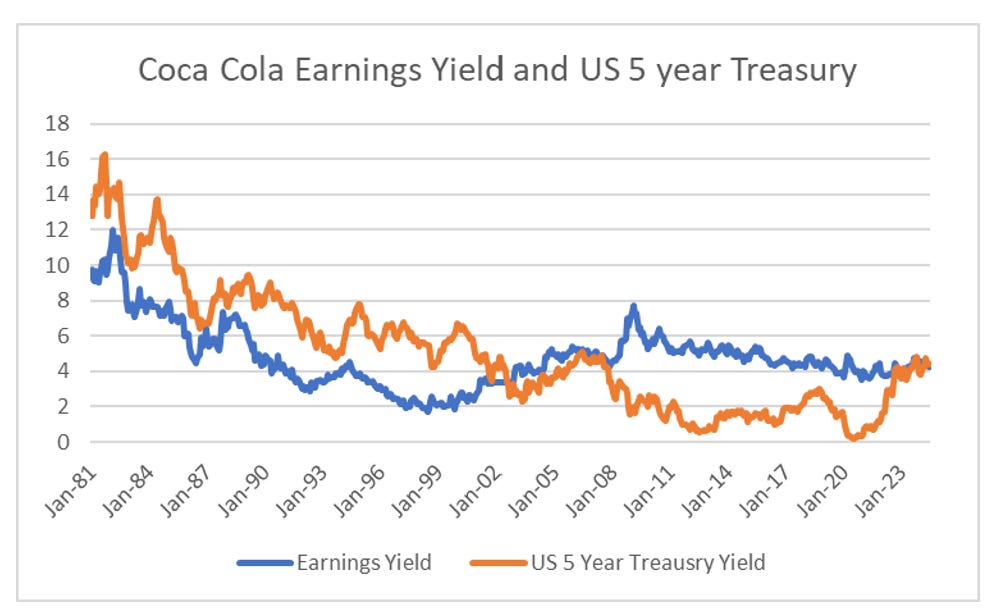

Looking at Coca Cola earnings yield, and US 5 year treasury yield, you could have argued Coke was a sell in 2000, and a raging buy in 2009, when its earnings yield touched 8%, and 5 year treasury yielded 2%.

And the share prices did dip 50%, and the earnings yield never went back to 2%.

I expected the S&P 500 to have a similar dip to Coca Cola as interest ratse went higher. But in 2024, despite higher interest rates, the stock market still has a distinctive tendency to return capital.

Coca cola “only” has a market capitalisation of USD 270bn now. What about leading stock, and fellow Berkshire Hathaway holding, Apple? Well for the first time since 2008, its earning yield is below a 5 year treasury yield.

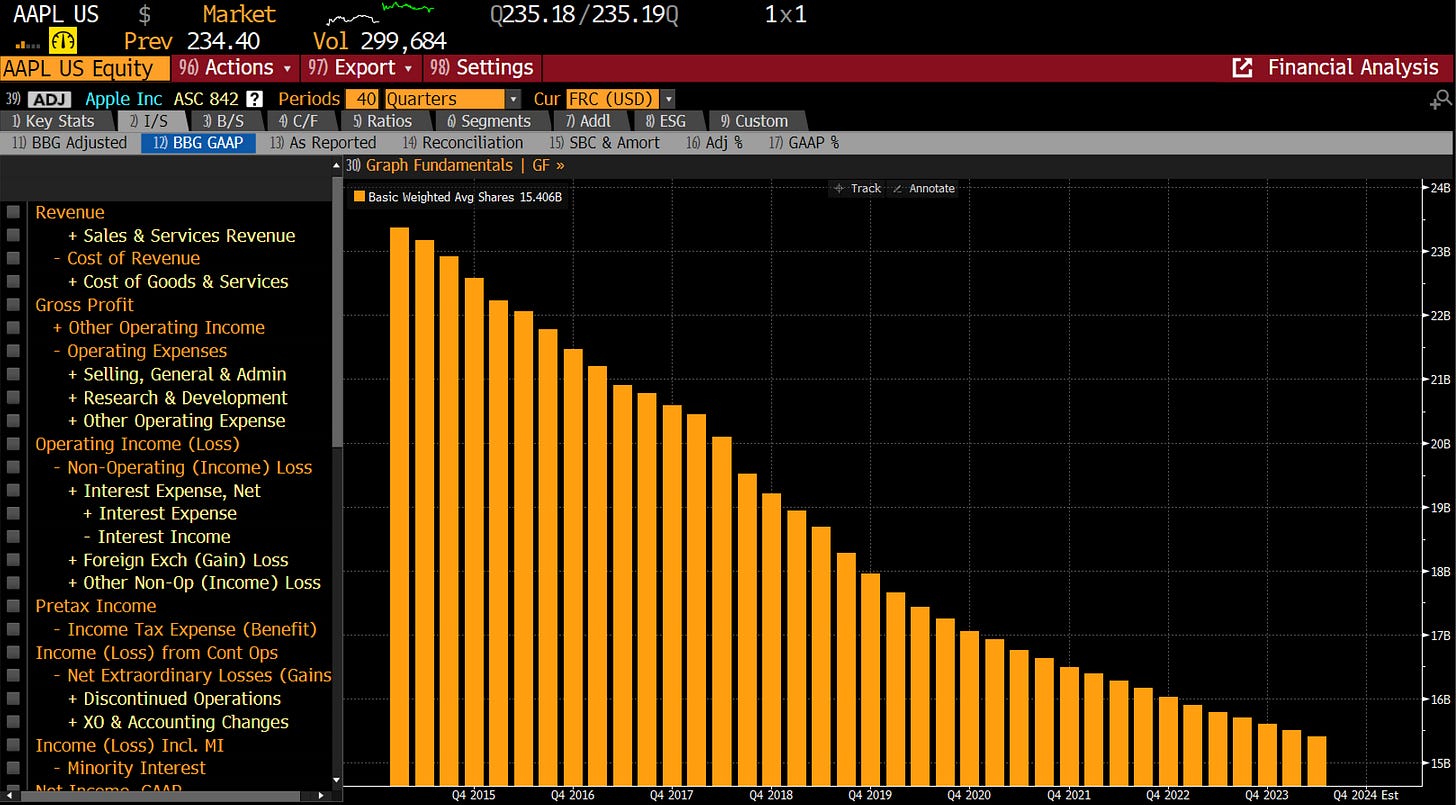

Despite this, there is no meaningful slowdown in share buybacks. And this is true across many of the leading stocks.

I think the final, and most surprisingly evolution of American capitalism is tax practices. While every major government has high levels of debt to GDP, and is looking to increase defence spending, while also de-risking their China exposure, US corporate tax practices are seemingly untouchable.

This for me is the true Super Saiyanjin aspect of American capitalism. When did US corporates become untaxable? How is such an outcome possible in a democracy? Many aspects of American capitalism seem improbable to me, but continue to happen. I do wonder if “government” as we know it is coming to an end. The idea of state provision of education, health care, security, pensions are all in the process of being wiped away, and replace with only “for profit” corporations. The ultimate aim seems to be a return to the 1920s, and a very limited role for government. The signs in the US are already there. Life expectancy is falling.

While wealth to GDP is at close to all time highs.

I have always been pro-capitalism. Its the only system that works. But the problem with this super-capitalism is that it radicalises those that miss out - a tendency that we see every day in the news. From assassination attempts, to the return of communists to political mainstream. The foolishness of Super Saiyanjin capitalism is that every day it creates and radicalises more opponents. I keep hoping that we are in a period of 1970s, when excessive power of labour was curbed without to many problems.

What I was hoping for was that American capitalism would evolve again to deal with the issues that face the US. But I am starting to wonder if the political system may well be broken. I think a lot of people are coming to the same conclusion as me. Gold continues on its quiet bull market.

I wish the Fed and the US government took the message from gold more seriously - but seems unlikely to me. GLD/TLT still looks good to me.