Simon Kuznets is quoted as saying there are four types of economies in the world. Developed, undeveloped, Japan and Argentina. In essence, he is saying that rich nations tend to have predictable economic growth, as do poor nations. But Japan and Argentina fit neither of these models. Like Kuznets, I often puzzled over Japanese economic growth. How can I nation that I so admire not have seen wage growth for 30 years? How could a nation that was so technically advanced be so moribund? In 1996 working as an English teacher i was stunned when a colleague said I could have a mobile phone will all calls included for USD 20 a month

Even more amazing was that my next mobile phone in 2000, a Nokia candy bar was heavier, more expensive, and had less functionality. The point was how did a country with such a huge lead in mobile phone technology manage to stagnate? You could argue the same in semiconductors and optical equipment, where Japan was miles ahead of its competition. But Japanese GDP and wages have stagnated since the early 1990s, and its lead in most vital technologies have been lost. For Kuznets and the rest of the economic industry, it is very hard to explain how Japanese nominal GDP today is lower than 1992.

Comparing Japanese GDP to USD GDP over time is also arresting. What is not clear here is that in the early 1990s, Japanese GDP was close to overtaking US GDP.

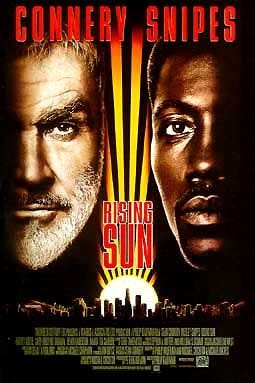

American will naturally see this as the superiority of American capitalism. Maybe it is. But in the early 1990s, the US was in fear of Japan. Trade friction was a huge political issue. Many films and popular culture represented this fear. Most obviously was 1993 film “Rising Sun” - but even 1982’s Blade Runner represented a future of dominant Japanese culture.

My thoughts on this was that Japan was the Saudi Arabia of capital markets, and they funded growth elsewhere, but this never led to sustained growth in Japan. When credit markets blew up such as the Asian Financial Crisis or the GFC, capital would return to Japan, yen would appreciate and deflation and stagnation would return. The title of this substack, Capital Flows and Asset Markets, comes directly from this theory. But as mentioned in a recent post, perhaps I should change the title from Political Cycles and Asset Markets. This made me think, is there a political cycle that explains Japan’s malaise? Well yes, I think so. First of all, losing World War II was highly detrimental to Japanese growth. Prior to World War II the Japanese economy was rapidly catching depression era USA.

In 1980, as Japanese economic growth surged, again Japan was becoming a threat to the USA. But in 1980s, the bureaucrats and CEOs of Japan Inc would have been men who would have distinct memories of the last outcome when Japan threatened to overtake the USA. For this reason I think Japan agreed to the Plaza accord, which saw the Yen appreciate significantly. With an export led economy, this yen appreciation should have been devastating for the Japanese economy.

Of course the capital flows that this yen appreciation policy caused led to the greatest bubble known to modern economics, it does not take away the fact that Japan agreed to a policy that should have weakened Japan Inc. Another example of Japan choosing weakness was the relocation of substantial parts of the semiconductor business to former Japanese colonies, Korea and Taiwan. For years Japan sold as much as the US in semiconductors.

But as Japan stagnated, Korea and Taiwan have surged. Japan, Korea and Taiwan are as mighty as the US when it comes to semiconductors. And Japan was instrumental in Korean and Taiwanese success. American businesses tend not fund competitors - they usual aim to destroy them.

What I find most intriguing about the political theory of Japanese decline, its that implies that Japan can choose to end decline just as easily, should politics change. My read is that politics has changed, but only incrementally so far. But I can’t help but think even the US would prefer to have a strong Japan to act as a counterweight to China. As a fan of popular culture, this would also fit in with famous South Park episode - Chinpokomon. In this episode, Japan uses anime and constant assurances of their weakness to take over the US. Playing a long term strategy to avoid conflict with the US certainly fits in with my experience of Japanese strategic thinking.

Personally, I am not a fan of conspiracy theories (sorry Zerohedge… I still love you guys anyway), but I think this one is maybe 70% true. If you are bullish Japan, its a good reason to get more bullish - as Japan no longer needs to hide its light under a bushel.