I was state school educated in Australia, so I missed out on an education in “classics”. But whenever I hear a good turn of phrase, I bring it into my vocabulary. “Hubris before nemesis” is one such phrase - basically meaning arrogance precedes a fall. I have seen many investors suffer from it, and I have also suffered from it myself.

As it happens I was in the Midlands this weekend - Peaky Blinder country for my American readers - and had a fascinating chat with an engineer in the car industry. The first part was that demand was falling of a cliff. Higher interest rates, and the withdrawal of government subsidies was crushing the auto market. Tesla’s share prices has lagged the market for a few years now.

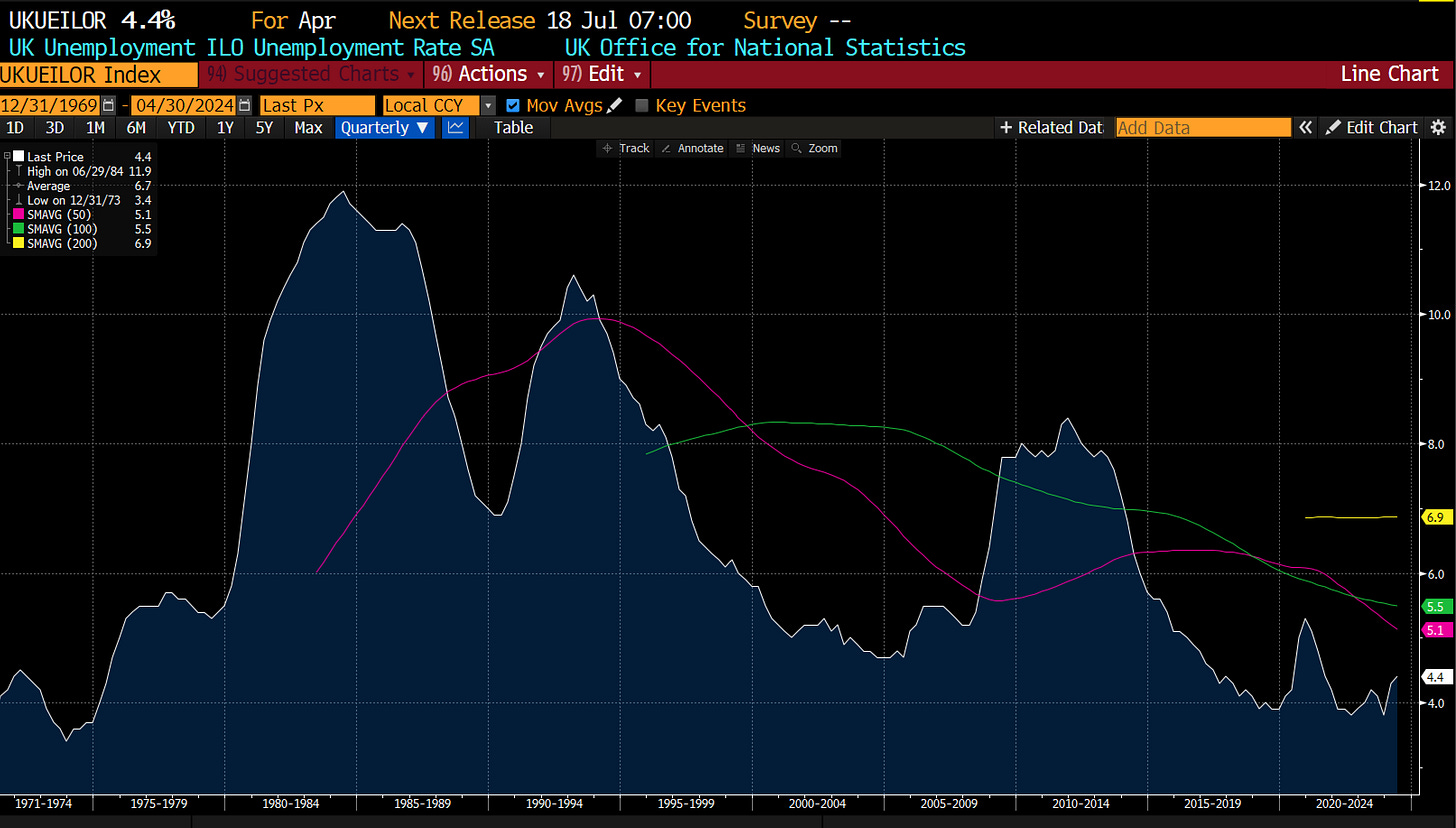

The second part of the conversation was how difficult it was to recruit and retain engineers. Every manufacturer was understaffed, and trained engineers had the whip hand, especially young engineers as companies had to deal with a wave of retirements by older engineers. UK unemployment rates remain very low, and below levels seen in 2007 for example, but beginning to turn higher.

Slowing auto market, unemployment ticking up and Bank Of England cutting rates. This sounds like conditions for deflation, and buying long dated bonds. If that is your line of thinking, then you are in luck! 30 year gilt yields remain at close to the highest levels since 1997, and at levels around when Liz Truss apparently broke the gilt market. What a bargain!

Politically, buying UK gilts is problematic. The easiest way to show this is with housebuilding. Post World War II, politics was pro-labour, and getting people in to homes was a priority. There was a huge boom in government and private sector building of houses. Inflation was high, interest rates were high, and house prices were low. Buying in the 1970s or 80s as supply was falling, was the key to riches, particularly as interest rates were also falling.

Labour is targeting 1.5 million homes over its 5 year term, or 300,000 homes a year, so inline with house building in the 1960s. A cynical, hubristic fund manager would likely say, every political party for the last 20 years has promised more homes and failed. And that would indeed be a fair point. But simplifying the political maths, we can just look at the changing voting power of baby boomers. Baby boomers are defined as people born from 1946 to 1964. In the UK, that gives us a group 14.4mn people. In 1979, when Thatcher was elected, they were 26% of the population. They are now 21% of the population, and falling in numbers everyday. In other words, their relevance as a voting block is now in decline. Politically, it was impossible to ignore their wishes from 1980s onwards. From 2024, the baby boomers need to scrap with everyone else. This analysis understates boomer influence, as they tended to vote more than younger people. Rishi Sunak choosing July 4th as the date of the General Election is a transparent attempt to reduce student turn out, as they are often registered where they go to university, and will likely be at home July 4. Voter ID rules etc are also part of this pro-boomer voting policies.

Assuming the polls are correct, and Labour achieves a generational win at the general election, we can expect pro-boomer policies to be reversed. I suspect Labour will hit its house building targets, as it will see it as a policy to win the next election on. I also expect council tax to be reformed and charge on current value, to encourage baby boomers to downsize and free up homes for families. Falling house prices in real terms is likely. Another aspect of pro-labour policies that should return is that a strong exchange rates is encouraged, as it boosts workers incomes. Remember when central banks raised interest rates to keep exchange rates strong? That policy should return I think. Post World War II, UK interest rates rose to over 15%. I think a similar type of shift is likely.

What are bond bulls looking at? Almost all bond bulls are looking at money supply, which is negative year on year, and has historically coincided with bond buying opportunities (since 1980).

The problem with this analysis is that from 1980s onwards, voters wanted smaller government, and higher asset prices. Governments were “encouraging” deflation. This is no longer true. Governments are encouraging inflation, and central banks need to act as a brake. Bonds are nemesis - they are the asset that will suffer in this new world.