Since launching my new fund, Brumby Capital, markets have rallied strongly and yet oddly the short book has not been much of a problem. Why? I don’t short indices, and most of my shorts are in the US. The equal weighted S&P 500 have been pretty flat over the last year. This has been in line with my pro-labour view of markets. Or in other words, the average company in the US has been okay, which it what I would expect with rising labour costs and rising interest rates.

The problem is that no one seems to have told the Magnificent Seven. It continues to surge higher.

There is a lot of bearish chat surrounding AI at the moment, and we even have Michael Burry buying puts on PLTR and NVDA. AI is often portrayed a bubble that is about to burst.

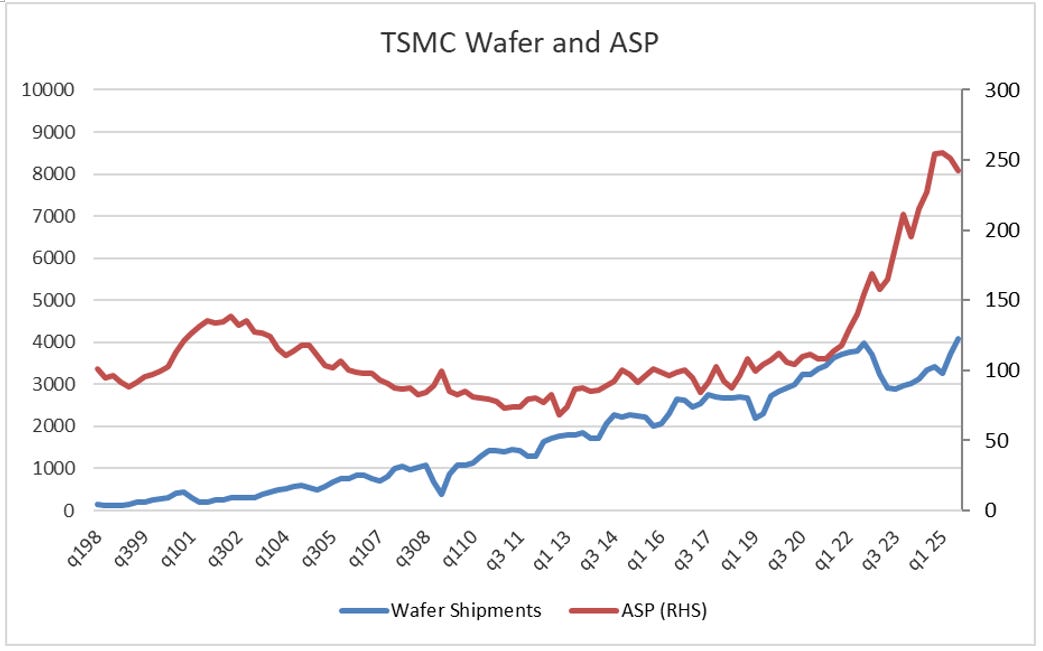

But what exactly does a bubble mean? For me, the stock market follows pricing, and pricing normally follows supply. Previous bubble bursting was driven by decline in prices caused by over investment. For example, broadband and semis in 2000. We can see both the dot com bust and the current boom today from TSMC semi pricing. The late 90s saw bubble and then bursting in 2000s. Pricing has surged again, so if history repeats semiconductor pricing should fall again, and the bubble will burst.

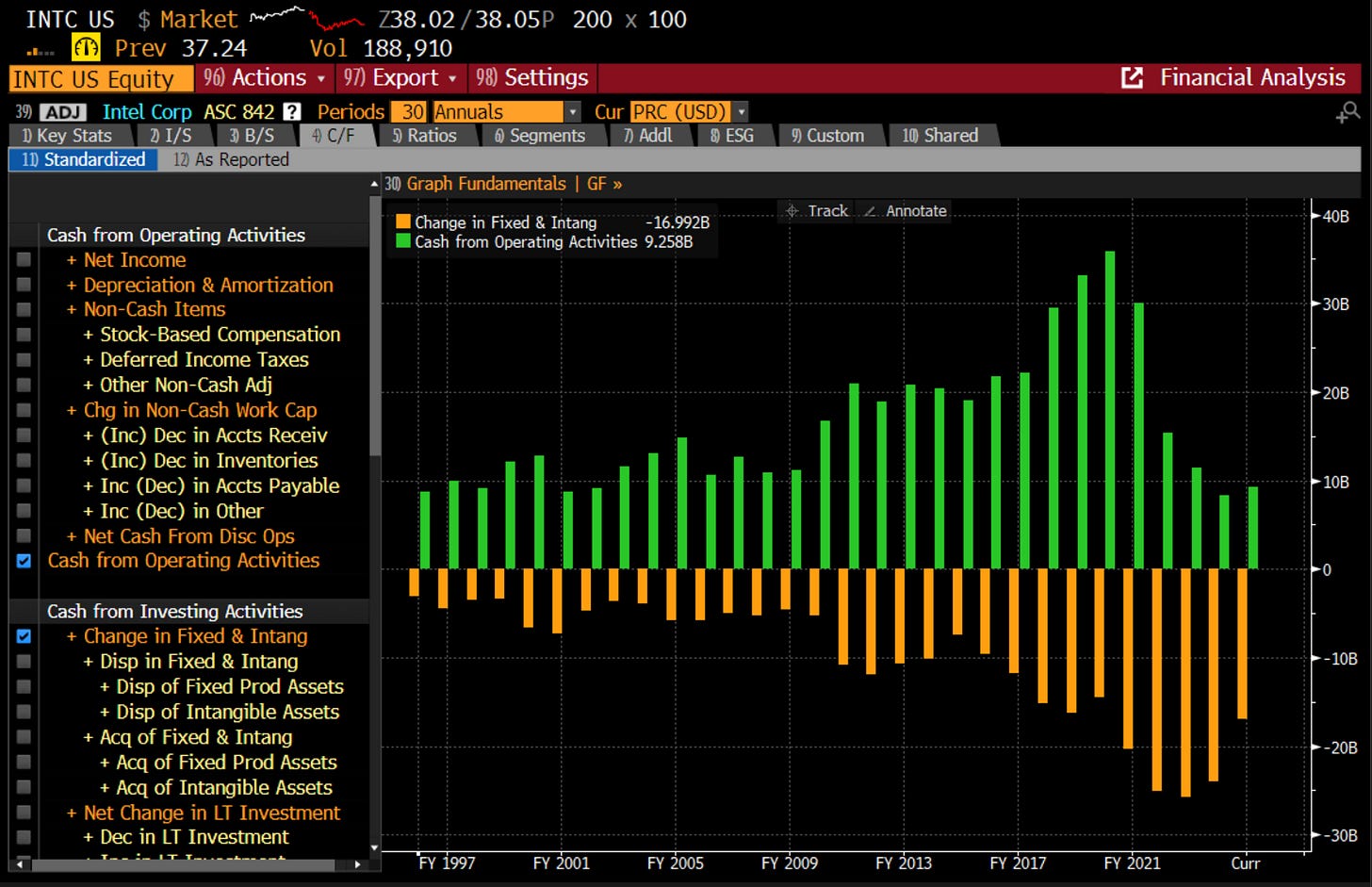

The problem is that back in 2000, there were a lot of near competitors for TSMC. If we look at just TSMC, Intel was a near competitor. Intel was investing USD 7bn in 2000, compared to a 16bn today, and 25bn a few years ago. But we can see that it does not generate the cash for it to invest these days - which is why it has asked for help from the US government.

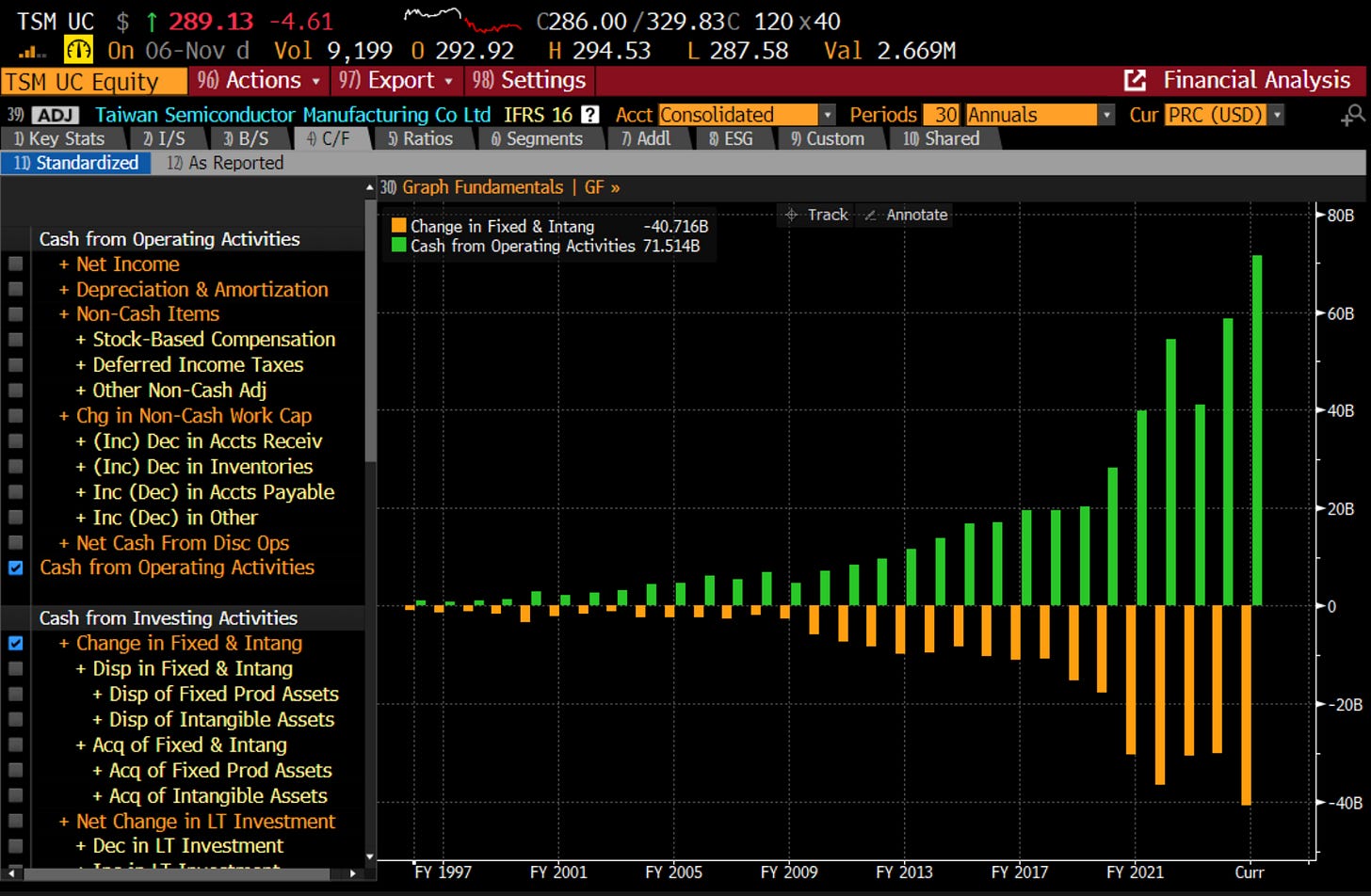

TSMC was investing USD 3bn USD in 2000, and now is investing USD 40bn. But almost always investing less than the cash it was generating.

In the 1999 dot com bubble - Intel and TSMC were generally correlated. A bubble bursting should take out all operators in an area, as everyone suffers from falling prices.

But that is not the case anymore. TSMC have been distinctly uncorrelated to INTC since 2024.

I think what I am trying to say, is that bubble bursting is the wrong name for what happened in 2000 and 2008. It was free markets at work, where new entrants started to take market share from incumbents, and so the incumbents began a price war. I used to take weakness in a small player as the beginning of a price war. Back in 2000, weakness in TSMC was a great lead on weakness in INTC. But this relationship no longer holds for TSMC and INTC, but for the whole tech area. SNAP has been weak, but META strong. NIO has been weak but TSLA strong.

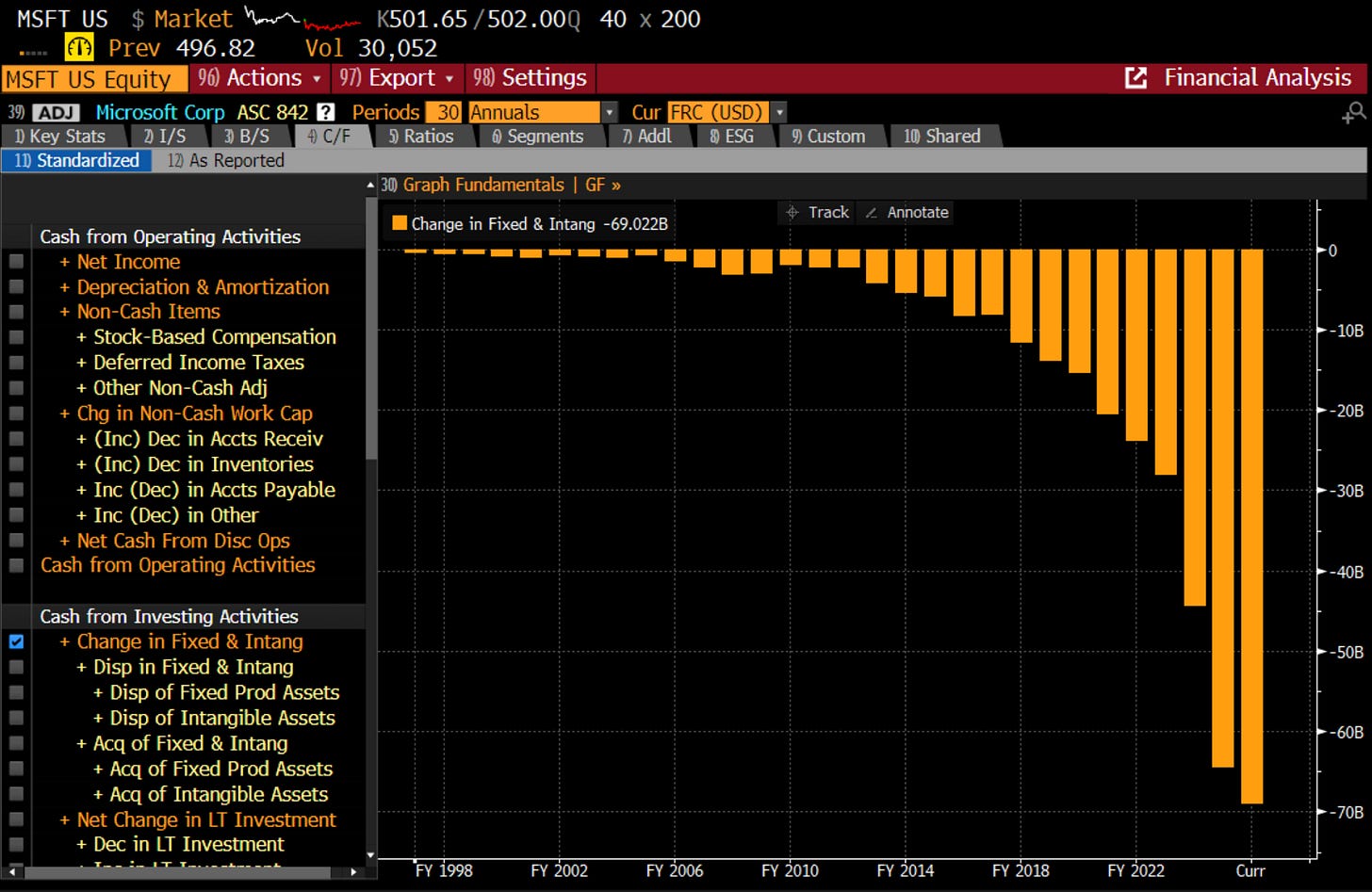

If I had to put a finger on a difference, it would be that the biggest companies no longer compete on price, but compete on investment. Who can out invest the competitors? Microsoft is an example of this. Capex has increased exponentially. Is this a new feature of a pro-labour world? Companies compete on investment not price?

The Chinese government has encouraged its big tech to compete on price, and its tech sector has underperformed the US massively. But China has also had deflation and lower bond yields.

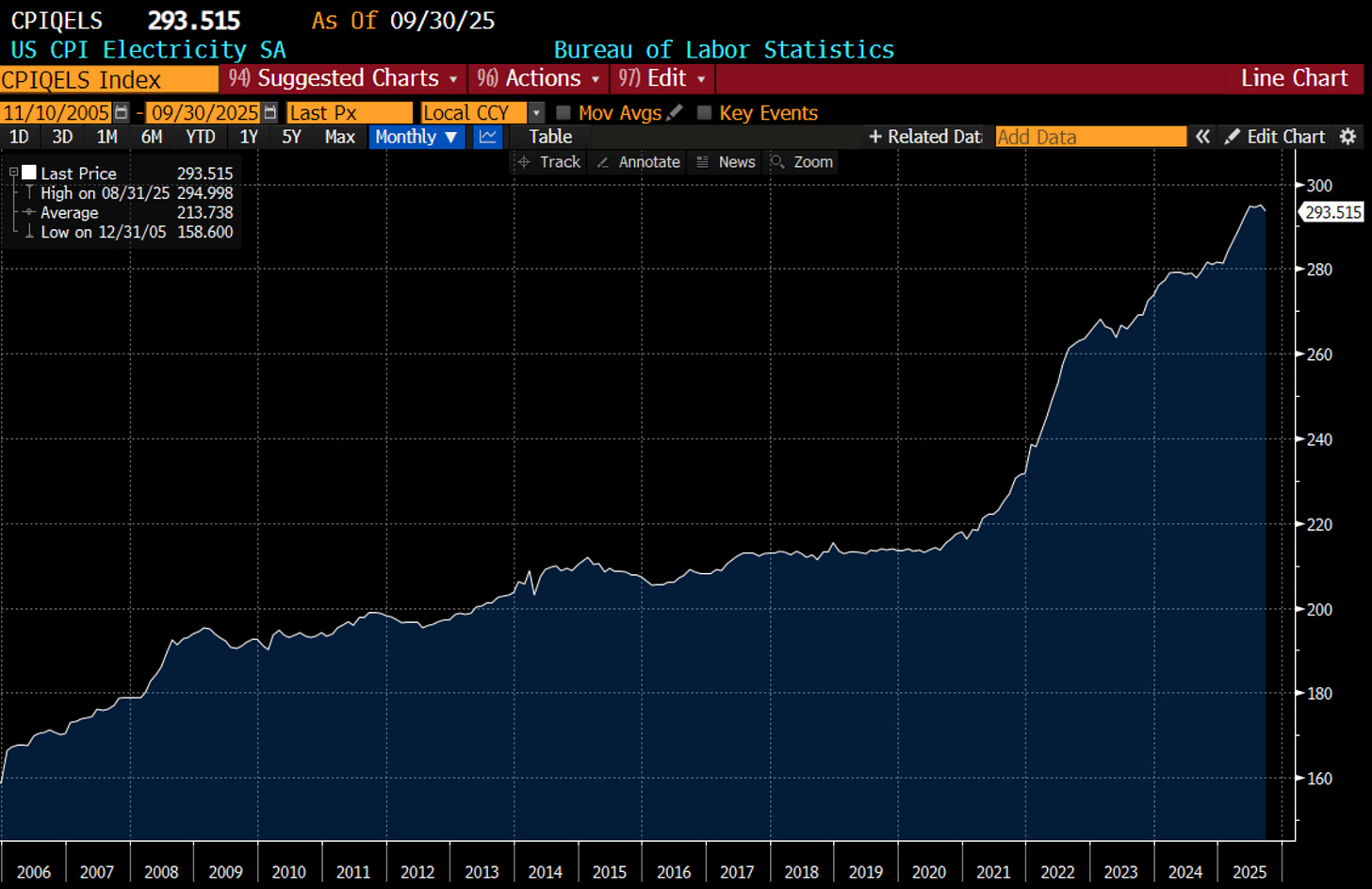

With US tech the “invest to compete” model is probably driving inflation - particularly in electricity prices.

The outlook to Mag 7 is as much political as it is financial. When do voters tire of inflation and falling real wages? When do politicians act to get lower prices? Perhaps Michael Burry has his timing perfect. I don’t know. But for me, as long as gold is trading well against Mag 7, I can keep to my current positioning.

If this inflects lower, then I will have to think about how to hedge the Mag 7 risk.