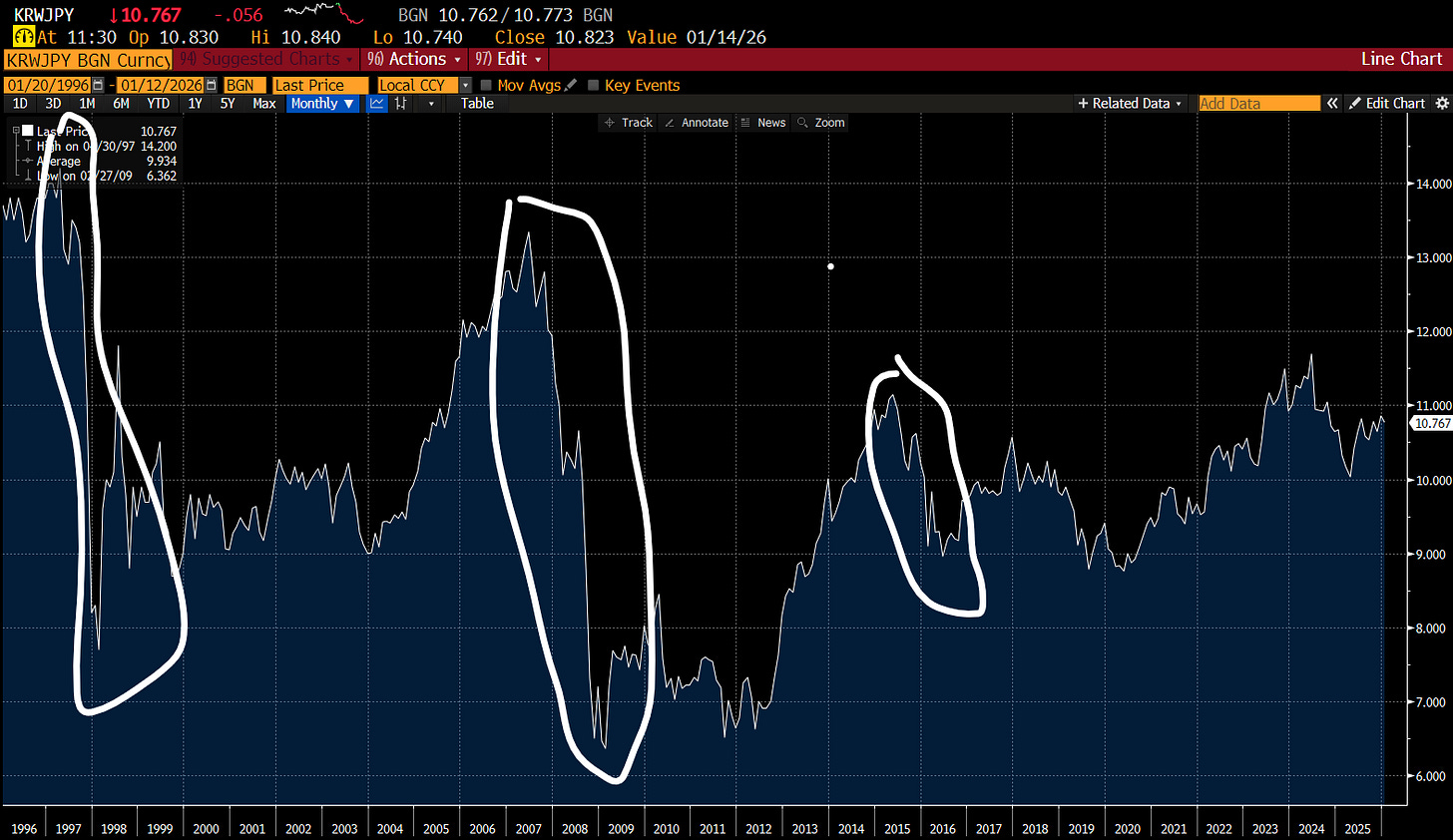

I love currencies - they (used to) have a purity that was unsullied by the capriciousness of CEOs and/or Presidents. They used to act in predictable ways, and given the two sided nature of currencies, you did not need to take a view on whether something would be “good” or “bad”, it just needed to be “better” or “worse” than the other side of the currency pair. A good example was the Korean Won/Japanese Yen currency pair. Both countries are major exporters of tech to China and the US, but Korea tended to have more inflation than Japan, so every now and then you should expect a reset in the Korean won lower versus the Yen. 1998 and 2008 were big resets, and 2015 was a minor one. But since then, nothing really seems to move this currency pair.

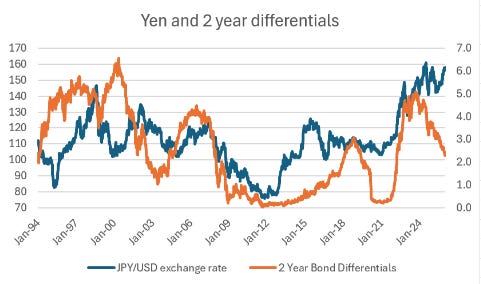

Even more surprising has been Yen weakness despite rising JGB yields. The differential between US 2 year and Japanese 2 year bonds has fallen substantially over the last 12 months, and Yen remains weak.

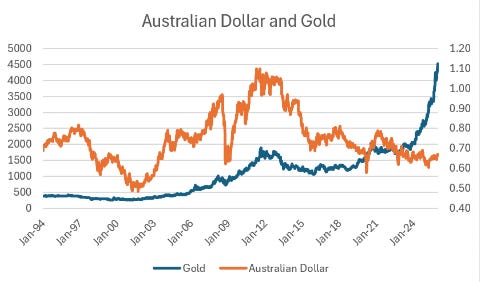

You could normally rely on the Australian dollar to move with commodities. It remains a large gold mining nation to this day - and yet the Australian dollar and gold price no long move together in any meaningful way.

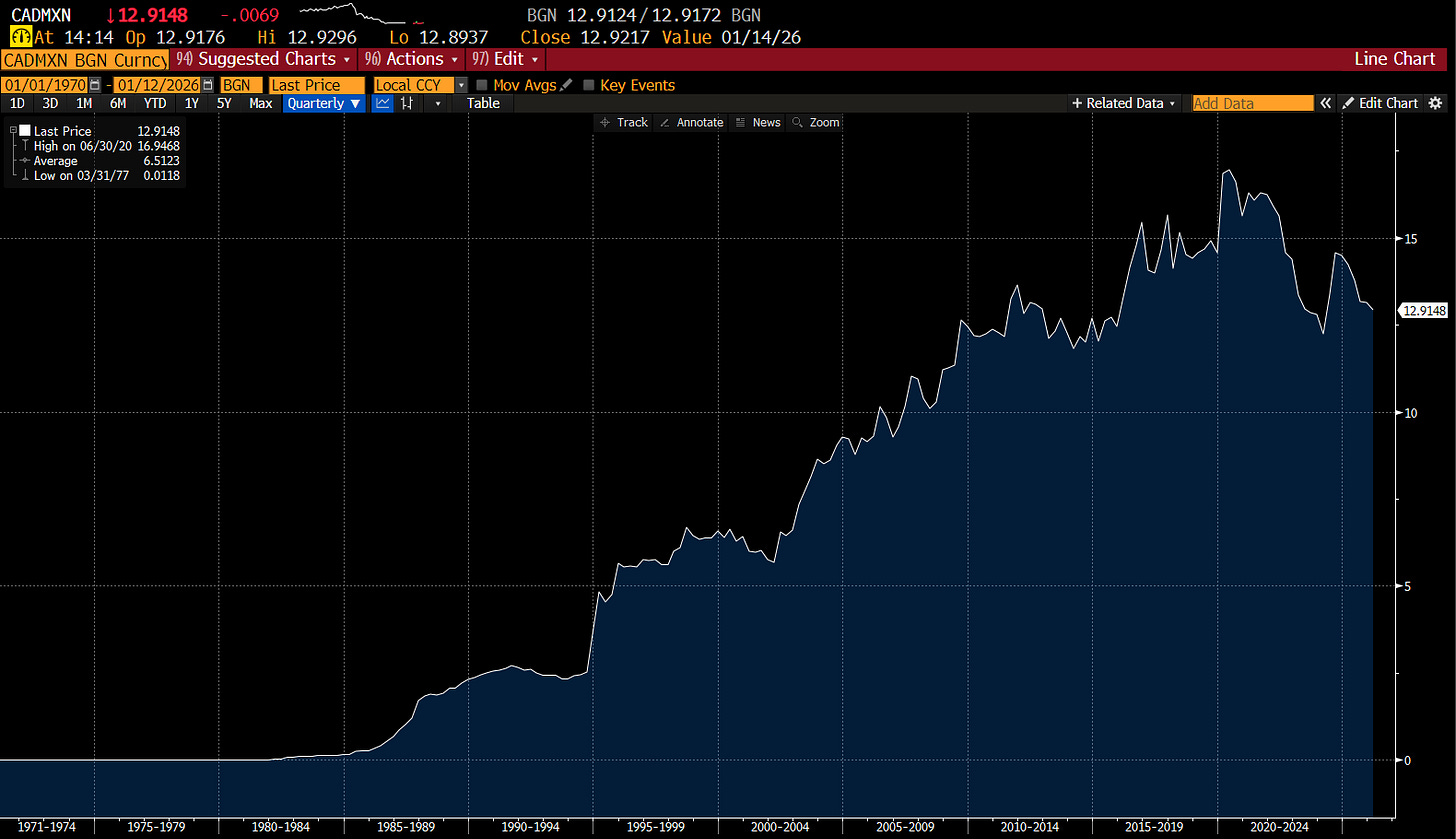

Even historically reliable trades like long Canadian Dollar short Mexican Peso has broken down. Both Canada and Mexico do the majority of their trade with the US and have a commodity tilt to the economies, but better management saw the Canadian Dollar preserve value. However, this cross rate has now gone nowhere for 10 years.

Of all the currency relationships, only one continues to hold, and that is the Swiss Franc tends to appreciate when uncertainty rises.

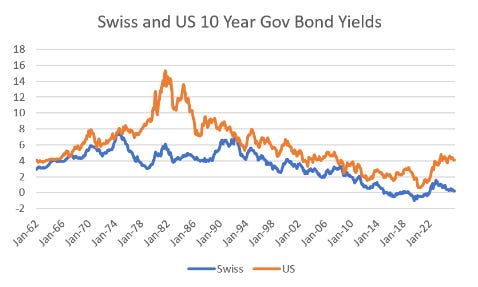

Switzerland is a tell on what has changed. In the globalization period of free capital movement, yields between industrialised nations tended to follow each other. But in the new world of industrial policy, yields and currencies are a political choice. The US has chosen fiscally driven growth, and now has higher interest rates and a weaker currency than Switzerland, who remains relatively more committed to preserving the value of its currency. The market recognises that Swiss policies are more likely to preserve the value of its currency, which explains why its bond yields are diverging from the US, just as it did in the 1970s and 1980s.

This would seem to imply that currencies move according to the expectations of government policy, rather than moving due to free market principles. So Yen weakens now, because policy expectations are that the government will continue fiscal expansion. Likewise with Korea, and given the US is threatening both with tariffs and abandoning the military alliance, this seems like a reasonable bet. But what about Canadian dollar and Mexican peso cross? Well Mexico almost always ran its government with a strong industrial policy component, and dubious fiscal constraints. The flatlining of CAD/MXN seems to imply that the market thinks Canada will follow Mexico with these policies. As this was already priced into Mexico, its has led to the relative outperformance of the Peso versus the Canadian dollar. All of this basically says that no currency seems safe anymore, as every one is forced to adopt fiscal expansion and industry policy. It also explains why precious metals are surging.