I have always wondered why the seven wonders of the ancient world were concentrated in nations that now seem underdeveloped - Egypt, Turkey, Iraq and um.. Greece (!!). Why were the once the richest nations in the world, but are now second tier powers as best? Did these nations all lose their way? I think the answer lies in the old silk road which terminated at these nations, and was the key source of trade for centuries. As trade routes changed, the fortunes of these nations declined as well. The Mongol Empire stretched from Asia to Europe, and pretty much captured all the nations worth conquering at the time. Empire and trade were intertwined.

But the centre of the world, the Eurasian continent was stitched together by trade - by cart and horse. And the trade generated the wealth to create the finest cities of ancient times. The seven wonders of the ancient world, are all at the Western End of the Silk Road trade route. There were plenty of wonders at the Eastern End as well, but where trade went, wealth and technology followed.

What happened to these nations? Nothing really, just technology destroyed their lucrative trade routes. Rather than moving caravans along the megacontinent, improvements in ships and navigation made long distance sailing made the peripheral states, with easy access to ports the new powers in the world. This was the era of the British, Spanish, Portuguese and French Empires. Travel by sea allowed traders to direct cargoes to locations where the profits were largest. The undoubted superpower of the time was the British Empire. British Empire was centred on the area not touched by the old silk road, but a new empire. Britain ran the world by dominating the new world, not the old world.

While the British Empire was extensive, it had an extremely strong focus on controlling ports. Hong Kong, Singapore, Penang, Gibraltar were all ports under British control, with a view to controlling and maintain power. Losing control of the Suez Canal marked the true end of the British Empire, as it could no longer control the main access points to trade.

Trade is power. China provides a good demonstration of how trade provides the profits to invest into technology. Chinese exports surged form 2002 onwards, but patent applications only took off much later.

As I have said in my last two posts, rather than the digital and real world merging, I am thinking more along the lines of the digital world eating the real world. Or to put in another way, you first need digital success before you can have real world success. I think Donald Trump is one example, Elon Musk could be one potentially, crypto is another example. So what I am saying is that just as the rise of naval power destroyed the ancient world, the rise of digital world is destroying old power bases as well. For me, US economic history shows they have form is rapidly adopting technology and allowing political decisions to reinforce a lead in technology. When Henry Ford introduced the Model-T, mass car culture came to the US before anywhere else.

This led the US to physically different from the old world, as anyone who has visited Los Angeles will know, its a car city. Trying to walk around L.A. is pointless, as is Miami and many other American cities. A US economy centred around auto production was a marvel during the 1950s and 1960s, until US oil dependence became an issue, and US car makers were getting out competed by German and Japanese car makers. That is the US does what it always does, push a new industry to its limit.

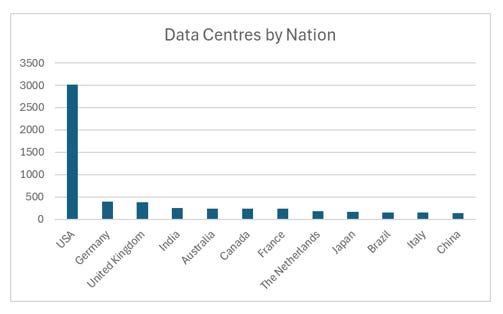

And just as Britain understood that controlling the nodes of naval trade (ie ports) was the key to economic success, the US has understood controlling the nodes of the digital trade is essential to success. With the cost of new data centres rising with the cost of Nvidia chips, it is very hard to see how any nation can catch the US (unless a new technology comes along).

There was a time when most of the world was under British control, one way or another. In a digital world, we are all under American control one way or another. The market confirms, and the Trump reelection suggests, that America first policies are now embedded in Washington. My guess is the dominance of the digital world and America over the rest of the world increases from here.