Back in 2011, I started writing and distributing free research. The main aim was to make myself known to the investing community, but it was always enjoyable and interesting to see what comments would come back. And my last post, generated an above average number of comments. Generally speaking, when I write, I write with a point in mind. This post is more to comment on the comments.

First of all, in my post I found it interesting that Zerohedge was generally bullish. Zerohedge replied directly to me (yes Tyler Durden - and as far as I know, the real Tyler Durden, not one I imagine I am talking to from time to time) with:

Zerohedge has been “bullish” since March 2020 when the Fed started buying junk bond ETFs at which point it became clear a drop will never again be allowed. In retrospect, it has been the right call.

I missed this bullish turn in Zerohedge (March 2020 was a busy time) - but they have been correct, its been the right call. What frustrated me back then, was that there was seemingly no “market punishment” for the Fed basically committing the US government balance sheet to the market. I would have assumed inflation and dollar weakness would come from such a decision. In reality, it has happened, but with a delay. The move in gold recently has been enormous, and for me directly related the actions at the Fed. As Scott Bessent has pointed out, when you buy corporate bonds, you are starting to make political decisions.

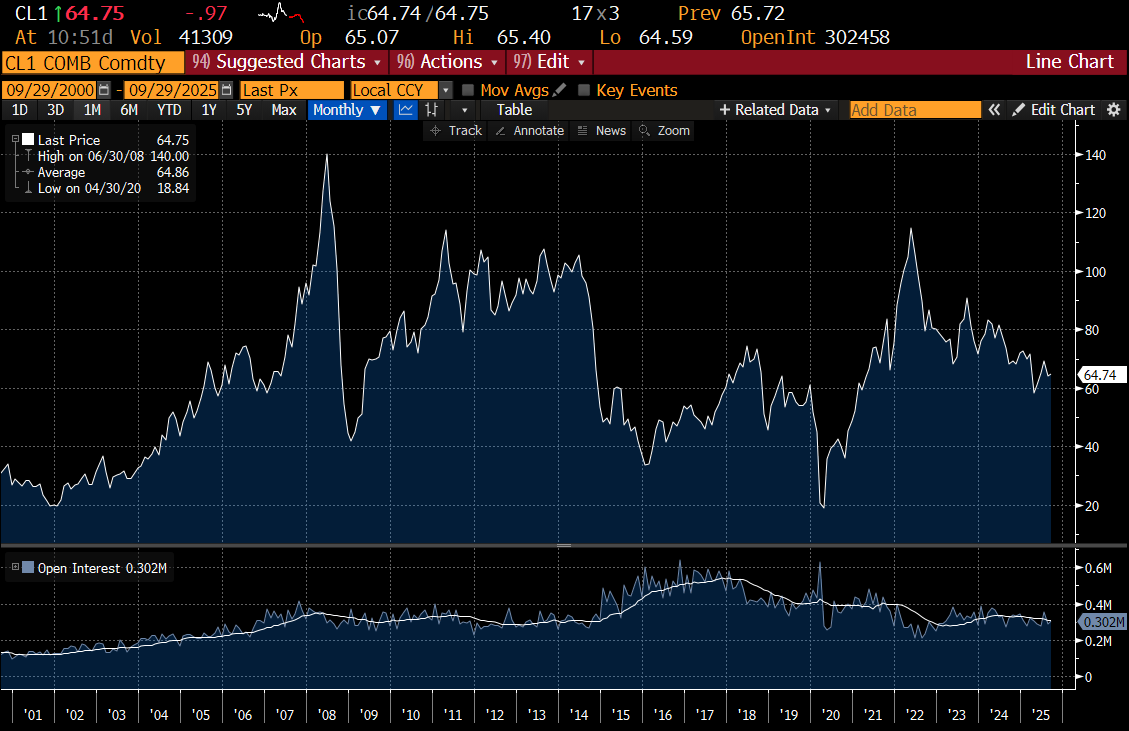

Normally a surging gold price is not good for US equities. But what has really supported the market has been a weak oil market, which has kept inflation at bay. 2022, which was a poor year for equities was the last time oil was above US 100 a barrel, and the current oil price of USD 65 was first seen over 20 years ago.

Which leads me on to two more comments from subscribers. One was looking at the XLK/XLE (tech ETF v energy ETF) and picking up a potential turn. Rather than use these ETFs, I have used the S&P 500 sector returns to generate a much longer term chart.

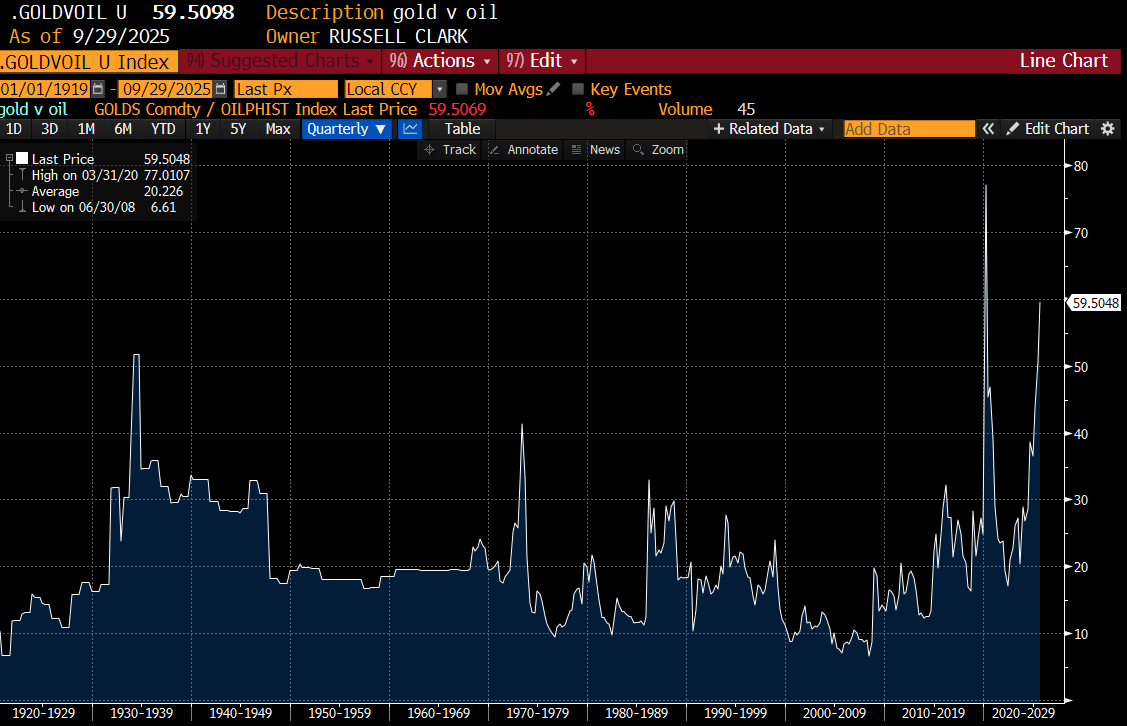

Comparing oil to gold over a very long time horizon, there is no question oil looks cheap.

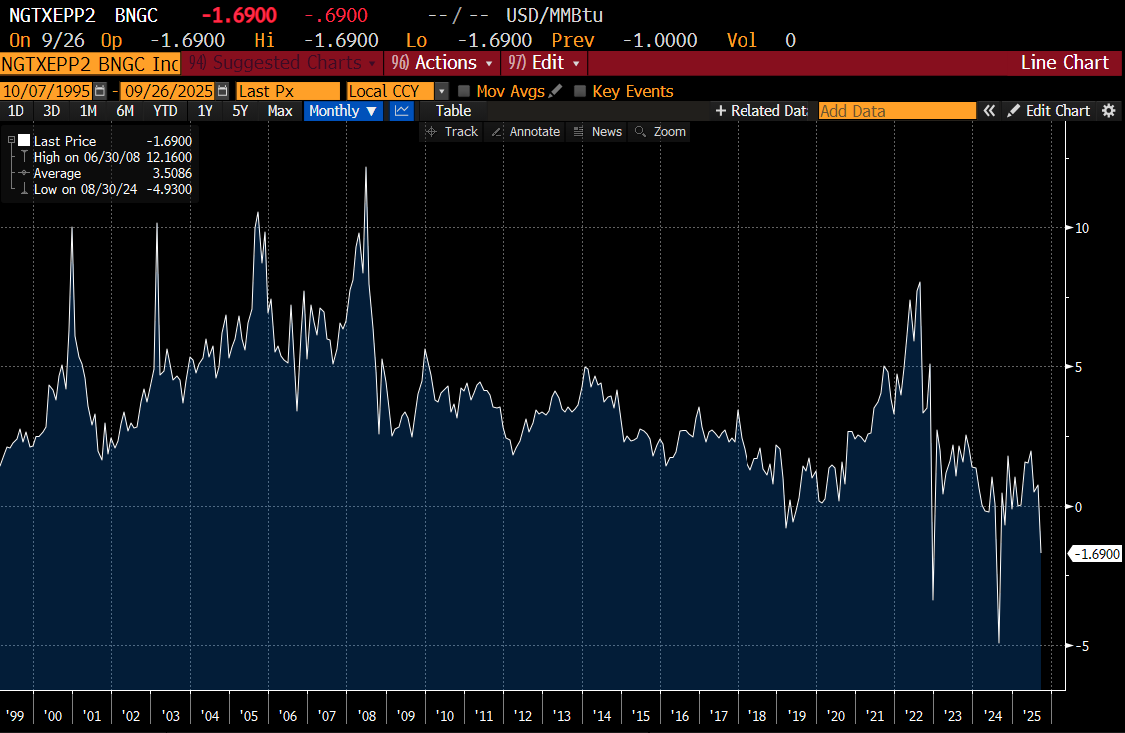

If there was one chart that explained the US exceptionalism, and the performance of tech versus energy, it would be spot price of Permian natural gas. It spiked in the weak years for US equities of 2000, 2008 and 2022, but as of today is pricing NEGATIVE again. A second subscriber was sure that the Permian was heading into trouble. Low prices would do that - but was there any sign of change? Like falling production, or pricing discipline?

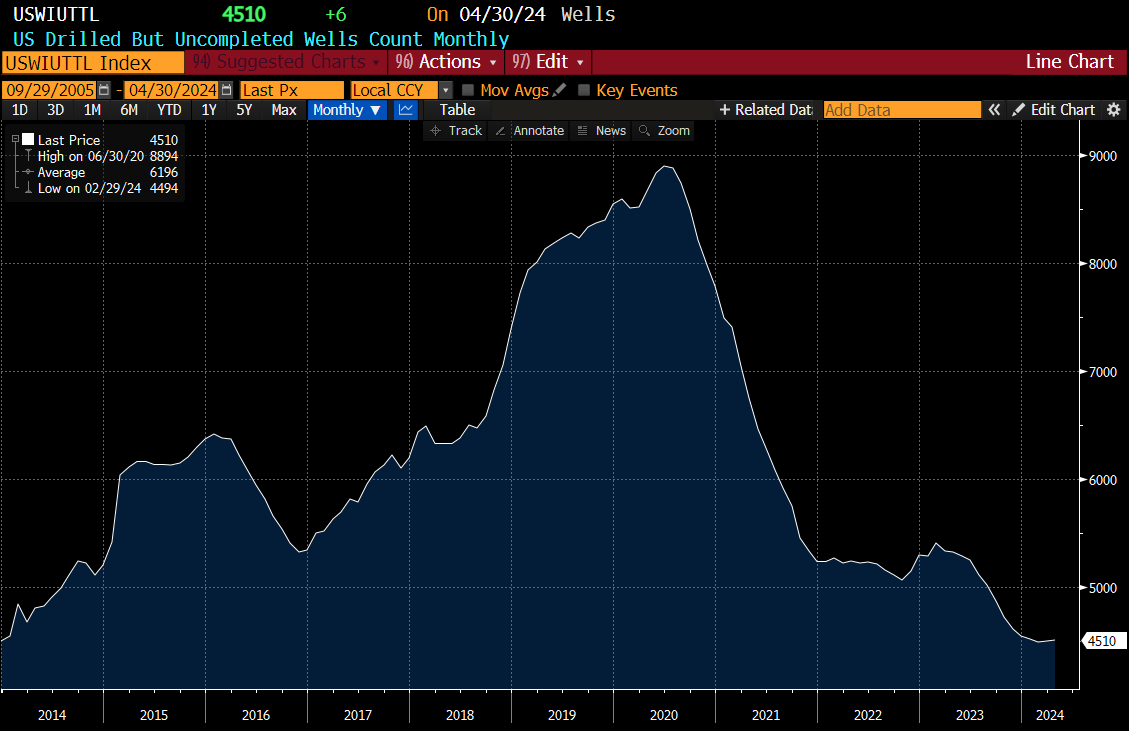

Usually low prices drives supply destruction. There has been some signs of that, with US producers running down inventory of wells. They changed how they report this number in 2024, but the trend remains the same.

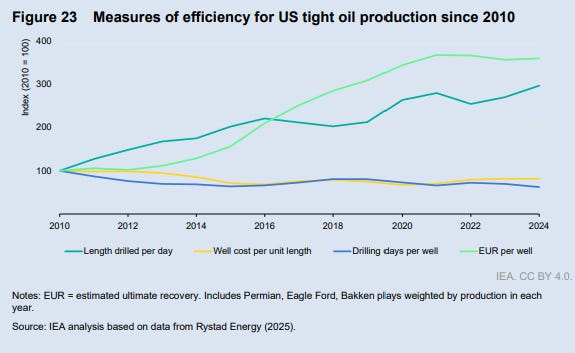

US shale producers have been able to increase productivity per well substantially. Mainly by buying bigger bits of land, and then extending the length of the horizontal drilling. The dark green line in below chart.

A Canadian subscriber (and they tend to know about oil) was saying that the Permian was a mess, and no less than the Diamondback CEO was bearish on US oil production. Diamondback is one of the best shale producers, so I was intrigued by this. And it is true that outgoing CEO, Travis Stice has commented that as current prices, shale does not make sense, and oil production will decline. But for me, this is not enough to get super bullish oil. It just says the oil is low, and short term producers will pull back from investing. However, in my reading on shale, I did find something interesting.

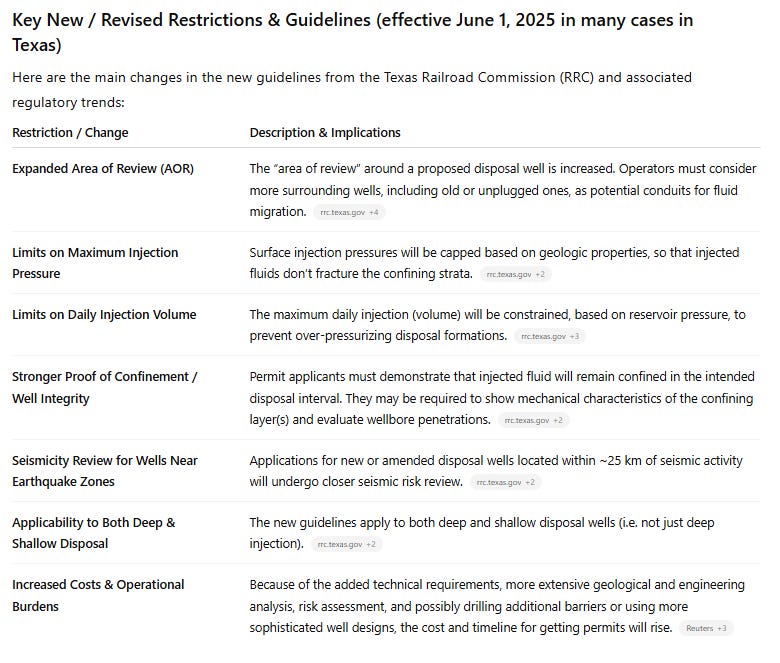

The US shale industry is really centred on the Permian region these days. From June 1 2025, the Texas Railroad Commission (RRC) will be changing regulations on wastewater. The Chat GPT summary of the changes are below:

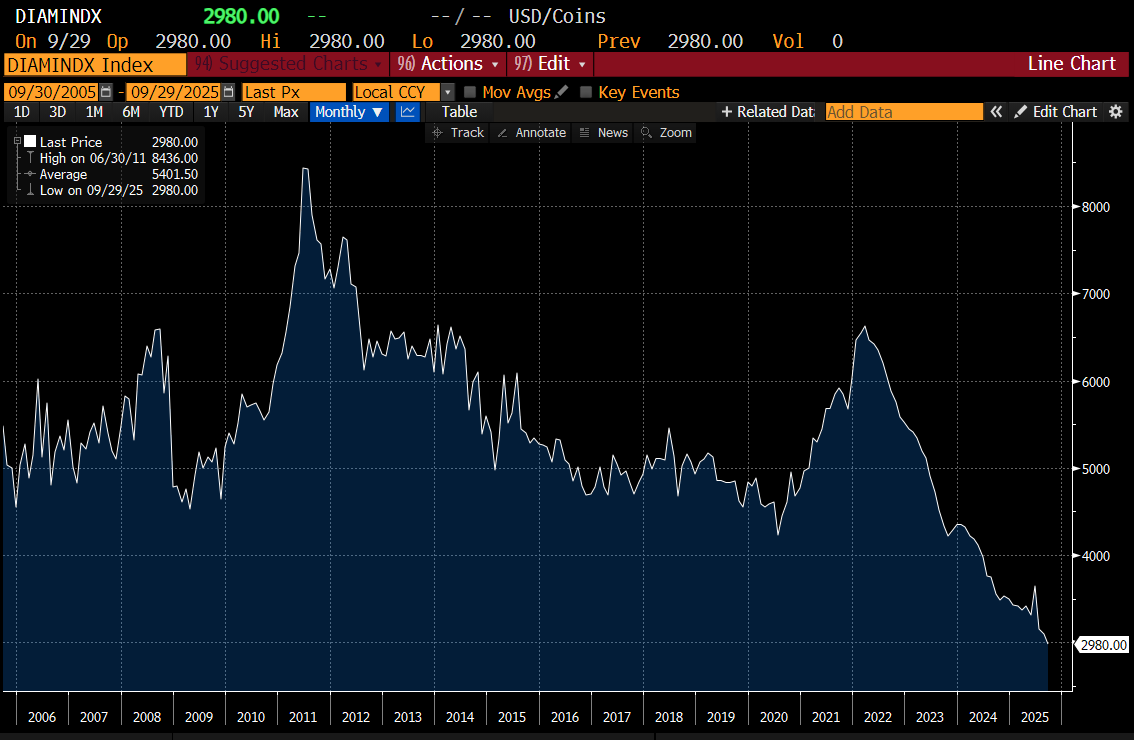

Basically, for every barrel of oil, you create four barrels of wastewater, and the RRC is cracking down on this. Why? There have been instances of the wastewater leaking into freshwater reservoirs and causing old oil wells to rupture. This should put some cost pressure on the Permian shale producers. I have mixed feelings about this. Part of me wants to be bullish about oil, as I am used to gold and oil moving together. But part of me is starting to wonder if oil is a dead commodity. For me a dead commodity is when technical developments render a commodity worthless. We have seen that happen recently with diamonds as lab grown diamonds become indistinguishable from the real ones.

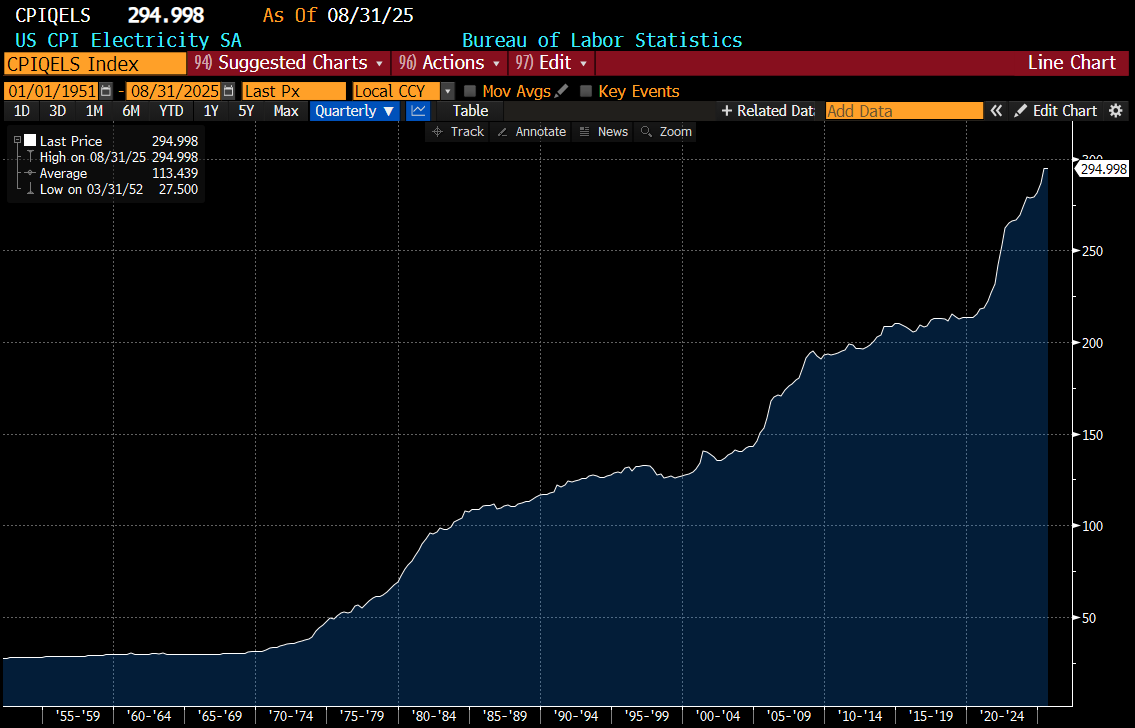

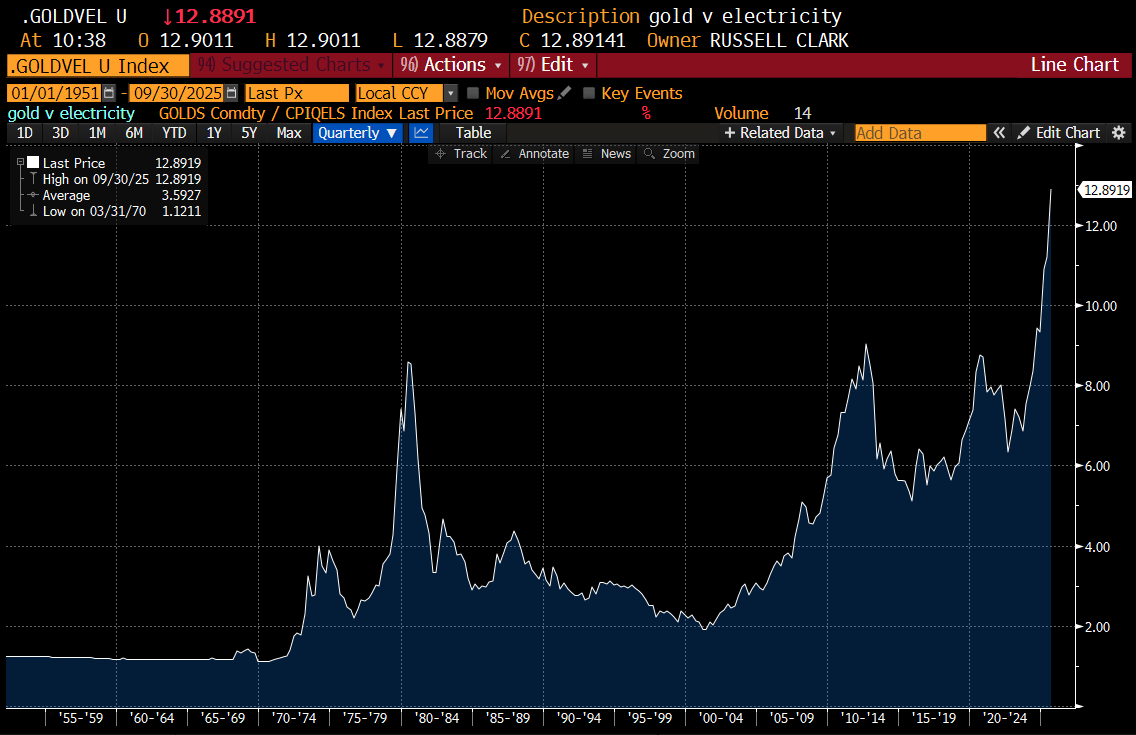

Oil and natural gas were vital commodities as they drove inflation. But we can see that electricity price inflation in the US is not following natural gas and oil prices. Maybe we just need to ignore oil prices.

There is a small problem with this. If I look at gold versus US electricity CPI, it also looks very overvalued. This makes sense if you think US shale pricing has kept inflation in the US in check.

So in conclusion - I was wrong that Zerohedge had suddenly become bullish - my bad. I think the market has done well more from low energy prices that Fed buying. And there could possible be a turn in energy against tech, or maybe not. There is a possibility that oil is a “dead commodity”. But if electricity prices had detached from energy prices, then an inflation shock with out an energy shock is now a possibility.