I caught up with Rupert Mitchell of Blind Squirrel fame and we were chatting about markets. I pointed out that my friend John Hempton (@John_Hempton on X) was having a tough time. John has a different, but very effective, style of shorting selling. In simple terms, he tracks “bad” people as they move from company to company. Bad in this case means they act in ways that are “bad” for share holder value- he then shorts the absolute worse using a proprietary system. Its a great model - but I knew it would be a problem when liquidity floods the system. 2021 for example. And apparently this year too. But shorting when “bad” companies have gone up is good… so to speak.

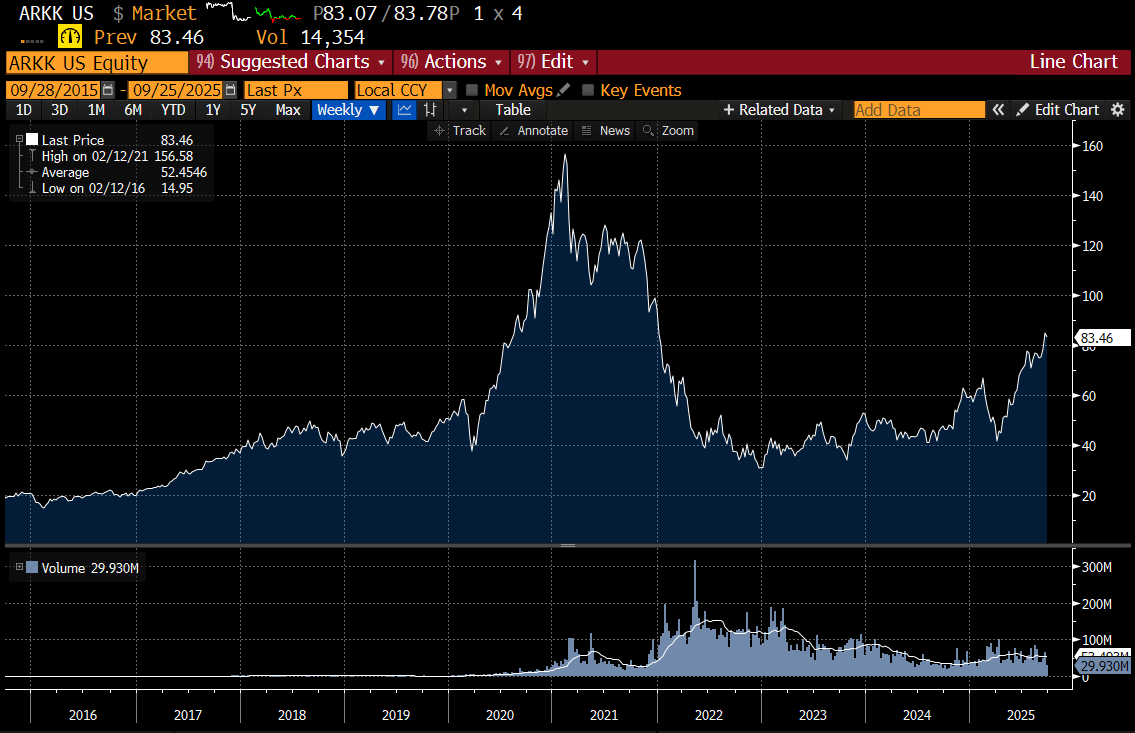

Rupert mentioned to me that Zerohedge, which was the “most bearish website on the planet” was now also bullish. This was news to me. But a quick look tended to confirm this observation. I also noticed that the ARK Innovation fund was at 4 year highs - a bull market fund if there every was one.

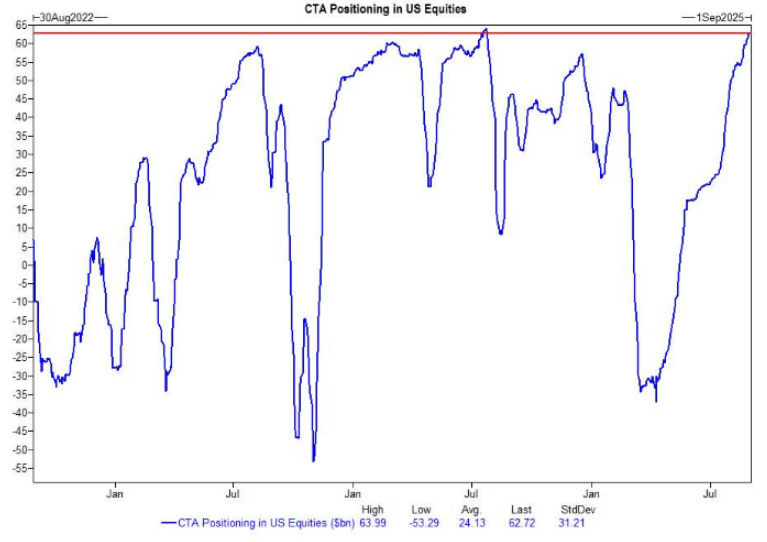

Goldman was also telling me that CTAs - the true definition of dumb money - were back to max long equities.

And credit spreads were back at all time lows.

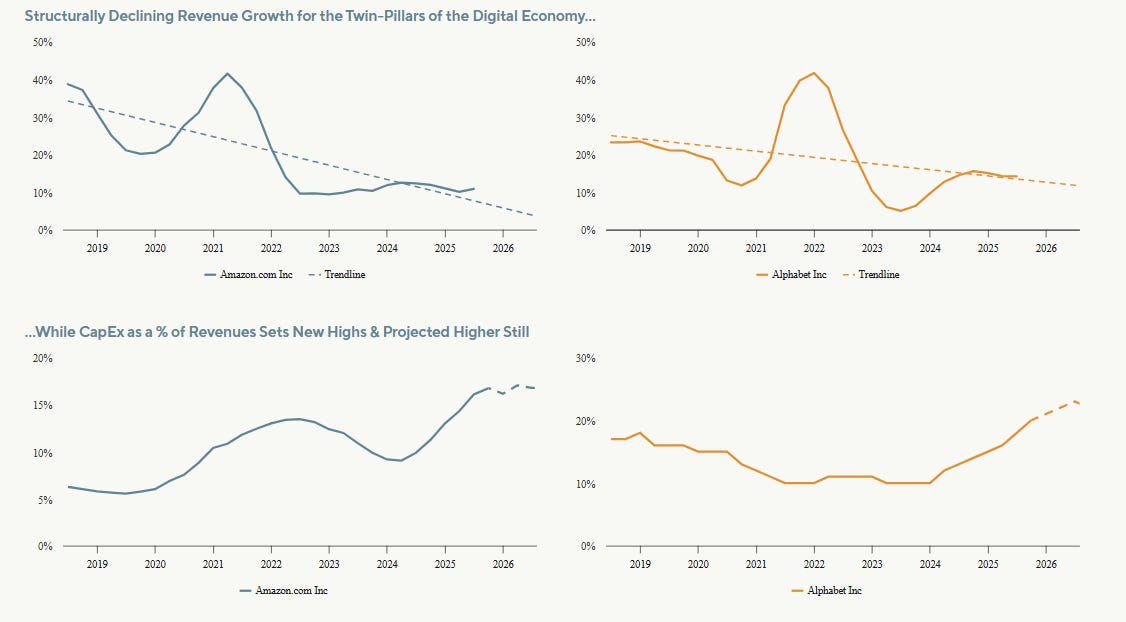

And then we had this interesting piece of research from GQG (I don’t know them), highlighting a bearish view on US tech. The key to its bearish view was that top line growth in slowing, while Capex is now increasing for tech companies.

And as I have pointed out a few times, gold outperforming S&P 500 tends to mark turning points.

So far, so bearish. We just needed one more trigger I think.