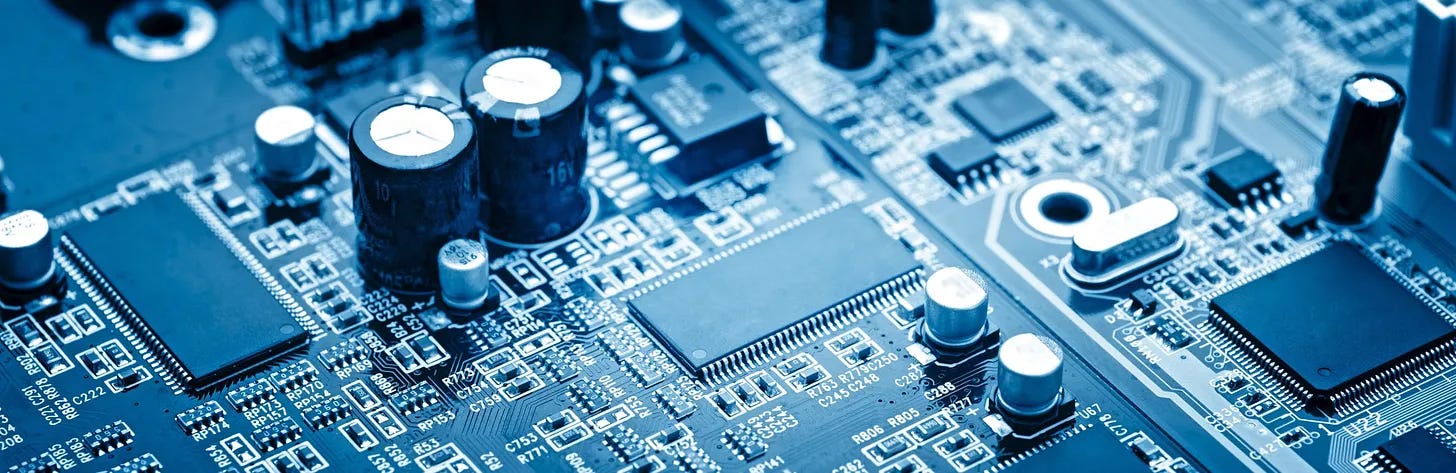

A few months ago, I thought semis looked a good short. Bond yields looked to be going higher, and DeepSeek and its collaboration with SMIC had showed that the current model built around OpenAI and Nvidia was probably too high cost. A quick look at the ASP of SMIC compared to TSMC (the fab that Nvidia uses) showed a yawning gap in pricing. My theory was the OpenAI and other big US tech companies had tried to monopolise expensive chips by bidding up the price of cutting edge Nvidia chips to keep competition out. What DeepSeek showed was that using lagging edge chips and clever software you could make a very competitive product at a fraction of the price. It seemed to me that even if Chinese competition was kept out, a US start up would likely copy the DeepSeek methods putting downward pressure on Nvidia and TSMC pricing.

The above data points are to Q1 2025. The good news is that we can get an idea of trends before quarterly reports come out.