Moody’s downgraded the US over the weekend. Yields have gone up and down, but we see that the 30 year is only marginally higher than where they were on Friday.

Meanwhile in Japan, the long end of the bond market decided it may as well trade as if it was the one suffering a downgrade. Japan still has a lower credit rating than the US. In contrast, even with the sell off, Japanese 30 year JGBs yield less than the US, so you may well wonder what is the point of rating agencies? (In my view, they could be abolished with little effect on financial markets - other than making a few government agencies actually think about what they are buying - but another story for another time)

Despite Japan having a lower credit rating than the US, its 30 year bonds had a lower yield than the US - and in many ways acted as a lead on 30 year treasury yields. Are JGB yields going to be higher than the US? Or are US yields about to rise as well?

The Japanese often found the rating agencies views to be ridiculous. With the second largest foreign reserves in the world, and huge foreign investment overseas, Japanese found it hard to believe that anyone could think there was any credit risk with JGBs.

Back in the free market period (1990 to 2016) what I found worked best was looking at NIIP to describe the strength of the Yen, and low JGB yields. Japanese NIIP has continued to be strong, as US NIIP has been weak. But Japanese NIIP has not changed, buy JGB yields are rising quickly. A positive NIIP meant that when there was trouble, the Japanese would bring money home, and Yen would rise and yields would fall. This no longer seems to happen.

So why are JGB yields weak? I am pretty sure it is not from foreign selling. I know for a fact that Japanese physical bonds are hard for foreigners to buy. How? Because in my old fund I bought some and had to produce a whole bunch of documents to be allowed to. I can assure you buying Irish, American, Spanish and German bonds was much easier. So the JGB market is dominated by domestic buyers. Helpfully the MOF provides some details on JGB auctions. Demand was very strong until 2017. But from 2017 onwards demand has weakened, and continues to weaken. The accepted/offer rate is taken from MOF data - and is the amount of 30yr JGBs bought divided by the amount that was offered.

I first thought change was coming to JGBs market during Covid in 2020. I thought this was a deflationary event, and yet in 2020 30 year JGB yields never really fell as much as I thought they should. Since then, they have been a in a substantial bear market. We have a longer market history for the 10 year JGB, and one thins we can see is that the amount of 10 year JGBs being offered as been climbing for a very long time.

If increased issuance is the driver of higher yields, then US treasuries should not bee too far behind JGBs. SIFMA show a steep increase in issuance.

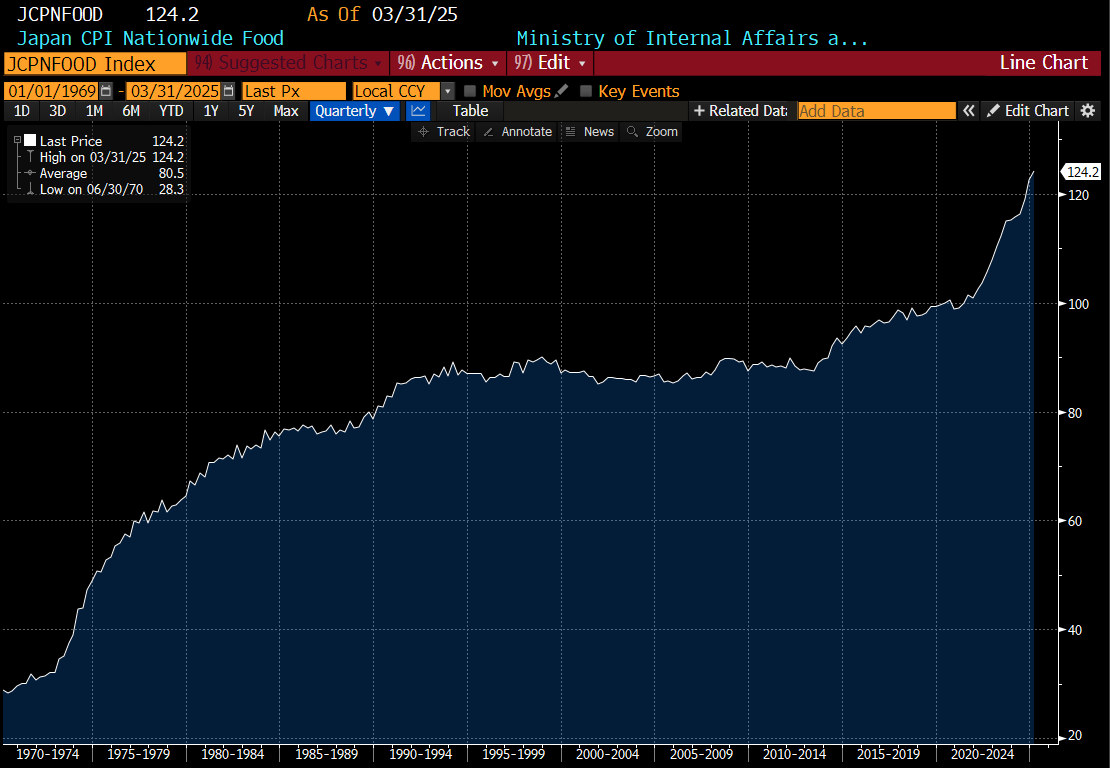

When you also notice that Japanese budget deficit is only 2% of GDP currently metrics are very negative for US treasuries on a relative basis. There is only one thing I can find that really stands out for Japan. Food inflation (driven by rice price increases) has continued to surge in Japan.

With the Yen at a super weak exchange rate, the market seems to be trying to tell the BOJ that they should raise rates more aggressively, and strengthen the Yen. Unlike other central banks, Japanese interest rates remain low, and the balance sheet has barely contracted at all.

But while the US does not have a rice problem, it does look like US food inflation looks ready to rise again in my view. Beef prices have trended higher again.

What does it all mean? Well first rating agencies are useless. Secondly, central banks are living in a past that does not exist anymore, and should be raising interest rates, not cutting them. And thirdly, sitting idly by as food inflation surges is a one way ticket to political and likely bond crisis. I suspect US treasuries will also sell off.