I originally became interested in gold as an inflation trade. In simple terms I see governments looking to boost wages, which will create inflation. This could be offset by higher interest rates, but it seemed to me to be we were heading for a re-run of the 1970s. The trade I chose was GLD/TLT. On the long term chart, we are really starting to move.

Of the two legs, long GLD or short TLT, the long GLD has been far the better trade. Traders would probably cut the TLT side of this trade, but I am not so sure. For me, there are some thing about gold that make me nervous. One has been the surge in gold miners. I always tell people, you can own gold, but only rent gold miners. If gold mining was a good business, then gold supply would increase radically and the gold price would be weak. With the spike in the gold price this year, the NYSE Arca Gold Bug Index has approached all time highs again.

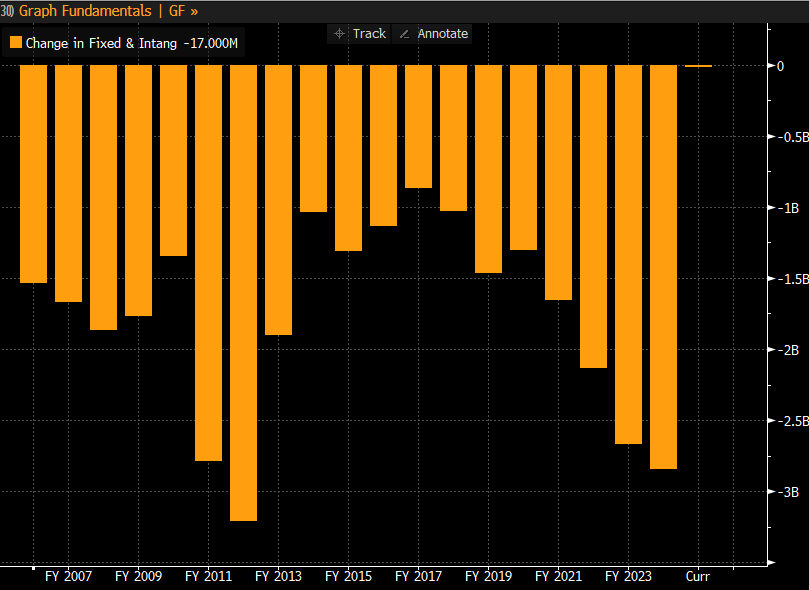

The question I am wondering is whether the surge in gold miners means its time to sell gold? The time to worry about gold is when gold miners start to spend on bringing projects on line. Newmont has increased capex in the last few years.

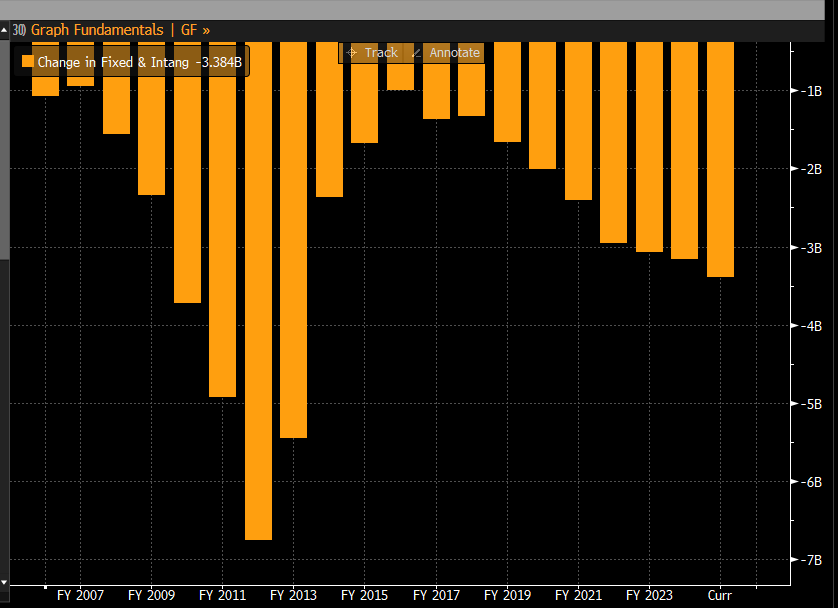

Although Barrick Gold (another good gold company) has been more restrained.

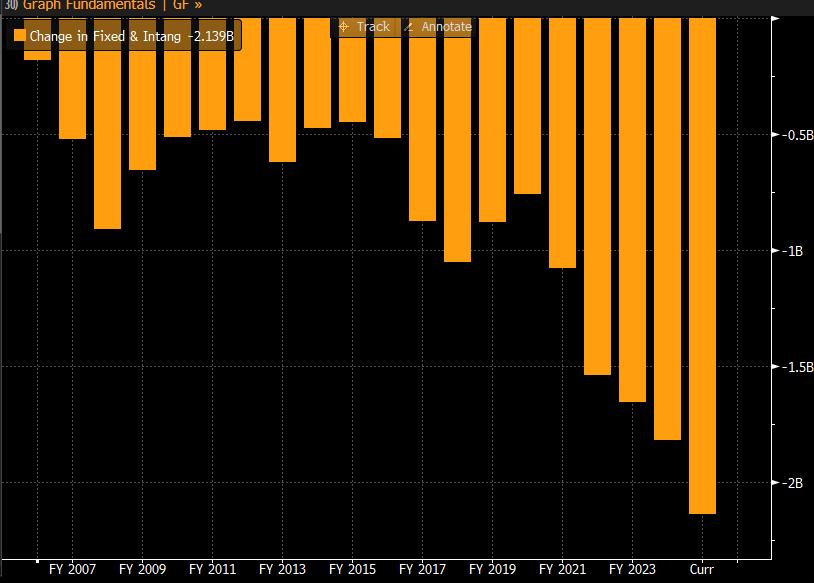

But then Agnico Eagle Mines is at peak capex.

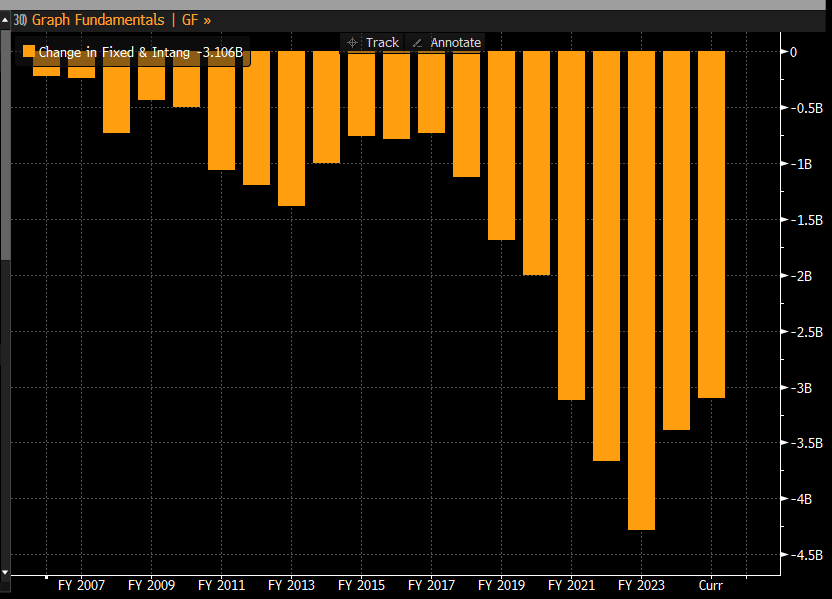

As is Chinese gold miner, Zijin Mining, at least compared to the previous peak in 2013.

The increase in CAPEX could of course just reflect how difficult it is to get gold out of the ground, but nevertheless, I prefer gold when gold miners are struggling. Now that gold miners are also doing well, I am a bit more nervous about gold.

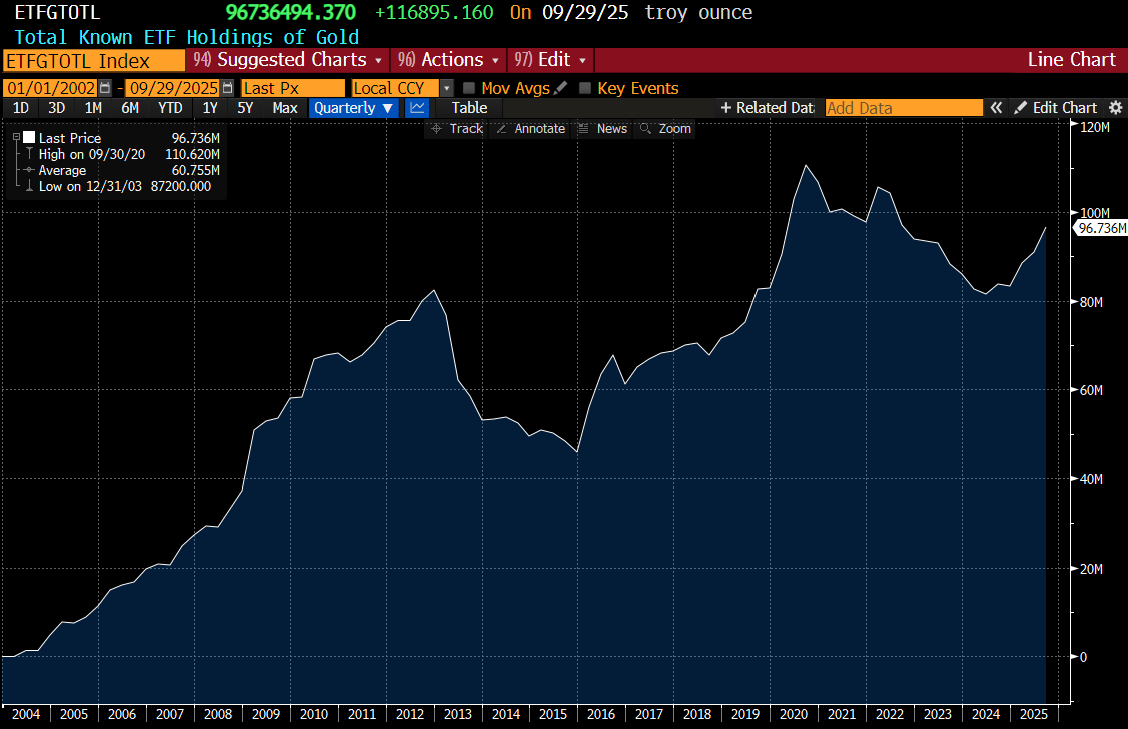

When I look at ETF holdings of gold have risen recently, but remain below peak levels. If we saw a huge increase in ETF holdings, then I would get very nervous indeed.

Gold has had two serious bear markets. From 1980 to 2000 and from 2011 to 2019.

Back in 2012 I laid out a bear case for gold in a note that crashed the server due to its “popularity” (read long gold investors getting nervous). For me gold is an Asian asset that happens to be traded globally. If you travel to India and China, which is bit less than 50% of humanity (especially if you count the diaspora), a large chunk of wealth is kept in gold. So why did gold do poorly in the 1980s and 1990s? Because the Chinese Yuan and Indian Rupee was weak, and the average Chinese and Indian person was becoming poorer. And gold soared from 2000 to 2013, when the Chinese Yuan strengthened and Indian Rupee was stable, and then was weak from 2013 when the Chinese Yuan and Indian Rupee was weak. What is great about this analysis is that it explained why gold was weak during the Asian Financial Crisis, and the China devaluation scare of 2015. Conventional western analysis would suggest interest rates cut then should have spurred gold price, but it did not.

But this does raise a problem. Gold has soared without the Chinese Yuan or other Asian currencies being particularly strong (Indian Rupee is very poor). But that can be easily resolved. The Chinese Yuan should be much stronger than it is. Its trade balance has surged in recent years. If we had not moved to a new era of capital controls and tariffs, then the Yuan would be much stronger.

And China does not want to put its trade surplus into treasuries, which leaves only gold as a viable option. Chinese holding of treasuries continues to fall even as its trade surplus surges.

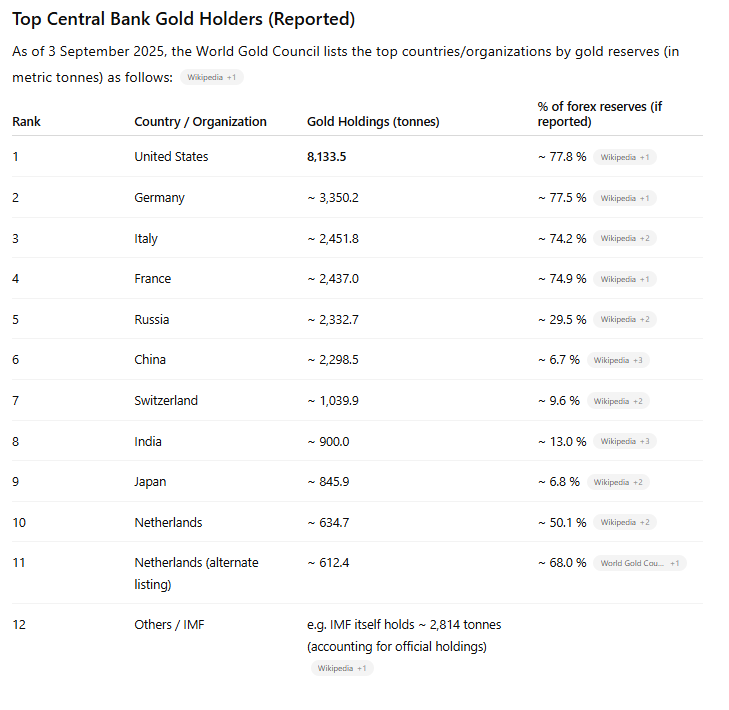

If we assume this is Central Bank buying, then as long as Chinese trade surplus stays strong, China will keep buying gold. It seems a number between 3000 tonnes to 4000 tonnes would be reasonable, looking at other countries holdings.

Using round numbers, that is 1000 tonnes more tonnes of buying which equals 32 million ounces, which is USD 121 billion, or 20% of the annual trade surplus. This seems very reasonable, and would be one third of current total ETF holdings. The risk is more political than anything else - that China decides not to buy gold, perhaps as they perceive it as poor value. But given how the West froze Russian foreign exchange holdings, there seems little they can do. I think a better signal will be if Chinese trade surplus begins to fall. But so far there is no sign of that. It also helps explain the dispersion between gold and oil prices. Lower oil prices boosts the Chinese trade surplus.

Coming back to the GLD/TLT trade, much higher yields would probably cause gold problems, by slowing trade activity, and offering a more attractive alternative - but for the Trump administration has made clear, short term objectives of growth often override long term strategic goals. Gold is probably okay, but a spike in yields could cause problems for gold, but should leave me doing fine.