A friend of mine said I should take a look at the most recent Strategy preferred issuance. The headline is that it pays 10% annually, which sounds attractive, but made me think, where is Strategy going to get the cash to pay that dividend? Their Bitcoin holding generates no cash. Looking at the Term Sheet, it seems likely they will never pay any dividends.

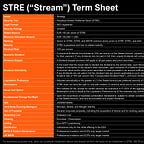

The key point here is the dividend deferability. I post it below. Basically, dividends will be paid through the issuance of more securities (never selling Bitcoin).

Dividend Deferability

In the event that the Issuer fails to declare the dividend by the record date, such failure shall constitute the issuance of a notice of deferral (“Deferral Notice”)

Subject to the terms of the Issuer’s other securities, upon issuance of a Deferral Notice, the Issuer shall use commercially reasonable efforts over the following 60-day period to sell STRK, STRD, class A common stock and/or other junior securities to raise proceeds in an amount sufficient to cover any deferred dividends plus compounded dividends thereon

If any dividends are not paid in full the dividend rate per annum applicable to such unpaid amount will increase by 100 basis points following each subsequent dividend period, up to a maximum dividend rate of 18% per annum (the “Compounded Dividend Rate”), until such dividends, together with compounded dividends thereon, is paid in full

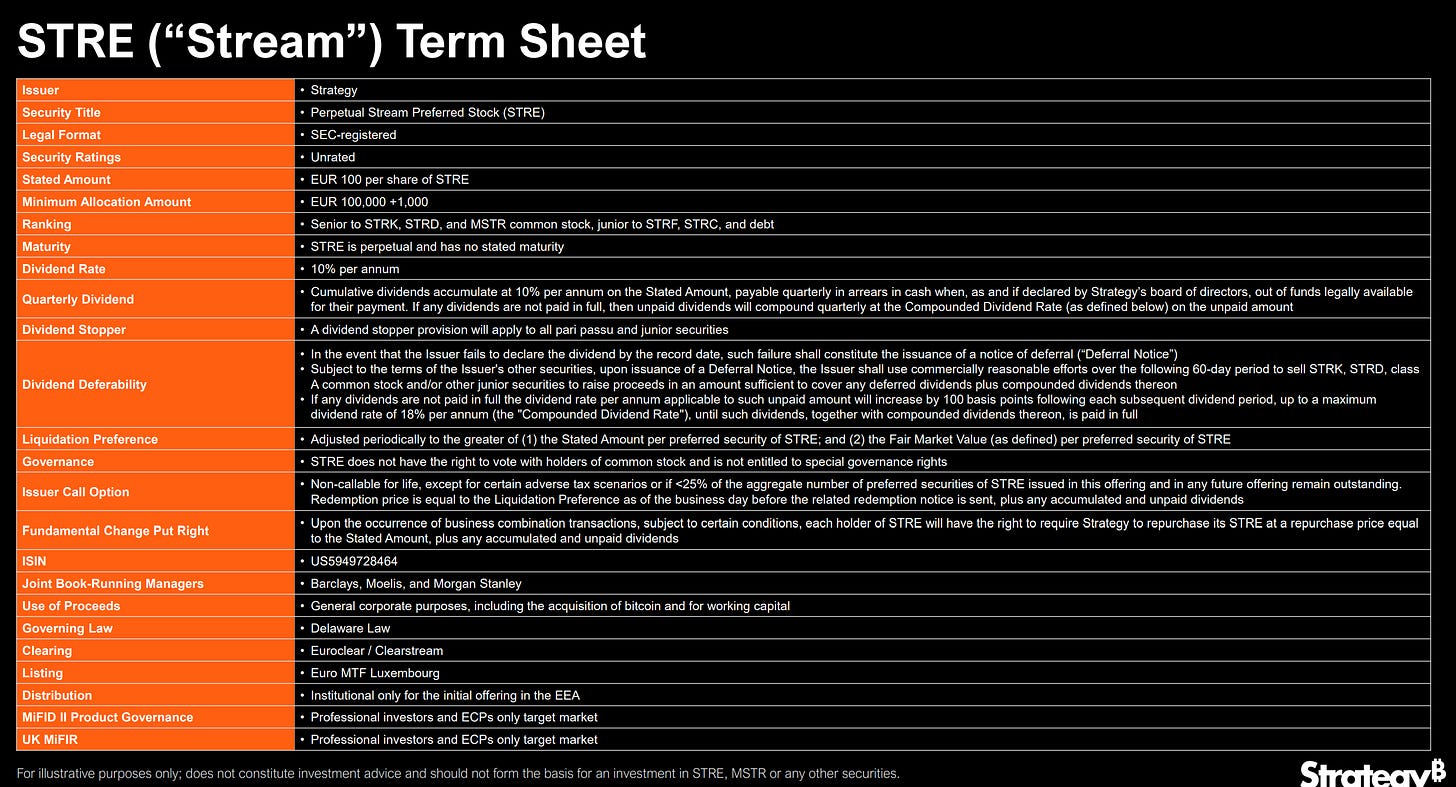

This marks a change in strategy for Strategy. Initially, Strategy raised capital through equity issuance and convertibles. The benefit of this was that neither issuance required any further cash flow (ie dividend or coupons).

This made a lot of sense when its market cap traded above its NAV. However this is no longer the case.

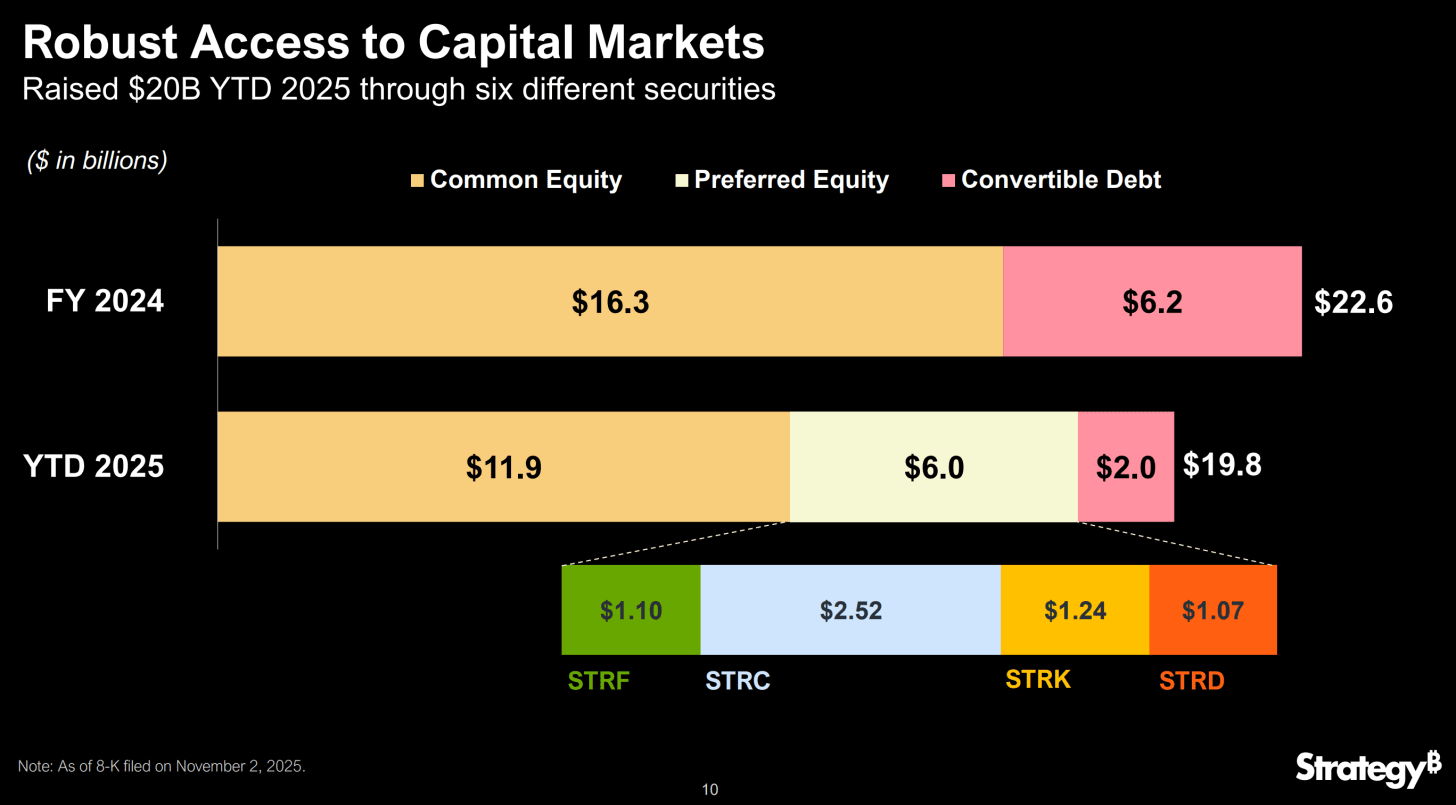

Issuing debt makes more sense than issuing equity, and hence the growth in “preferred equity”.

Strategy is explicitly saying that Bitcoin will annualise at faster than 10% going forward, and that it will issue more debt to pay this off when and if needed. It seems unattractive to me - especially compared to the convertible debt. In that case you got the stability of bond, with the upside of bitcoin. In this case you are being offered a high dividend yield, but which the company does not have the cash flow, and will not sell any of it Bitcoin stash to pay. You are hoping that future preferred equity buyers will turn up to help pay your dividend.

Probably the most negative feature of this is that in a prolonged slump in Bitcoin, the debt holdings could start to grow in size at the rate of 18%, causing preferred equity holders to become the dominant owners of the company (it would need to be a very long slump - but then again gold had a 20 year bear market from 1980 to 2000). In such a case, they could theoretically force the sale of the bitcoin holding to get repaid. (This is my reading of the Term Sheet - but I am not a preferred equity investor - please correct me if I am wrong).

In my previous note I wondered if Bitcoin bearishness drove Bitcoin higher. This is more evidence to support this view. Without widespread bearishness, will Bitcoin take a while to recover? I would be more upbeat on Bitcoin if the IBIT (Bitcoin ETF) had seen some selling. As yet, there is none.

I think the biggest problem facing all asset markets is a widespread unease with the expense of assets - and how little trickle down we are seeing. Politically, the winds for asset speculation are turning, and hence Strategy has had to resort to raising yield to raise capital.