If you are reading this post, you have probably received the same email that I did offering the opportunity to invest in Substack. As of my writing this, they have already reached their legal maximum in subscriptions to this offering.

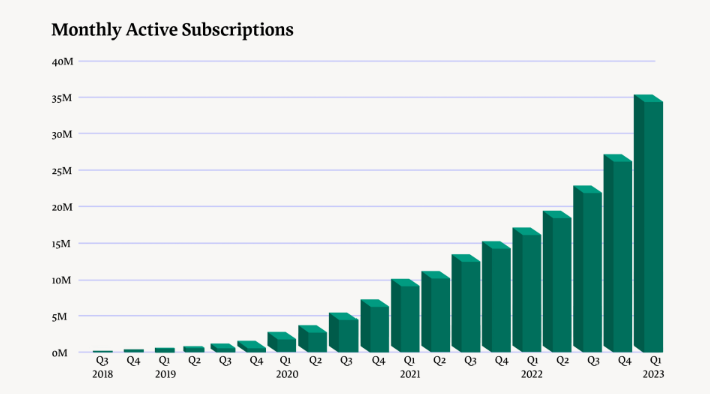

The average amount people have subscribed for is USD 1200 - and given its oversubscription means most people are likely to end up with USD 1000 or stock or less. This capital raise will give Substack a USD655m post-money valuation. Is that the right value? Lets analyse some of the numbers they give us. As you would expect monthly subscriptions have been growing rapidly. In my experience somewhere between 5 to 10% of free subscribers become paid subscribers.

I am one of 17,000 writers earning money on Substack. The top 10 publishers on Substack are taking in USD25m annually. Substack do not disclose who these publishers are, but looking at another content creator website like Onlyfans, the top publisher is probably is making 10 times as much as the 10th. So lets say USD7m for the top publisher, and USD 700k for the 10th (if this is correct some of the financial Substacks that I have collaborated on should be in the top 10 writers). Just like Onlyfans, the top 10 writers probably make 25% of all revenue, which puts last year total revenue for Substack at USD 100mn. Growth recently has probably been supercharged by the closure of Revue.

Cumulative money paid to writers is USD300m. Substack have not given out any audited financials, but eyeballing the numbers below, it looks like maybe USD10m was paid out to writers in February. If we add in some growth and annualise, what would maybe equate to USD200m paid annually to writers. With 10m a month in fees paid, and 17,000 paid writers, the AVERAGE publisher is making around USD 600 a month or USD 7000 a year. But this obviously skewed by top performers. My guess is the MEDIAN paid writer on Substack is making close to zero.

Substack revenue stream is pretty transparent, as it takes 10% of money paid to writers with another 4% taken by Stripe.

So on annualised revenue basis, Substack is making about USD 20m, and so the valuation of USD655m is a punchy 30 times sales, but obviously this valuation includes a lot of growth, and reflects the annuity style income stream that this should generate. As shown above, the total revenue through the business (before Substack takes a cut) probably grew from USD 100m to USD200m.

OnlyFans and Patreon are slighly more mature (in both senses of the word!) business models. OnlyFans continues to grow, while Patreon has recently announced layoffs. This seems to mean content creation is a winner take all model. For Substack, the nearest competitor was Revue, which was bought by Twitter in 2021. The good news for Substack, is that Revue has been shutdown this year. This all sounds good for Substack, but 20x sales on a probably loss making business strikes me at best fair, rather than cheap.

Their Form C (required by Reg CF) appeared on EDGAR a week or so ago, the numbers included are for 2020 and 2021. The 2022 numbers should appear soon, IIRC they have 120 days from FY close to make them available.

Agreed- but that is why they are pushing internally generated subscribers- saying Substack is the nest way to grow that. Substack network has been my biggest source last two months anyway

Also, some top performing Substacks generate enough following and thus resources to build their own platform and go direct to consumer. If the top producers do this this with some consistency the valuation seems quite rich.

And the real question is what have the VC’s seen that doesn’t make them want to invest anymore. Aggregators on the internet are winner take all, but Substack is a far way off from being an aggregator. Yet it is well on its way.

Just factor in for a marketplace that eventually they build their own payment processor, and usually increase the transaction fee and they start adding stuff like seller services. So that 10% will go a bit northward or 20% and could potentially reach 30% for some areas. Could.... not would.

Also didn’t notice the terms on the mail. Is it equity we are being asked to invest or a convertible loan?

Russell. Are you trying to be cancelled by the algos?!

I thought I was pretty reasonable. TBH if you really want to build loyalty a valuation that was cheap would have been a smarter play....

Loved the piece and the analysis. As a former cap markets banker also 100% agree with your approach re building a register. If only they spoke to the people already on their platform with the experience... the trouble is that they think some douche 2 year old in Palo Alto knows better