AI is incredible. I have always wanted to make a short film about a story I heard about a fund manger in the early 1990s that went to Korea. Its a funny story, and I thought it would make a good short film. I always wondered how I could do it and low and behold with Google’s VEO I was able to make it. It is on my Tiktok, or you can see it here on substack.

In 2019 when I looked at big tech, and in particular Meta and Google, I tried to get an idea of how large they could get. Basically I looked at total advertising spend (ex-China) back in 2019 which was about USD 600bn. I assumed that digital share of advertising gets to 75% or so, and that Google and Meta take 75% of that. Which gets a total revenue number which gives around USD 340bn. Google was forecast to have revenue around USD 200bn in 2020, and Meta around USD80bn. At this time TikTok was beginning to take off, and Amazon and Microsoft where expanding into advertising so there seemed some downside risk to the market share numbers to me. I also thought the US cycle looked extended, with NIIP data pointing to extremes. Advertising revenue is very cyclical, so I thought big tech looked like dead money. For awhile this analysis seemed on the money for Meta - but after a volatile 2020 to 2023 it has surged to new highs.

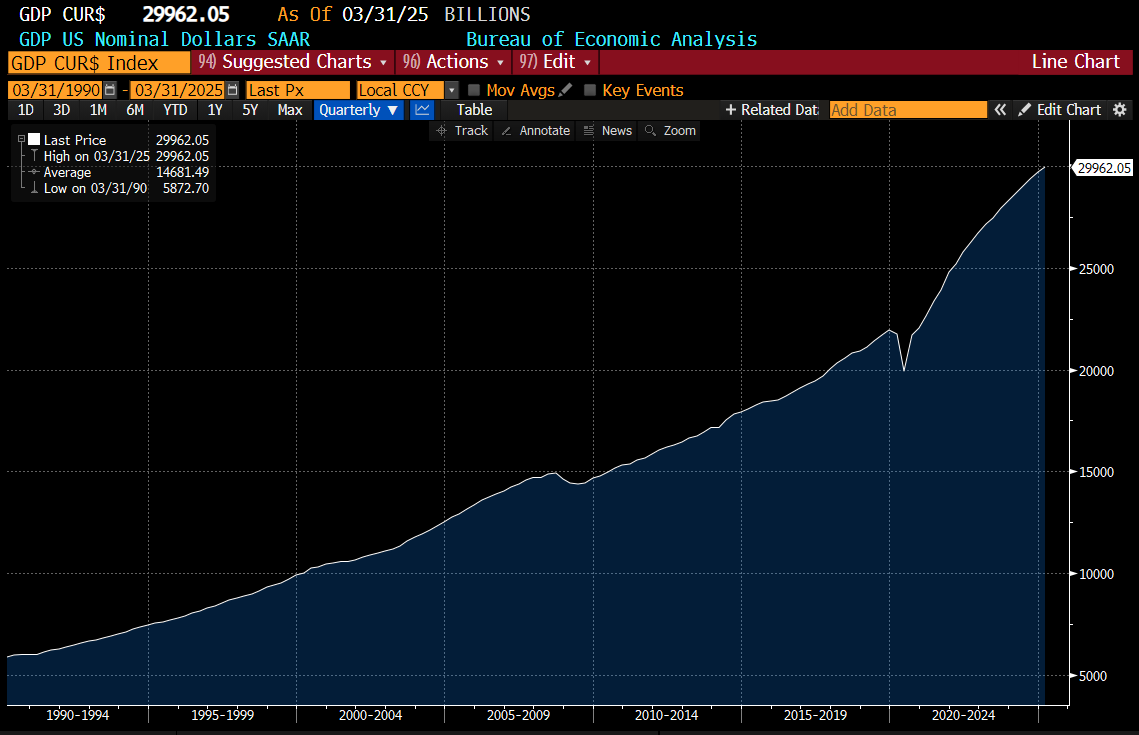

This was sort of true for Google as well, but stock is now at new highs. Where did I go wrong? Well first of all, US fiscal spend has moved US GDP much higher in a rapid amount of time. Advertising tends to be fairly stable as a share of GDP, so strong GDP means strong topline for these companies.

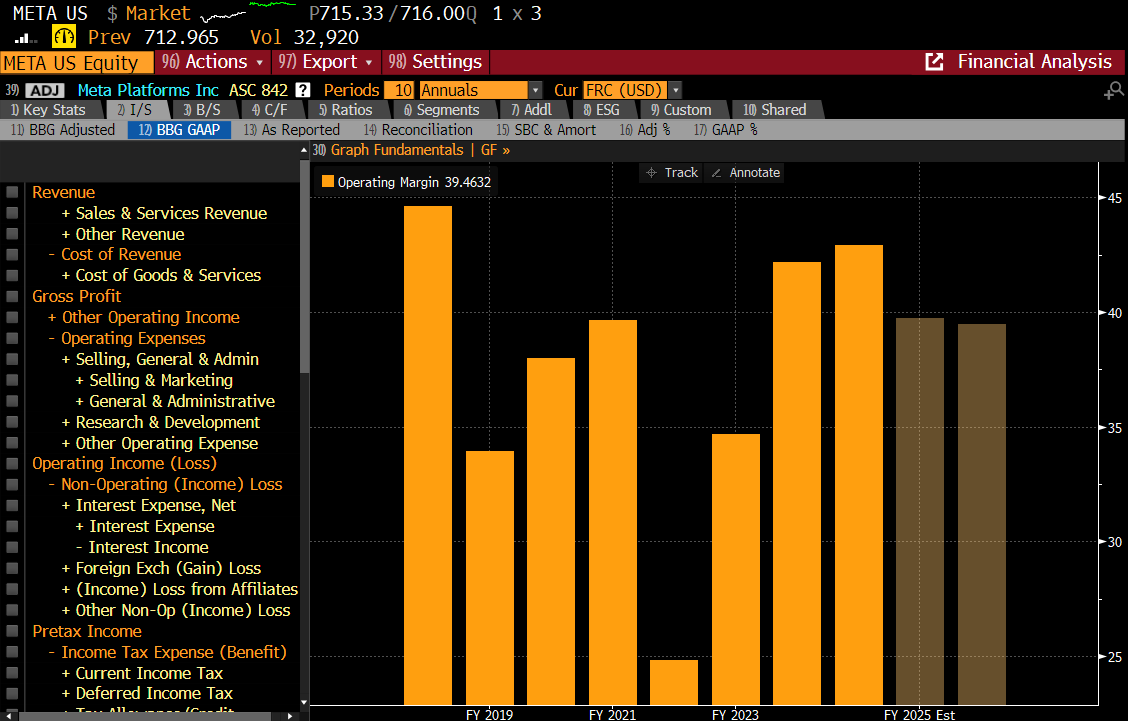

The other thing is that Big Tech has been generally able to control costs very well. Meta saw margins dip briefly, before pushing them back to highs.

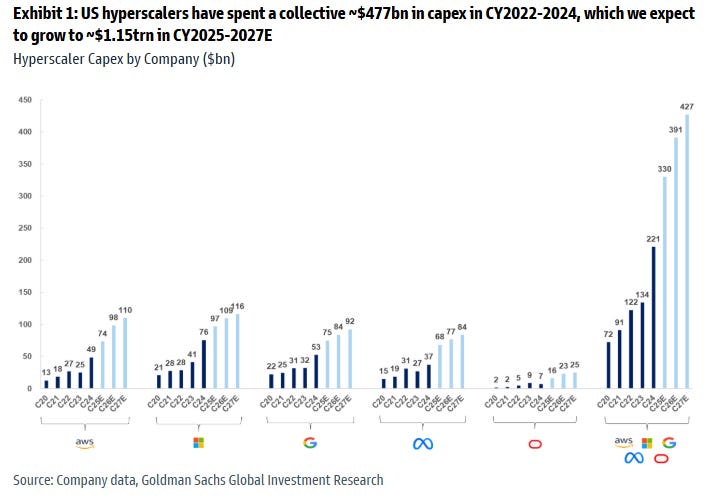

The conclusion is that these are incredibly well run business that can grow with GDP, and cut costs at will. There are potentially loads of political problems, and regulatory problems like those that affected Chinese tech, but US tech views seems to be well represented at the White House. Probably the best thing about these businesses is that can grow the top line with little additional capex. And here is the problem with AI. AI seems to be offering relatively little new growth for a lot of capex. The big AI spenders are looking to spend USD 1 trillion in the next few years. For comparison, Amazon spent USD 21bn building its cloud business from 2006 -15.

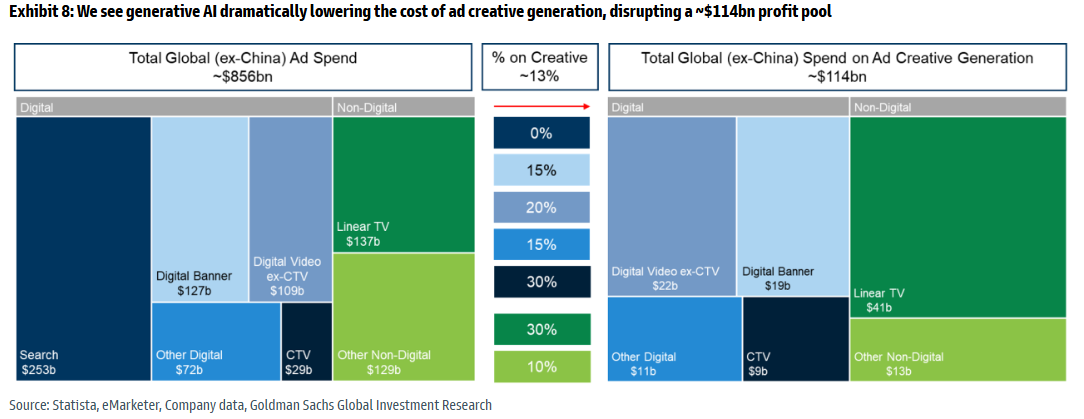

There is nothing wrong with Capex, but its good when it generates additional revenue. And here is the problem. As the video above shows, it should allow big tech to capture more of the advertising creative generation. But this only adds USD 114 bn or 13% to addressable market.

My reading of the AI boom is that ChatGPT is changing the way people search for information. I know that I am as likely to search for things on ChatGPT and Tiktok as I am to search on Google. For me, the investments into AI for big tech is as much about defending market share than growing revenue. For me, this changes the nature of big tech. The risk is that they choose to cut margins for awhile to keep competition out. I thought something might happen when TikTok started to take market share - but whether Meta and Google just out competed, or the political pressure brought them into line I can’t tell.

So my problem with big tech are three fold. One is that a recession is overdue, which should slow top line growth. Secondly, the industry is becoming more competitive with the entrance of new players in the AI space. And thirdly, Capex is exploding to capture only incremental growth. The risk is that GDP growth surges again. But when I look at long term government bond yields, I think that risk is diminishing.