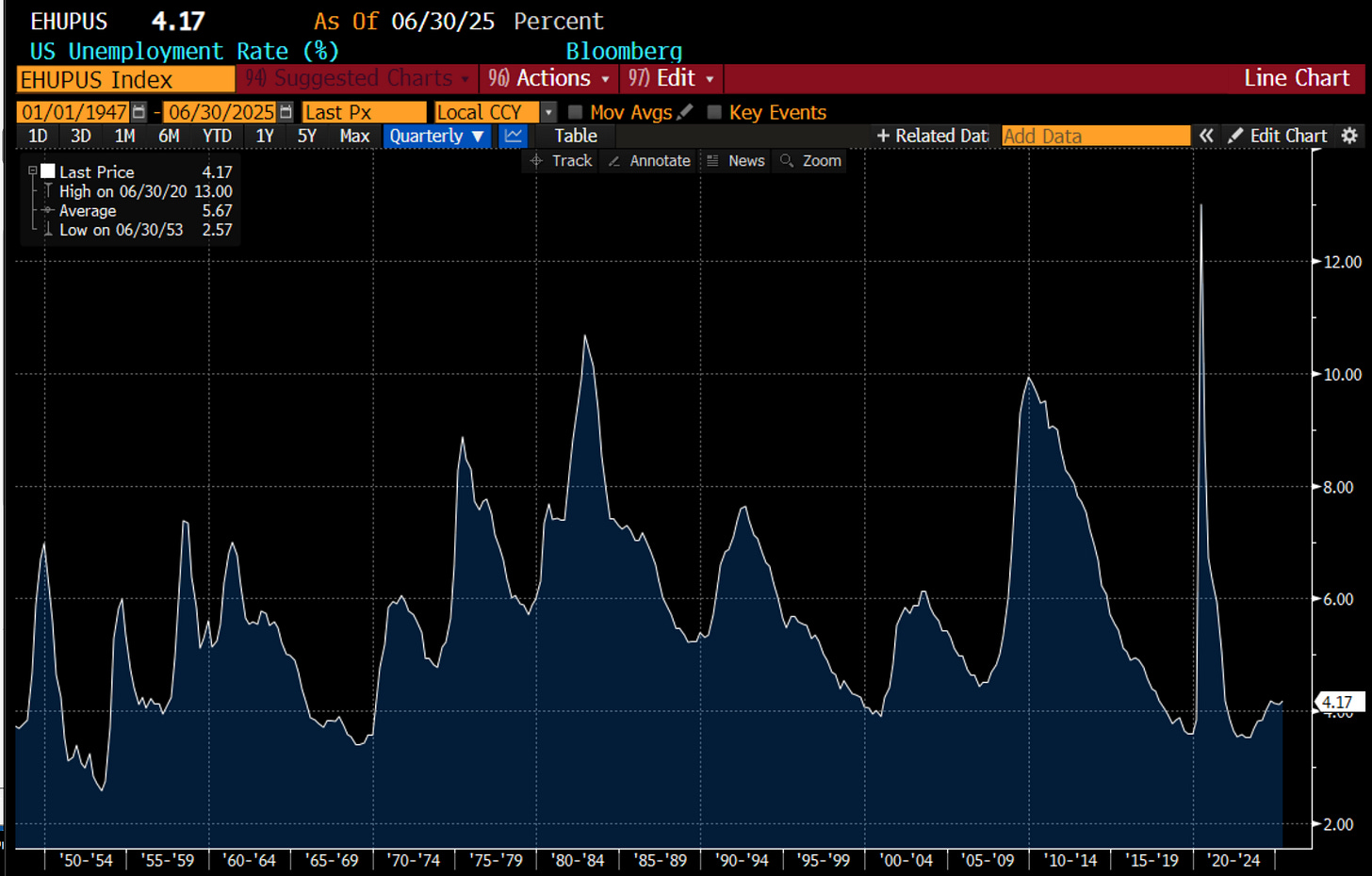

The blessing and curse of getting older is that you know that everything can change. The blessing and curse of being young is thinking nothing will ever change. I found myself explaining a recession to a 27 year old the other day. He looked at me like a mad man - but maybe I am the crazy one for worrying about them. We have not seen a prolonged period of unemployment in the US for over 10 years.

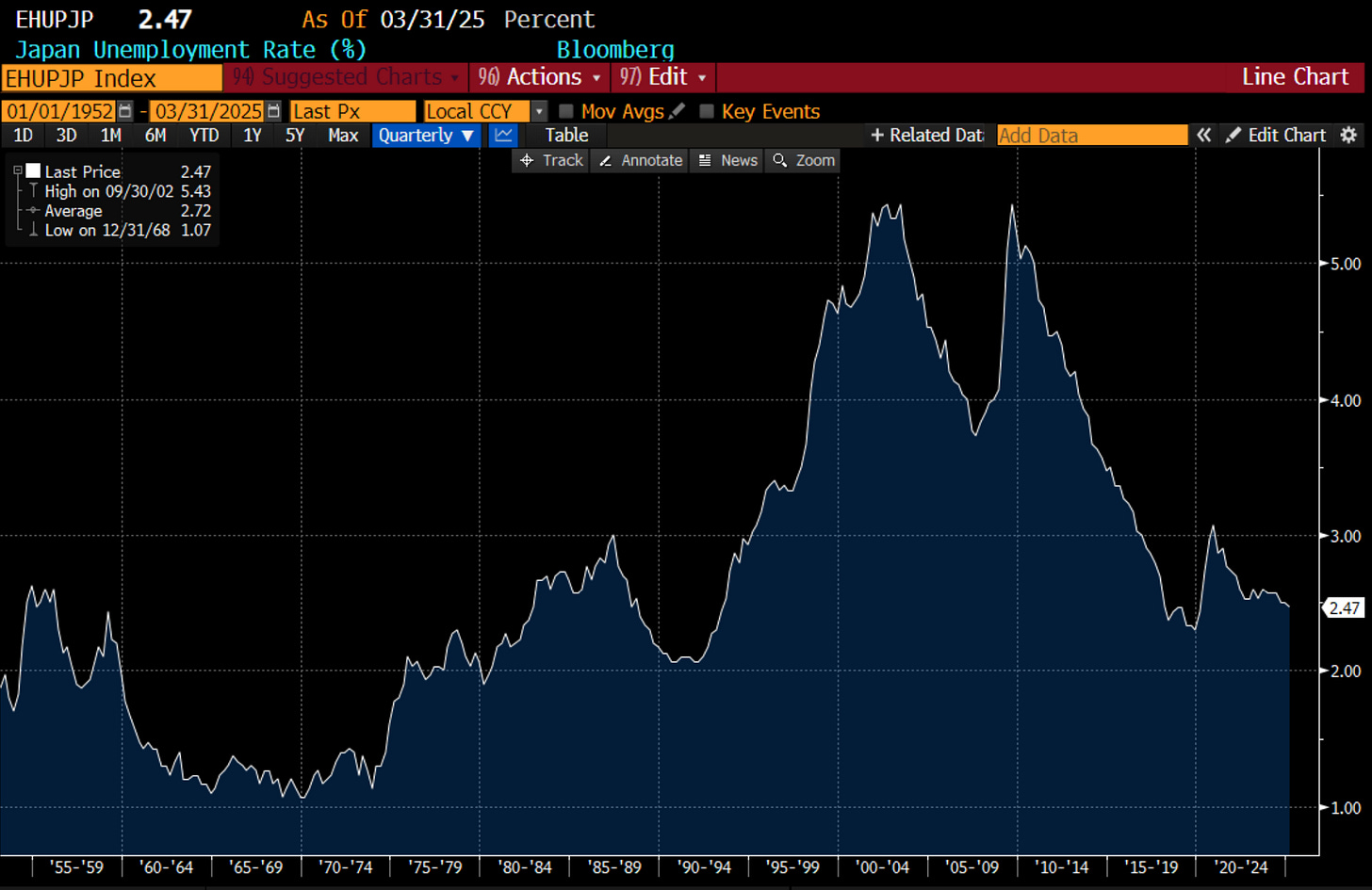

I saw Japan go through a long struggle with rising unemployment in the 1990s. But again since 2010s, sustained unemployment is a thing of the past.

Perhaps my homeland of Australia is the best example of an end to unemployment. I matured in the 1990s, and thought 2000 was a peak in employment markets to never been seen again. Since 2000, unemployment has been generally lower than the 2000 peak. To quote Harold MacMillan “you have never had it so good”.

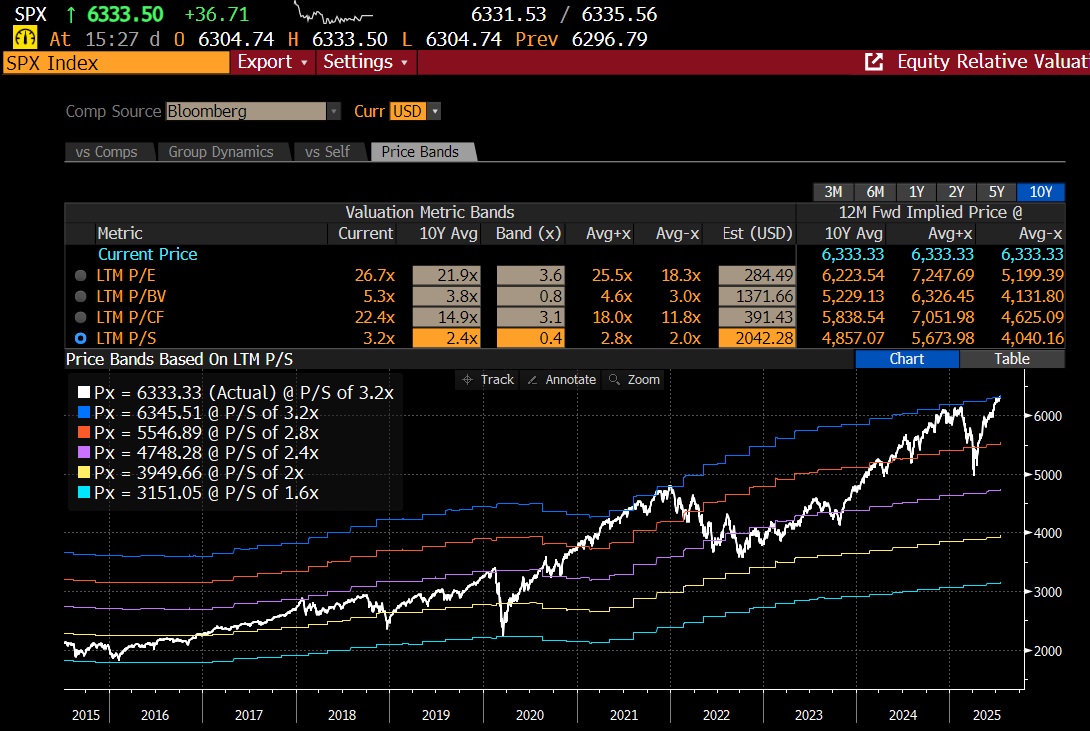

This period of low unemployment has coincided with stocks being priced ever more richly. The S&P 500 has gone from 1.6 times sales to 3.2 times sales today.

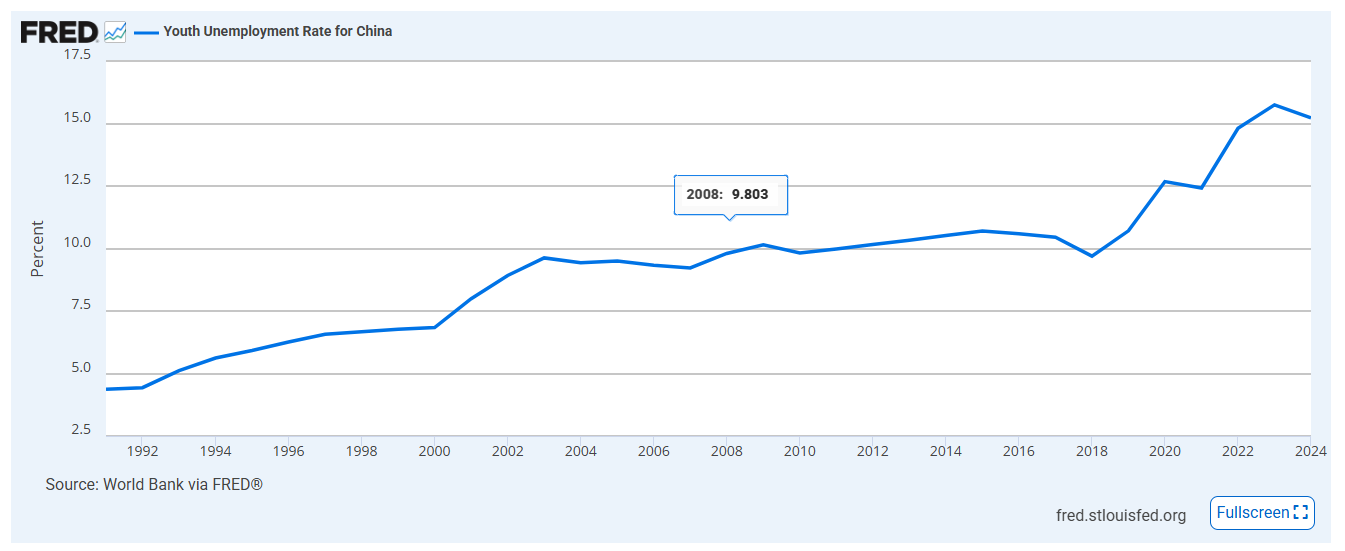

Only one country I know of has seen unemployment worsen in recent years - and that is China. China would be the only country that has seen defaults rise, but also see government bond yields decline and deflation. It stock market trades much more cheaply as well. You should be able to see where I am going with this.

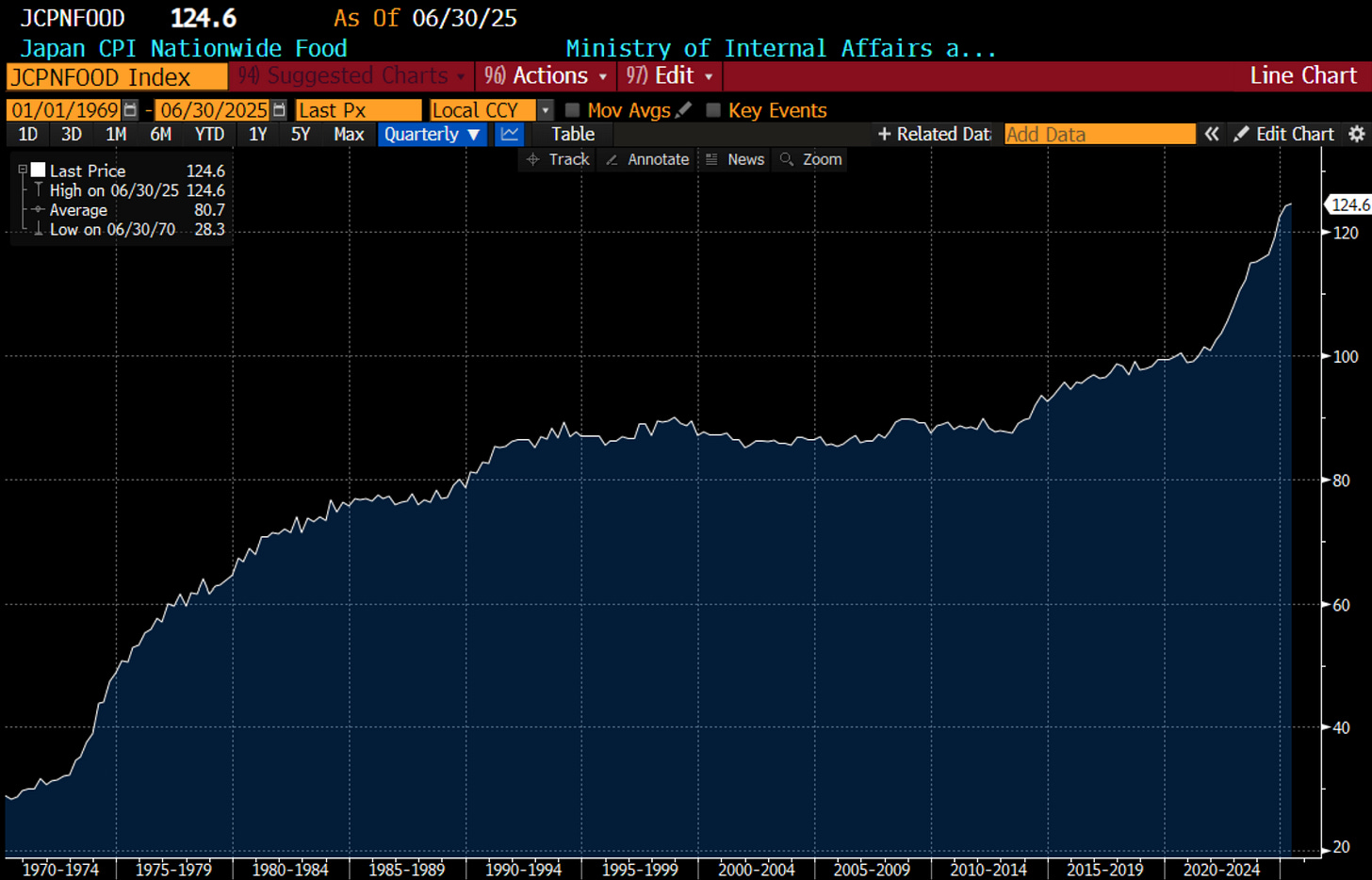

In my pro-labour view, I saw the ever rising sales for corporates being compromised by rising costs, and rising yields. For example in Japan, stagflation has ended. Food prices have stagnated for decades are now rising rapidly. Low unemployment seems to lead to higher stocks, but also higher inflation. This is standard economic theory.

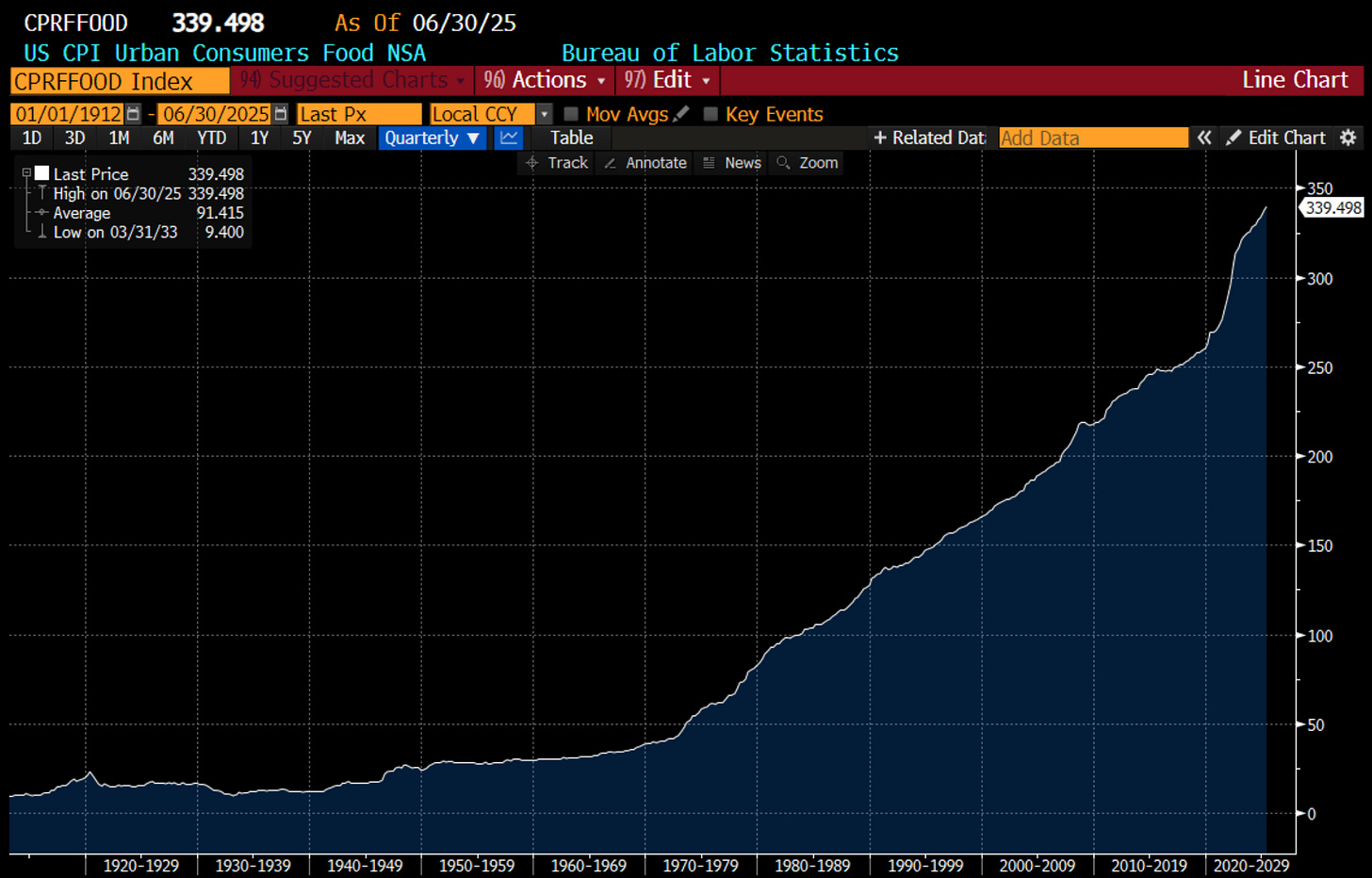

When we compare to the US, we can see the deflationary 1930s clearly, and then the inflationary 1970s onwards. Recent years have seen a sharp acceleration again.

When do politicians choose inflationary over deflationary policies? Obviously after the oil shock of the 1970s, there was a move to tighter monetary policy and then a move to more “pro-market” policies in 1980s. The inclusion of the former Communist nations into the world trading block, was also a deflationary policy. Obviously, the world has moved away from these deflationary policies, with predictable effects on the long end of the bond market.

One of the obvious things about “pro-labour” inflationary policies, is that voters want the employment without the inflation. Japan is only the latest example of the ruling LDP suffering politically.

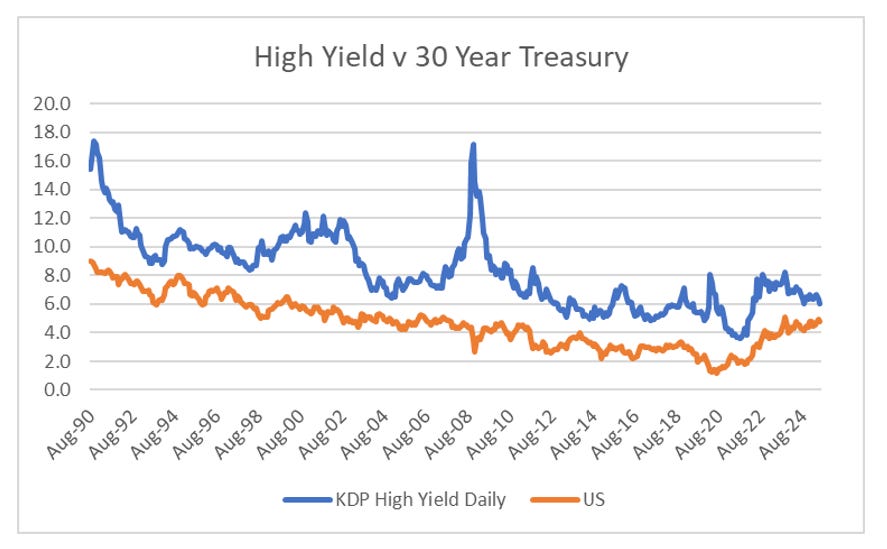

All of this is inflationary - and we are seeing yields rise globally. At some points voters tire of inflation, and business tire of higher interest rates costs, and as a society we accept higher unemployment for lower inflation. When is that point? In the US, government yields are rising, but corporate bond yields have stayed contained, so far. That is treasuries are weak, but corporate bonds yields have been contained.

Higher government bonds yields forcing up corporate bond yields would be seismic change in American finance. For 40 years, we have had the opposite, with falling government yields acting as a tail wind. If government policy begins to act against business borrowing costs, I would start to expect some political change. I think this is why gold is attempting to break higher against the S&P 500 - perhaps sensing we are near an inflection point?

At some point voters will tire of inflation, and business will tire of rising yields, and then the politics will turn to deflationary policies again. But right now, higher yields look close to impacting markets again. To borrow from Soros, I think you need to see the price action in bonds affecting markets first before we see any political change.