I will admit, I have only started taking a close interest in politics in recent years. Like many of the “elite” I was shocked by the Brexit vote, and the election of Trump. But having spent a few years reading and thinking about politics, every election this year has conformed to exactly the same message - “show me the money”.

The market and the Economist where surprised by recent election results in Mexico, France and India. Working on the received wisdom, of full employment and strong stock markets, France and India should have returned strong pro-government results, and yet in both countries the ruling party suffered reversals. India is the more interesting, as Modi was seen by the Economist as a populist, race-baiting, strong man that the global voting public was ever more favouring. The opposition was seen as lacklustre at best. The election reduced the ruling party lead in seats by over 200.

In Mexico, the surprise was how large was the endorsement of the ruling party. Despite populist ALMO stepping down, his successor garnered even more seats. ALMO and his party was seen as populist, and so in the same boat as Modi. The Economist frets about what all this power for ruling party might do, while ignoring the real message. Voters are screaming “show me the money”. ALMO showed them the money. Modi plainly did not show them the money.

Perhaps even more importantly- ALMO did not make the richest man in Mexico richer. Carlos Slim, who controls America Moviles, has not seen the share price rise over the last 10 years. India’s richest man, Mukesh Ambani, has seen his Reliance Industries soar in value. White line is America Moviles, red line is Reliance Industries.

In France, the richest man in Europe, has continued to prosper. LVMH has been a great stock.

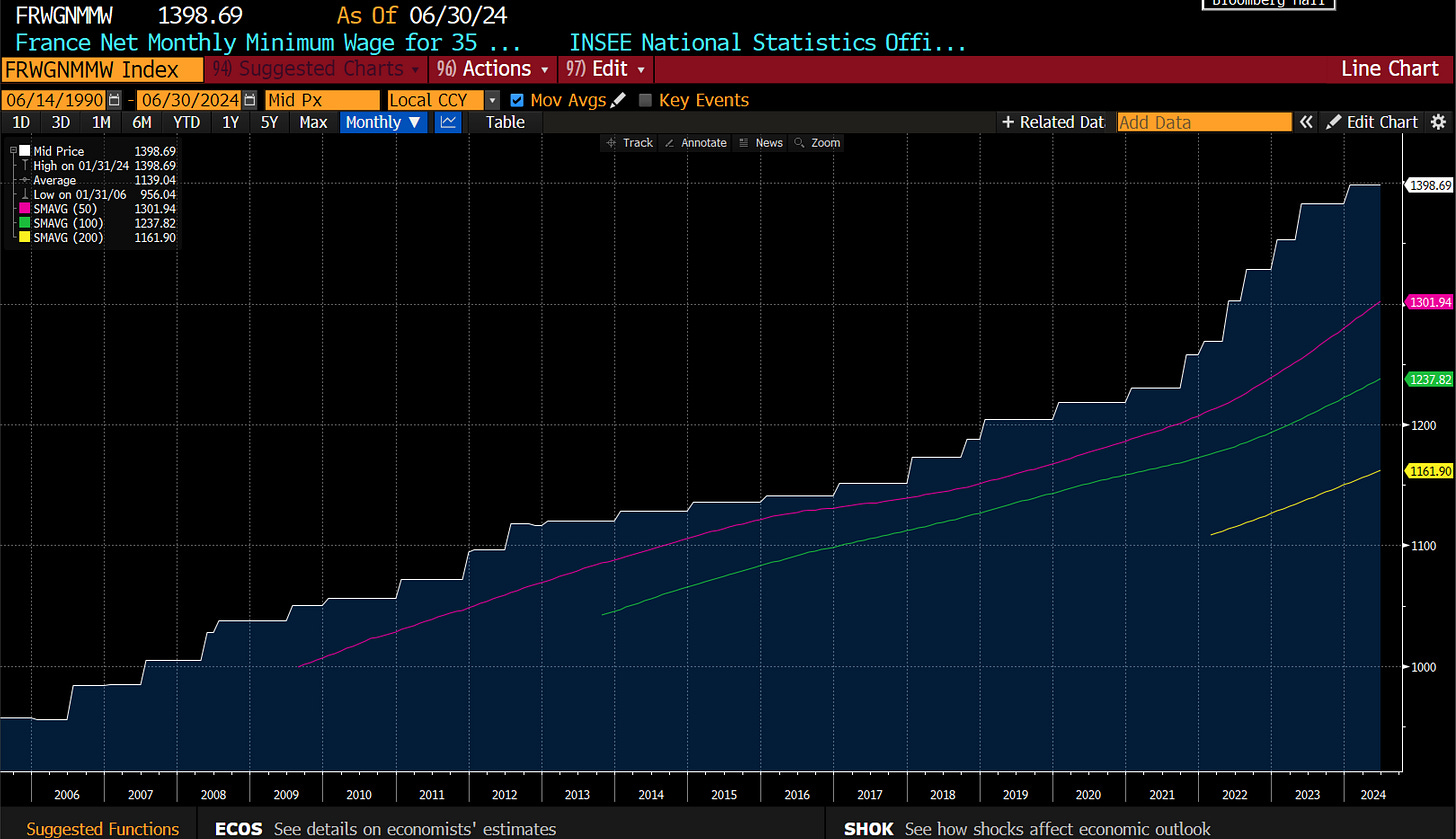

To be fair French Minimum wage has risen recently quite sharply.

But only in line with CPI.

I use the rich as a proxy for asset prices, but the idea is the same. Voters want more money, and cheaper asset prices, particular housing. In the UK, Labour is campaigning of pretty much exactly that platform, and are heading for a landslide. I am a political neophyte, but understand what voters want. Why do so many “professionals” not get it.

What does this all mean for the US presidential election? Too hard to tell. Markets have been more lacklustre under Biden (which is a good thing politically) and he retains more of an everyman (but very old) demeanour than Trump. If Democrats can paint him as the favourite of corporate America, then Biden will do much better. I suspect that this means the Economist analysis showing that Trump is more likely to win, is probably wrong again. I suspect Biden to outperform, with the election being much closer than expected.

(Full Disclosure: Last year, the Economist advertised for someone to be the British Economics writer. I thought it sounded fun, but doubted I would get the job. I submitted a CV, and a sample article, and was told I would receive a reply in a few weeks. My expectation was maybe a phone call, I hoped to have an interview in their office, but in the end I received nothing - not even a rejection email. Sadly, the Economist recruitment process has gone the same way as their political analysis - subpar. The sample article I wrote became this piece. My disappointment in the Economist may be based on this, but I do think their political analysis is very weak these days.)