In case you missed it, Oracle, reported numbers last week. While earnings was in line, it surprised the market with a huge pipeline of new AI related cloud bookings. An already large stock gapping 36% higher is extremely rare - and this was on top of a huge run up from the April lows.

As the FT points out, Oracle has been able to out compete other cloud rivals to build bigger bookings pipeline in its cloud business.

As the FT reports, this huge growth in pipeline is driven mainly by a huge deal with OpenAI. The scale of growth in mindboggling. They expect revenue from the cloud business to USD 144 bn in four years time. Oracle sales were stuck at USD 40bn for a decade. It essentially saying its new business will create nearly 4 times the business in 4 years time.

While the FT article suggests that Oracle was able to undercut some of the bigger established cloud operators, what seems more likely is that demand is so strong, the large cloud businesses are reaching capacity constraints. Google, Microsoft, Meta all have their own AI systems that they are trying to compete with, while Oracle seems exclusively focused on cloud, making them an ideal partner for OpenAI. Oracle seems to be implying that OpenAI is going to be giving them around USD 100bn of business a year in 4 years time. For me, the only comparison I can think is when Chinese demand started to take off in 2000, the market simply could not get its head around the scale of demand.

My problem is that this sounds bullish, and is bullish. But how do I match up such a bullish announcement with the continued outperformance of gold relative to the S&P 500? It feels like a US centred tech boom should see S&P 500 outperform gold, not the other way round.

Big gold turning points against the S&P 500 have historically been times to show caution. Oracle numbers suggest the opposite.

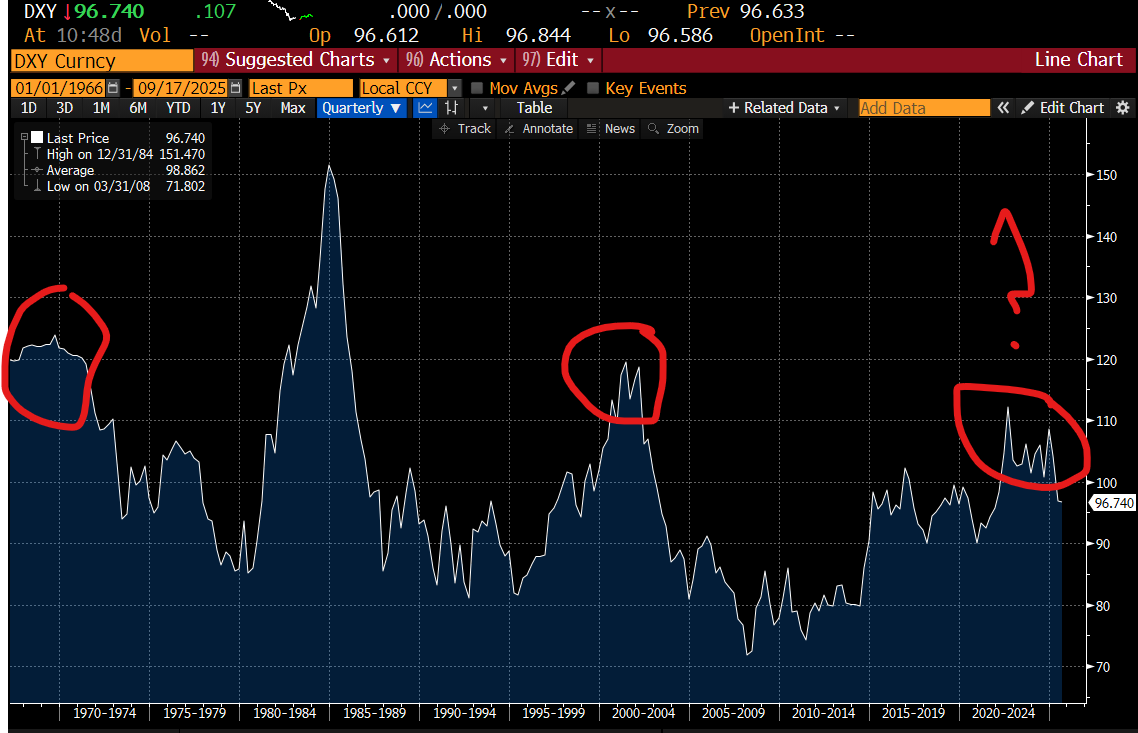

Perhaps gold is just responding to a weakening dollar. The turning point in markets in 1970 and 2000 also marked points when the dollar weakened then too.

There is a possibly bullish read on this.