I had viewed the political machinations around the Federal Reserve as a transparent attempt of the Trump administration to control interest rates and push them lower. The market has agreed, with 2 year Treasury yields touching 3 year lows.

The pressure on the Fed has also led the price of gold to surge, as investors question the safe haven nature of the US dollar.

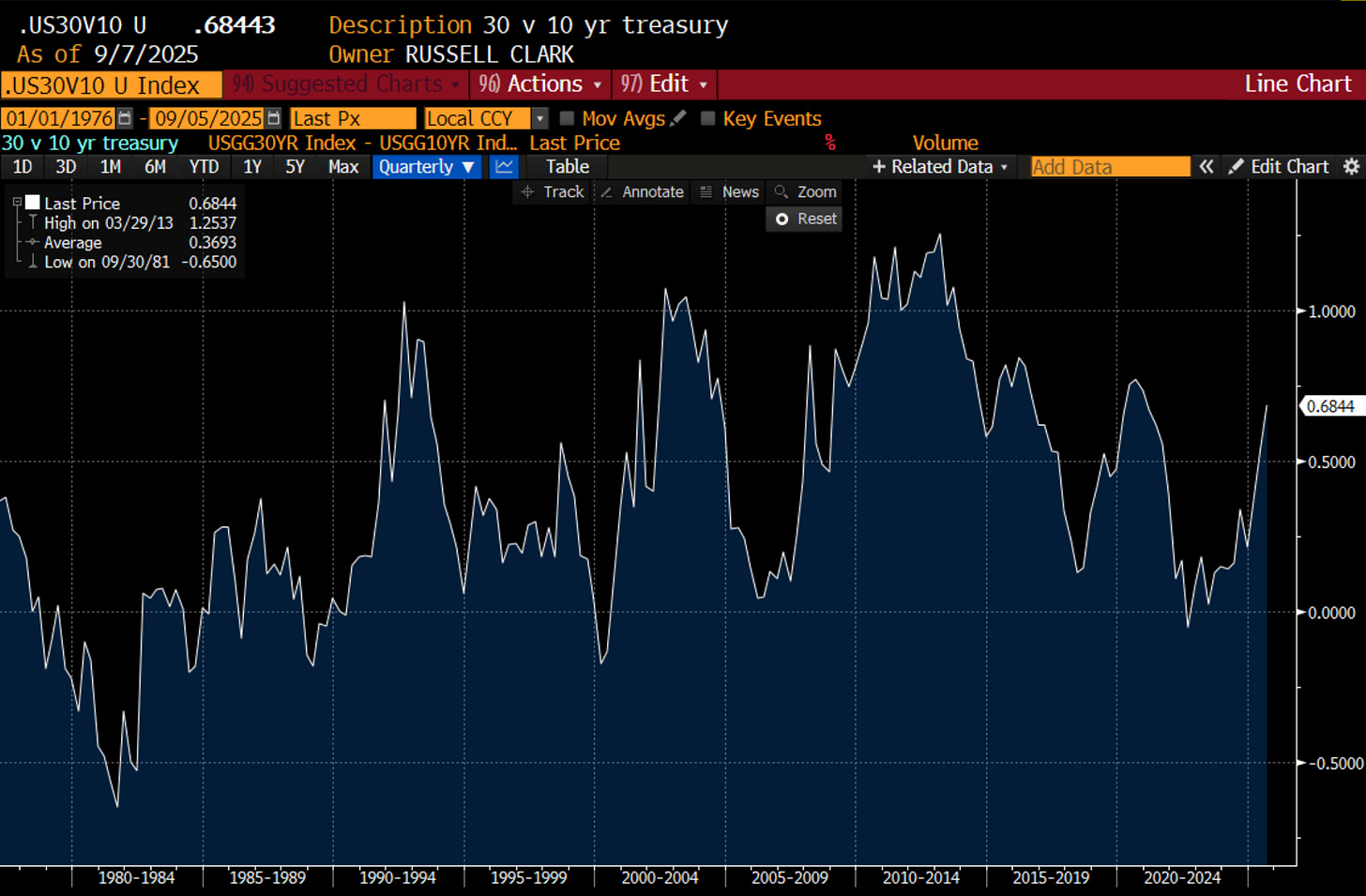

My preferred inflation measure, the 30 year yield to the 10 year yield, has also surged to new highs. That is market seeing yields lower in the short term, but needing to be higher in the long term.

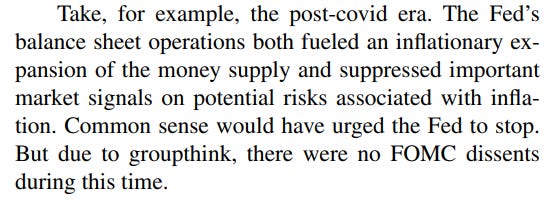

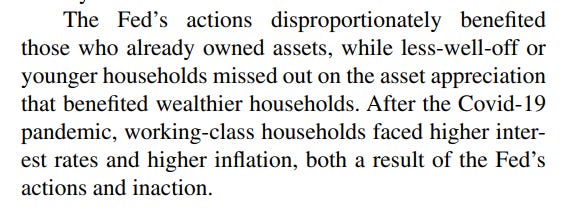

So far so simple. The Trump administration puts a friendly team in at the Federal Reserve, the dollar tanks, the stock market surges and everyone is happy. And that would be fine by me. But I just read an interview of Scott Bessent in The International Economy, and he had the following criticisms of the Fed policy in recent years.

And then this:

It is particularly noticeable that since Covid, (and really from 2016 onwards) the spread on corporate debt to treasuries has become low and stayed low (COVID aside).

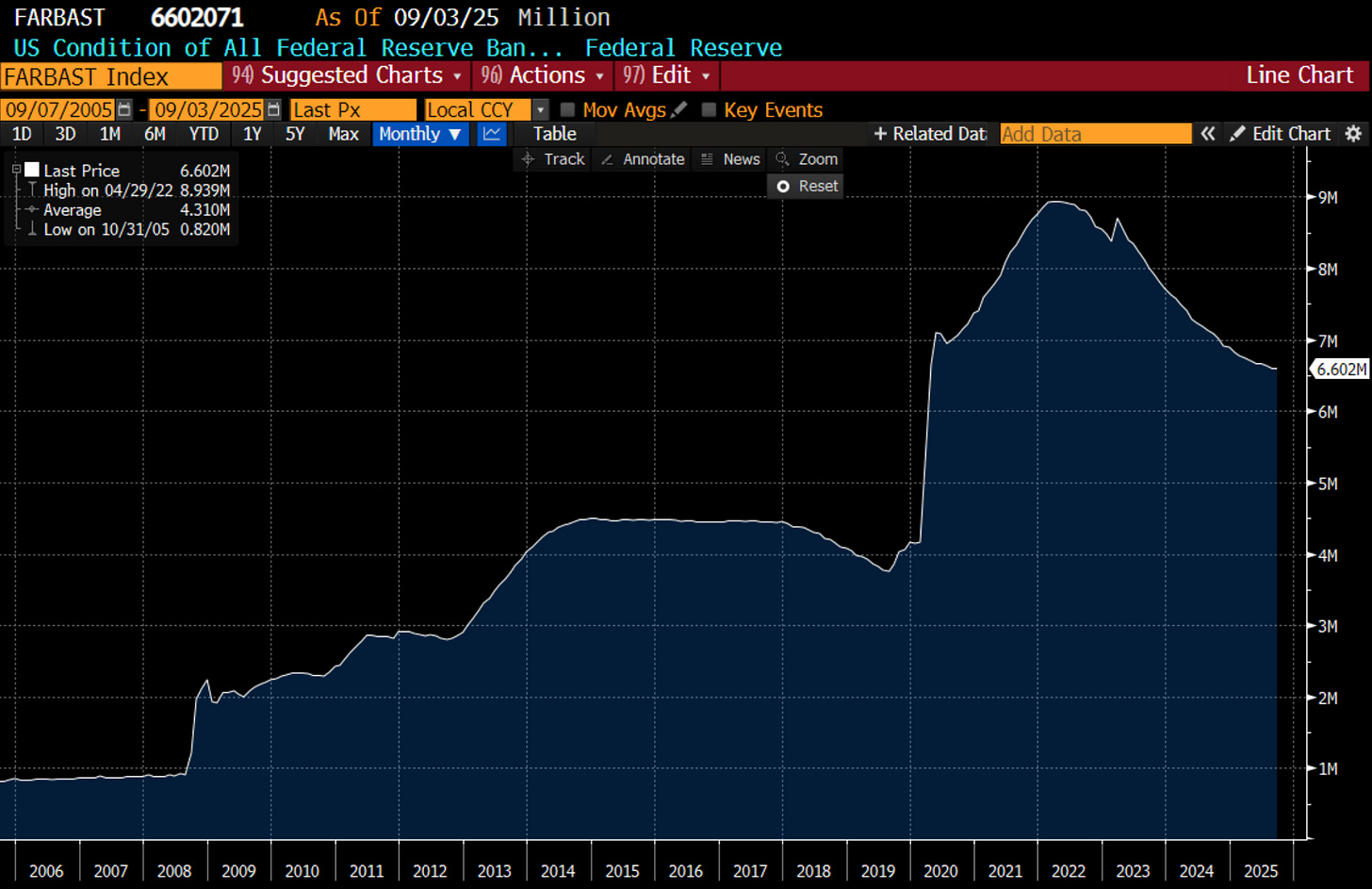

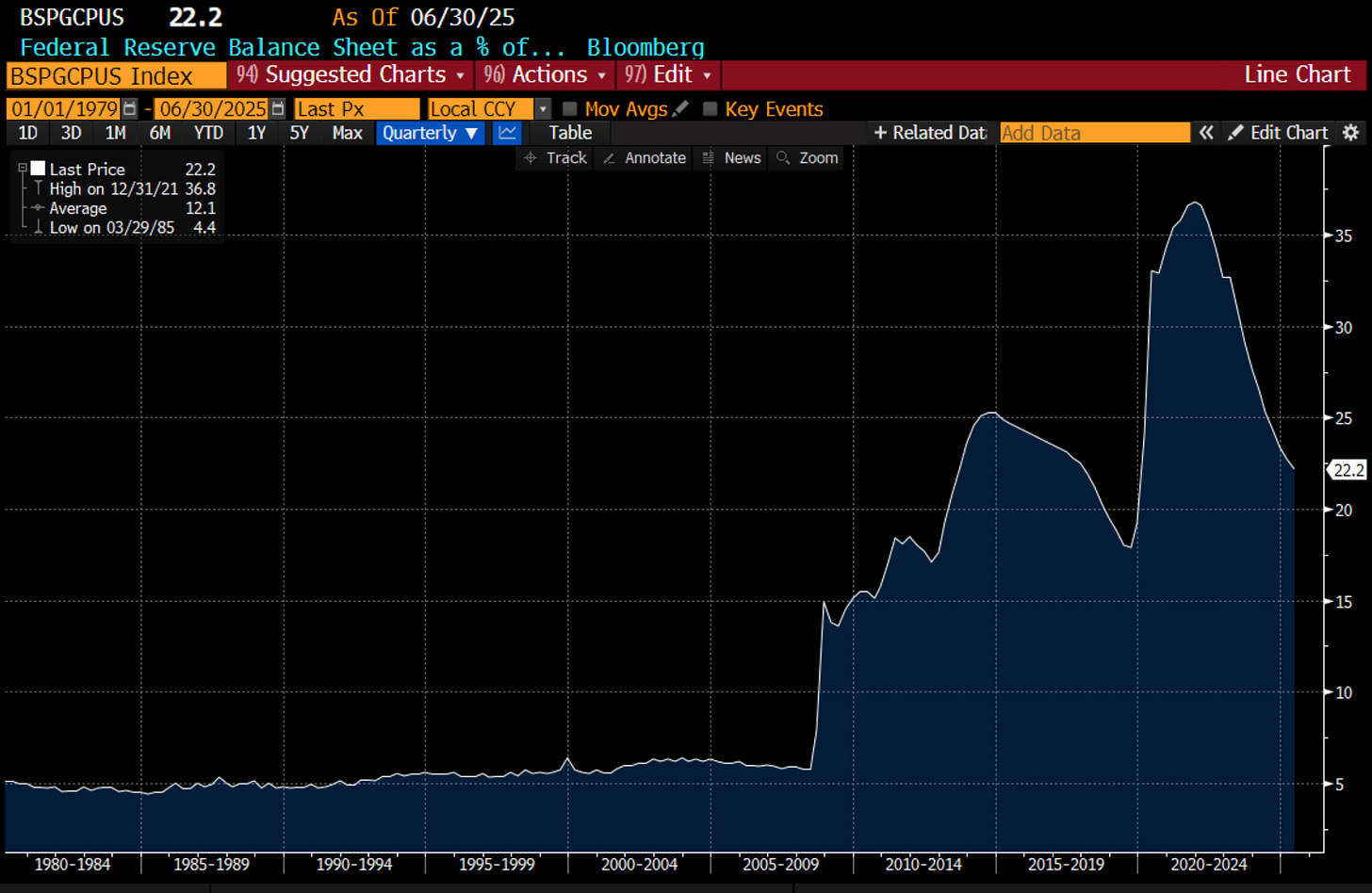

The market has learnt that the Federal Reserve will always be the buyer of last resort. The Fed happily expands its balance sheet at the first sign of trouble. But what Bessent is saying is that this is a policy that Fed should not be doing. To be fair the Fed, it has run down its balance sheet in recent years, but I don’t think markets have priced in any removal of a backstop.

As a percentage of GDP the balance sheet is down from a high of 36% to 22% today. But prior to 2008 it was only 7% of GDP. With US GDP at USD 30 trillion, 7% would imply a USD 2.1 trillion balance sheet, or a USD 4.5 trillion reduction.

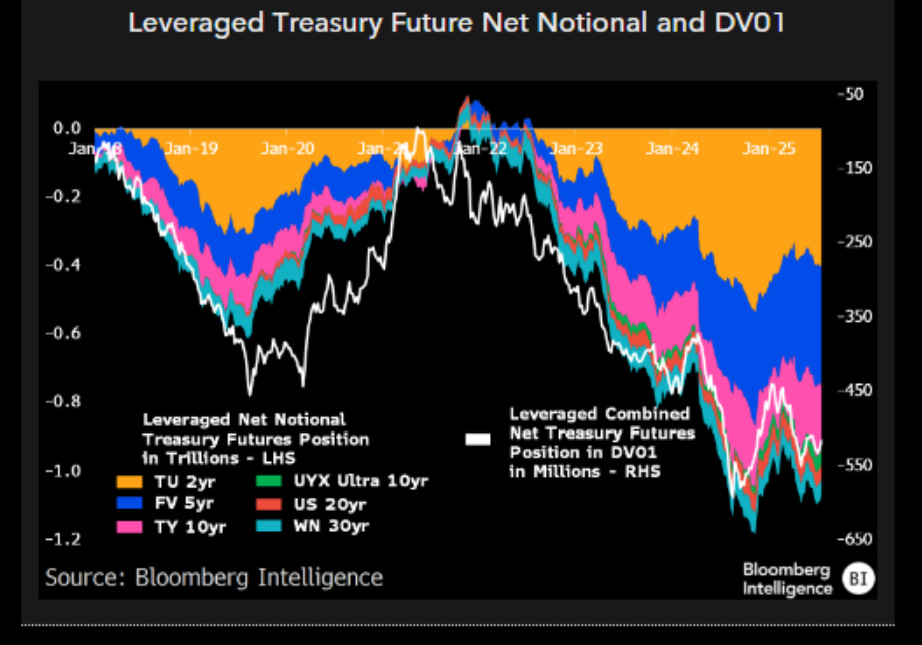

Is this just talk, or is it Trump administration policy? Would it really allow credit markets to operate freely again? If true, it would be extremely bad news for leveraged bond trades - or basis trades. After dipping in 2022, basis traders have come back in vengeance.

The basis trade has expanded massively since the GFC for two reasons. QE and clearinghouse reform. Clearinghouse reform has meant that hedge funds can get all the leverage they want from clearinghouse, as the clearinghouse can not go bust, and the lenders have no transparency on who is borrowing. This should be a recipe for disaster, and we have seen moments when this looked like it would be a disaster, but central banks have stepped in to take the other side and bail out hedge funds. If Bessent is putting political pressure on the Fed to reduce its balance sheet, then the risk of malfunction in the treasury market is rising.

I think the base case for most investors would be the the Trump administration and the Fed would bail out investors, but politics is a funny game. And not all asset owners are the same. Hedge funds and private equity guys being zeroed would not cause much of a political problem I think. Let’s see.