Someone asked me about Yen the other day. It was a good question. The old widowmaker trade was shorting JGBs. Short JGBs was a very popular if unsuccessful trade from 1994 to 2016 or so. As Japanese bond yield were so low, hedge fund used to love shorting JGBs and going long higher yielding bonds like US treasuries or Aussie bonds. The problem was that every crisis would see hedge funds gross get cut, and they would all buy back the shorts at the same time, and yields went lower and lower.

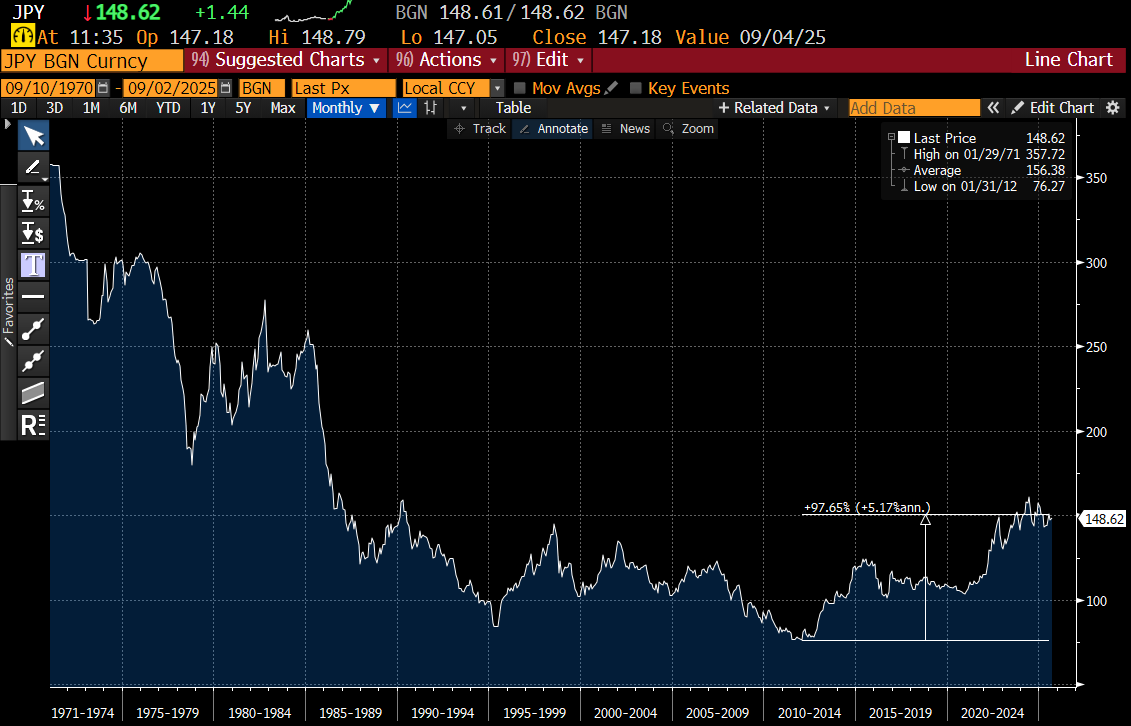

As well as selling JGBs, hedge funds also used to love shorting Yen - even though the Yen was generally a strong currency until 2011 or so. Since then, the Yen has lost half is value against the US dollar. In this graph, up mean weaker Yen.

Despite its weakening bias, markets have gotten very long Yen in 2025. CFTC data use to be very useful for working out when to go LONG Yen - such as 2008 or 2015 or late 2024, when the market was extremely short Yen. But as you can see, even with some reduction of late, the market is the longest it has been on Yen since data started. This suggests short Yen is the better trade.

The long Yen position is not due to high interest rates. 2 year yields are among the lowest in the world.

But Japan is running a near 5% current account surplus. This should be bullish. And the Fed being attacked by Trump, should also be bullish Yen.

And many macro traders are looking at the Yen versus the Swiss Franc, and calling for a turn, as it has fallen to life time lows against its safe haven comrade.

So why is Yen not moving? My take is that Japan has moved from being a totally separate part of the Asian financial world, to an integrated part of Asia. And this is probably accelerating under the Trump administration. Yen weakness is completely in line with Asian currency weakness.

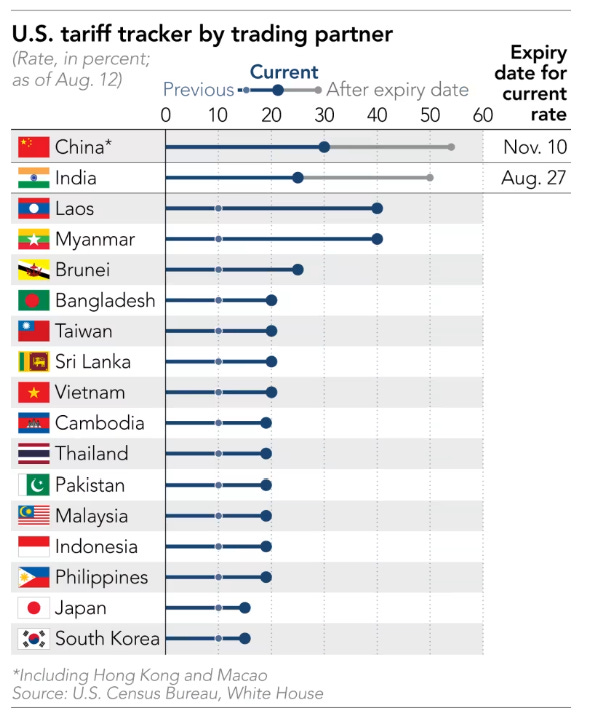

So the better question is not why is the Yen weak, but why are Asian currencies so weak. The Trump administration has decided to tariff the two Asian giants, China and India at over 50% (potentially).

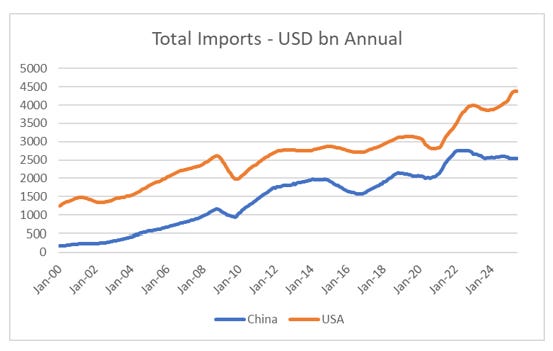

The problem Asia has is that Chinese imports are not acting as counterbalance to the US anymore. China imports have been weak last few years, even as US imports have surged.

From my perspective, currencies seem to be in an era of fiscal dominance. The Euro has rallied when Germany began to spend to rearm. Asian currencies probably need a fiscal push from China to move higher. Is there any signs of that? Well Chinese 10 year yields have stopped falling.

And domestic equity market is looking better.

Putting it all together, I think the Yen looks okay. I would say is not your “father’s yen” - its a new currency for a new era. But currency markets have become political. The recent strength in the Euro reflects a belief that Europe is finally at least trying to get its act together. Asian currency weakness reflects a lack of that belief. But perhaps rising yields in China and surging equity market suggest long Yen might be okay? Time will tell.