The Gold/S&P 500 ratio got back to the 200MDA, and then spiked again.

Which makes a larger turn in the market more likely, implying either a bigger fall in the S&P 500 or a larger spike in gold.

And GLD/TLT finally broke out of its range.

Credit spreads have widened a tad - from very low levels.

8 month VIX continues to trade richly - something I have taken to imply that investors are keen to hedge risk.

Spot VIX still looks too low compared to UX8.

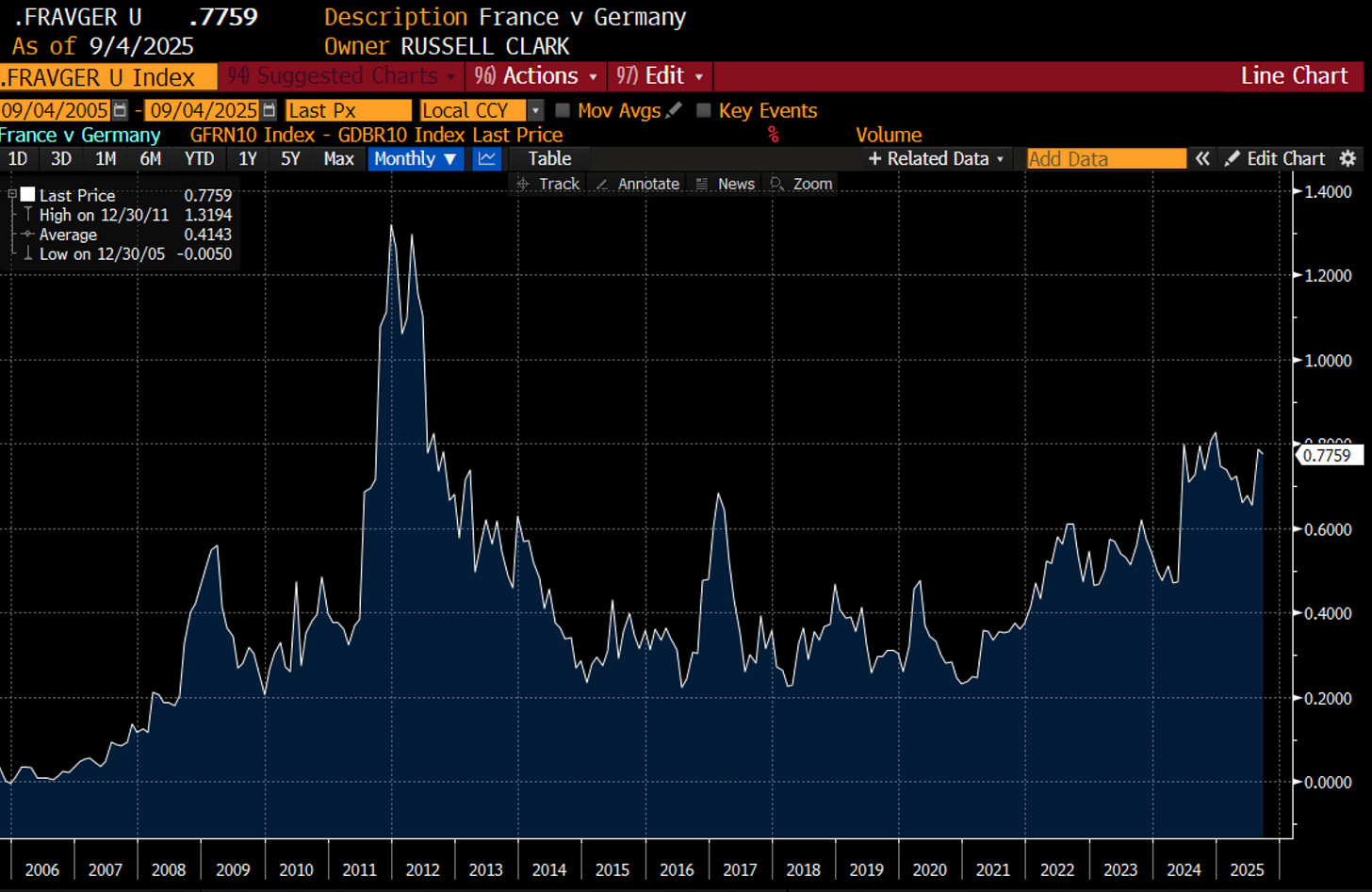

With tame commodity prices, my best guess is that the movements in equities, bonds and UX8 are markets positioning themselves for some sort of government debt crisis. The widening in French bond yields to German bond yield remains unresolved.

And the back up in long dated JGB yields suggest a market that wants higher yields.

For now, long dated US treasuries remain well behaved. But a decisive move about 5% beckons in my view.

Markets seem to be saying that inflation is building, and the current enthusiasm for interest rates cuts seem misplaced. I would agree.