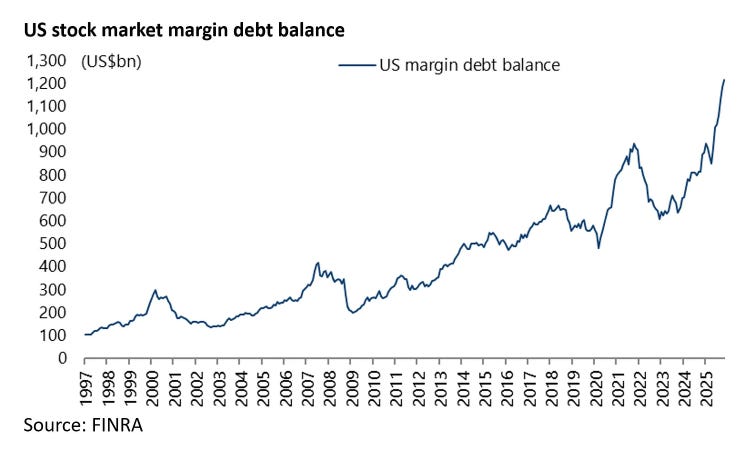

As mentioned in a previous post, one analyst I always make time to read, and generally want to be positioned the same way as is Chris Woods. A subscriber helpfully pointed out that he does indeed publish on Substack - and he has just written a piece entitled, “The US is Now One Big Bet on AI”. Most of the charts in his note should be familiar to people of a bearish disposition, but I had missed the surge in margin debt that has happened recently.

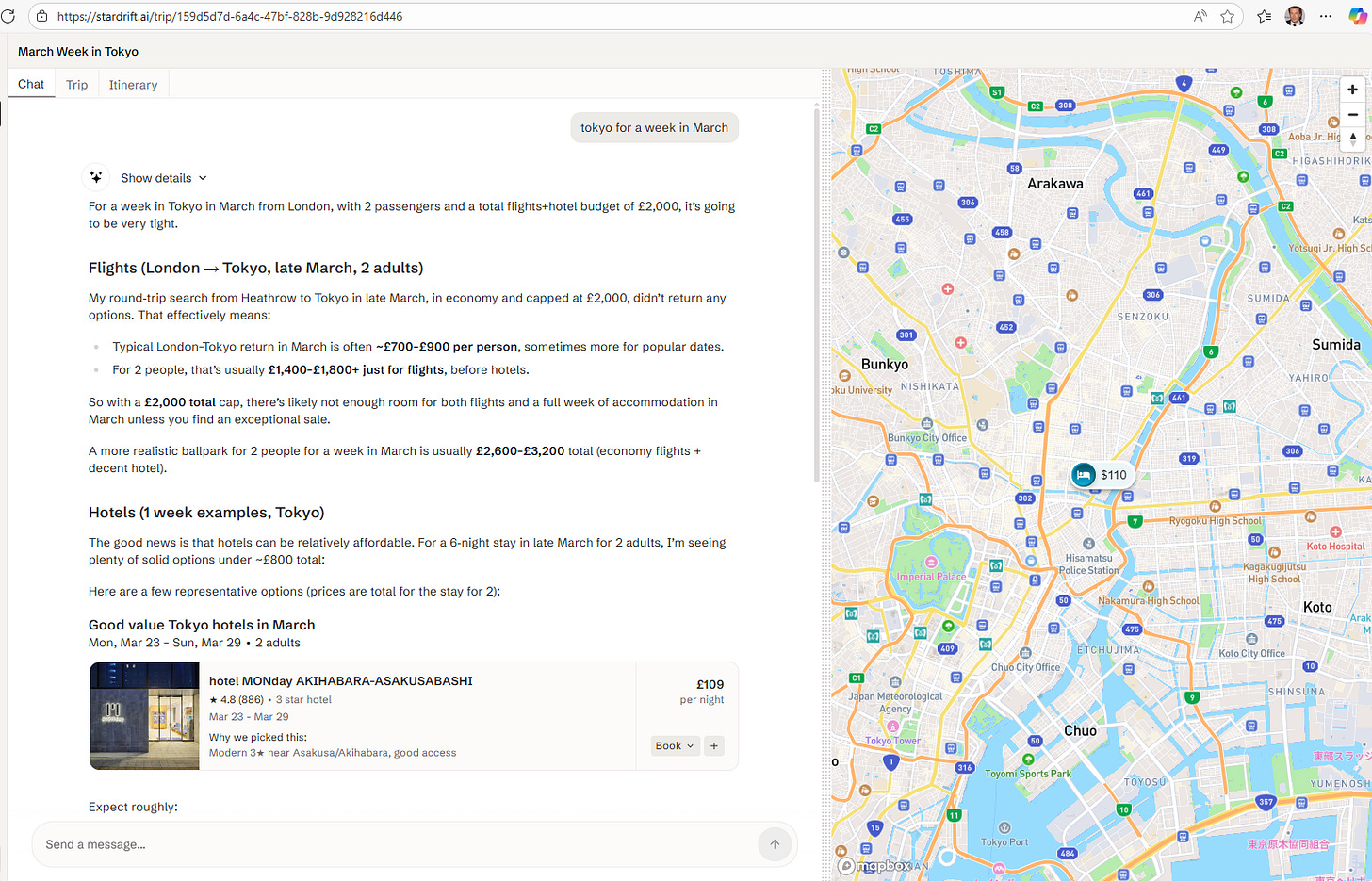

I know a lot of people that are bearish on AI, but for me I struggle to get that bearish. Somewhat unusually for me, I have invested in to two tech start up in recent years, and both are now moving down the AI agent route. I typically do not like start ups, but I tend to invest in people, and both these start ups are run by people I trust. The first one I am invested in called Stardrift, and it is run by niece out of San Francisco (the one that recently got married). My niece, Leila Clark, is brilliant - but there are a lot of brilliant people out there - but she is also trustworthy - which is a far rarer quality. Stardrift is an travel app that plans trips for you. I have played around with it, and it is very good. It remember previous preferences and can plan an entire trip around a budget. Below is a screenshot.

I have a friend and neighbour, Tony Lynch, who has worked in the automotive industry, and he came to me with an idea for a car finance company that pre-approves finance before people look at cars. Typically financing is done at the end, and then the deal often fails, so I liked the idea of this. There was already a company doing this, but his idea was to use AI to reduce the call centre costs. Tony is passionate and driven, and a natural salesman which made me think this had a chance at being something very big, and he was also able to set up the investment using the UK, SEIS structure which is VERY generous to start up investors. If you are not familiar, half your investment can be used against tax payable immediately, and all capital gains are tax free (for UK investors). Once they started the business, they found that the AI call centre they built was very scalable, and extremely versatile. Tony called it “low cost outbound AI”

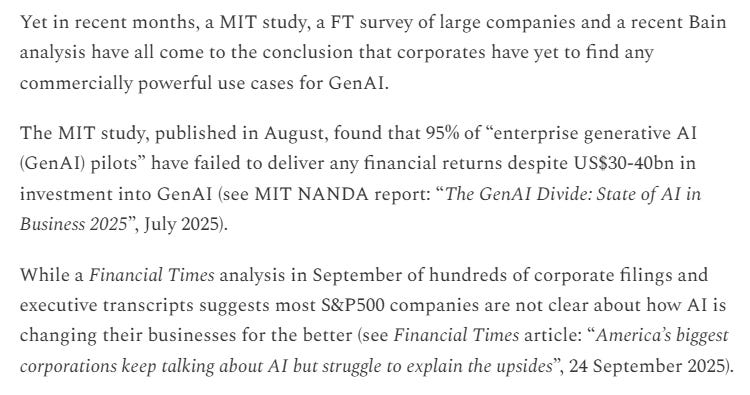

I am invested in these AI plays, mainly from relationship perspective, not from any strong view on AI. But what I do get from both Leila and Tony is that customer acceptance of AI is very high. People are very willing to try these products, and when they do, they are finding them useful. In recent month I have seen a lot of publicity about studies finding companies struggling to work out how to use AI. Below is from Chris Woods.

For me, I look at this, and think this is not what I am hearing from Leila and Tony who are working at the coalface. The other thing I have noticed is how much AI has improved in video making. Every now and then I make AI videos about finance for Tiktok. This is just for my own amusement - but the improvement in this area is phenomenal. The last video I made was in the change in tech investing over the decades.

The improvement from a video I made 6 months earlier was phenomenal. A video about an apparently true story of a fund manager in Korea in the early 1990s.

For me, I don’t think AI is a bubble, but I can see it becoming dangerous for markets in a different way. The AI boom has cause memory prices to skyrocket

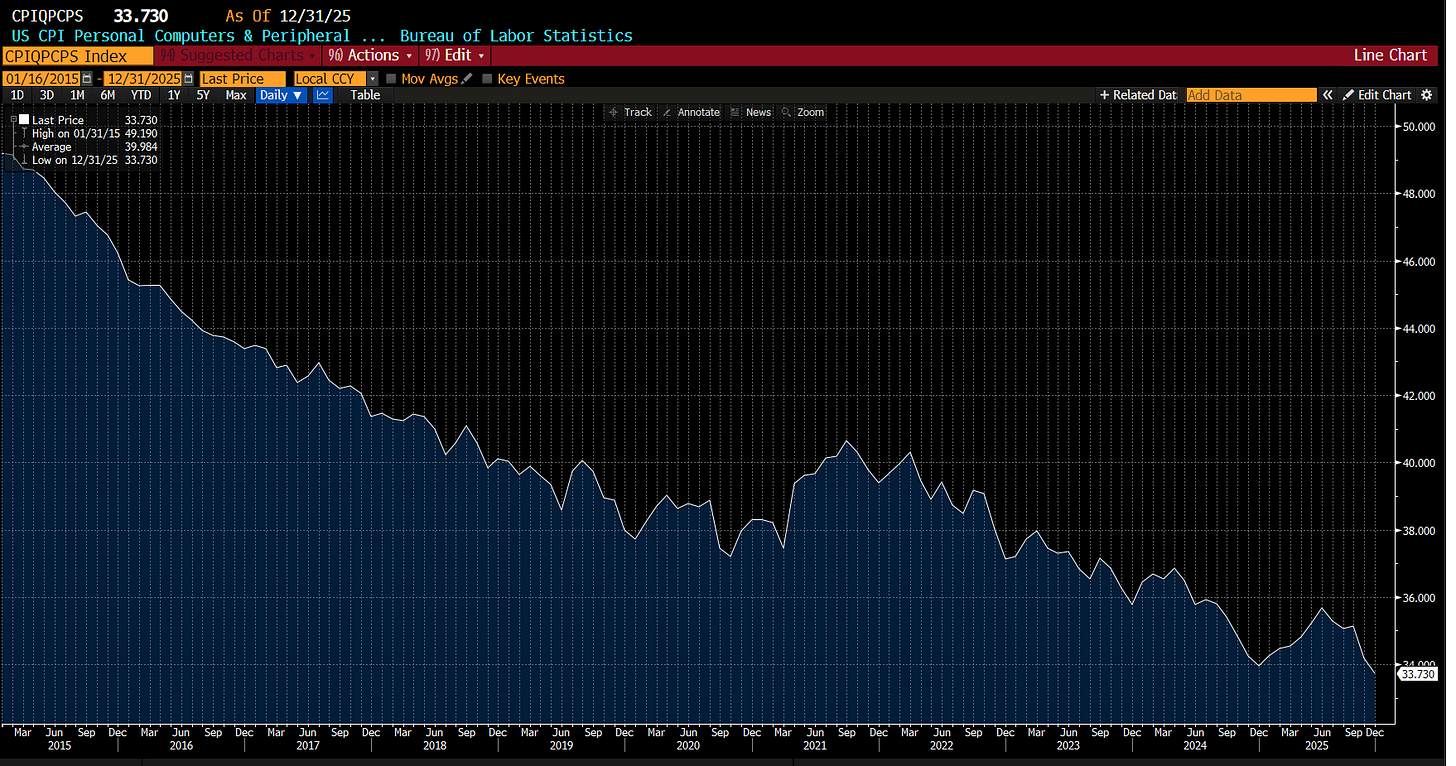

According to the Economist, this is going to cause the price of PCs to rise by 15-20% and smartphones to see a similar increase. For me, nothing says inflation like old technology rising in value (this is a depreciating asset - it should never rise). If we look at used car CPI in the US, when this was rising, we had an inflation problem, that is the 1970s and 2022.

Similarly, PC prices also broke trend and rose in the inflation period of 2021 and 2022.

I think Chris Woods is right, AI is the economy now. And the problem with AI is not that its a bubble, but that loose fiscal and monetary policy is stoking demand when we are running against hard physical constraints. I think AI is likely to drive the next leg higher in US treasury yields.

If the Fed wants lower long end bond yields, it will have to break the AI story by causing a recession. I think more likely is that higher bond yields need to create a crisis first.