Federal Reserve policy making makes far more sense when you think about PPI (cost to companies) than if you think about CPI (cost to consumers). CPI has continued to rise steadily, while PPI essentially flatlined from 2010 to 2020.

The Federal Reserve target rate and PPI yoy have a much better fit than CPI in my view.

Commodity inflation is always tricky to predict. Supply and demand can be extremely variable, so I am going to focus on wage inflation. Currently US wage inflation is running at 4.3%, down from a peak of 7%, but still at the one of the highest rates since 1980.

Since 1980s, the Federal Reserve has been able to induce a recession by raising interest rates. Typically a good sign that this was going to happen would be widening of credit spreads. I use the KDP daily high yield index, and 5 Year US treasury to generate this credit spread. No sign of any widening at the moment.

Why is there no sign of credit widening? Probably because the US government has gotten into the habit of spending it way out of problems. US government spending looks to have moved structurally higher.

One fly in the ointment in this pro-labour story is that, as I have pointed out many times, the Federal Minimum Wage has remained at USD 7.5 since 2010. The contrast to the rapid increases seen in the 1970s is stark. Why is the government not actively raising wages more?

Politically speaking, the Federal Minimum Wage is a bust. However at the state level there is a lot of movement. California has adopted a rapidly rising minimum wage, while its great rival Texas has kept its minimum wage flat. Broadly speaking, Democrat voting states have higher minimum wages. Which for me confirms the idea that in the US, what voters want, voters get. As an aside, the difference in minimum wages between California and Texas probably explains why “traditional Conservative” politicians in the US and the UK are political disasters. Pro-labour policies, while being culturally conservative is the only way forward.

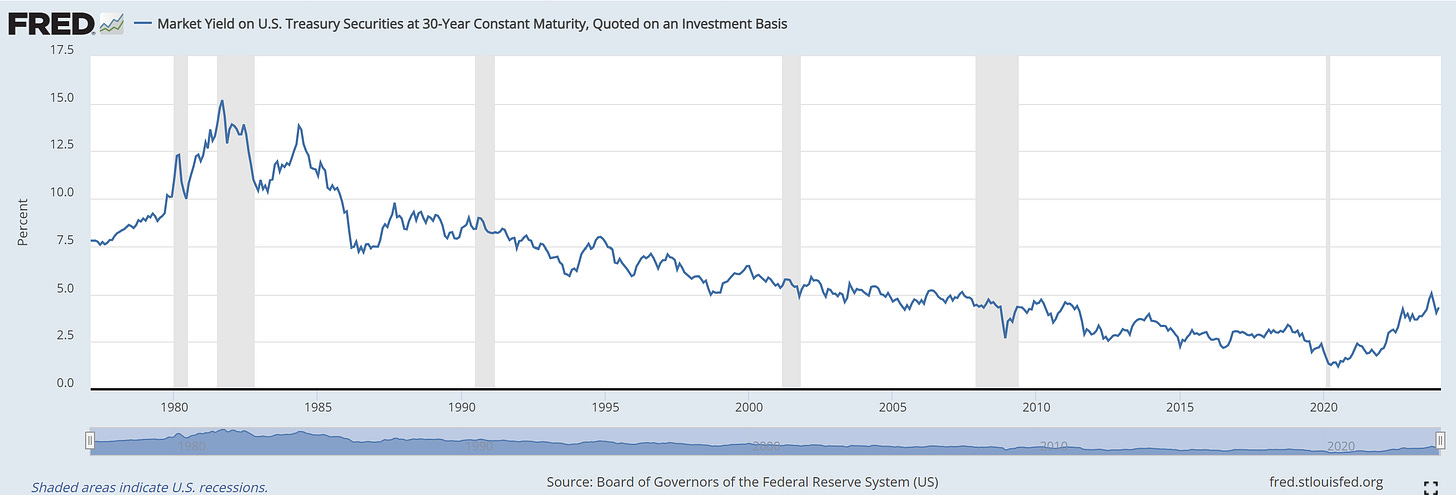

What is interesting about this is I can now make a political guess, that will then drive a fairly clear economic outcome. I am going to guess that wages, including minimum wages, in Republican parts of the USA will rise to be much closer to those seen in the coast areas, and this will drive higher food and manufacturing CPI. This gives us some simple numbers to play with. If we assume Texas minimum wage doubles of 10 years, this implies 7% wage inflation for 10 years. Looking back at wage inflation in the 1970s, and post Covid boom, 7% wage inflation was where we got to. Add in a term premium and I suspect 30 year US treasuries need to get to 10% before they look attractive. Certainly that was the buy zone on 1980s.

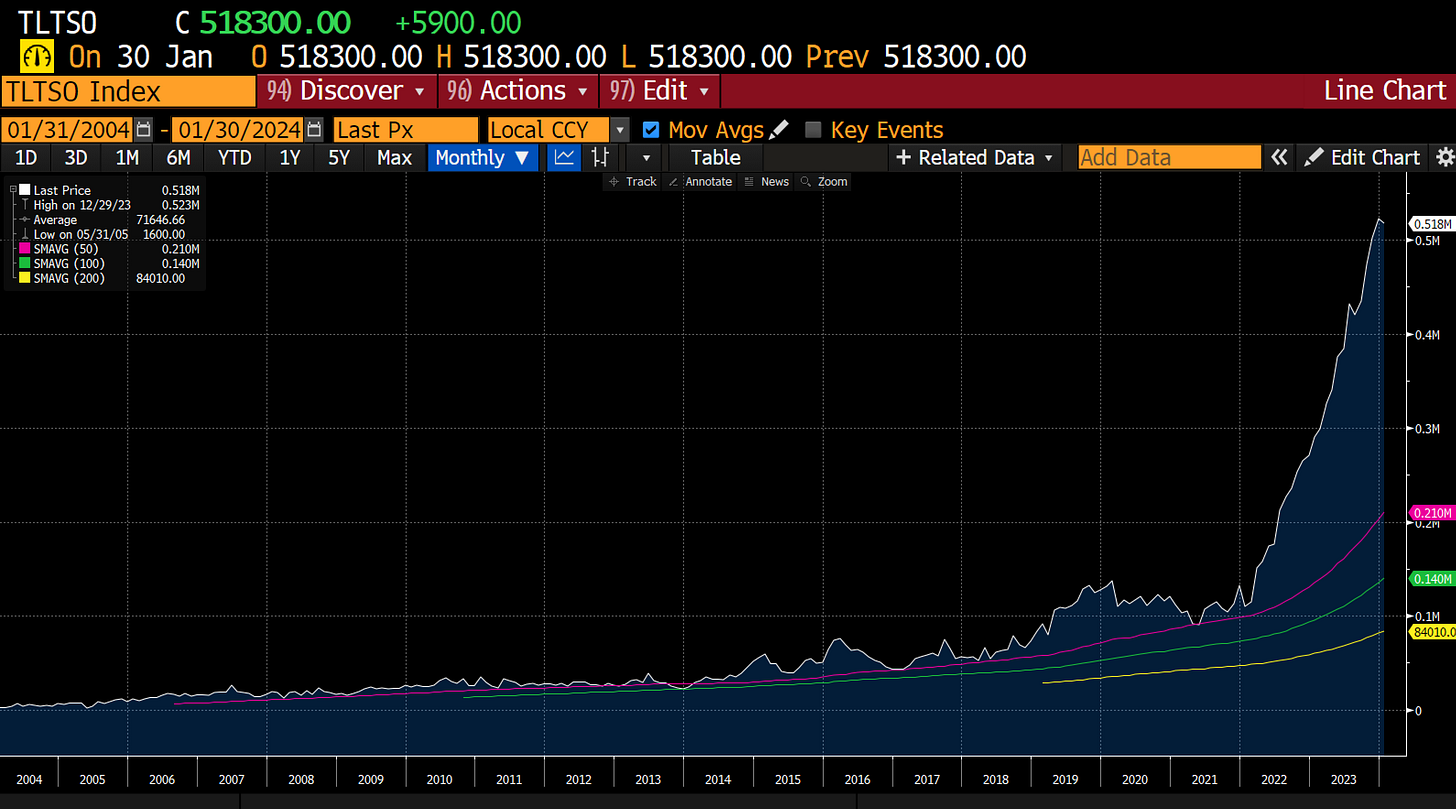

For investors that believe the politics of the world is unchanged (why they would believe this is a mystery to me), for some reason they are locking in 30 year rates at below 5%. The surge in shares outstanding in TLT suggests old habits die hard.

7% compound wage inflation seems likely to me. Treasuries are a short.