Nvidia has been THE play on the AI revolution. Not only does it have a monopoly on cutting edge GPUs, it has also had a lock on the software needed to develop AI products. This has propelled Nvidia to an over USD3 trillion valuation.

As I understood it, the success of Chat GPT suddenly opened an opportunity for Microsoft to access the search market that has been dominated by Google, as well as strengthen their existing business software franchise. Google needed to invest as well to maintain their position in search - and perhaps to attack Microsoft’s business software market. As the number of very high end chips needed for AI was constrained my manufacturing issues (ie only TSMC could make them) - the business model for Google, OpenAI and Microsoft was to bid up the value of these chips to make it too expensive for other players to follow (that is to follow the Amazon business model of huge start up capital losses to build a moat). In other words, big US tech wanted to corner the market for GPUs. The US government did its part by banning the sales of high end chips to China. Despite surging pricing, wafer shipments from TSMC have stagnated.

Nvidia only uses TSMC to make it cutting edge GPUs. So from a business perspective, Nvidia has surged with surging pricing (not surging volume) in my view. In my experience, this tends to be an opportunity to short (pricing is volatile - volume is forever). TSMC surged with chip pricing in 1999 to 2000 dot com bust - and then fell as supply came on line and pricing fell.

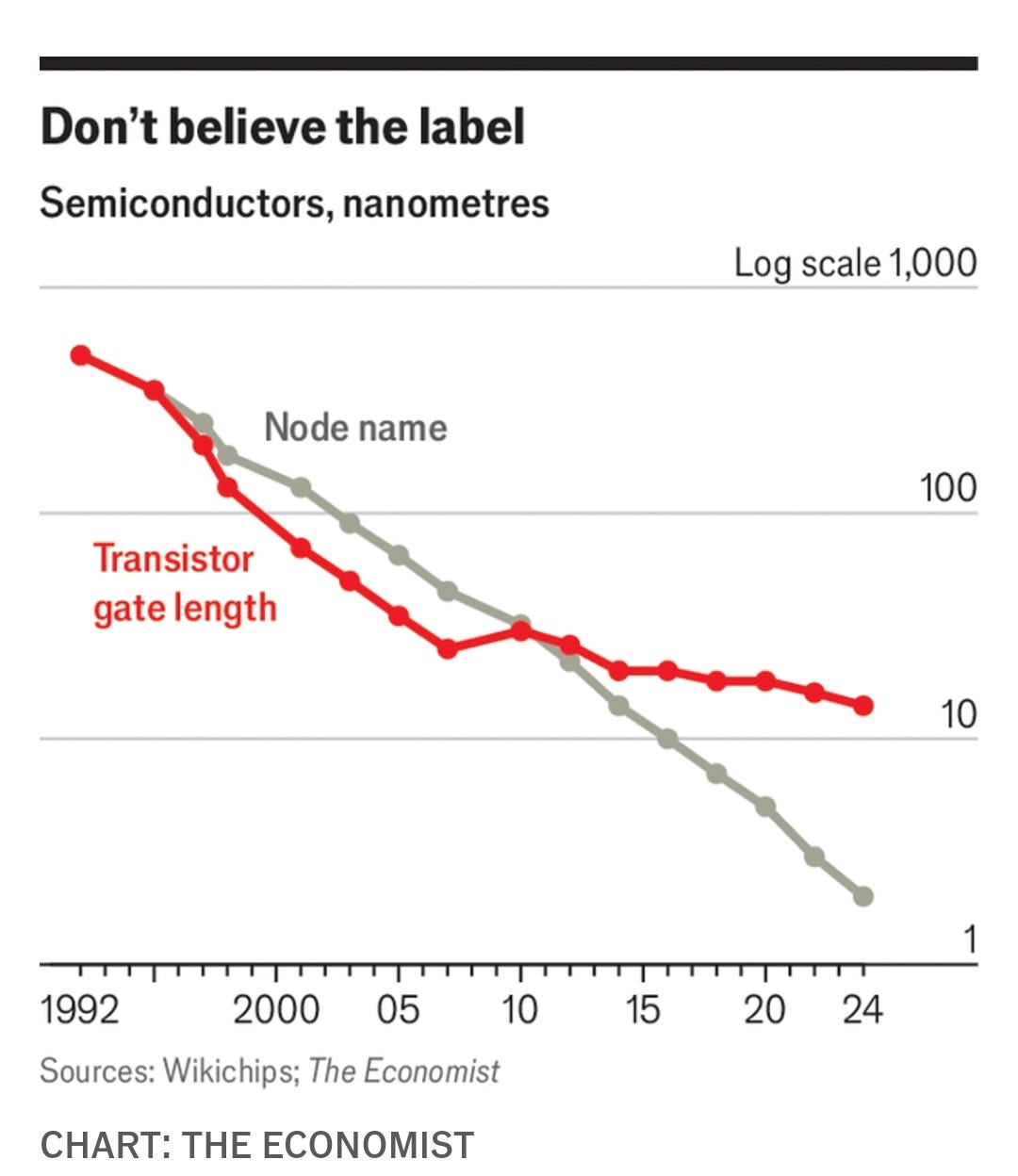

One big difference between 1999 and today is that the semiconductor industry is not advancing as quick as it used to. In 1999 and 2000, moving to a new node meant a vast decrease in transistor gate length (read as improved performance), but in recent years productivity improvements have slowed greatly. The Economist has a great chart showing how productivity has slowed.

For me, the semiconductor industry reminds me of the oil industry in the 2000s. Productivity in OECD oil production was declining rapidly, which delivered strong pricing and profits to the OPEC monopoly. But after some time, high prices spurred innovation, and we saw the eventual growth of US shale. This changed US oil production profile, which had been in decline since 1970, and led to lower prices.

Examples of new technology or new processes that destroy the profitability of incumbents and break monopolies is, in my mind, the best part of liberal democracy free market capitalism. The freedom of choice - and the freedom to compete. From this perspective, the emergence of Deepseek and its low cost AI model using older technology should make Nvidia a slam dunk short. The business model for OpenAI has been eviscerated, the large tech companies, that have already starting investing into next generation computing (quantum computing for example) and have been handed blueprint in how to reduce costs to make a AI system, should be ripping up their capex plans. Speculators that have been hoarding Nvidia GPUs should be dumping them into the market before pricing collapses. In a free market - I am sure this would be happening.

To be fair, there has been examples of US tech companies that have faced Chinese competition and continued to thrive. Apple still does well in China, despite low cost Chinese phones, and US cloud companies have also held up well against Chinese cloud companies. Cisco survived the onslaught from Huawei, and Meta seemingly survived the rise of TikTok in the US. So perhaps Nvidia could be the same? The problem I have is that Open AI has a business model built around charging users access - and DeepSeek model gets around that. Also, Nvidia is heavily reliant now on a just a few clients - and Microsoft in particular. Maybe I am wrong, but I don’t see how Microsoft does not look to replicate DeepSeek’s success. The idea of Microsoft deciding it makes sense to invest USD80bn, to then be competing against systems that cost a fraction of that price is not one I comprehend. The big risk to shorting Nvidia is that it gets seen as a national champion and trades higher as Tesla has done since the re-election of Donald Trump.

I can see how tariffs would be good for Tesla, but I don’t see how the average consumer can be banned from using Deepseek or its inevitable copycats. Of course, companies like TSMC, Nvidia and ASML who have all benefited from their monopoly positions would not like to cut prices. Nvidia is not a short if the US government works to maintain its competitive position. But Nvidia’s gain would be at the loss of competitiveness for the US. In EVs, cloud computing, handsets, drones and a range of other industries, the US is already losing competitiveness to China.

In a free market, Nvidia would be a short - but we are not in a free market anymore. That being said, I don’t think it will easy to ban Deepseek and other low cost LLMs. I cannot help but feel this genie is out of the bottle - and GPU pricing is going to fall - which would be bad for Nvidia. Or perhaps, realising that cutting edge is not so advanced as it should be (see Economist chart above) the US government bans any and all Nvidia exports to China to protect US developed AI. China is still a large market for Nvidia - so this would be bad for Nvidia. In almost all cases I can think off -free market, and non-free market Nvidia loses here.

All eyes should be on Microsoft. It was their investment into Open AI and their capex plans that have been instrumental in driving the Nvidia boom. If they decide to go the Deepseek route - or are forced to by their competitors to do so - then Nvidia should collapse, which in this case would be a good thing. If Nvidia does not collapse, then the US has truly lost its way, just as Japan started to do in 1991, and which this market bears much resemblance to.