It is pretty easy to be negative on private equity. Their business model seems to be built around the use of leverage to juice returns, while using the cover of private markets to give the illusion of stable returns (which is important when using leverage). That was why I was surprised to see that despite the bond bear market, AUM at Blackstone has hit new all time highs.

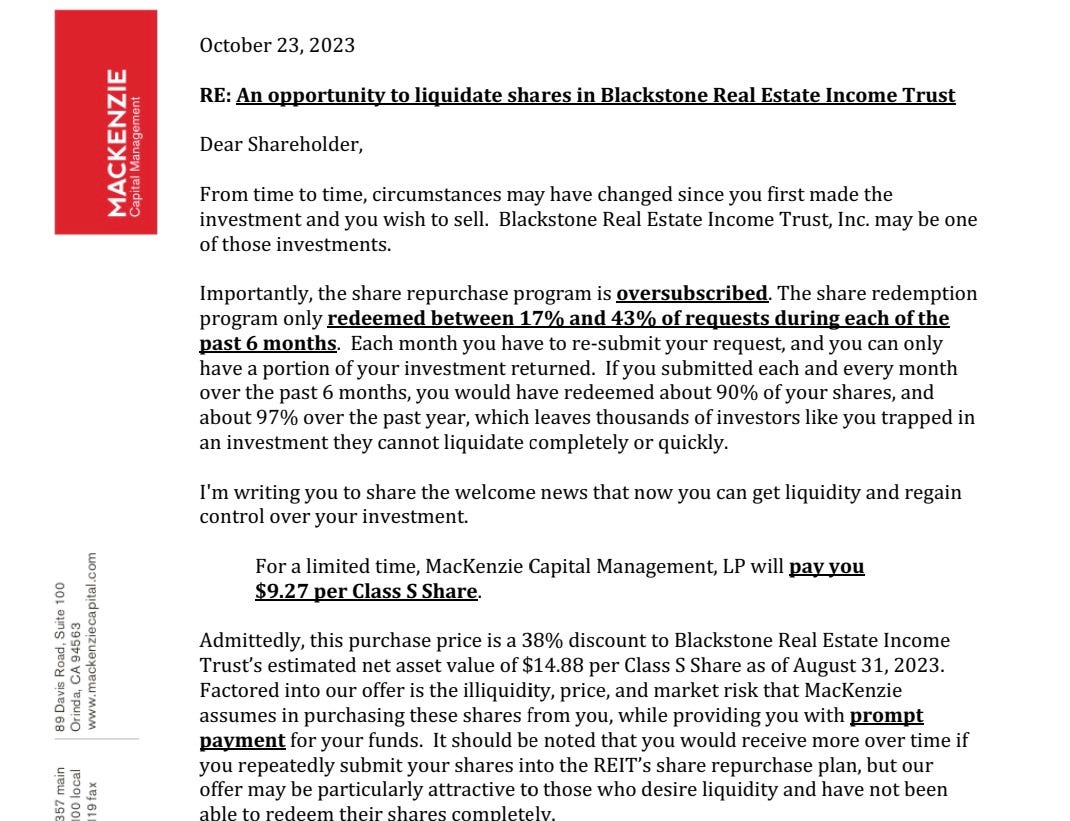

Taking a closer look at Blackstone, they obviously have problems with the private REIT, BREIT. My friend and subscriber, George Adcock, passed on some very amusing details on BREIT. A firm out of California, MacKenzie Capital, is offering liquidity to BREIT investors at a 38% discount to stated NAV. To be fair, the entire deal is only USD 15m, so not huge, but is the discount correct? And does this mean Blackstone is in a death spiral?

Again my friend George pointed me in the direction of another Substack written by Warden Capital, which goes in a lot of detail on a USD 4bn investment by the University of California (UC) into BREIT (post is here). This was at the height of redemption requests for BREIT, so UC received much better terms than other investors. Namely, guaranteed return, and also guaranteed liquidity.

That Blackstone can cut deals like this to prevent itself being a forced seller, probably explains why the shares have performed better than expected.

Rupert Mitchell, the writer of the Blind Squirrel Macro substack, is also writing about how investors seem to be paying extra fees to private equity to hide volatility. While this may seem crazy, having talked to many allocators over the years, I can understand why this is attractive to them. In proper bear markets, like the GFC, many funds are forced to sell what they can, not what they want. Allocators want and need (for career purposes) to avoid mark to market events like that. Private Equity allows allocators to avoid that pain. As the UC investment into BREIT shows, this is a structural advantage.

The other problem with shorting Private Equity is that they are benefiting from the flow of funds into private credit. The leading firm here is Ares Capital, which is just off its all time highs. Private credit has the structural tailwind of banks being forced to hold higher rates of capital, and avoid riskier lending, creating space for Private Equity firms.

When I think about all of this, I am reminded of another difficult to short business - Chinese property developers. As far back as 2011, Evergrande was known to be courting trouble with very aggressive financing structure, and for years it was the biggest single short in all of Asia. From its lows in 2015, it then rallied by over 1000%, as government policy supported property markets and property developers. It was only when Chinese government policy moved decisively against developers did the short in Evergrande work, but by then the original short sellers had gone bust.

Private Equity also benefits from a government policy that allows them to use carried interest to reduce their tax bills and juice returns. Reform is often talked about, and yet this tax treatment continues. Private equity expend a lot of political energy on retaining this structural advantage. When, and if, US politicians decide to close this tax advantage will be the time to short private equity. I suspect you need to see the Democrats control both houses for such a change. My views on a pro-labour shift means I think this is likely. But short selling is often a timing game. I am not sure this is the right time, but then again a week is a long time in politics!

Share this post