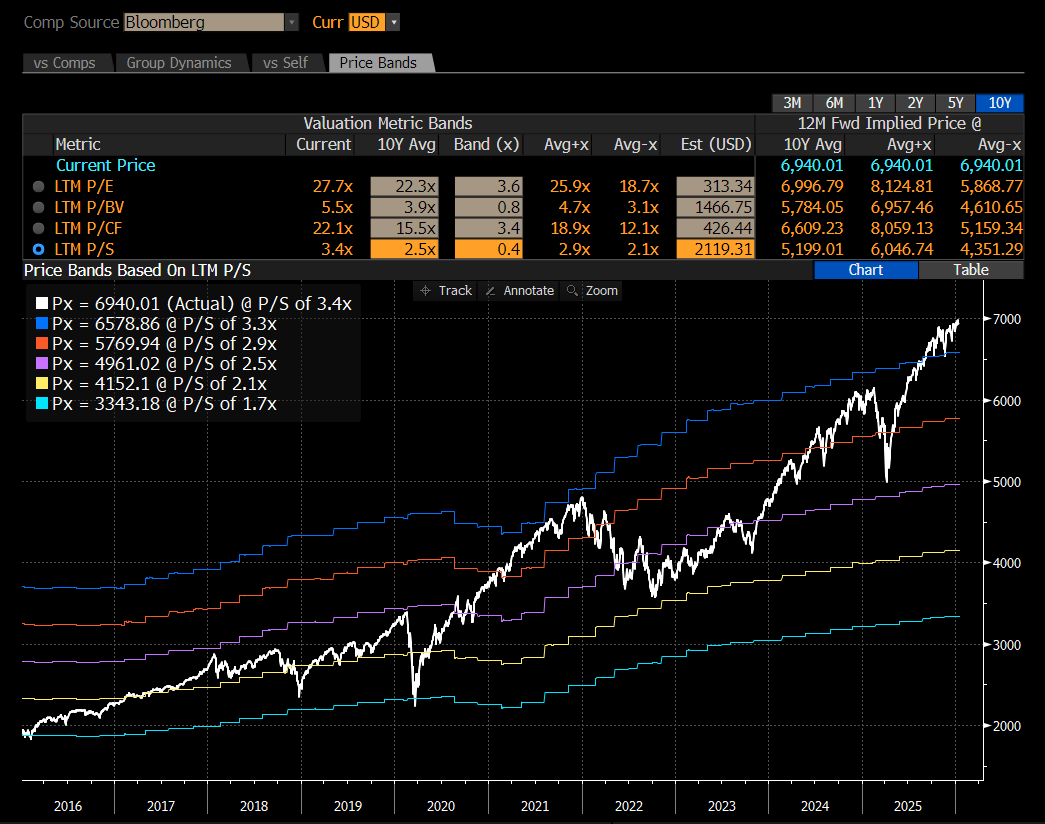

However you cut it, the S&P 500 is an expensive market these days. The entire market trades at 3.4. times sales.

And on a Net Worth to GDP, we are also pushing back at peak levels.

A lot of this rerating has been driven by the tech sector. Nvidia which traded at 1 times EV/Sales as recently as 2014, now remain above 20 times EV/sales. When I started at the peak of the dot com market, 7 or 10 times EV/Sales was considered mad - but you have wanted to buy Nvidia on such a multiple.

Buying very expensive assets has normally been a problem for investors - but as we have seen in markets in recent years, expensive assets have been in fact reassuringly expensive. The problem I had was typically this expensiveness was only seen in the AI space, which is tricky to analyse, but recently markets have offered very expensive industries which we can use as a roadmap to understanding what is priced into AI stocks.