The “secret” in fund management is to find a bull market, and ride it all the way up. If there is anything special about me, is that I am very happy to short the bull market I rode all the way up, once I think it is done. I did that with mining stocks and emerging markets, and now I am doing it with bonds. I like it as it is working smarter rather than harder. The really great thing about it is that once I find a bull market, I know that I will make even more money when I get around to shorting it (raising money when you are running net short and right is much easier than raising money when you are right and net long - fact).

The best bull market is finding a story that is so big, that the mind just can’t understand it. The best real example I know off was with iron ore in 2002. A buddy of mine as working at an Australian mining company, and told me that the strategy team had asked the economic team to forecast Chinese iron ore demand. At the time, China had recently overtaken Japan as the biggest steel producing nation. Data from that time is below.

China had 10 times Japan’s population, 25 times Korea’s population and 65 times Taiwan’s population. So the economics department came back with an estimate that Chinese steel production would grow 8 times, and would need to import more iron ore that was currently being produced globally. The feedback was that this was impossible, and they needed to tone down their numbers. Broadly speaking, the economists they were correct, but the business people were spooked by the investment that this implied, so ignored the forecast.

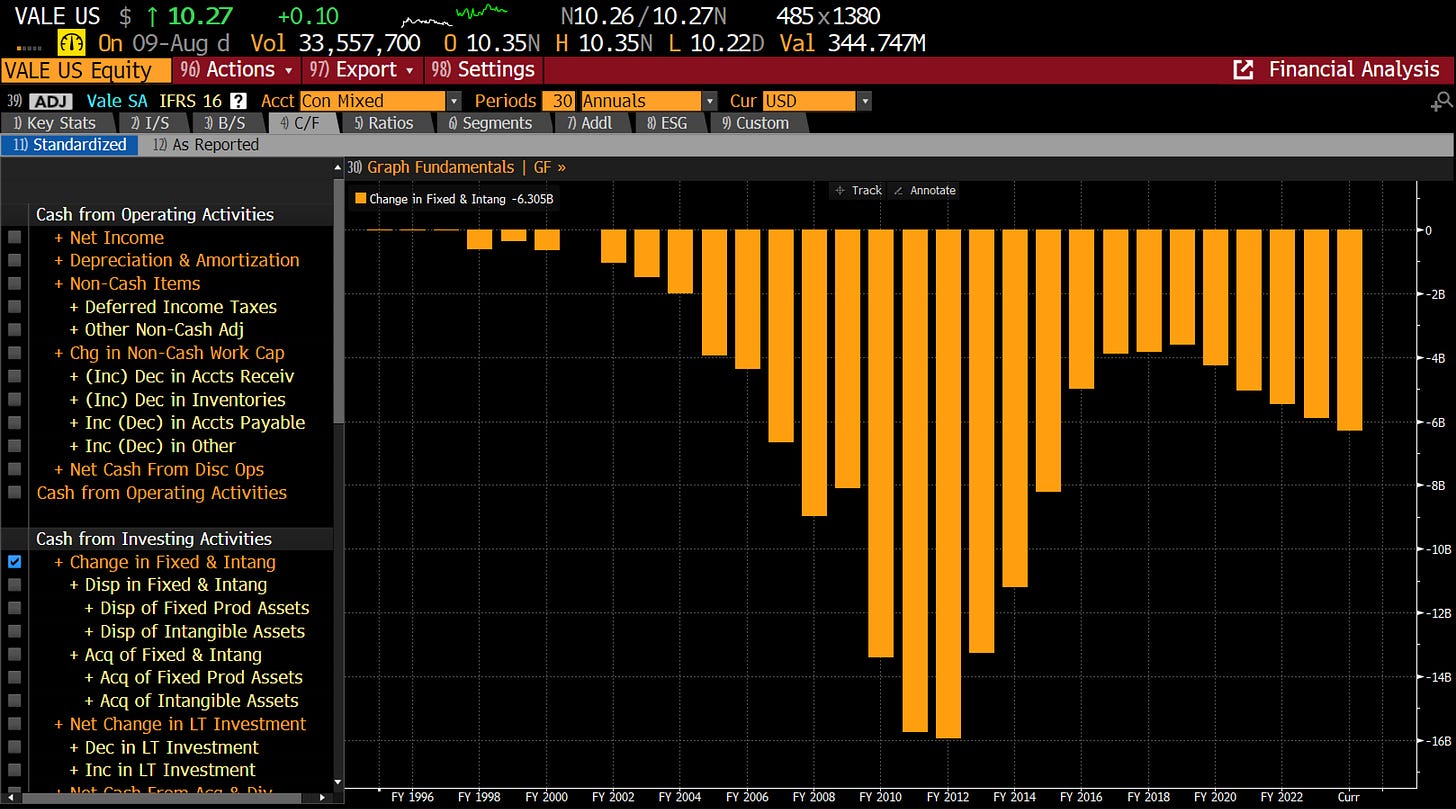

Pure play iron stocks like Vale in Brazil did phenomenally well, 20 baggers from 2002 to 2007. But why did Vale peak in 2007 if Chinese steel production has risen another 50% from that point?

The answer to that question is capital expenditure. As no one believed Chinese demand could rise that much, capex budgets were kept under control until 2006 or so, and then exploded higher. This not only reduced cashflow to firms, it also eventually raised supply and reduced prices.

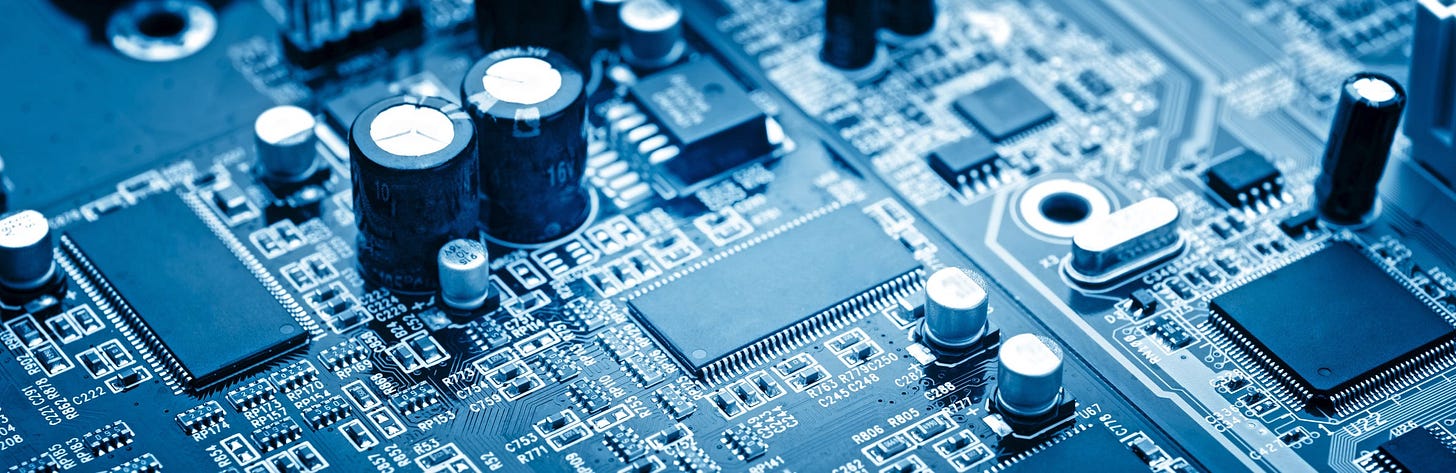

Semiconductors have been even better than mining as an investment. The Philadelphia Semiconductor Index is up 10 times in the last 10 years.