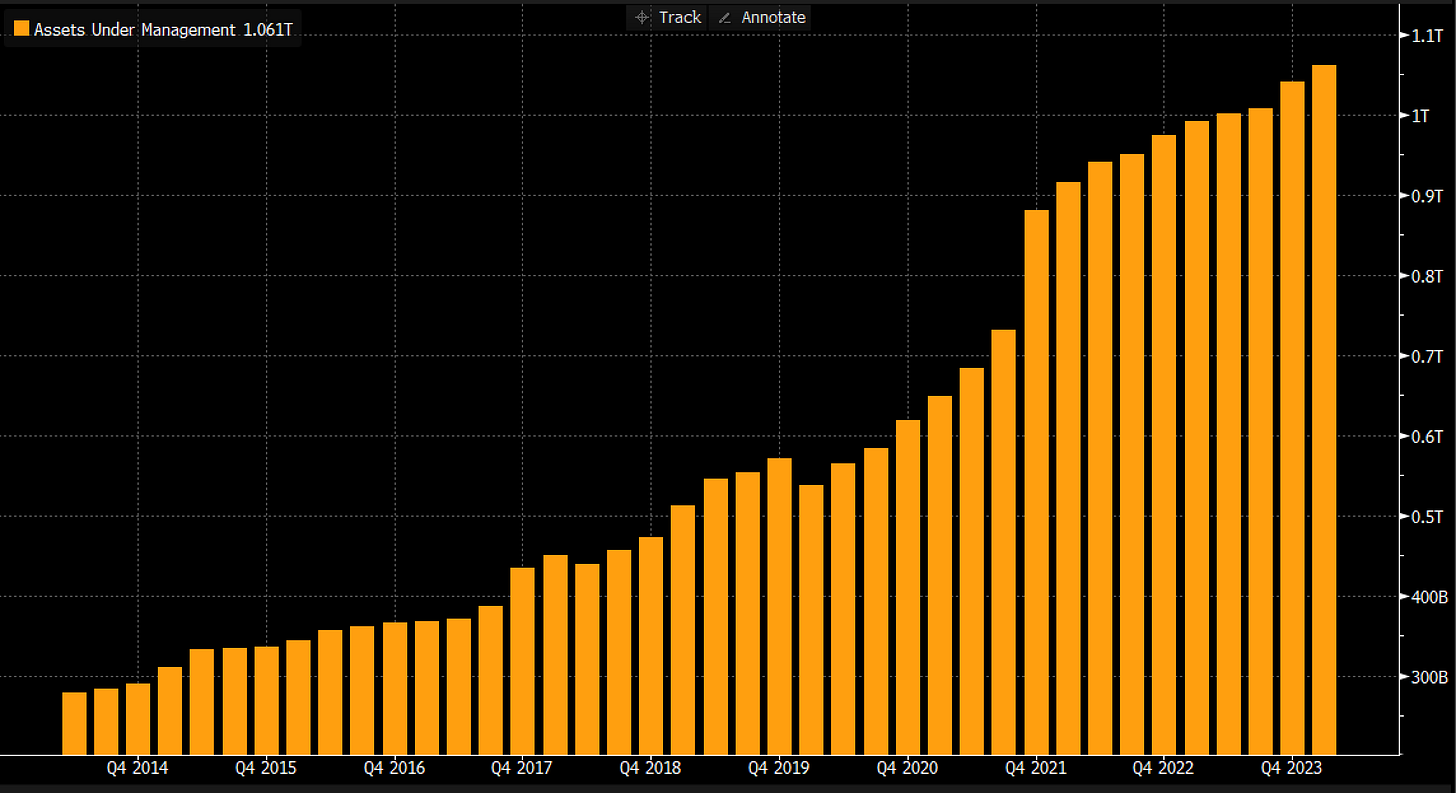

It seems to me, most fund managers want to short “financial engineering”. To be fair that worked in 2007/8, but when fund managers think about shorting “financial engineering” today, they are probably thinking about private equity. This has been a tough short as I noted recently. Even with 5% interest rates, Blackstone is still raising assets.

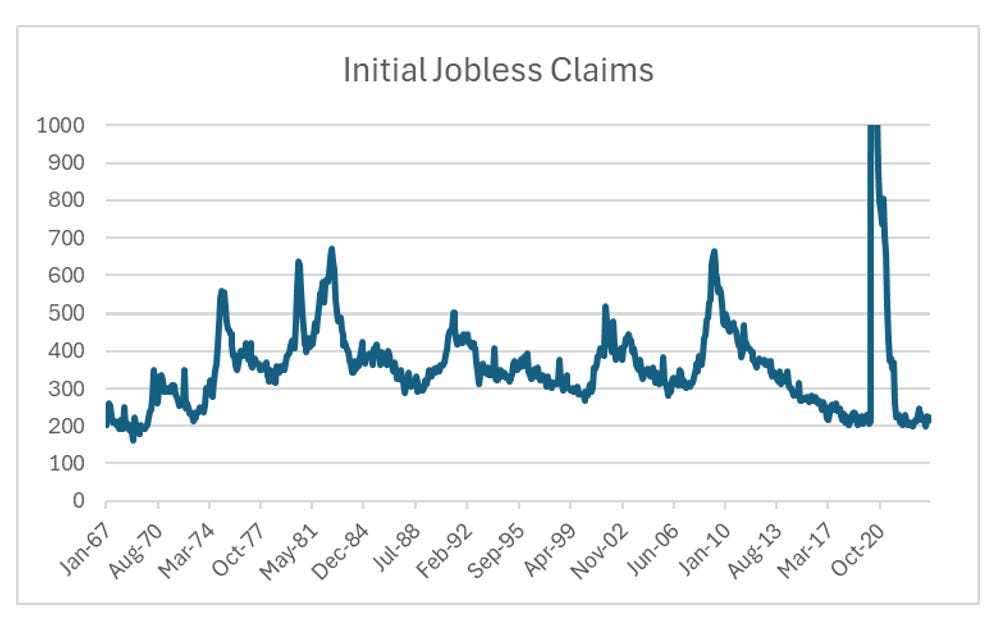

The real problem with shorting financial engineering is that there is still no sign of rising unemployment. Excluding the Covid spike, US initial jobless claims are still running at 50 year lows. And government policy still seem intent on keeping employment at full levels.

I have been arguing that the move in GLD/TLT is indicative of a pro-labour change in the world. That move has accelerated in the last month or so. So rather than focusing on shorts that require asset prices to fall, lets focus on shorts that suffer from rising labour costs.

I have looked at fast food chains as shorts before, but recent developments have made we want to take another look.