As mentioned in previous posts, ISDA provide a Standard Initial Margin Model (SIMM), is reactive to price movements, rather than forward looking. In my understanding, the problems in clearinghouses are most likely to occur when a trader is doing a spread trade between two very similar, but not identical products. So in my thinking, problems are likely to occur where clearinghouses believe similar products are very highly correlated. One area this could happen is in interest rate products. Clearinghouse consider the correlation between a 20 year bond, and a 30 year bond to be 99% for example.

The other thing you need to look at is the “delta concentration risk”, which basically sets an upper limit to how much a position can make or lose. The ISDA-SIMM details concentration risk for credit spread trades, which seem to me to rather low, with the exception of mortgage backed securities.

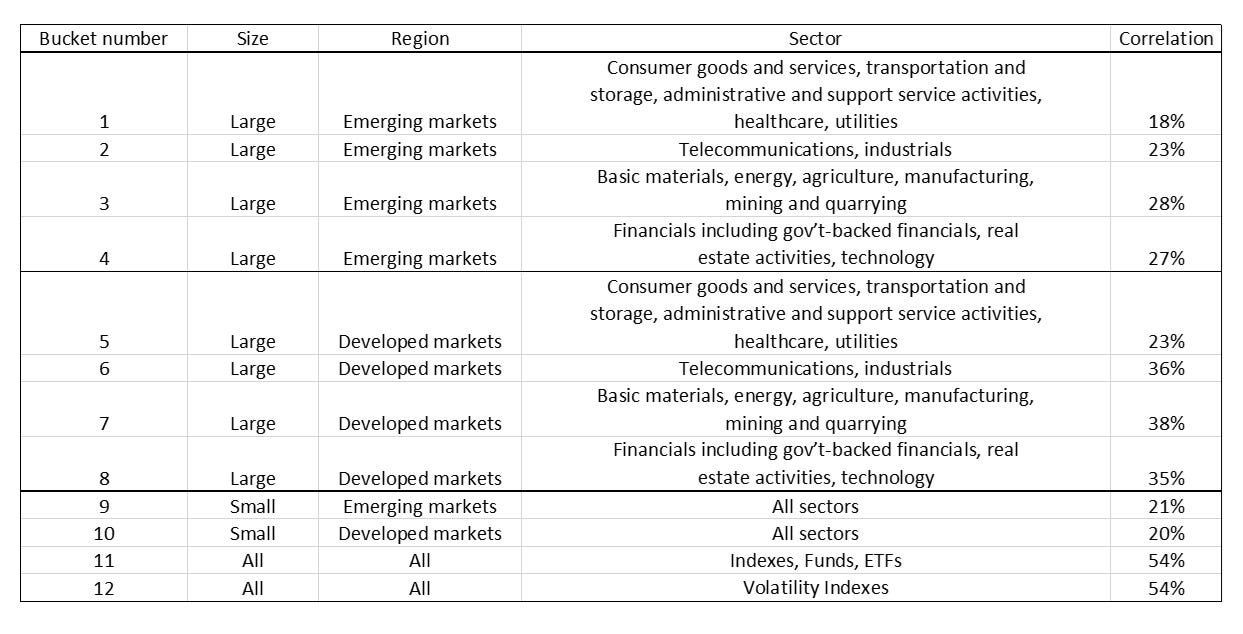

Within the equity space, clearinghouse risk pricing is a bit harder to follow. To summarise, a stocks will be classed according to its size (large cap, which is defined as a market cap of over USD2bn, or small cap), geography (emerging or developed), and finally 4 separate industry categories. Generally speaking the higher the risk, the lower the correlation. However, there was one area that caught my eye. Indexes, ETF, and Funds (bucket 11) are considered the least risky, no matter what their composition. This would mean that for investors interested in holding a risky asset, from a capital perspective, you should always hold it via an ETF.

Within the equity space, the one area that has a high delta concentration threshold is ETF and Index based products. This would imply that a fund can leverage up holdings of ETFs far more than single stock holdings. And in fact would prefer an ETF to a stock. ETFs also have the highest correlation discounts, so I would expect problems to come from ETF liquidity issues if clearinghouses were a problem. Very low liquidity if S&P 500 futures may be a sign of this.

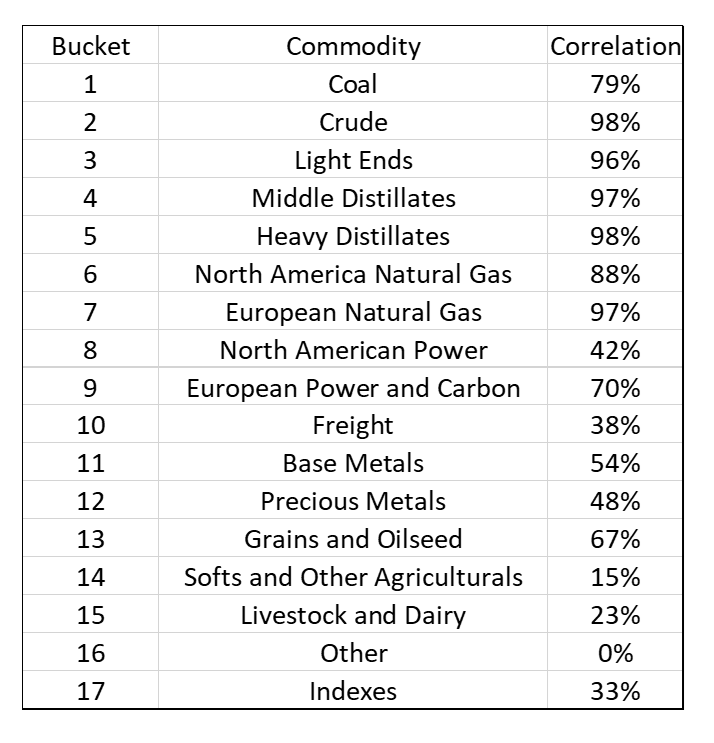

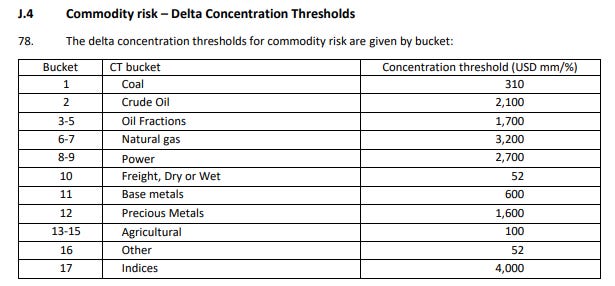

However, the one stand out area for high correlation discounts and large delta concentration thresholds is energy and particularly oil. So two different crude products, such as European and US oil would be given 98% correlation.

What we also see is that between different crude oil buckets correlations are very high. So diesel prices soaring above crude could also cause problems.

Delta concentration is also very high for crude oil and natural gas. Note nickel is a base metal, with low correlation offset and a low delta concentration threshold, and yet still nearly blew up LME.

Looking at the example of Einar Aas, and his power trades, my guess would be that large moves in oil spread trades would be most likely to cause problems with clearinghouses. If we look at the June/July 2022 spread for Brent, we see the sort of spike that should cause problems.

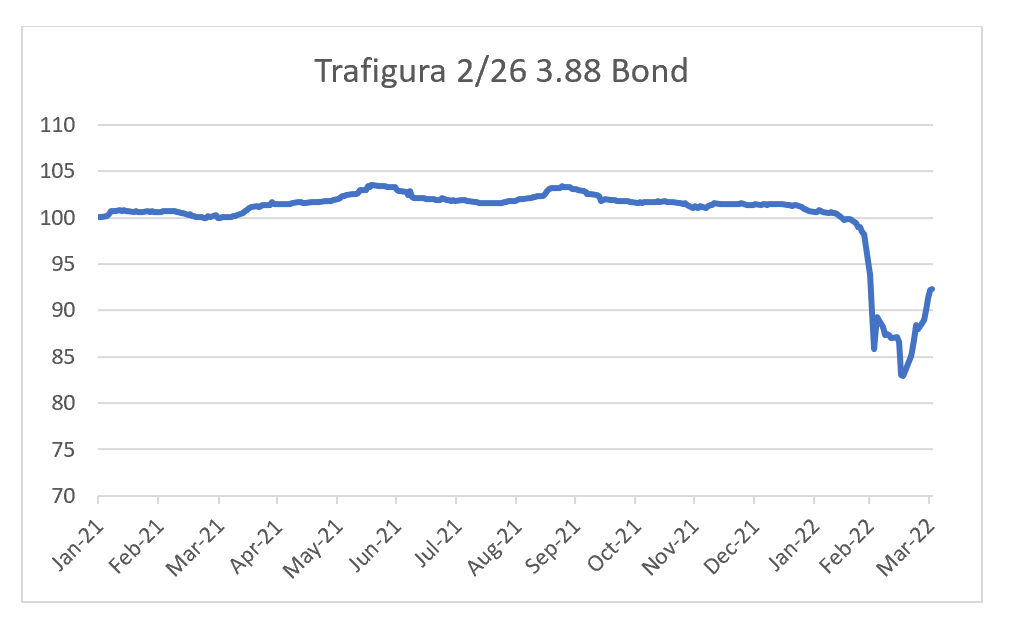

Despite this move, the clearinghouses have shown no sign of distress. We have seen some distress in oil trader Trafigura’s bonds. But these are already showing signs of recovery.

The lesson I take from this is that clearinghouses can keep the financial system from suffering solvency issues, as long as liquidity is being provided. The question that remains to be answered, is when liquidity is withdrawn, does this turn liquidity problems into solvency problems?

Share this post