In 2022, clearinghousse were at the centre of two large capital destructive moves. LME was a the heart of the spike in nickel price, which was resolved by LME cancelling trades to the benefit of JP Morgan and its clients. We then saw the collapse of the gilt market, driven by margin calls by LCH and could only be resolved by the Bank of England stepping into the market. I have long argued that the clearinghouse model is more prone to crisis and panics than the bank centre model that it replaced. I have taken a closer look at LCH after a couple of subscribers sent me this news release from LCH.

In an interview the head of this new service estimated that initial margins could fall by 50% or more (link). The problem is that collapsing initial margins can then lead to a crisis as the clearinghouse then has to raise margins quickly in response to a crisis. Perhaps the most surprising feature of this announcement is that this is been carried out, while the issue following the collapse in gilt prices in 2022 have yet to fully play out at LCH. So I have gone through the IOSCO- CPMI disclosures in detail to see what we can learn.

The first thing it should be pointed out is that LCH and CPMI-IOSCO disclosures are not particularly transparent to outsiders. Data is disclosed on 8 separate default funds (the mutual pot into which all members pay) - they are Equities, Fixed Income, OTC_FX and Interest Rates for the UK based Limited part of LCH. For the European based LCH SA - the default funds are Cash and Derivative, Fixed Income, OTC CDS, and €GC Plus. Each default fund seems to match up to a clearing service, but the names are not a perfect match which is why I say seems. For example, the Equity default fund would seem to match up EquityClear clearing services, while the fixed income default fund seems to match up to RepoClear. And €GC Plus seems to match up the Tri-Party Repo Clearing Services. LCH discloses data for each default fund and clearing service each quarter. There are over 200 data points which are disclosed each quarter, and LCH produces an excel spreadsheet with 12 tabs.

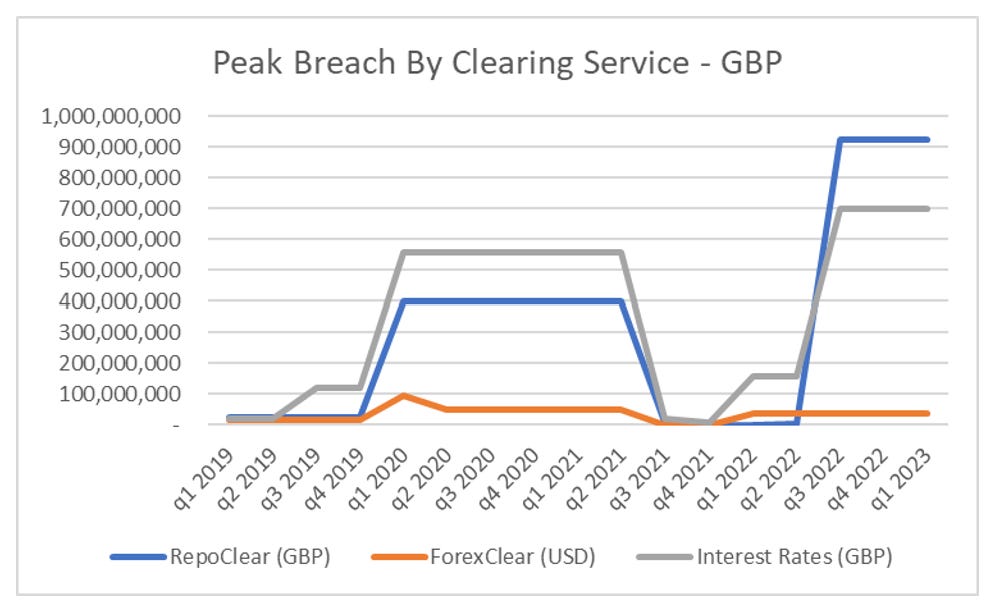

Having looked at IOSCO-CPMI disclosures for a few years now, and having seen the meltdown in the gilt market, we can try and pinpoint the important data, and try understand the risks in LCH. First of all we can look at peak breaches by clearing services. Equity breaches were tiny, so left out of this graph. For those of you at home, this is disclosure 6.5.4. Note this is peak breach in last 12 months, so when it plateaus, it means that most recent quarter did not see a higher breach (I have found the numbers to be occasionally revised without warning). As you would expect, RepoClear and Interest Rates saw big breaches, of a total 1.6bn GBP in Q3 2022.

So for the Limited, UK based clearinghouse, we know the Repo and Interest Rate clearing was where the problems were centred on. Oddly, disclosure 6.5.1.1 gives us the number of times margin was breached in the quarter. So even though the size of the margin breach in the clearing service was similar, there were peak of 237 margin breaches for Repoclear and nearly 19,000 for Interest Rate clear in Q1 2023. What I do not understand is why margin breaches continue to rise even as interest rate markets have settled down.

Peak breach amounts would point to RepoClear as being as large a source of risk to the clearinghouse at its Interest Rate business. Oddly, the maximum variation margin paid to the clearinghouse for these businesses would suggest RepoClear to be too small to be that risky.

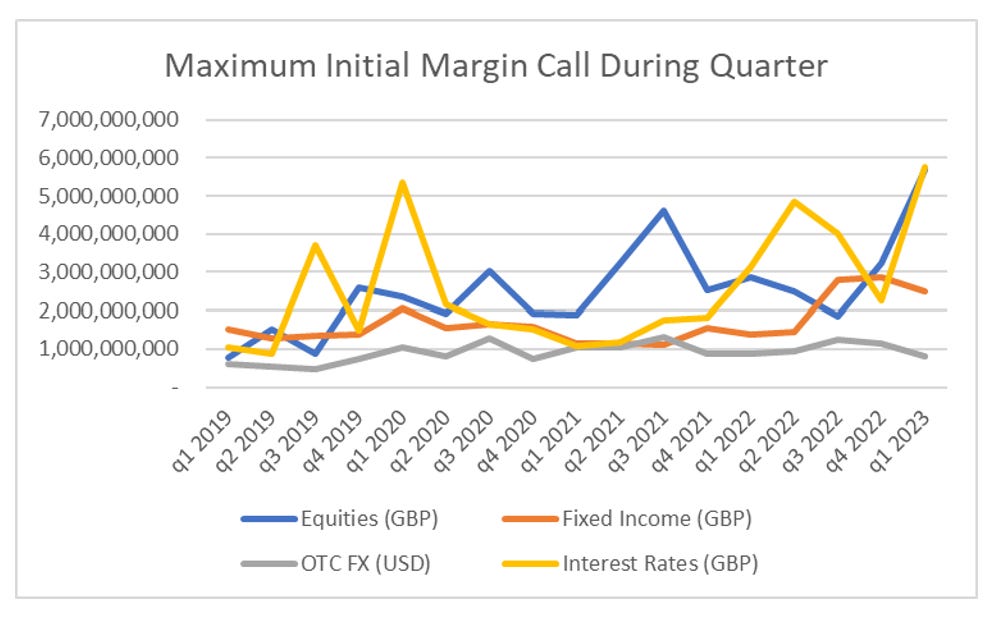

The best measure of risk actually comes from initial margin. This is the amount paid by members of the clearinghouse to ensure they get paid. The volatility in the interest rates initial margin, where it has twice climbed from GBP 1bn initial margin to over GBP 5bn in the space of a few quarters.

What do these data points say to me? The interest rate business is where the majority of volume is traded at LCH, but the relatively low initial margin to variation margin suggests that this volume is concentrated in high volume low duration assets, with little risk of capital loss. This makes sense to me. The equity business seems to be correctly priced, with high initial margin, and little margin breach. The standout risky business seems to be in the Fixed Income/Repo business. A simple risk measure to look at would be size of peak margin breach to initial margin. As initial margin is contributed by both sides, when a breach is approaching 50%, it means the losing side as burned through all their initial margin.

Why is the fixed income peak breach to initial margin look so different to interest rates in most recent quarter? For some reason, initial margin fell at the fixed income/repo even though it doubled initial margin double interest rate. Very strange. One of my big problems with clearinghouse is that they are incentivised to get initial margins as low as possible. The fixed income/repo market at LCH also distinguishes itself by having a different membership make up to the other default funds.

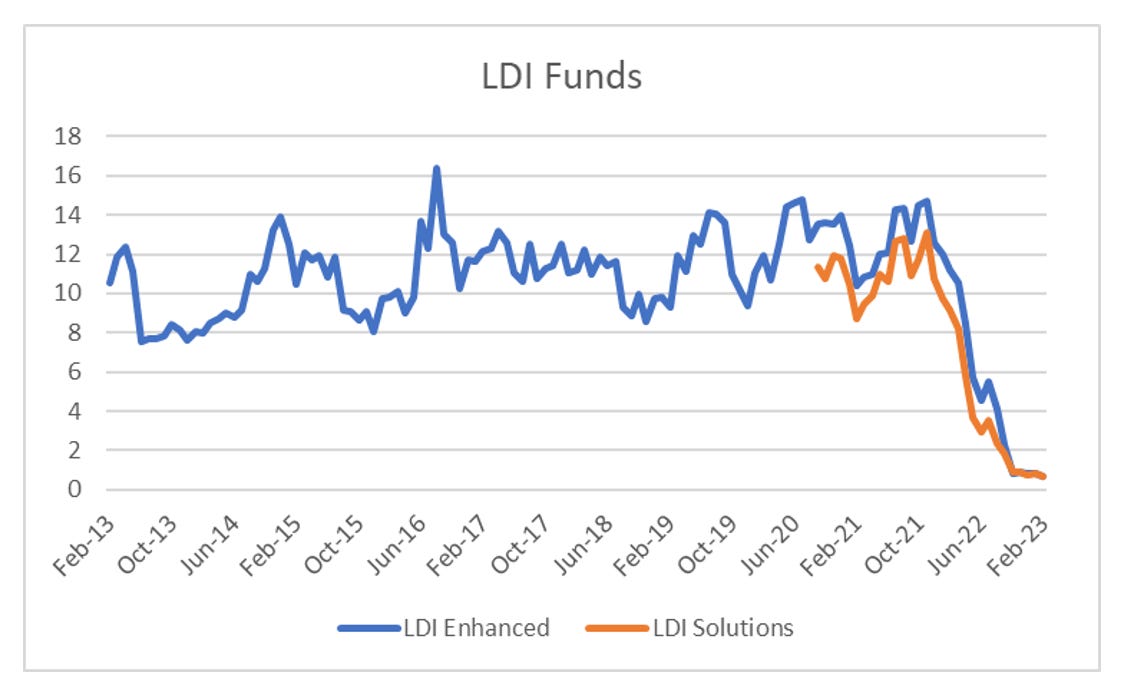

To recap from my last post on clearinghouses and LDI, LCH allowed a number of asset manager to directly access the RepoClear directly. Here are all LCH members that are only members of RepoClear.

Most notably is the inclusion of a number of LDI funds. Sadly, these funds are no long listed on Bloomberg, but I can repost the performance from my last post on clearinghouses.

The profit motive of clearinghouse leads them to seek to increase volumes, and increase membership. What we have seen with LDI meltdown, nickel market, and European power trading before that, is that the system is guaranteed to become unstable. The good news for regulators is that when it threatens a large bank like JP Morgan in the nickel market, the clearinghouse can organise an indirect bail out by cancelling trades, or the BOE can intervene in the market to provide liquidity, without having to directly bailout large banks. Small investors without political power can be left to go bust (see Silicon Valley Bank for another example of this regulatory bias to large corporations). The clearinghouse model remains for me a failed financial reform, but as a process to allow back door bailout of large banks, it remains unmatched.