I was reminded to look at clearinghouse by the beginning of lawsuits about the nickel debacle at the beginning of 2022. The fact is that nickel is a bit of a niche market, the really important market is in interest rate products. Back in September, the Liz Truss budget cause a sharp sell off in UK bonds (gilts). This in turn caused problems at LDI funds in the UK who were hit with margin calls, and prompted the Bank of England to purchase gilts to stabilise the market.

The above graph is taken from a Bank of England report which blames the funds - particularly LDI funds. The real culprit is the clearinghouse, but as they were following regulator’s directions, I guess the BOE feel that they cannot be blamed. For long time readers, I have highlighted that the move to clearinghouses at the centre of the financial system has changed the market in a very fundamental way. The first thing you need to know is that the clearinghouses, with the regulators full support, have wanted more asset managers to be members of clearinghouses. They have largely succeeded as can be seen below. Please note the increase in non-banks in clearing in right hand side graph.

If you go to the LCH website you can get a full list of members. While I expected to see asset managers (usually large pension funds) to be listed as members, I was surprised when I came across LDI Funds as members of Repo Clear. As you can see below, there are 13 LDI funds. As far as I can tell, they are all managed by Insight Investment Management Group a £653bn asset manager. Insight is owned by Bank of New York Mellon, which is also a member of LCH - although not in RepoClear. Why do funds owned by a member of the LCH need to become direct members themselves? My assumption is that perhaps Bank New York Mellon did not want to either take on the trades that the LDI funds were doing, or be responsible for the margin calls (same thing really).

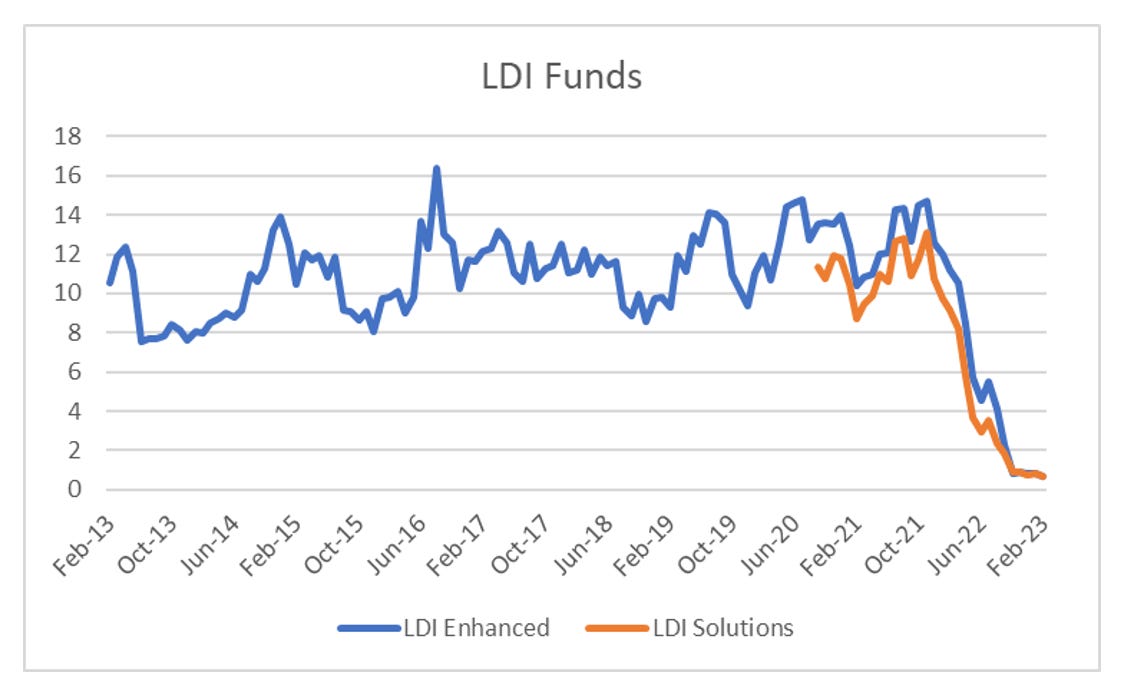

The last two funds listed above in the LDI section - LDI Enhanced Selection Longer Real Fund and LDI Solutions Plus Partially Funded Index-Linked Gilt Fund are both listed. Performance is shown below.

Without knowing the specifics of why LDI funds were direct members of the LCH I can only speculate on the reasons for this, but to my mind it stinks. The reality is that the banks used to regulate the repo market themselves, with the majority of trades between banks themselves. As can be seen in middle graph below, banks used to be borrowers from the repo market, but as banks have increase their holding of treasuries, in 2018 the US banking sector became net lenders in the repo market. The implication is that asset managers have to be the borrowers. So on one side you have large sophisticated banks with a long history of operating and pricing repo, while on the other side you have asset managers. The clearinghouse is profit driven, so is incentivised to get capital costs as low as possible. If the asset manager is passively run (that is the counterparties know exactly how they will be positioned), then the chances that the passive manager is going to be on the wrong side of a trade is going to be very very likely.

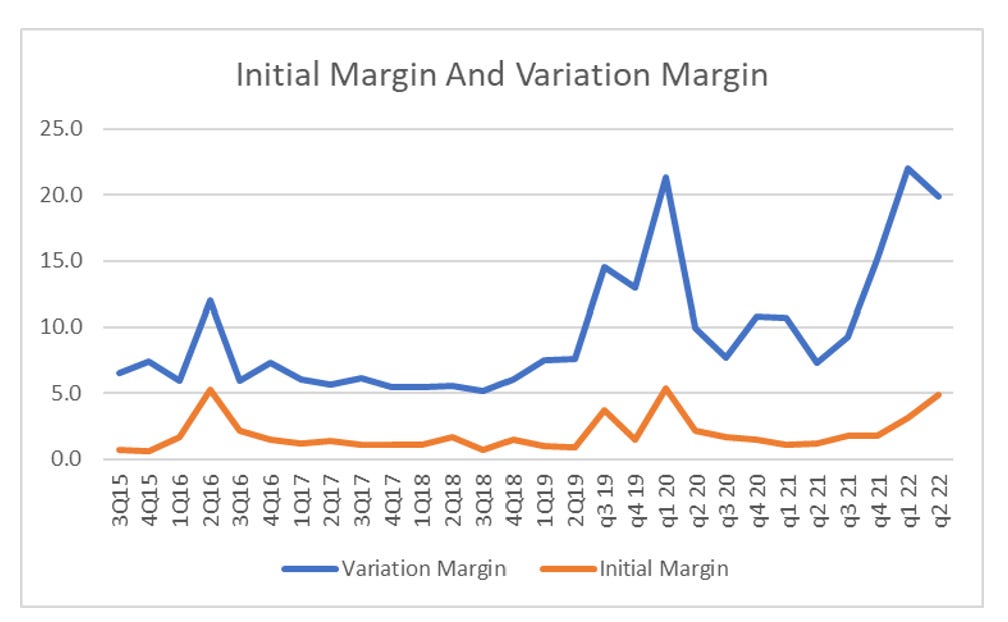

The final problem, and what causes markets to be volatile and suddenly destroy capital is that the clearinghouses have gone out of the way to reduce the amount of capital in the system. This has been done in a number of ways. Most transparently is the trend to have low initial margin.

Low levels of initial margin mean that margin breaches are then margin calls become more likely.

LDI funds have been granted direct access to clearinghouses to try and increase liquidity. The clearinghouses set risk based on historic volatility, and raise margin as volatility increase making markets MORE volatile. This has now happened at least three times - the reop blow up in 2019, the nickel blow of up of 2022, and the LDI/Gilt blow up of 2022. I could potentially add treasury market illiquidity in 2020. The clearinghouse at the centre of the financial system is failed reform in my mind. But the regulators keeps blaming funds. This is even after the banks have told the regulators that the clearinghouses are badly run (See “A Path Forward For CCP Resilience, Recovery and Resolution) As long as cleringhouses are profit seeking and remain at the centre of financial market, expect further market blow ups, and expect asset managers and retails clients to continue to lose money. A regulatory change that makes a financial system more unstable, while systemically being disadvantageous to retail clients is not a regulatory improvement, its embarrassment and a scandal.