The way I work is pretty simple. I look at the where we are today, look at when was similar in the past, and then position my portfolio to make money if past repeats itself. I looked at the current politics of tariffs, and anti immigration, and thought that we would see wage rise significantly. In my mind this would drive inflation unless central banks raised interest rates significantly. This led me to being long gold and short treasuries. This trade has been good.

I tried to find a long term graph to quantify how far this could run. When looking at this graph, it suggested a 1970s style market, which was bad for asset markets.

In other words, I expected gold to massively outperform the S&P 500. That is beginning to happen, but not to the extent I thought.

Looking at this, the strategy makes sense, I just need to be patient and wait for the market to come to me. Which is fine. But one thing has caught me by surprise has been the performance of emerging markets and cyclicals vs defensives. Emerging markets have broken out, after being a nothing done since 2007. (I am sometimes called a permabear - but I started as a Emerging Market fund manager, and went bearish in 2008 - so justified when it comes to emerging markets in many ways I think. My real mistake is not seeing the US market doing this well for so long.)

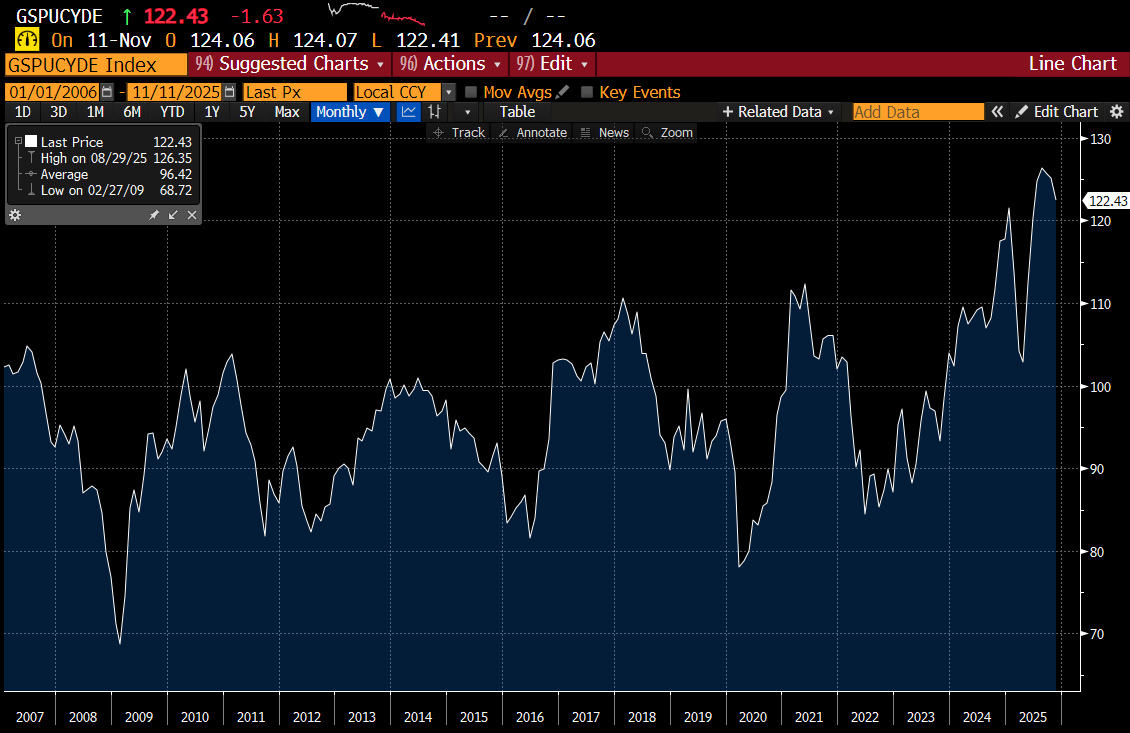

Not unrelated has been the surge in cyclicals versus defensive stocks. Below is the GS cyclical v defensive (ex commodities) chart.

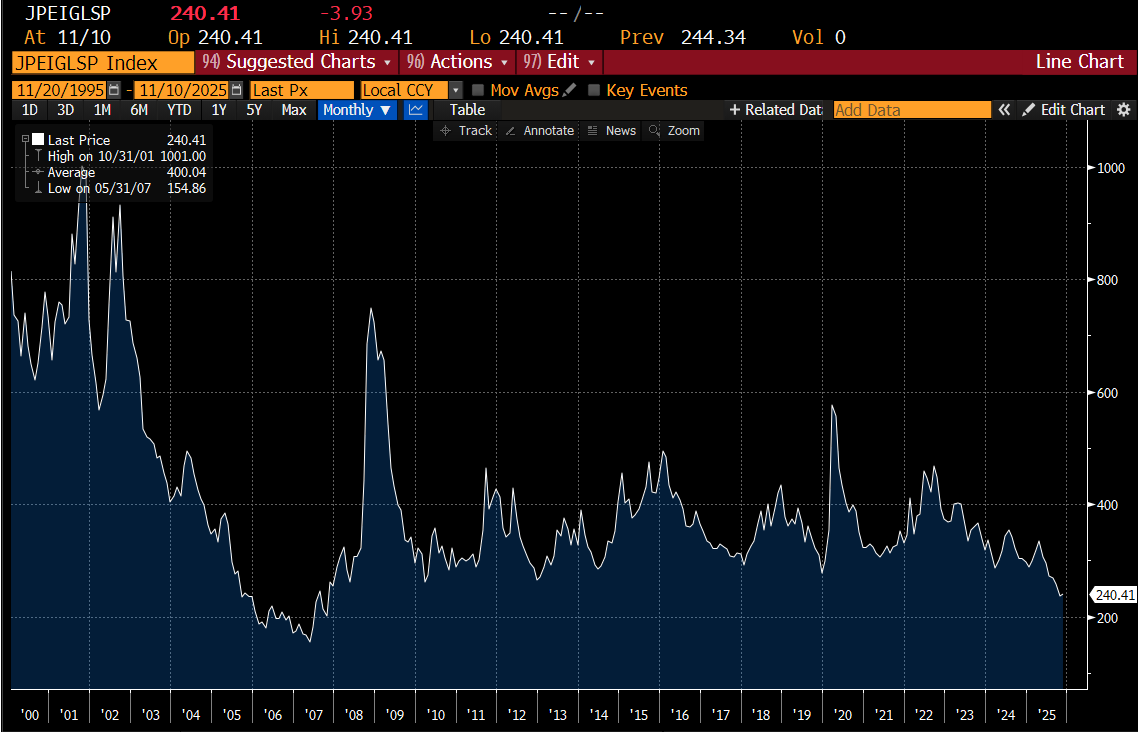

Spreads on emerging market debt has also come down to extremely low levels.

My view of higher interest rates, which despite central bank cuts, the long end of German and Japanese bond markets still have cycle highs in yields, and rising tariffs did not think this would be a good environment for emerging markets. Of course, this could all just be top of the market stuff - and that would suit me fine, but I started to get an inkling of another way to think about markets other than as pro-labour vs pro-capital shift. So what could explain the big moves in gold versus treasuries AND the continued rise of asset values?

So going back to first principles, I see an inflection in the bond market which has been driven by political change. I still see that as correct.

Now I saw the political change as one that prioritised raising wages, and particularly in real terms. And wages have certainly risen. But maybe rising wages and rising interest rates are symptomatic of something entirely different. In the pro-capital era, which ran from 1980 to 2020 in my view, the idea was that countries competed on price. Investment would flow to wherever was cheapest (Japan in 1970s/80s, Asia in 1990s, China and Eastern Europe in 2000s). If a country became too expensive, then it was likely to suffer a capital withdrawal, slow growth, deflation and weak currency until it became attractive to foreign investors again, and the cycle would turn again. It was a system designed to keep prices of all goods in check, which in turn led to lower and lower interest rates. Rather than calling this pro-capital, perhaps we should call this “price is king” era. Lowest priced operator wins. Underpinning this was governments cutting tariffs, and allowing the free flow of goods, capital and people. These policies would mean that high paying jobs flowed to the countries with the best educated workforce, while low paying jobs flowed to countries with cheapest workforce. Cities with the brightest and smartest people did well, while everyone else had to compete via price. This was globalisation, and it has been rejected at the ballot box in the west.

So the new system that is being conjured into existence is that governments choose where investment and jobs are created. For a sense of irony - the 1980s and 1990s was the movement of communist nations into the world trading system, and price based economies. The 2020s seems to be representing the reversal of that system in the West - or if you like, the Sinification of the US. China has strongman leader, the US has a strongman leader. China directs industrial policy, the US directs industrial policy. China bans foreign technology, the US bans foreign technology. Chinese government complains about foreign portrayal of China, the US government complains about foreign portrayal of the US. You get the idea.

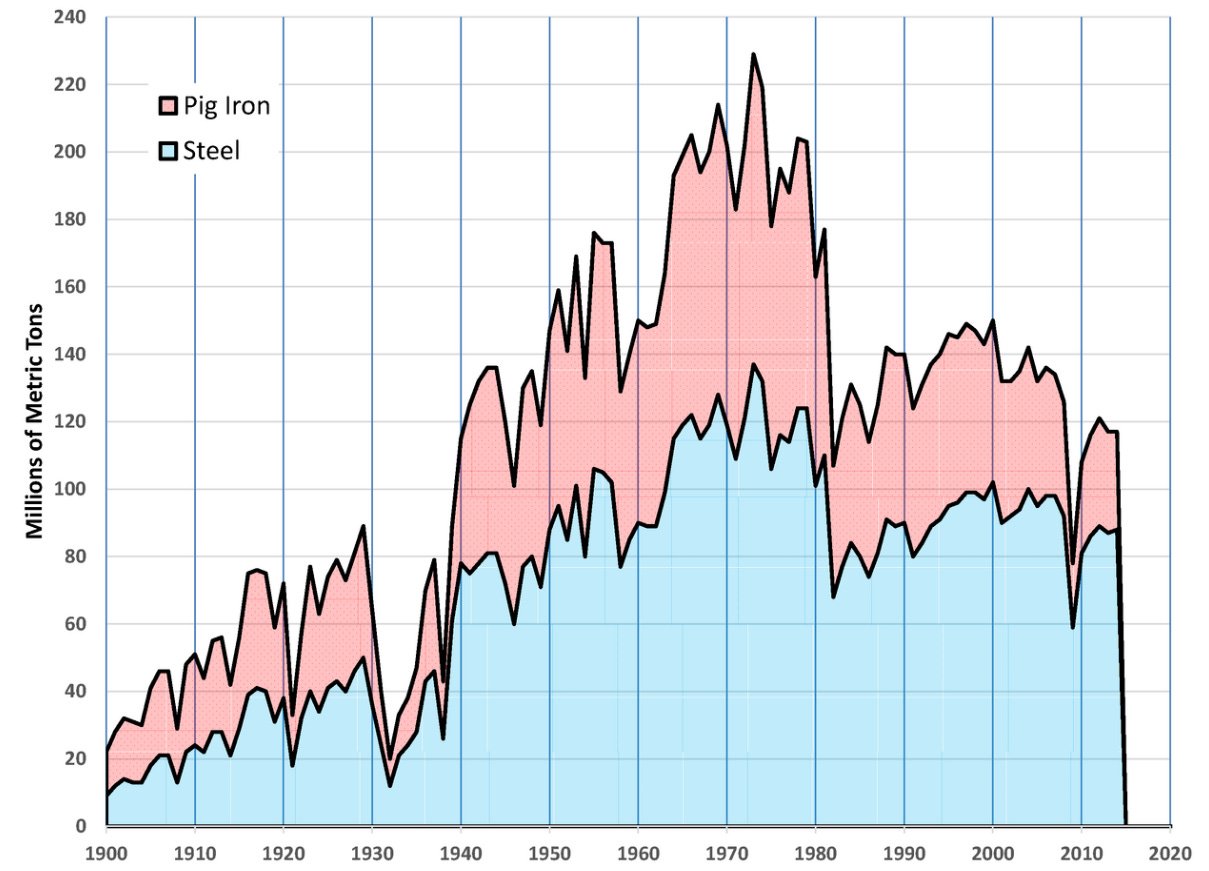

In the “price is king” era, investing could lead to profoundly negative consequences. Currency crisis, debt crisis, over capacity. This had the negative effect of discouraging investment. A much better business was one that with pricing power, and limited investment needs (Coke Cola, See’s Candy, “Old” Microsoft). But in a new era perhaps we are in the “investment is king” era. Now I know a lot of people reading this will be rejecting this out of hand - but hear me out. Back in the first pro-labour era, from 1945 to 1980, the US grew production of everything. Steel production grew through that whole era.

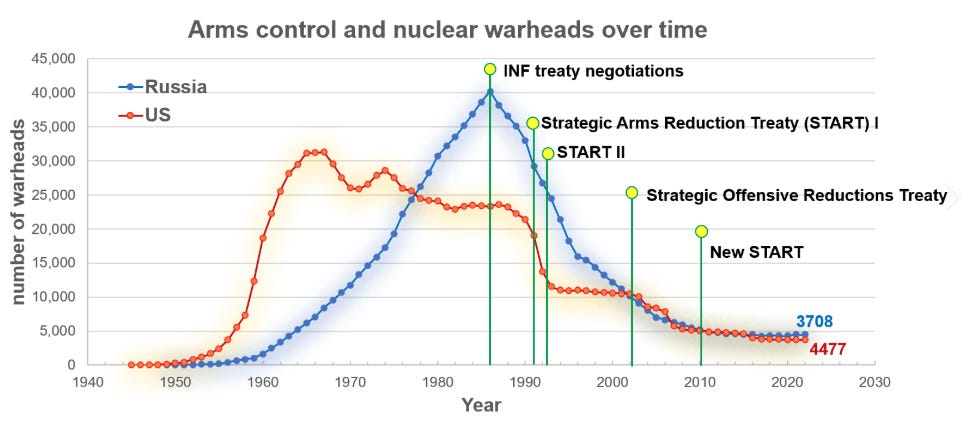

Steel was a vital resource and needed to be produced at home. We could see a similar logic in nuclear warheads. Competition spurs investment and production, while collaboration spurs price wars. Competition is inflationary, collaboration is deflationary.

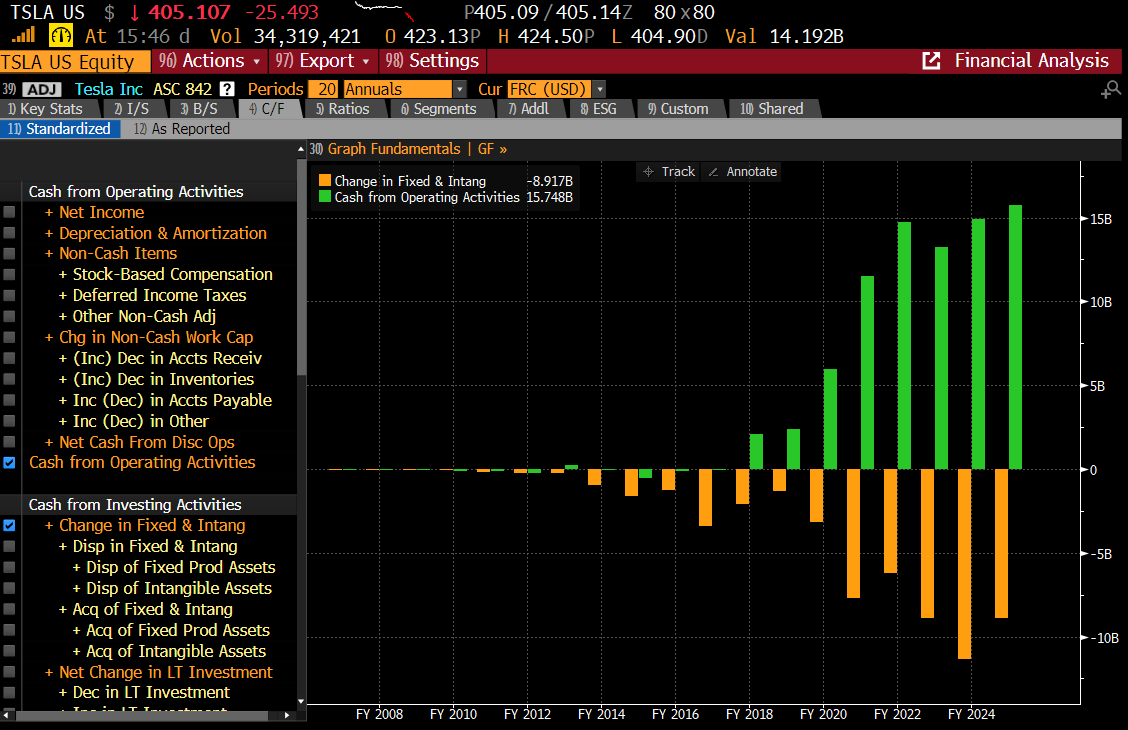

Maybe the old cold war needed steel and warheads. The new cold war needs AI, compute and electricity. So in my first “pro-labour” era, you did not need to worry about investing - demand would always be there, and prices would always rise. In the “pro-capital” era, financial assets did well, and pricing could fall, hence excess investment was a big mistake. Tesla was a forerunner of this change - it was very much “built it and they will come” style investing. And if you think about the subsidies that EVs have had thrown at them - this is the success of “investment as king” era.

This “build it and they will come” attitude attracted record short interest. The short sellers were dead wrong. A lot of them are still around, but have quietly moved on to other projects.

I would say right now, in the AI world, there is some angst over the “built it and they will come” strategy. And I understand that. But I also do not see US politically moving back to “price is king” world, because that would imply allowing Chinese tech to dominate. What I think is more interesting is the AI build out now seems to be crowding out other borrowers, and forcing up the price of electricity. This should weigh on markets - and makes the 1970s more likely. But until the threat of China is dissipated, I would not bet on a deflationary bubble bursting. More likely we use up all the excess capital lying around. Betting on higher yields still makes a lot of sense to me.