I started writing about the parallels of the East India Company to the giant tech firms of today in a Christmas Special. The key part of the article was analysis provided by The Economist. Looking at other monopolies that got into political trouble when profits were a meaningful percentage of GDP.

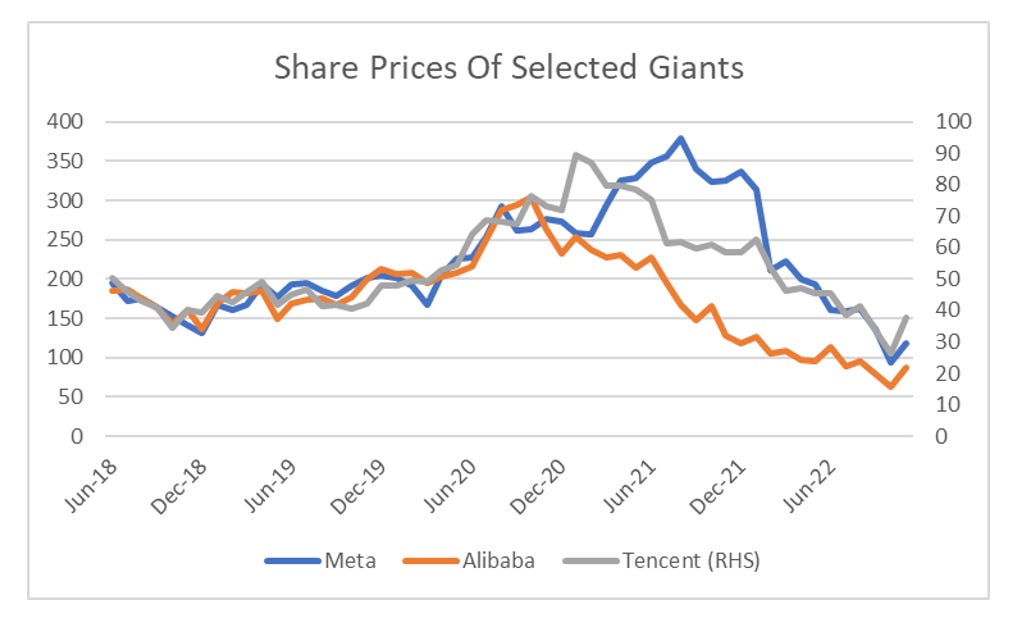

What excited me about this, was a few years later the Chinese tech companies all imploded after political intervention.

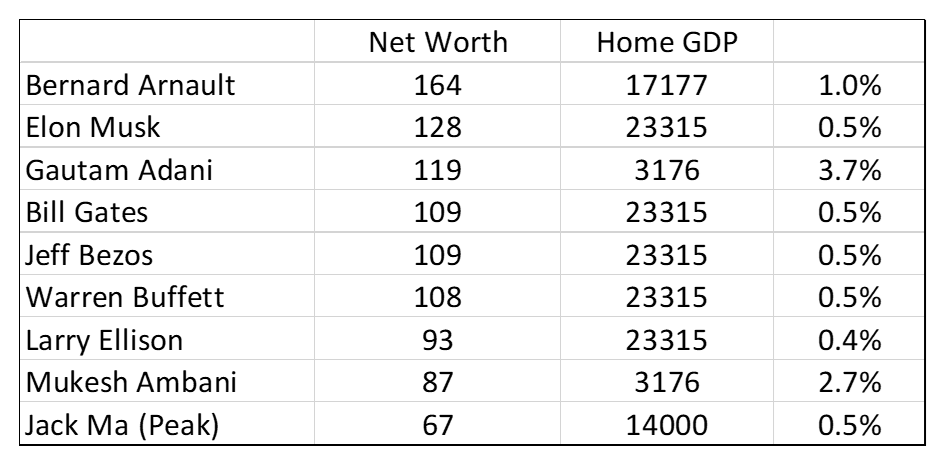

I also modified The Economist analysis to look at individual’s net worth as a percentage of GDP to try and find potential political problems. This was in early January, and showed just how extended Adani was before problems befell the Adani group. Note I used Jack Ma peak wealth of 0.5% of Chinese GDP as a warning signal that trouble was brewing.

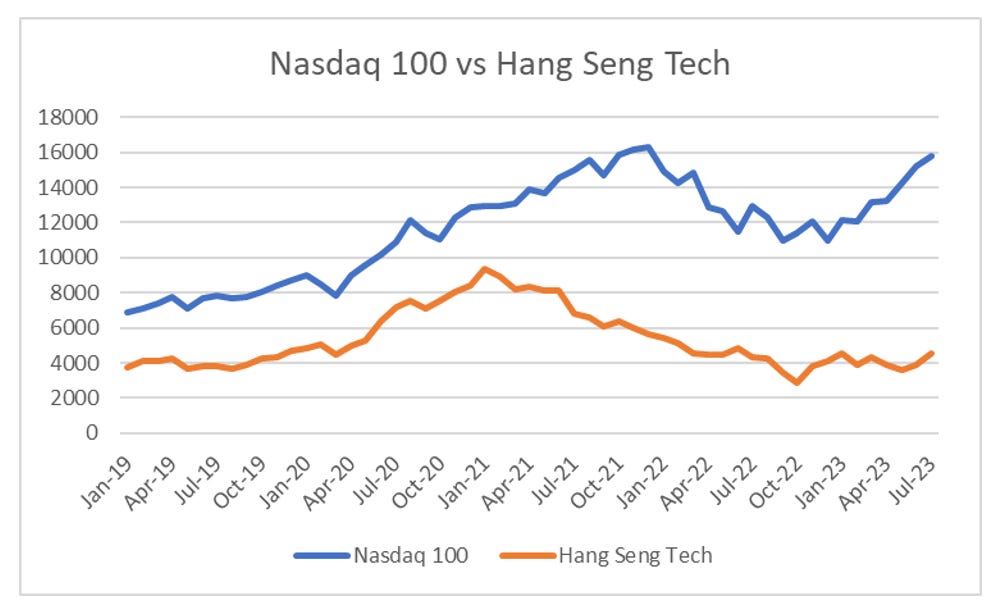

The one big caveat I had to this analysis was that it was comparing the most successful companies (Apple, Microsoft, Google) to the East India Company. The East Indian Company controlled India and much of South East Asia, and had an army of over 260,000 soldiers. Not only that, but the East Indian Company also exerted substantial political power at home as well. Surely in the age of universal suffrage, the idea that corporates could exert substantial political power to the degree that the East India Company did must be fanciful? Well the comparison are becoming more easier to make. The East India Company sent back riches from its monopoly on the spice trade (among other things) to shareholders and the government of the UK. Very little tax if any was paid to India or other South East Asian nations under its control. As pointed out, the current tax arrangements between the US and Ireland mean that US corporates pay little to no tax on their offshore earnings. China is making sure it’s corporates pay appropriate tax, and is definitely under Chinese government control. From a US investor perspective, this make Chinese tech stocks “uninvestable”. And the stark underperformance continues.

I originally thought we would see a similar crackdown on US tech as we saw in China. For example the OECD had agreed a large tax reform to tax US multinationals. But as my recent post highlights, it looks like Ireland is acting to defang this reform. I also thought the FTC with its new commissioner and forceful support of the Biden administration would bring fundamental change to the tech sector. The recent rally in Activision share price represents the market view that the FTC will be forced to back track on its plans to stop Microsoft trying to dominate the gaming sector.

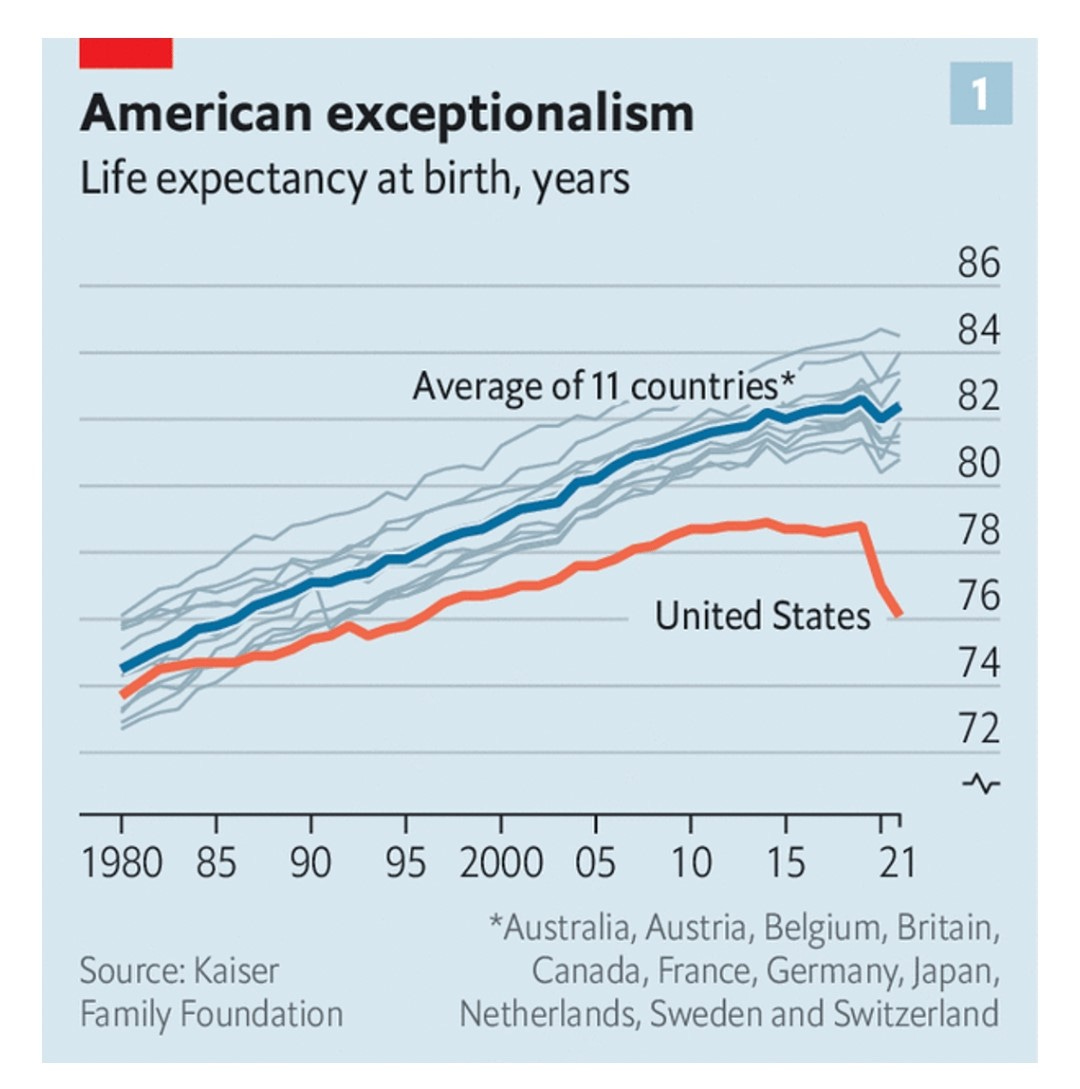

But is all this “winning” by US corporates ultimately a loss for the US? For me it is now apparent that US corporates live beyond the reach of US political control. US healthcare reform is not even talked about despite the US having by far the worse healthcare outcomes in the western world. This combined with the complete inaction on school shootings (if dead children cannot motivate political activity - what can?) implies a US government that is broadly powerless to control (large) US corporates.

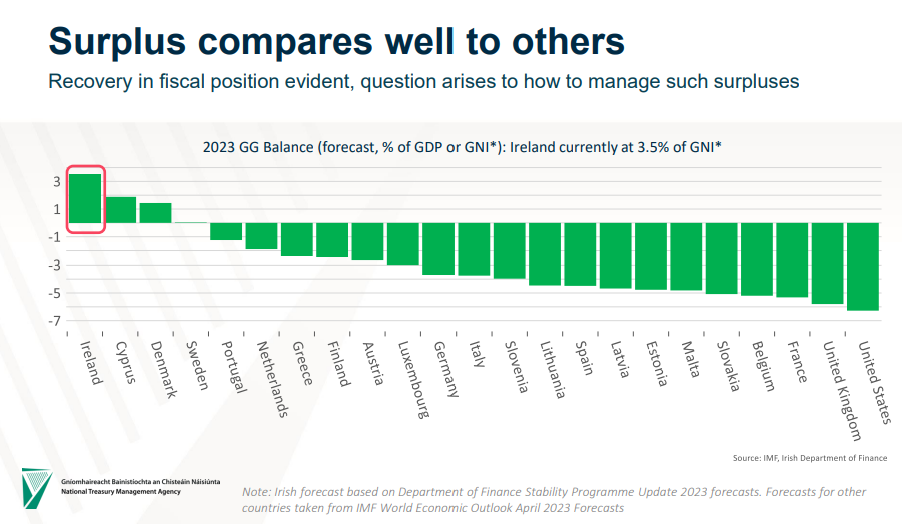

The fact of the matter is that government deficits will need to be reduced at some point. With exception of Ireland, the western world continues to spend more than its raises.

I do expect taxes to go up at some point, although I already pay quite high taxes. But my vote will go to any government that will end the chronic tax dodging that is now part of US corporate culture. And this is where China may be edging out the US. While Chinese tach giants have become univestable, the Chinese government has shown they can be brought to heal. For nations looking to deal with the US or China, you now face the choice of a democracy, but with unaccountable corporates, or a dictatorship with accountable corporates. It makes the question of dealing with the US or with China far harder than it should be, and it already expressing itself in falling belief in Western values. The difficulty of getting unanimous support for Ukraine against Russian aggression is just one sign of this. India and South Africa were notable abstentions.

The East India Company was responsible for the taxation of tea in the United States, which led to the eventual revolt and loss of those colonies. I am beginning to suspect similar dominance by US corporations are going to lead to similar rebellion against US commercial power.