I quite like my idea of a political shift from pro-capital to pro-labour. It fits in with what I am seeing, and provides some useful predictions on how markets are going to act. The big problem is that I am leaning heavily on the experience of the western world after World War II. I have been trying to find other examples.

Ever since I read an Economist article from July 2018 entitled, “History’s biggest firms”, I have started to think about international shifts from pro-capital to pro-labour. What was interesting about the Economist article was that it looked at the usual suspects of oversized firms that needed government intervention, Standard Oil, Microsoft, IBM, US Steel and AT&T. However the article also included the East India Company, which while a company, was the de facto government of India, exercising control over India for British interests.

While including the East India Company in with the traditional monopolists was interesting, it was when the author applied some analysis for future monopolists it became very interesting. In particular it highlighted Chinese tech companies at risk, well before that became a market wide concern.

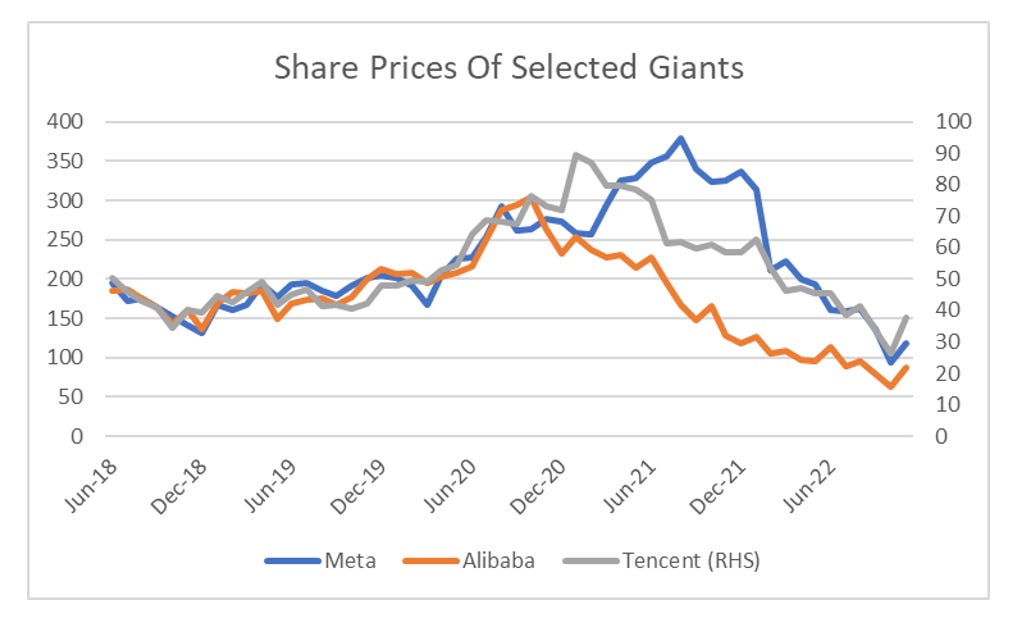

Facebook, Tencent and Alibaba have all duly run into trouble of one sort or another. As fairly typical of Economist market predictions, it was very wrong before it was very right. Tencent and Alibaba were clearly on the wrong end of government intervention. Meta, as Facebook is now known, was probably also on the receiving end of more subtle state intervention.

In the case of Meta, Alibaba and Tencent, I am sure that they have suffered from regulators deciding that these firms were too powerful, and rules were changed to help distribute power back to other firms, consumers and workers. But in the case of the East India Company, which lost its monopoly in 1813, it was in fact taken over by the British State, who only truly lost is monopoly in 1947 when India became independent. This makes me think there are two types of pro-labour shifts. One domestic, where governments help curb the power of over mighty corporates. Standard Oil, AT&T, Alibaba and Tencent all fit into this model. The other pro-labour shift which is where local workers and governments take control back from foreigners. East India Company is one example, but you could argue the nationalisation of oil firms in the 60s and 70s, and formation of OPEC as another. I would have to argue that the second form of pro-capital shift is far more inflationary than the first. World War I and II destroyed the British Empire. A map of the British Empire in 1910 was reduced to just a few small enclaves by 1960.

What I am trying to get at in a roundabout way, is that pro-labour shifts are the natural outcome of pro-capital policies. Pro-capital policies tend to concentrate capital and power into ever smaller number of people or states, and while efficient (and deflationary) eventually provokes a political reaction. Over the last 20 years or so, American corporates have come to dominate every major industry. Investment banking used to quite competitive, but now only US banks are top tier. In retailing, Amazon is the dominant player in almost all western markets, while Disney and Netflix are the dominant streaming players. For operating systems for technology, you will be using Microsoft, Apple or Google systems, and with Apple and Google, you are reliant on their app stores. Payment systems are dominated by Visa, Mastercard and Amex. Electric vehicle market is dominated by Tesla. Theoretically there is nothing wrong with US corporates dominating the western world. However in practice, US corporates pay far less tax on profits generates overseas that they do in the US. In Europe particularly, the use of Ireland as a base for operations has meant that 12.5% has been the legal tax rate ( Apple famously found 12.5% even too high for many years, utilising a structure to lower tax rate to 0%).

Could tax issues really begin a political shift against US dominance? The Boston Tea Party, which eventually led to the American Revolution, was a protest against the tax policy of tea imported by the East India Company. Or to put in another way, American colonists rebelled against policy that favoured a multinational that has managed to secure beneficial tax policy. So what would a pushback against US led policy look like? First of all would be reducing reliance on the US dollar. We are starting to see signs of that, with record central bank gold purchases in Q3.

I am not sure where the World Gold Council gets it data from, but bigger central bank buying would make more sense. The other feature of beginning to reject US rules would to be reduce the US of treasuries in foreign reserves. This is something we have seen with both Russia and China.

It is not hard to see that Hong Kong and Taiwan also moving to holdings less treasuries. This probably understates the Taiwanese influence on treasuries, as Taiwan is second largest foreign owner of mortgage backed securities, owning some USD200bn.

In my ways, a long GLD/TLT trade is taking a view on the value of the US dollar and its ability to hold its empire together. As the British empire declined its currency consistently weakened against the US dollar (and gold). The spike in the value of the pounds versus the US dollar in 1800s was during the American Civil War.

China is not ready so supplant the US. A cataclysmic event like World War I or II would probably be required for such an outcome, but given the way the US has weaponised the financial system, it is easy to see most countries wanting to reduce the use of the US dollar, or have an alternative financial system outside of US control. In this case a pro-labour shift can be read as a shift against the dominant power. Selling treasuries to buy more gold makes sense. Longer term, I suspect the performance of gold versus treasuries to be repeated.

While this note started out trying to dive deeper into how a pro-capital to pro-labour shift might look, its ended up with the same investment conclusion. Long GLD, Short TLT.