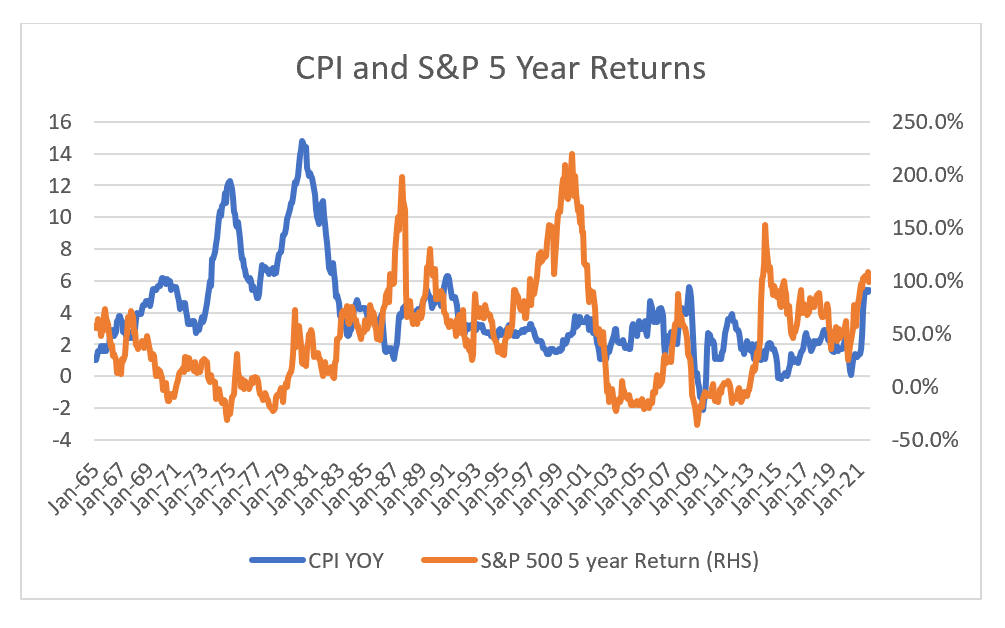

One of the big problems with financial markets is survivor bias. A good example is the bond market, where investors who survived the bond rout of the 1970s would constantly caution younger investors on the bond market throughout the entire 40 year bull market in bonds. Shorting JGBs was such a terrible trade, it earned the moniker “widowmaker”. I have wondered for a while if US equities, and particularly the S&P 500, was becoming something similar to a JGB trade. I am starting to think the clearinghouses provide a way for us to think about the S&P 500 as a new JGB trade. First of all, using historical analysis would suggest a number of reasons to be bearish on US equities. Typically, when inflation is rising, the S&P 500 has struggled. 1970s saw rising inflation, and poor returns from the S&P, and likewise, the very mildly rising rising inflation of 2000s, also saw stagnant returns.

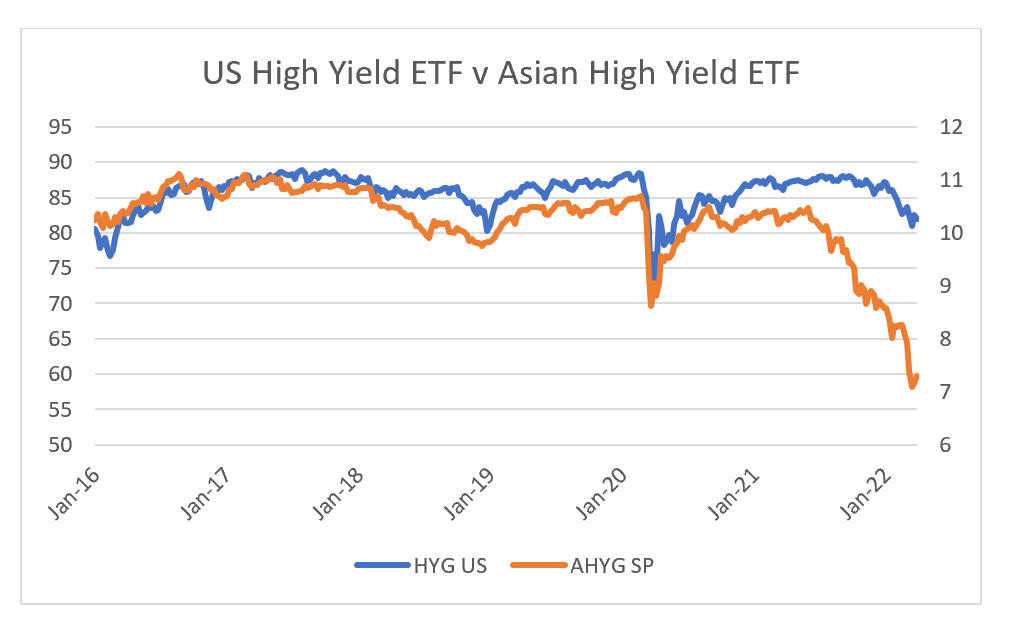

But the more I think about markets and politics, the more I realise that governments react to what societies want. After the inflationary 1970s, policy making was set to combatting inflation. If that meant unemployment and bankruptcy rose, then so be it. Hence the natural tendency of markets to underperform as inflation rose. But the structural changes made by politicians meant that inflation was always going to surprise to the downside. So to continue the analysis, after the GFC and then the Eurocrisis, voters and politicians basically did not want financial crises anymore, particularly ones that led to soaring unemployment, and this has led to institutions intervening in markets to ensure stability. So in my last “Buy the Dip or Sell the Rip” note, I was looking at HYG US, and saying it was still saying sell the rip. The yield on high yield is also still far below CPI.

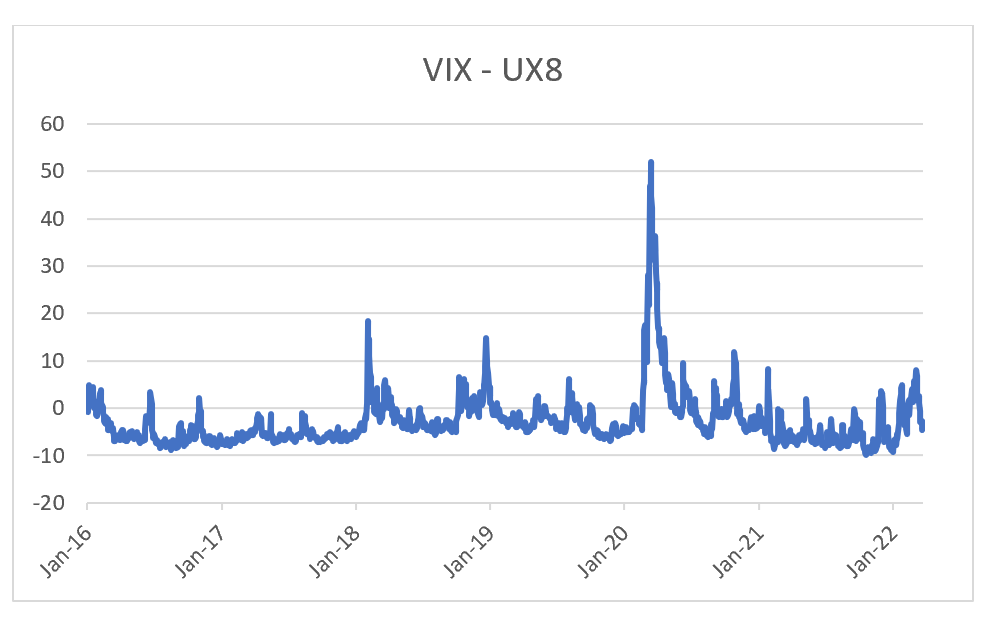

When I look at the VIX curve, Spot VIX is again trading at a big discount to UX8 (8mth generic VIX) which is a sign of complacency.

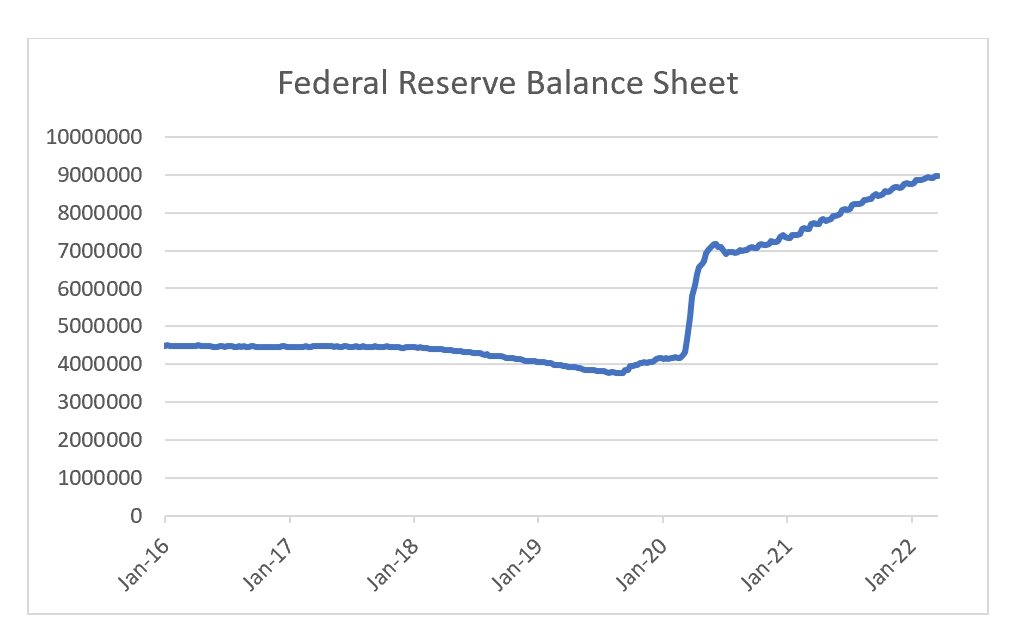

However my recent work on clearinghouses had made me think about markets with fresh eyes. The clearinghouses do not set risk with an eye to future inflation. They also don’t set risk prices with an eye on how leveraged underlying participants are, or even how they may all have the same positions. The clearinghouse is only concerned with liquidity. The less liquid, the more risky the asset is for clearinghouse. Which is probably why large cap US stocks have been able to trade so well for so long. Now, as we seen with the LME, and Nasdaq Oslo, one trader can destroy those clearinghouses, but unlike the LME and Nasdaq Oslo, western credit markets have been able to rely on a very large player to provide all the liquidity they need to keep asset markets moving - central banks. For that reason, the biggest and best “buy the dip” reason I can come up with is that the Federal Reserve balance sheet is still growing.

Market carnage was far more widespread in Q4 2018 when the Jerome Powell suggested that balance sheet reduction was on autopilot, that during Covid when the world went into a cardiac arrest. When I looked at Japan, as model for markets after the GFC, the markets would look through what the central bank and governments wanted, and prices assets correctly. Hence I was not a big believer in QE working. But I can now see that the replacing of investment banks with clearinghouses allows central banks to provide liquidity directly into markets, allowing asset prices to rise (as has been their policy goal since the GFC). The issue for investors is when do governments place reducing income inequality, or combatting inflation as their main policy aim? China has already moved down that route. The China dominated Asian High Yield ETF (traded in Singapore, but quoted in USD), shows what happens when governments withdraw support for credit markets.

So buy the dip, or the sell the rip is not a technical question of valuation or market positioning. It is a question of whether the Federal Reserve pulls liquidity or not. If central banks pull liquidity, then clearinghouses will reprice risk, regardless of the outlook, as they did in 2018, and in China in 2021 and 2022.

Share this post