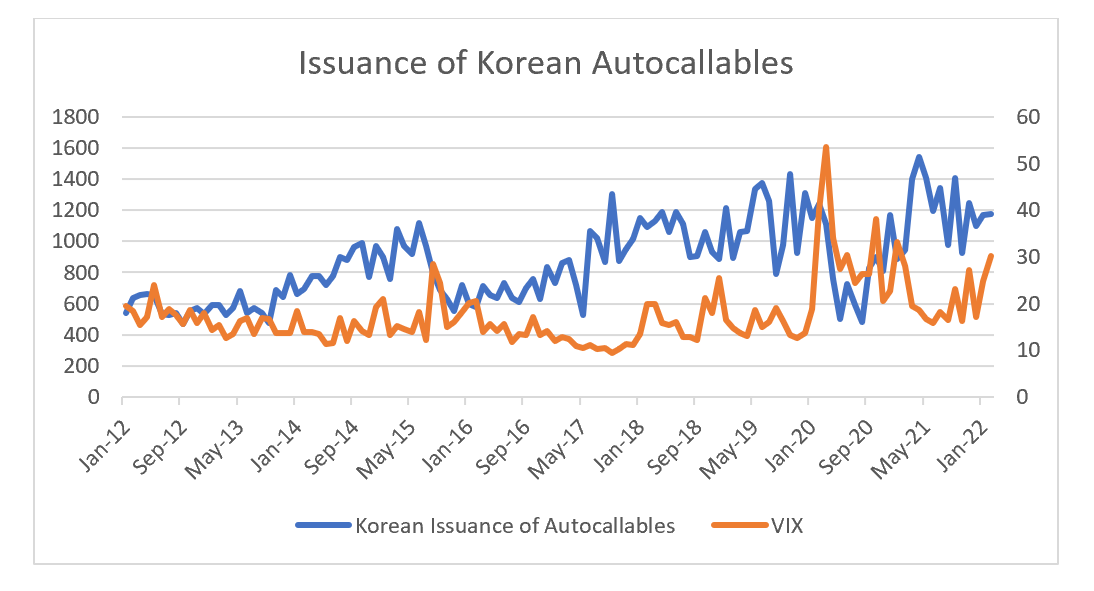

The autocallable market essentially sells volatility to generate yield (its a retail product that sells puts on the market). It shares many features with current clearinghouse structures, it has the tendency to reduce volatility in the short term, and increase it in the long term. The nature of Korean autocallable market is that issuance tends to drop when VIX spikes, and then increase again as volatility falls. Despite the lacklustre equity markets this year, up to the end of February, autocallable issuance has been strong.

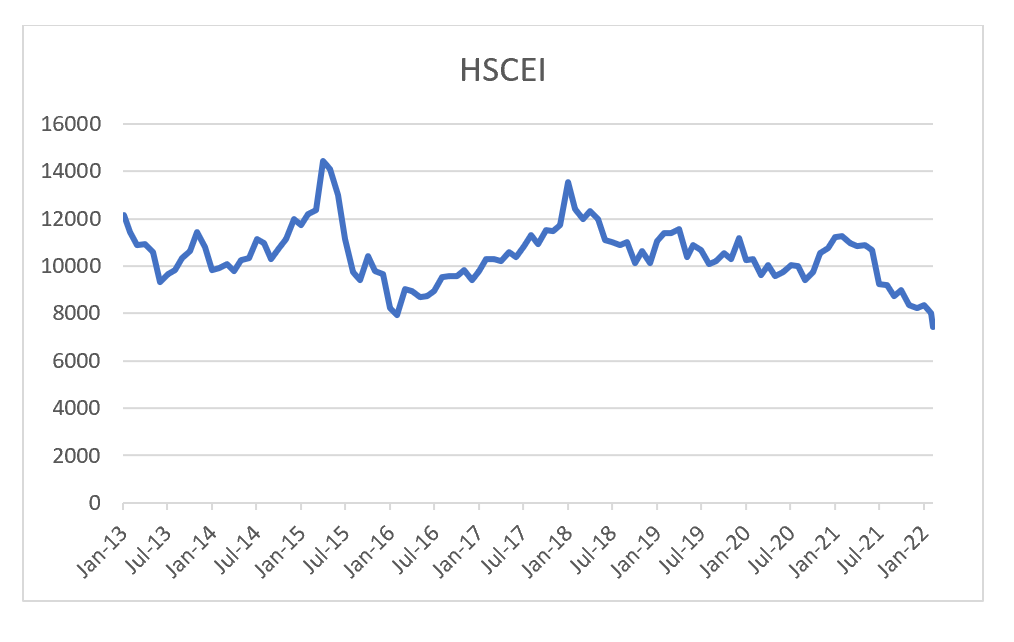

The last substantial blow up in autocallables was in HSCEI linked products in 2015. A blow up in autocallables means that the products turn from sellers of volatility to forced buyers of volalility. In practical terms it means you see the price of market volatility spike, and remain elevated as there will be a number of forced buyers. You can see that the in 2015, the VHSCEI began to trade at ever wider premium to VIX.

At the time, the HSCEI was the most popular index for Korean autocallable structurers. Today, the most popular indices are S&P 500 and the Eurostoxx 50. Kospi 200, Nikkei 225 and HSCEI are also used, but are not as popular. Having looked at these products for a long time, the risk of them becoming problem will be rising when dividend futures are falling in value. The autocallables are naturally long future dividends, so when they are falling, stress entering the system. 2023 dividend futures for S&P 500 and Eurostoxx are falling. While the Covid fall in dividend futures are obvious, I would also point out the dip in dividend futures seen in Q4 2018.

One particularly unpleasant feature of the autocallable market has been the rising use of the “worst of” features to get higher yield. So even though Eurostoxx and S&P 500 are the most popular indices, they will also often be tied to a third index to gain extra yield. If this third index breaks a barrier, then the entire product is “knocked in” and places upward pressure on volatility in all the markets. The HSCEI Index is now trading at 7412, 40% below 2021 highs. Most barriers are set at 50% declines, so we are getting close to being knocked in.

As we have seen with Russian stocks, if Chinese SOEs get sanctioned by the US financial system underlying valuation is no longer important. The risk of an autocallable blow up is rising rapidly.