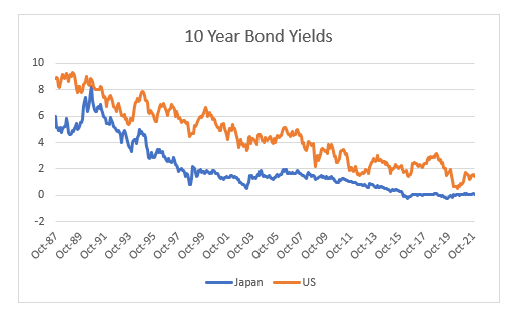

WHY DOES THE US HAVE LOW BOND YIELDS?

On almost every metric, the US looks nothing like Japan, and yet its bond market continues is Japanification. Maybe bond yields reflect the power of labour versus capital?

Prior to the Global Financial Crisis, the Japanese bond market had been an outlier in world government bond markets. Certainly, the very low bond yields in Japan in the late 1990s and early 2000s were seen as an aberration, and were popular, if very unsuccessful shorts (see Widowmaker trade)

Looking for reasons why JGB yields were so low was - in financial market terms - child’s play. The Japanese stock market had peaked over 30 years ago, land prices had been in an ongoing and brutal bear market, Japanese yen was very cheap, implying that a rally would create a deflationary impulse, and Japan ran a huge investments surplus with the rest of the world, implying it needed to keep rates low to keep the yen weak. However, the US bond market has followed the Japanese precedent, despite having none of this similarities. Nikkei is still below its peak from 1989, while the S&P 500 has nearly tripled its pre-GFC high.

Using farm land values, Japanese farmland has also been in a prolonged bear market, and now trades below US farmland prices. At their peak they were some 5 times higher than US prices.

The Yen is trading on a real effective basis at the lowest level in thirty to forty years, implying that a yen rally would be very deflationary, and perhaps justifying low bond yields. The US dollar is trading at a strong level, implying possible currency weakness, and more potential inflation.

Net international investment positions, which I have normalised to nominal GDP, also show the US is nothing like Japan. Japan has ever increasing surpluses, while the US has ever increasing deficits.

However, I can find one stark similarity in macro economic data between Japan and the US which could go to explain low bond yields in both countries. Using the US Federal Minimum Wage, and the IMF Japan Wage Tracker as long dated guides to wages in both countries, we can see that in 1980s, both countries inflected to slower wage growth, and in the 1990s onwards outright wage deflation in Japan.

This would imply that contrary to received wisdom that government bond yields are not impacted by budget deficits, inflation expectations or central bank credibility. The most important factor to bond yields is the power of labour over capital. This would explain steadily rising bond yields in the post World War II boom, and then subsequent fall in the globalisation since 1980s.

The implication is that if governments begin to set and raise wages, then bond yields are at risk of rising. While there is much talk about increasing the power of labour and unions, bond markets seem to be signalling then enduring power of capital. Given that it took the rise of the USSR, the Great Depression and World War II to move Western government to pro-labour policies, market are probably correct in assuming continued pro capital policies.

Russell, I have followed your writings/interviews for many years and have always been impressed by your analysis but as a retail investor couldn't access your hedge fund business. Now that you have moved on from that (and all the headaches that running a HF brings) I was wondering if you had given any thought to maybe starting up an "active" ETF that would incorporate your analysis and strategies that a retail investor could get in on. Harley Bassman (credit guy) and Mike Green (all around investor type) have joined up with Simplify Asset Mgmt and created some new and innovative ETFs centered around their expertise. Simplify does all the backend work of setting up and maintaining the ETF and you could run the strategy and investment decisions (leaving all the drudge work to Simplify). I would love to be able to invest with you if you thought that might be something you would be interested in. Thanks for your consideration, Rick

hey Russell, so if we think about the wacc, for Japan would it not be the case it is undoubtedly on the way up, given the massive reallocation to equities in recent years. and of course the demographics & labour impact. so it is kind of believable that the long term trajectory of Japanese yields is up?