Equities have been remarkably strong over the last three months. There has been a string of good news, collapsing natural gas prices in Europe, China ending Zero-Covid, and seemingly backing away from its pro-labour policy stance, and lower commodity prices. That being said, the core pro-labour trade, long GLD, short TLT has traded very well.

In fact the way GLD/TLT has traded recently is in line with my thinking on moving pro-labour. On every measure that I look at, be it house prices, minimum wages, or even debt to GDP measures or even voting tendencies all point to politics and politicians needing to get REAL wages to rise. What that means in practice is that they need asset prices to fall relative to wages. This is true everywhere - China, Japan, Europe, North America and South America. The first thing politicians needed to do was to ensure than unemployment falls to low levels. Here the UK provides us with very long term data (from the BOE) on unemployment rates. Prior to World War I, unemployment was around 5%, in the interwar periods it averaged closer to 10%, and in the pro-labour period from end of World War II to 1979 was closer to 3%. In the pro-capital period from 1980 onwards, 7% has been more usual. The most recent level of 3.5% places us much closer to the pro-labour era than anything else.

The weird thing about pro-capital or pro labour policies is that the need to achieve the same things - rising real wages. In a competitive democracy like the UK this makes total sense to me. Policies that don’t raise real wages are going to election losers. One way to look at it is Gold to wages, and again we can use BOE long term data to see where UK wages are relative to the gold price. Collapsing real wages in 1930s and 40s laid the groundwork for a shift to pro labour from 1945 onwards. Collapsing real wages in the 1970s laid the groundwork for a shift to pro-capital policies from 1979 onwards, and collapsing real wages over the last 15 years is laying the groundwork for a pro-labour shift. I sit in wonder at the Tories thinking wage austerity is a winning election policy, as I sit in wonder at investors buying 10 year UK gilts at 3.3%. Living in the past is the only way to describe it.

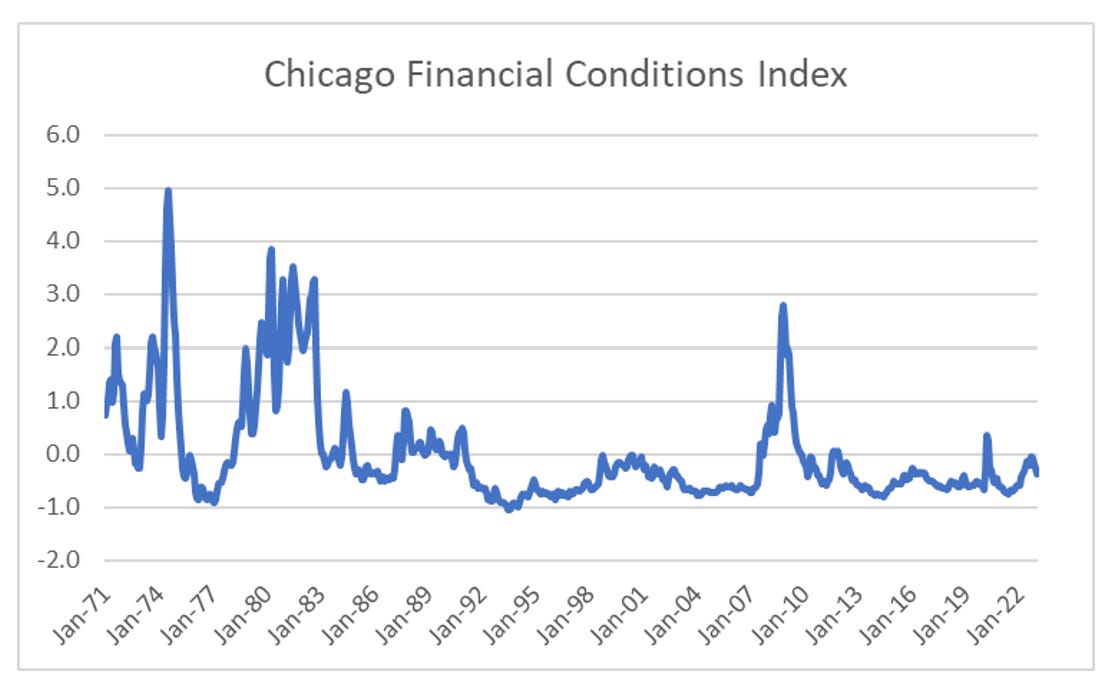

What does a shift to pro-labour ultimately mean? Well for one things I expect financial conditions to be much tougher than what we see today. The Chicago Fed has a financial conditions index that goes back to the 1970s. What this says to me, is that when old crusty fund managers talk about the carnage of the dot com bust, or the GFC, we really know nothing. Its the fund managers around in the 1970s, of which I met a few when I started out who know what we could be listening to. When they talk about investing during the 1970s, I could still hear the despair even in the early 2000s.

Low unemployment means the price increases and wage increases are passed along more easily, and this is exactly what we see. UK Retail Price Index is rising at the higher rate since the 1970s. But the political emphasis is, or will be soon on raising real wages - because that is where the votes are. The BOE is well behind the political curve here.

So why are markets so strong? Collapsing European natural gas prices offer a pretty good reason. Not only does it imply less pressure on the cost of living, it also means interest rates could potentially stay low.

This biggest surprise have been that European natural gas storage is higher now than this time last year. European natural gas in storage at the end of February is nearly 100% higher than the same time last year, despite Russian pipeline exports to the EU making up one third of supply in 2021.

Europe was saved by an unusually warm winter. Using data from www.degreedays.net - we can see Koeln/Bonn in Germany had a significant drop in “heating degree days” relative to previous years.

We can also see that there has been a lull in the growth in government spending in recent months, but this looks to be moving higher now.

My best guess it buy the dip on the pro-labour trade - or buy commodities, and sell financial assets.