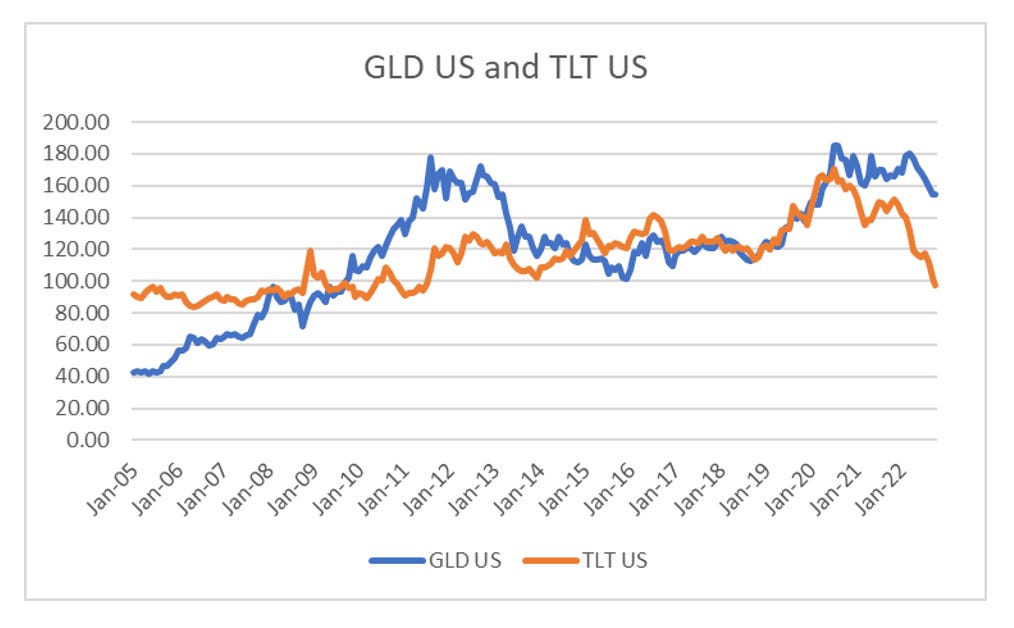

The basic idea behind recommending a long GLD (gold) short TLT (treasuries) trade was the idea that as governments moved pro labour, this would force up wage inflation, and force central banks to raise interest rates. GLD/TLT has traded well and touched a new cycle high during the month.

However, the TLT side of the trade has been the much better trade. TLT has erased all gains since 2010, while GLD has fallen 20% putting in a bear market. The smart trade has been to be short GLD and TLT.

Should I get rid of the GLD part of the trade? I have mixed feelings about this. First of all, my working assumption is that pro-labour policies would occur with food inflation. Causation is difficult to tease out here (that is - do high wages cause food inflation or does food inflation cause high wages??). Food prices have been much strong than gold this year. Gold has much more closely tracked raw industrial commodity prices, than food prices.

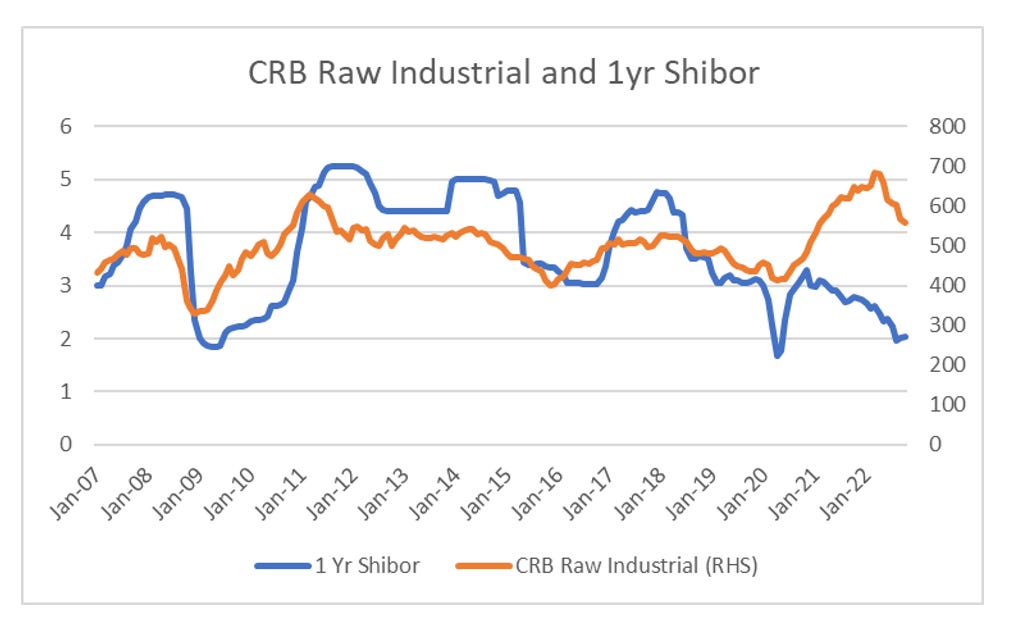

While food is a global consumed and produced, raw industrial consumption is much more heavily concentrated in China. And China has seen a big slowdown this year, driven by a slowdown in the property sector as well as its zero covid policies. The CRB Raw Industrial index tends to follow Shanghai Interbank Rate fairly closely, as both are driven by levels of Chinese activity. There was a breakdown in this relationship in 2021 and early 2022, probably driven by the rest of the world exiting Covid and then the Russian invasion of Ukraine, but the relationship between commodities and Chinese activity seems to have reasserted itself.

Since 2008, it has generally made sense to buy commodities when Chinese interbank rates are starting to turn, and particularly around the 2% level they are today. As mentioned in a previous post, when we look at new deaths to new case ratios in China, they are converging with Korean, Japanese and Singapore levels, which suggest that Covid in China is not as deadly as it was, leaving the possibility that restrictions could be relaxed.

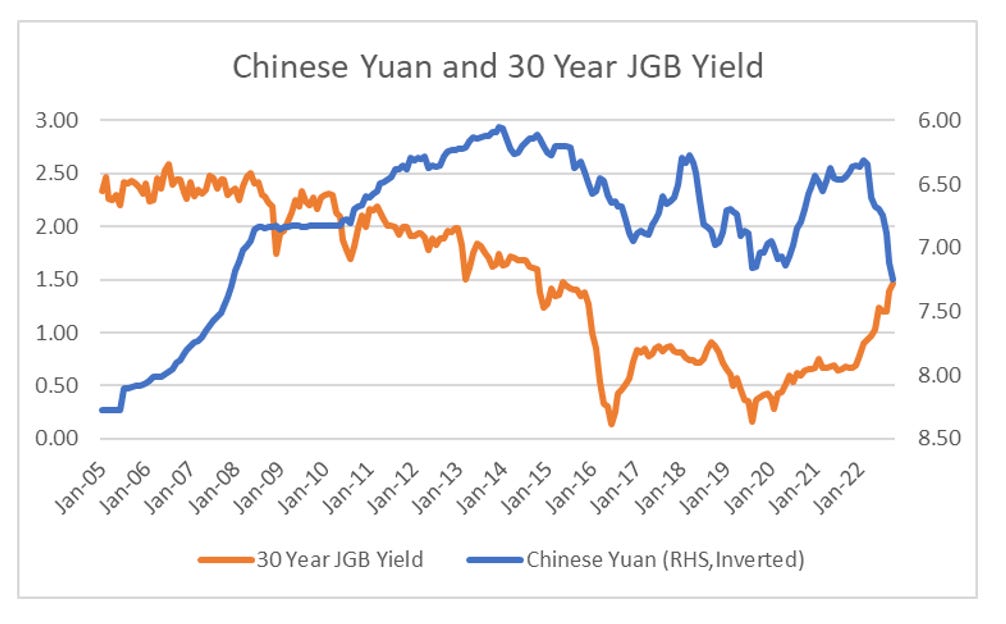

Commodities (and particularly gold) do not like a strong dollar and particularly a weak Chinese yuan which has breached the 7 level lately. I perceive a weak yuan as deflationary, and Yuan weakness in 2015 to 2016 was accompanied by a collapse in Japanese bond yields. This time the fall in Yuan has not been accompanied by a fall in Japanese bond yields, but rather the steepest sell off in decades.

What does this all mean? I think pro-labour policies are extremely inflationary, and that this inflation has been held in check by rapidly rising interest rates AND zero covid policy in China. If zero Covid should end, then the brake on industrial commodities should come off, and all commodities should rise again, which will require further interest rate increases. The risk is that China economically implodes, but oddly the bond market does not seem to be signalling that at the moment. I think keeping the GLD side of the trade makes sense to me.